Introduction

This report focuses on Marriot International, Inc. financial reports for the fiscal period between 2011 and 2013. Specifically, it covers the company, its current and future strategies and performances and comparative financial ratio analysis with regard to other players in the industry.

Structure

Presentation of Marriot, its current and future strategies

Marriot International, Inc. operates in more than 72 countries with over 3,900 hotels worldwide as an operator, a franchisor and a licensor of hotels and timeshare resorts. It has nearly 325, 000 associates. The company also is involved in developing, operating and marketing residential property and offers home services to owners. Marriot simply manages or franchises and does not necessary own these hotels (Marriott International, Inc., 2012). Marriot International, Inc. is listed among the best hotel chains in the world (Vidyarthi, 2014).

In the year 2013, the company was managing 42% of its hotels, 55% were franchised, 2% were leased or owned while the rest were classified under unconsolidated joint ventures (Marriott International, Inc., 2013). Marriot has classified its operations under North America Full Service, Limited-Service, International and Luxury.

The company’s current strategy has been effective in delivering results. For instance, Marriot has grown its portfolio and increased the number of hotels significantly in the year 2013. The company’s leadership has focused on a global expansion, particularly in the US, Africa (Pretoria and Rwanda, Kigali), Asia, the Middle East, Brazil, India and other parts of Europe. These new developments would add 67,000 new rooms. Marriot recorded a management fee of $1.5 billion globally. It is now the largest hotel company in Africa. The company has also focused on growing its flagship brand through massive investments, particularly in London, New York, Miami, Abu Dhabi, Bangkok, Shanghai, and India among others.

In the fiscal year 2013, diluted earnings per share were $2, which represented an increment of 16% relative to the previous year. Adjusted Earnings Before Interest Expense, Taxes, Depreciation and Amortization (EBITDA) increased to 9%, operating income Margins reached 40% and return on invested capital rose to 32%. At the same time, Revenue Per Available Room (RevPAR) increased 4.6% globally.

The company’s rewards and loyalty programme exceeded 45 million subscriptions, responsible for over half room occupants globally.

The Web site (Marriott.com) was responsible for one-quarter of the global room booking nights in the year 2013. Nearly 13 percent of these room booking nights originated from mobile devices.

Marriot’s future strategies for expansion have focused on opening new hotels in emerging markets. In the Asia Pacific region, for instance, the company intends to open a new hotel through different ten brands. This would increase its hotels to 330 with over 96,000 rooms by the year 2016. The agreements signed would see the company opening additional 78 new hotels with over 22,000 rooms, which would be high-end, luxury hotels. In Africa, Marriot intends to acquire new hotels in Pretoria to drive its growth. This would double the number of rooms to 23,000 for the region and Middle East.

Additionally, the company has identified emerging tourism destinations for its new hotels because of its contribution for economic growth and job creation in such regions. In this regard, Rwanda in Sub-Saharan Africa has been chosen for the largest hotel in the country. The company hopes to open its Kigali hotel in the year 2016. This is a part of an aggressive growth strategy for the region. Marriot is building a close partnership with the Rwandan-based Akilah Institute for Women to train women for jobs in the hotel industry and drive the growth of the travel industry in the region.

The company has also focused on providing the necessary resources to achieve most of its goals, particularly efforts to lessen energy and water usages by at least 20% by the year 2020. This is a major focus on developing global green hotels.

Marriot International, Inc. believes in a bright future ahead. To achieve the bright future prospects, the company has focused on investing in effective marking and social media platforms so that it can appeal to the tech savvy customers. Marriot notes that nearly half of the global population is below the age of 25.6 years. A part of this population consists of the generation Y, which account for over 19% of all room night bookings in the US under the business class category. Marriot expects this number to increase steadily to 37% by the year 2020. The expected growth will result from many graduates, workers and business travellers. Given the relevance of this segment of consumers, Marriot intends to introduce new brands and services designed to meet their unique needs and improve current brands with the “technology, design, wellness, and food and beverage experiences that are important to them” (Marriott International, Inc., 2013).

Marriot International, Inc. has recognised that the current business conditions are favourable as the global economies continue to grow and prices rise. This would increase the number of hotels and customers’ spending habits.

While the year 2013 reflects positive achievements, Marriot International, Inc. also recognises risks associated with its business operations.

Comparative Ratio Analysis and Trends

Data for the analysis were obtained from various sources, include the MarketWatch, Inc., CNN Money, the company’s financial statements and Yahoo Finance among others (MarketWatch, Inc., 2015).

Liquidity

Current Ratio

Total Current Assets/Total Current Liabilities

Marriot International Current Ratio reflects a bad sign. For the past three fiscal years, the ratios have been less than one. This suggests that Marriot may not be able to meet its short-term liabilities with its currently available short-term assets. Although this is a bad sign of the company’s efficiency, it may not go bankrupt and can get financing from other sources.

Acid-Test Ratio

These stringent ratios are below one, suggesting that Marriot lack adequate short-term assets to meet immediate liabilities and therefore must rely on the sales of inventory to meet such obligations. Investors must be careful with the company.

Accounts Receivable Turnover

The company’s revenues were $12784, $11814 for the period 2013 and 2012 respectively while $43 million and $32 million were accounts receivable for similar periods. The company provides gross revenues and when applied yield the following figures 297 and 369 for the year 2013 and 2012 respectively. It shows the company almost collects accounts receivable daily.

Average Collection Period

Marriot International, Inc. generally collects accounts receivable within 30 days.

Solvency (Debt Management)

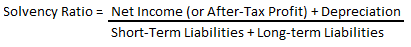

Solvency Ratio

Marriot’s solvency ratios have generally been low, showing that the company could default on debt obligations.

Debt-Equity Ratio

These ratios are not extremely high, indicating that Marriot uses external debts to funds its growth strategies.

Operating Cash flow to Total Liabilities Ratio

Cash flows from operation/Total Liabilities

Marriot’s cash flows generated from business activities do not adequately cover its total liabilities because of low ratios.

Activity (Assets Management Ratio)

Inventories Turnover

Total Revenue/Inventory

The company’s inventory turnover has increased and indicates strong sales for the last two years. Data for the fiscal year 2013 were not available.

Day Sales Outstanding

Net receivables/ (total revenue/360)

Marriot takes approximately between 25 days and 30 days to collect revenues after business activities have been concluded.

It is in the interest of the company to collect outstanding sales as fast as possible to get cash for its operations.

Fixed Asset Turnover

Total revenue/property plant and equipment

Marriot has high ratios and therefore effectively uses its investments to generate cash. The company needs to increase its asset base to support growing demands for hotels and to support its sales activities.

Total Assets Turnover

Total revenue/total assets

Marriot has been able to use its assets effectively to generate revenues. Although these ratios fluctuate, they are stable. The company is not sluggish in making sales and therefore there are few challenges with its asset categories.

Profitability

Profit Margin

Net Income applicable to common shares/total revenue

The company’s profit margins have risen steadily in the last three financial years. It shows that Marriot generates returns for investors.

Return on Assets (ROA)

Net income available to common shares/total assets

Since the year 2011, the company has been able to convert its cash into investment and generate income from it effectively. The rate has increased steadily. As the figure increase, it would show that Marriot would be earning more incomes from less investment.

Return on Owners’ Equity (ROE)

Net Income applicable to common shares/total stockholder equity

These ratios are negative for the last three fiscal years. Marriot has not been effective on generating incomes from new investments. It is imperative to relate these ratios with peers in the industry. However, these negative ratios should be a source of concern to any investor.

Market Value

Price/Earnings (P/E)

Price per share/earnings per share

This is the value, which investors are willing to pay for the company shares, and according to the industry benchmark, Marriot is currently doing well relative to other companies. Hence, it has a good future growth prospects.

Market/Book

Market price per share / book value per share

Marriot has negative market to book value ratios. These ratios indicate that Marriot has been earning poorly on its Return on Assets. The Return on Owner’s Equity also reflects negative trends.

Conclusion

Marriot International, Inc. has focused on a growth strategy to improve its presence in mature markets and emerging ones, particularly in Africa, Americas, Asia and certain parts of Europe. The company wants to exploit tourism and travel industries in these regions. At the same time, Marriot intends to embrace IT and social media platforms to target the generation Y consumers, as well as introduce green technologies to save on water and energy consumption. Different ratios show various operations of the company (Marriott International Inc: Five Year Financial Summary, 2015). Financial data show key statistics for Marriot International with a greater depth for individuals whose use such information for decision-making (Yahoo Finance, 2015).

The company’s revenues have grown steadily in the past three years. Nevertheless, it is imperative to understand the financial ratios against the industry benchmarks or use other companies’ ratios for comparison for a clear picture of Marriot’s financial performance.

Relative to other players in the industry such as IHG, Hilton and Wyndham, Marriot seems to have the lowest current ratios. Although these ratios fluctuate, these four hotels have performed relatively well in the past. At the same time, it also has the lowest acid-test ratios. Hence, other companies may be able to meet their obligations than Marriot International, Inc.

Assets Management Ratios show how companies use their assets to generate sales. Among all the mentioned companies, Marriot has the highest Fixed Assets Turnover and Total Assets Turnover ratios. They show that Marriot manages its assets to generate sales than other companies in the same industry.

On the other hand, the company also has relatively poor Debt Management strategies compared to other companies in the industry. For instance, it has the highest Total debt to total equity (percentage) and Times -Interest-Earned (times) ratios. These ratios indicate that Marriot relies on debts to fund its operations compared to other companies.

The company has the highest debt/equity ratios compared to IHG, Hilton and Wyndham. Its highest ratio was 1.21 (2013) while Wyndham had a ratio of 0.83 in the same financial year. This industry could be capital-intensive and therefore these ratios may be acceptable. However, less capital-intensive companies may have lower ratios of below 0.5.

Profitability ratios are imperative for investors who would like to understand whether their chosen companies generate returns. Marriot’s profitability ratios have increased. Apart from Hilton, other hotels have extremely higher profitability ratios relative to Marriot. For instance, in the fiscal year 2012, IHG recorded a ratio of 29.32% compared to Marriot’s 4.83%. From these diverse performances, it could be difficult to determine the exact industry average.

From the data available from different hotels, market value average could range from 20 to 25. However, some companies have recorded high ratios than the industry average. Market/Book (Times) for Marriot is negative. IHG also recorded a higher ratio of -104.052 in the fiscal year 2013. Other companies have maintained positive ratios. This could indicate undervalued stocks or give poor yields to investors (Peavler, n.d).

It is imperative for investors to compare different ratios against industry averages to determine the performance of a given company. Financial analysts and investors must rely on different ratios, tools and industry averages when reviewing financial statements of companies (Wright, n.d). Ratio analysis assists investors and creditors to identify specific areas of concerns and review financial health of a company. In this case, Marriot should review its operations, particularly in areas with extremely low ratios.

References

MarketWatch, Inc. (2015). Marriott International, Inc.- Financials. Web.

Marriott International Inc: Five Year Financial Summary. (2015). Web.

Marriott International, Inc. Marriot 2012 Annual Report. Web.

Marriott International, Inc. Marriot 2013 Annual Report. Web.

Peavler, R. (n.d). What is the Market to Book Financial Ratio and its Calculation and Use? Web.

Vidyarthi, K. Top 10 Largest Hotel Chains in the World 2014. Web.

Wright, T. C. (n.d). Negative Leverage Ratio.Web.

Yahoo Finance. (2015). Marriott International, Inc.: Key Statistics. Web.