Abstract

Law firms and lawyers in the United Kingdom are facing complex and compelling challenges in order to remain viable and competitive in the market. In the last few decades, the legal profession has undergone greater transformations due to deregulation, new information technology, liberalization and the growing of the global marketplace.

This paper examines the impacts of legal deregulation in the legal industry in response to the client’s confidence and the quality of services delivered. During the research, the researcher used structured questionnaires and semi-structured interviews as a method of collecting the required data for analysis. The analysis is based on the research conducted in the legal industry based on the case study of Touchstone Legal Service Company.

The analysis of the study shows that the legal industry is experiencing tough moments in trying to cope up with the needs of the new market. Legal firms are forced to develop alternative business structures in order to compete with the non-legal firms which have already established business models that meet the requirements of legal deregulation. The research indicates that marketing strategy is recommended as one of the possible ways of solving the possible challenges in the current market. The study identifies knowledge management as a tool that promotes innovation as well as solves problems in legal firms.

The study failed to research on how marketing strategy should be implemented to achieve the required solutions. There is a need, therefore, to carry out research on marketing as a strategy to be implemented in legal firms in order to meet the requirements of the current legal market.

Introduction

In the traditional legal regime, the law industry was regarded as a special field. For that reason, the industry was exempted from the common rules which were applicable to other industries in the marketplace like the billing law. In 2007, the government of the UK established the legal service act which lifted the legislative restrictions on the legal industry. The legal action is implementing a set of rules and guidelines in an attempt to balance the interests of consumers and producers of legal firms in the United Kingdom and United States (Annelise & Takashi, 2010, p.10),

The legal services act has affected all categories of law firms (large, small and medium-sized) that they have been forced to form alternative business structures for them to survive in the marketplace. Touchstone Legal service industry is a law firm which offers services in areas of bankruptcy, foreclosure defence, immigration defence, litigation and criminal law, family law and other legal presentations and advice to their clients (Weiner, 2012, p.68).

Based on the research conducted in the Touchstone Legal service industry, the paper gives an analysis of the impacts of legal deregulation in the legal industry in response to the confidence and satisfaction of consumers. This is attained by analyzing the changes in the market place and how the changes have influenced the operating environment of the business as well as the business model the law firms have impressed in order to survive in the competitive market (Wetherly & Otter, 2014, p.85)

The study is co-relation research which seeks to establish the relationship of the dependent variables with the independent variables. The independent variables, in this case, are customer satisfaction and quality of services while the dependent variables are the proposed alternative business structures which include the marketing tools and the development strategies (Cowdroy, 2009, p.4).

Definition of terms used

2007 Legal Service Act (LSA 2007) – this is a set of rules established by the parliament of the United Kingdom to promote competition in the legal market.

Alternative Business Structures (ABSs) – these are the new business structures that legal firms have to implement in order to compete with the non-legal bodies in the market.

Knowledge Management (KM) – this is the knowledge and skills that lawyers need to acquire in order to implement the required new structures in legal firms.

Background history

In the last decade, the European Commission promoted the idea of modernizing the professions in Europe within member states as well as lawyers’ services. This modernization of legal services involved the enhancement of competition in the market by promoting a high level of regulation. The provision of legal services in the European countries is regulated by governmental and self-regulation under the professional body.

As much as the rules and regulations vary across the countries, there is a common rule which stipulates that becoming a lawyer requires the fulfilment of educational and training obligations as well as complying with the rules of the professional conduct (Fortney, 2011, p.9).

Wetherly & Otter (2014, p.85) observe that countries with low degrees of regulation have a higher number of practising professionals which generates a high overall turnover. Due to this, the European Commission considers light regulation as a driver to overall wealth creation. The member states are therefore encouraged to do away with unjustified rules to enhance competition in the marketplace. This has led to lower prices as well as increased the quality of the services. The idea of improved availability of varied professional services has led to the creation of job opportunities in the various states.

Mauborgne (2010, p.5) argues that the issue of regulating the legal industry is analyzed using the traditional approach. Traditionally, the private interest approach analyses the legal profession as a producer’s association which is adjusted to promote and defend the interests of its members. On the other hand, Otter (2011, p.12) argues that public interest approach analyses the regulation of the legal services by examining the success or the failure of the market. This approach focuses on the asymmetrical information between the clients and the lawyers in response to public goods and externalities.

In the public approach, services fall in the scope of the knowledge economy since lawyers are considered as experts with specialized skills and knowledge that is acquired through formal learning as well as the use of abstract concepts.

Clients in the legal market lack this knowledge, and thus the client-lawyer relationships are flawed (Tevfik, 2009, p.24). Fortney (2011, p.9) suggests that law firms should channel their efforts to their own ethical infrastructures to ensure that their management policies support ethical-decision making within their firms.

Cowdroy (2009, p.4) observes that the legal service act which is applicable in the United Kingdom and Australia stipulates that policy-makers and professional regulators have the mandate to implement ethical structures in the legal industry. Schneyer (2010, p.22) points out that New South Wales is considered as the first Jurisdiction to implement the practices of the 2007 legal service act. The rule implemented stipulates that lawyers within the authority appoint a legal practitioner director who has the mandate of ensuring that the services delivered in the legal industry are in agreement with the ethics and code of conduct.

Gray & McAllister (2009, p.26) argue that this is in contrast with the traditional legal regime which focused on the self-interests of individual legal practitioners. This approach led to the failures of attaining ethical standards in the legal industry. This led to the issue of deregulation in order to provide appropriate management systems and cultures to promote ethical standards. To curb the issue of ethical standards in the legal field, the regulatory bodies have introduced internal alternative business structures in order to cope up with the issue of legal deregulation. Cowdroy (2009, p.6) argue that legal firms need to put in place both informal and formal policies as well as work team cultures that encourage ethical behaviours.

The extinction of the traditional model in the legal industry is explained by the many reasons which came into existence as a result of globalization, recession and legal deregulation. The UK legal services market started to experience a reform since 2008 due to both pressures of economic recession and deregulation of the profession (MacEwan & Regan, 2010, p.12).

Due to the mentioned changes, services which were once regarded as highly specialized are no longer considered so since they are treated as commodities in the current market. In the contemporary market, law firms have no luxury of waiting for the customers on their premises, but they are forced to go out in order to get clients. Therefore, the technical competence of the lawyers is not enough to guarantee the success of the business or to retain the existing clients (Wetherly & Otter, 2014, p.105)

Schneyer (2010, p.28) observes that most of the legal firms collapsed due to the changing marketing conditions such as the shifts in clientele priorities. Internal varying conditions and globalization are considered as additional factors that have led to the contraction of law firms in Australia and the UK. Due to these changes in the legal industry, the legal firms have introduced a new business model which dictates the need for internal structures as well as a regulatory environment.

Fortney (2011, p.11) argues that global competition has extremely contributed to the contraction of law firms. Hence, in the last few decades, global corporations had the opportunity of selecting a cheaper law firm with similar legal qualities from the wide range of legal firms across the globe. Tevfik (2009, p.28) comments that this issue of outsourcing legal services from foreign countries like South Africa and other countries has greatly affected the legal firms in the United States and the United Kingdom.

Globalization has enabled foreign practices to compete more vigorously with other legal practices in the United States, United Kingdom and Australia. The traditional advantage of the U.S legal practices, which enabled U.S legal firms to dominate some segments in the legal market of Asia and Europe, is no longer valuable since foreign legal firms have managed to import the U.S model and improved it (Mauborgne, 2010, p.7).

Weiner (2012, p.54) indicates that U.S law firms need to change their business structures as well as their behaviours in order to fit into the new market where globalization is prominent. In addition to that, Cowdroy (2009, p.9) comment that the United States and the United Kingdom need to change their regulatory setups in order to capitalize on their legal knowledge and practices in the global market.

Otter, (2011, p.14) argues that in addition to setup and business structure, education is considered as another pillar in attaining success in the global market. There is a need to change the legal, educational system of the European countries in order to be business-oriented and ready to face globalization. Schneyer (2010, p.24) points out that the U.S legal firms have a better production technology as opposed to other foreign legal firms, but they lack adequate local knowledge (local language, local connections and reputation).

This has prompted the emergence of a partnership between U.S legal firms and foreign local legal firms in order to solve the issue of insufficient local knowledge and information. Nollkamper (2013, p.66) says that these local legal firms have upgraded their technology to a level that they have overtaken the U.S legal skills and knowledge.

Fortney (2011, p.14) says that multijurisdictional law firms are in a better position to easily combine the local knowledge and the American technology advantages even though they are faced with legal challenges like the issue of licensing individual jurisdictions. This is, therefore, the major reason which has contributed to the increased number of joint ventures since it is considered as a better option in response to regulatory restrictions.

Embley & Godchild (2013, p.44) observe that the reforms which are in the legal service act of 2007 were first proposed in 2004 in the Clementi Report. The report proposed alternative business structures in law firms which allow non-lawyers to compete with the lawyers in the legal market. It also proposed that non-legal firms have the right to legal ownership in order to offer legal services to the clients as required. Harper (2008, p.34) states that the report stipulated that disciplinary complaints are to be handled by independent agencies as opposed to the traditional regime where the office for legal complaints and the legal ombudsman did the job. In addition to that, the report proposed free competition for legal service providers under the supervision of the Legal Service Board.

Nollkamper (2013, p.56) observes that since the implementation of the 2007 legal act, the policymakers have introduced firm-based regulations for the legal profession apart from the traditional controls on individual practitioners. Anson (2008, p.49) comments that the legal service act has created a revolution in the regulation of legal practices because it aims at improving the management as well as the culture of the firm as a whole as opposed to the later regime which aimed at disciplining individual legal practitioners as well as resolving lawyer-client disputes.

Ribstein, (2010, p.7) states that the Legal Service Act 2007 (LSA) was established by the parliament of the United Kingdom to liberalize and regulate the legal services in Wales and England to promote competition and innovation in the marketplace as well as provide room for consumers to air their grievances. Sechooler (2009, p.4) observes that the 2007 Act initiates the formation of alternative business structures of legal industries in the management, professional and ownership roles. The Act stipulates that approved regulators have the authority to authorize licensed non-legal bodies to offer legal services in the marketplace (Ribstein, 2011, p.8),

Juny (2009, p.8) argues that the issue of allowing management consulting firms, investment banks, accounting firms, insurance agencies and other entities to offer legal services has led to innovations in the legal industry. It has also forced the existing legal firms to lower the prices of their services as well as change the manner in which they do their businesses. Carole (2011, p.11) adds that this has led to greater benefits to the consumers since they are able to receive quality services at better prices as opposed to the later regime where the lawyers could charge high costs on their services as well as poor offer quality of services.

The United Kingdom had experienced significant reforms in the legal industry since the 1980s under the Thatcher government when Lord Mackay was the Lord Chancellor. These changes are considered as legal deregulations and were therefore opposed by the legal professionals. The division between the solicitors and barristers along with economic changes of the 1990s weakened the effective professional opposition (Nollkamper, 2013, p.76). During the issuance of the 2004 clementi report and the approval of the 2007 Legal Act, MacEwan & Regan (2010, p.14) indicate that there was no professional opposition in place to stop the implementation of the reforms because

the employment of the Legal Aid Act of 1988 and the Courts Act of 2003 convinced the legal profession that the LSA 2007 was crucial in the legal industry. In 2010, the Legal Services Act of 2007 (LSA 2007) opened door for non- legal businesses such as banks and supermarkets. In addition, Alternative Business Structures (ABSs) became operational in 2012. The ABSs permits different types of lawyers and non-lawyers to form businesses together in order to encourage more competition in the market (Mauborgne, 2010, p.7).

Literature review

Introduction

The legal industry has for a long time been regarded as a special field protected from the general rules which govern other forms of businesses. The legal industry has been protected with lawyers being regarded as the only people who possessed legal knowledge and tools. This placed the legal industry in a position that never experience competition in the marketplace. The lawyers were exempted from general business rules like budget restraints and value of money as well as predictability in cost and time (Flood, 2013, p.56)

Nollkamper (2013, p.104) observes that during the traditional regime, the lawyer-client relationship was controlled by the law firm which had the authority to decide on how the services were to be delivered. Anson (2008, p.4) argues that this approach led to the failures of attaining ethical standards in the legal industry. The consumer power was extremely low as there was no real competition in the traditional legal market. This accelerated for change in the legal market.

The Legal Service Act which was established in 2007 by the parliament of the United Kingdom aimed at liberalizing and regulating the legal services in Wales and England in order to promote competition and innovation in the marketplace as well as provide room for consumers to air their grievances. The legal service act initiates the introduction of alternative business structures in the legal industry which allow non-legal industries to join in the various sectors of management, professionalism and ownership roles in the legal industry. The Act stipulates that approved regulators have the authority to authorize licensed non-legal bodies to offer legal services in the marketplace (Otter, 2011, p.18).

A remarkable change has been introduced in England and Wales by the advanced development of globalization, commercialization and information technology. The common consideration is the role of lawyers and the way clients access justice in the legal market (Wetherly & Otter, 2014, p.136). Flood (2013, p.46) indicates that this is the fifth year of change starting from 2008. The U.K government is therefore determined to ensure that the legal service industry is transferred from a ‘black box’ service approach to a knowledge-based service approach (Anson, 2008, p.36).

The literature review provides a balanced and precise understanding of the existing legal service market. The literature discusses the future of legal service by focusing on how and why the current changes in the legal industry came into existence. It also explains why the current changes in the legal industry require a more strategic approach to efficient working processes. It further explains why technology has become more useful in developing new modern ways of delivering legal services.

Changing legal market

The introduction of the Clementi’ report and the implementation of the 2007 Legal Service Act in the United Kingdom has led to the revolution of the legal industry. The legal firms have faced many changes like the introduction of new business strategies in order to adapt to the new demands of the market (Clementi, 2004, 6). Andrew (2013, p.4) states that, ‘The legal market is in an unprecedented state of flux’.

The current situation of the legal market is considered to be much more complex than ever. It is due to the combined regulatory changes and many other driving forces which have facilitated the transformation of the legal service sector. Dezalay & Bryant (2010, p.16) argue that there are strong drivers for change which have affected the legal market by pushing it out of the ‘black box’ towards the newly regulated market. The drivers are categorized into four groups; regulatory changes, new client demands, new kind of competition and collaboration trend.

Regulatory changes

The government of the United Kingdom established the legal service Act which has lifted the legislative restrictions on the legal industry. The legal act established a set of rules and guidelines in an attempt to balance the interests of consumers and producers of legal firms in the United Kingdom and the New South Wales (Dezalay & Bryant, 2010, p.14). The 2007 Act allows both lawyers and non-lawyers to go to the business together under the same footing. The Act stipulates that approved regulators have the authority to authorize licensed non-legal bodies to offer legal services in the marketplace (Bowles, 2009, p.14).

Dezalay & Bryant (2010, p.26) argue that these legal transformations have opened up legal doors for new entrants into the market in order to enhance competition. The newly licensed firms tend to have a greater focus on how they can develop various kinds of legal services and how they can provide them better to their clients. The non-legal firms use technology to improve on their ways of getting connected to their clients. As opposed to the legal firms, the non-legal firms do not charge hourly fee or shocking bills to their clients (Bowles, 2009, p.14),

The legal deregulation has therefore changed the legal market by enhancing a large interest from venture capitalists to join into the legal market. By allowing management consulting firms, investment banks, accounting firms, insurance agencies and other entities to offer legal services, the legal service market has become innovative and very competitive (Clementi, 2004, p.24).

The legal reforms in the current legal market indicate that there is a wide range of new legal solutions in the market. The changes have enhanced customer satisfaction since there are many providers of the legal services who compete for clients in the market. This has led to reduced costs of the services offered as well as readily available services which are easily accessed via the internet (Dezalay & Bryant, 2010, p.14). Clementi, (2004, p.25) argues that these reforms are likely to be implemented globally since states like Scotland have implemented the 2007 legal act even though they have done some adjustments on the regulations.

New client demand

The increased costs on legal firms have led to the shifting of power from the legal firms to the clients. Due to budget limitations most lawyers face many challenges but receive less income. The reason for that is that the clients have more legal issues to solve, but very little in-house resources to cater for the financial requirements of the external advisors. This challenge has forced the general counsel to seek for possible solutions by scheduling forums that predict the fees charged as well as demand discounts for the services rendered (Theodore, 2010, p.23).

Traditionally, lawyers established long-term relationships with their clients and this enabled them to offer services at their own set prices since clients did not have any other option. In the new regime, the long-term relationship has been broken down since clients have become the people controlling the market as they demand quality services delivered within the shortest time possible (Susskind, 2009, p.35). Ikechi & Sivakumar (2011, p.4) argue that since clients have proven to be dynamic in the new legal regime, it is essential for the legal firm to understand the business of the client in order to devise a better way of solving the challenges faced.

The marketing strategy emphasizes on the rationale of close relationships between lawyers and clients as a better way of understanding the needs of the client in order to be aware of the requirements required in the market (Badenoch & Clark, 2011, p.98). Porter (2010, p.78) conclude that most practitioners in the legal field perceive the issue as impossible because many clients have decided to use non-legal firms as vendors in the legal industry. These factors have led to the reduced demand of the legal services.

Roger bird (2009, p.77) observes that the current legal market is best explained with a shrinking demand accompanied with an increased supply, inadequate knowledge to guide firms on the increased changes in the marketplace as well as a stiff competition from the non-law firms. McArdle (2010, p.6) indicates that many law firms have failed to adjust to their new demands of the market as they still charge high costs on their services as much as there are no clients going for them. This has made it difficult for law firms to profit themselves in the competitive market where non-legal firms have better business models to operate in the market.

Many law firms focus their efforts on determining the amount of money lawyers should be paid on the services delivered rather than considering the client’s results to understand the possible improvements that need to be done on the services delivered. Most law firms have not developed better business models to enable them compete in the open market and as a result they fail to make a follow up to know the feedback of the client. Research by McKenna, (2007, p.54) indicates that lawyers usually believe that they offer quality services to their customers but the analysis shows that only thirty two percent of the clients appreciate their services.

Poynton (2011, p.8) suggests that it is essential for law firms to improve on their business models so as to ensure that lawyers are always aware of the clients’ feedback in response to the services rendered in order to improve on the value of long-term lawyer-client relationships. Yates (2012, p.89) notes that there is a remarkable decrease in client loyalty in the current legal market. Owing to the fact that many clients are only concerned with the kind of services rendered without considering the issue of loyalty.

In the research conducted, DavidWade & Hitchens (2009, p.23) report that seventy six percent of the clients terminated their client-lawyer relationship in one of the law firms in 2013. It is also noted that sixteen percent of the clients receiving the services offered by legal companies, rate the services offered as ‘excellent’ while eighty four percent of the clients rate the services’ efficiency as ‘below average’.

The collaboration trend

Colman (2009, p.13) says that the idea of sharing the economy has really transformed the legal industry. He adds that the issue of ‘shared economy’ and the current generation where people are determined to offer services to their possible limits, has altered the traditional way of operating in the legal market. In the new regime, new business is acquired by creating lawyer-client relationships via the internet. Cunningham (2011, p.18) indicates that fifty nine percent of the respondents use online sources which are accessed free to carry out their legal research.

In response to the discussed issue, Susskind (2013, p.43) comments that the new regime does no longer value the services offered by lawyers since they are able to access them easily and cheaply than before. This is in contrast with what is observed in the traditional era where clients were compelled to access legal services from legal firms only.

The current market has proven to be too competitive since lawyers not only compete with their fellow lawyers but also with other professions like banking and accounting firms (Burnham, Frels & Mahajan, 2009, p.34). Javalgi & Rajshekar (2010, p.20) indicate that accountants have dominated the legal industry because they are considered as professionals who offer better services to their clients. It is on the grounds that the profession uses client-centric approach which is considered as a marketing strategy which is viable in sustaining the success of the business.

The accounting profession is doing well in the new market because its operations are well adapted to the easy management of company meetings and submission of documents which is not common in other professions. There are also other new competitors in the legal market like the national chains which render the legal services at an annual fee which is relatively low in comparison with the legal firms. There are also other professions which offer tax information in response to legal matters and they advertise themselves as ‘one-stop-shops’.

There are also other significant collaboration portals like the association of corporate counsel which offers legal documents and other relevant templates to the clients as well as the Legal OnRamp (LO) collaboration which provides in-house counsel by inviting outside lawyers to offer the services (Boonghee & Naveen,2009, p.7). Hofstede (2010, p.76) says that clients have also come up with a collaboration strategy whereby they team up to share the costs of a certain legal service. It is also evident that some of the legal firms collaborate with clients for online legal services and electronic legal marketplace. This idea of offering legal services to clients at a very low price has led to a rising cost pressure in companies and as a result many clients prefer the non-legal firms to shop for prices.

New kind of competition

The legal service industry is experiencing a remarkable increase in rivalry within the profession hence destroying the unique value of the legal profession. The new kind of competition has promoted the oversupply of the services in the marketplace which has led to decreased prices of the services offered. A research by Young (2008, p.37) indicates that a number of lawyers have increased tremendously in the past twenty years in many Western countries.

He adds that when the supply exceeds the demand, producers face a stiff competition for they struggle competing for the available customers in the marketplace. This initiates the intensification of marketing efforts in the industry in order to ensure the success of the business.

The legal firm has registered an increased consolidation which has forced lawyers to treat their profession like any other business profession. This has also led to the introduction of alternative business structures in legal firms which ensure that lawyers deliver their services as per the accepted ethics and code of conduct (Choi & Headley, 2012, p.3). Gillian & Newholm (2010, p.23) indicate that the growth of costs was attractive in the past years when the nature of work was carried out within the house as opposed to the current situation where legal work is done in a competitive open market.

The new competition from foreign law firms which offer their services at a relatively low price has contributed to the contraction of U.S and U.K legal firms. The Legal Process Outsourcing providers (LPOs) are working hard to improve the value of their services by offering diligent services (Robinson, 2012, p.9). Chan & Mauborgne (2011, p.12) indicate that non-legal providers have taken a large share (approximately eighty five percent) of the legal market leaving the legal firms to compete for the remaining share.

In the new era, LPOs are considered as private entities with an added advantage since they have an access to outside talent, ability to cut down or scale up their operation and they have a customer support which operates 24-7. In the market study conducted, Kian (2012, p.74) argue that the LPOs have overtaken law firms and they are devising new business models of outsourcing legal service providers to increase their productivity returns.

New strategic approach to knowledge management and efficient working processes

McMurray & Susskind (2012, p.2) observe that in the current regime, clients observe the changing trends in the market which are initiated by LPOS and other new legal providers and as a matter of fact they are becoming conversant with the new tools and processes used in the new market. This has therefore force virtual legal firms to adapt to the new technology in order to be efficient in the marketplace. Legal firms are therefore left with the option of reviewing the value of their services as well as advancing in technology to correct their business models in order to maximize the accumulated knowledge of the firm in order to stand tall in the market.

After the analysis of the discussed information, Muris & Shoham (2011, p.43) suggest that the new regime calls for legal firms to deliver timely services by combining internal and external services as well as advancing the use of information technology in order to gain a competitive edge in the market. This is an indication that law firms are compelled to introduce a new strategic approach to knowledge management. This is regarded as a business tool which is meant to initiate change as well as promote innovation in the legal industry.

Angus(2012, p.9) observes that law firms are no longer the only sources relied for the production of legal services since clients are able to access standardized legal documents from online support which is virtually free. Law firms have lost control over the highly treasured documents and this has contributed in pushing the legal industry out of the ‘black box’. (Douglas & Yoram 2009, p.12) comment that the demanding and skilled clients (in-house counsel) readily access affordable legal resources hence not willing to go for the highly charged services which are offered by junior associates.

Law firms have to take a close analysis on how to share the existing knowledge and experience in serving their clients as well as come up with a better way of re-using the developed legal documents. This will help in developing a more standardized routine work in order to use the valuable knowledge they have in serving their clients better. To attain this, legal firms are to rethink on how they view legal documents and come into a conclusion that the documents only form a base for their legal services (Jaworski & Kohli, 2009, p.12).

Morgan (2012, p.15) says that in the survey that was conducted in America, law firms acknowledge the need for a new strategic approach to knowledge management and they are therefore working hard to introduce efficient internal structures in order to fit into the new market. Malcolmanderson (2009, p.13) indicates that out of the two hundred firms which were interviewed, one hundred and twenty firms revealed that they are aligning their internal operations in order to initiate knowledge management programs.

DiMaggio & Powell (2011, p.34) point out that law firms and knowledge management firms need to capitalize on this opportunity in order to do away with the traditional models of drafting documents by focusing on knowledge management activities that are of great impact to the operations of the company. This means channeling the firm’s resources to knowledge management projects which generate high returns to the company.

Legal knowledge management helps attorneys to carry out their duties more effectively since this facilitates the sharing of information, legal documents and experiences across the firm. Although the practice of sharing information has been in existence for a long time like organizing resources prepared by attorneys and access to the information by all people, knowledge management shifts the attorneys from the tradition model of operation to the modern way of operation (Bedlow, 2006, p.19). Kotler (2010, p.5) explains that knowledge management is used to improve productivity returns as well as solve problems.

Efficient use of information technology improves the possibilities of accessing essential information as well as controls the sharing of knowledge through the internet. This leads to better ways of solving problems since lawyers are well connected to share the problem in order to come up with a concrete solution. Advancements in the use of information technology enhances the effectiveness of legal work by making use of documents like checklists and descent automated procedures of carrying out the day-to-day duties (Byron, 2011, p.2). Ellis & Watterson (2012, p.7) argue that implementing automatic procedures of producing documents enable firms to deliver quality legal services as well as maintain their profit margins regardless of the amount of money used to structure the procedural documents.

Research methodology

The study is a co-relation research, which seeks to establish the relationship of the dependent variables with the independent variables. The study used the conceptual approach in developing the basic relationships of the independent variables and the dependent variables as a guide to collect the information. Realism approach was also used during the study as way of measuring the variables (Creswell, 2004, p.28)

The research used both qualitative and quantitative approaches as a primary research in collecting the required data as well as in analysing the collected data (Slorach, Embley & Godchild, 2013, p.132). The questionnaire was designed to analyze the general comments of legal service offered by both regulated and non-regulated legal practices from their stakeholders and potential consumers. The structured questionnaire was used to collect the self-reported data, which was both qualitative, and quantitative (Marcus, 2013, p.23). The semi-structured interview in the form of questions was also used to collect the quantitative data for analysis. The study employed both methods to collect data as a way of maximizing the possible results (Hodgart & Temporal, 2010, p.11)

The study used the secondary research to be able to obtain enough data for the analysis as well as to create a base that enable readers to understand easily on the researched issue as well as the variables constituted in the study ( Soderlund,2012, p.57). In the secondary research, the Bedford Central Library was chosen as main resources provider for the already researched journals, reports and any other relevant material of study. This kind of data was added up to the qualitative data obtained from the primary research (Ashish, 2011, p.123).

The study employed the interpretative view of study as a way of examining the current situation in the legal service firms with different size, service and business model using observations and surveys. This kind of approach helped in determining the current situation and the causes behind the situation as a way of obtaining first hand information for carrying out the analysis hence coming up with viable conclusions and recommendations about the study (Lorsch & Mathias,2009, p.34).

The case study method of research was used to collect the intended data since the research focused on the legal deregulation in the legal industry. In this case, therefore, a case study is said to be a strategy used in conducting a research, which entails an empirical investigation of a given current situation within its existing context by the use of various sources of evidence (Heintz & Smock, 2010, p.17).

The research was carried out in a systematic manner for the researcher to be able to demarcate the boundaries clearly. In this case, the researcher developed a research design, which helped in conducting the study since the research is a co-relation that the results obtained in one-step can create an impact on the next step of the research conducted (Byron, 2011, p.28).

During data collection, the sample for the study was selected randomly in order to ensure that the results obtained are viable. The intended sample was therefore obtained from stakeholders and potential consumers both regulated and non-regulated legal practices. Before the actual study commences, a pilot survey was conducted to ensure that the sample of the questionnaire prepared was viable in collecting the required data for analysis (Creswell, 2004, p.56). This helped in ensuring that ethical issues were catered for during the study and that the participants had the freedom of deciding on whether to fill the questionnaires or not.

During the analysis of the data collected, the researcher conducted a statistical test where the descriptive statistic was used to analyse the data collected in order to draw conclusions and recommendations which are viable (Byron, 2011, p.52). Pearson correlation was applied to determine the relationship between the independent variables and the dependent variables. The researcher was compelled to use the direct quotes from the interviews conducted in order to illustrate clearly the results obtained. After the research, the information is presented in a written form in a combination of pie charts and bar graphs expressing the results of the study (Ashish, 2011, p.127).

Analysis of the findings

A research by Bedlow (2006, p.17) shows that fifty five point six percent of the legal firms have contracted due to the 2007 economic recession which affected the whole world. Due to this effect, research indicates that forty five percent of the firms opted to merge with other foreign legal firms in order to sustain their business. Theodore, (2010, p.43) notes that within the past two years fifty seven percent of the legal firms have changed their business structures and forty percent of the population responded that they are on the process of laying new business structures in their firms. Muris & Shoham (2011, p.14) indicate that most firms are reacting proactively in response to the challenging market conditions as well as investing greatly in the development of business strategies in order to cope up with the current reforms.

McArdle (2010, p.3) indicates that almost two-thirds of the respondents (sixty six point seven percent) have channeled their resources (ten percent of their total fee income) into the business development strategies. The remaining percent said that they are planning to spend four percent of their income fee on such developments. Surprisingly, the research indicates that commercial oriented firms are the ones which spend fifteen percent of their total fee income on business development while legal firms spend six percent of their income (Susskind, 2009, p.6). Porter (2010, p.7) suggests that this is a clear indication that legal firms are not in a position to compete with commercial oriented firms and as a result they have lost a bigger share of the market to commercial-based firms.

McArdle (2010, p.3) indicates that the implementation of the legal service act provides an opportunity for legal firms to go for external investments. He adds that legal firms have experienced tough times for many years due to the disintegration of in-house market and they have also failed to capitalize on the opportunity of external investment. Research indicates that thirty percent of the respondents are still thinking on the possibility of external investment.

Porter (2010, p.9) notes that most legal firms have channeled their efforts into the development of alternative structures in order to compete with other legal firms as well as with the non-legal firms which have entered into the legal industry. Roger bird (2009, p.5) indicates that legal firms no longer regard themselves as special firms in the market, but as other normal businesses in the market. The profits gained by legal firms are still meager in comparison with the profits gained in the past regime, but law firms still hope for the best since they are working hard to change their business strategies in order to adapt into the needs of the current market.

It is noted that most firms have decided to work hand-in-hand with those companies which have already established alternative business structures in response to the implementation of the 2007 legal service act. Due to this, some firms have stopped working as full-legal service firms (Cunningham, 2011, p.12). Young (2008, p.46) argue that the idea of alternative business structures has crippled many legal firms. He also warns that for those firms which will not work towards the implementation of these new strategies there are high chances of closing down the businesses.

Business development

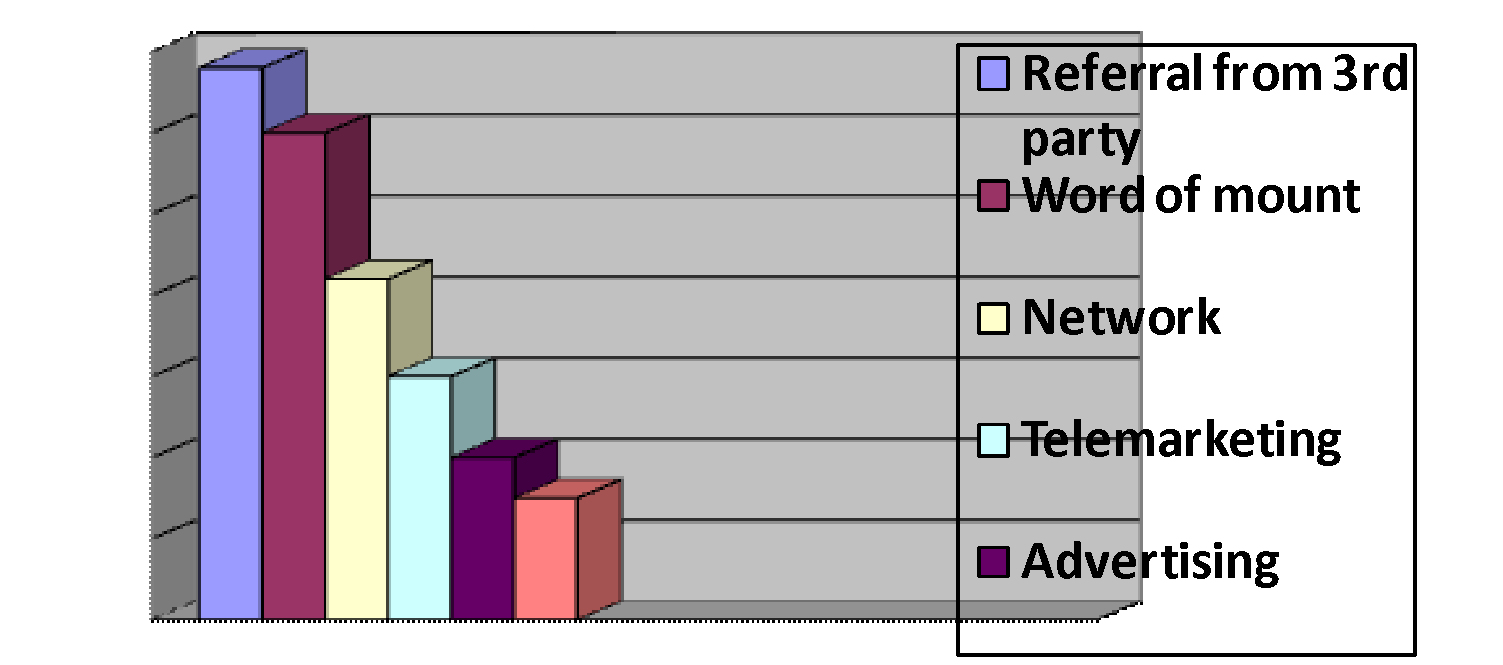

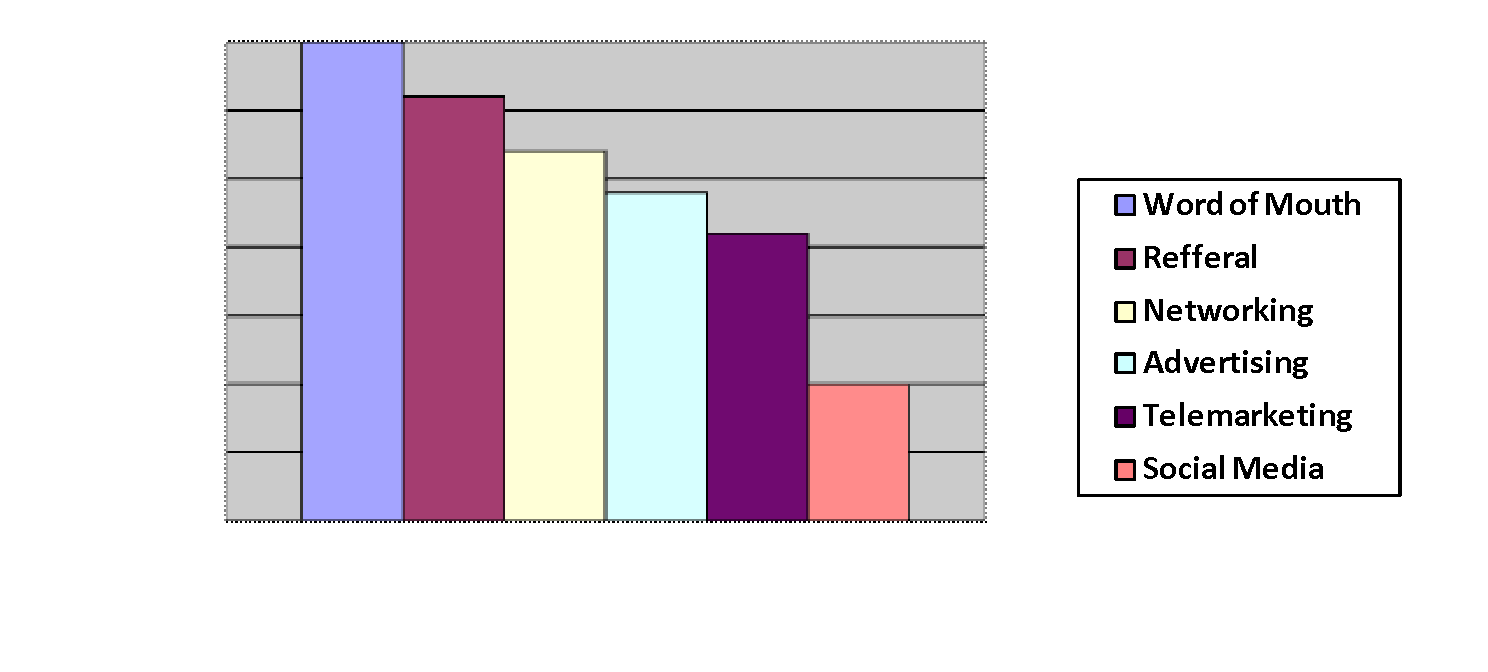

In the analysis of the research, the report considers the marketing strategies as well as the business development structures considered to be effective in the current legal market. In the research, respondents were asked to rank the modes of communication in response to their effectiveness in the market.

In response to the mode of communication suitable for law firms, Boonghee & Naveen (2009, p.54) indicate that a third of the respondents (thirty percent) recommended the use of ‘word-of-mouth’ as the most effective way of passing information to both commercial and private clients. It is also recommended that the use of word-of-mouth attracts new clients into the firm.

It is due to the fact that word-of-mouth takes a direct channel without passing through a third party before reaching the client. This is in contrast with the use of referral which goes through a third party such as estate agents or claims management companies. Word-of-mouth proves to be the best form of marketing since the feedback obtained guides the legal firms on the amount of fee that is supposed to be charged for both private and public clients (Heintz & Smock, 2010, p.51).

The use of referrals was also considered as a better way of communicating within the legal industry. Sixty eight percent of the respondents recommended the use of referrals as the best for commercial clients and sixty percent of the respondents recommended it as the second best for private firms. The use of social media was ranked as the least mode of attracting both commercial and private clients (Boonghee & Naveen, 2009, p.54).

Morgan (2012, p.12) indicates that solicitors who run law firms concluded that it is impossible for a legal firm to succeed in the new market without the implementation of client referral strategy. It is due to the fact that many solicitors consider client referral strategy as the first step in the process of generating new business models at a reduced cost. This information is represented in the graphs drawn below.

It is revealed that fifty percent of the legal firms have increased their spending on business development over the past three years and seventy seven percent of the remaining population reported that they already have plans of doing so in the following year (Soderlund, 2012, p.14). Analysis shows that between the two business development initiatives, twenty five percent of the non-legal firms have employed the business development expertise while fourteen percent of the legal firms have done so (Angus, 2012, p.8).

Soderlund (2012, p.14) indicates that the implementation of business development strategies work best for commercial clients as opposed to the implementation of a marketing strategy. It is on account of the fact that the marketing approach employs the use of electronic mails which in most cases are written in short-hand whereby many clients fail to comprehend the communicated information.

Collective approach

In the research conducted, Porter (2010, p.12) reports that respondents were asked to rank the business initiatives which they think are more effective in the current legal market. Ten percent of the respondents scored the ‘collective solicitor’ marketing strategy as the less effective strategy to sustain businesses in the competitive marketplace. In response to this study, the term ‘collective solicitor’ covers a wide range of solicitor-led networks, face-to-face solicitors and injury schemes.

Online presence

Research shows that the use of social media as a marketing strategy is not effective in sustaining the legal businesses. In the analysis, the use of social media is ranked as the least effective strategy for both commercial and private categories. In this study, the use of social media involves Facebook, Twitter and Linkedln. Since most legal firms do not regard the use of social media as an effective way of marketing their services, they consider the use of social media as a strategy of advertising tangible products, but not less tangible products and services like the legal services (Ogus, 2010, p.12).

Badenoch & Clark (2011, p.15) state that some of the respondents suggest that the use of social media can be profitable to a legal firm if used well. It also noted that most lawyers are not familiar with the new technology and it is therefore hard for them to use the current social media. In the analysis conducted, there is a clear indication that the presence of online services in a legal company has a potential of attracting potential customers.

Badenoch & Clark (2011, p.19) explain that some of the respondents (thirty five percent of the respondents) support the use of online services in the legal industry because they suggest that for the few legal companies that have introduced the use of automated documents, they have proved to survive in the competitive market. This indicates that the use of social media as a marketing strategy is very effective in the legal industry if implemented properly.

Business development perspective

Javalgi & Rajshekar (2010, p.31) indicate that the business development structures which have been in existence for the past years relate to the involvement of the business development expertise. Seventy one percent of the respondents indicate that non-law firms have managed to handle business development functions in a better manner than their counterparts.

Colman (2009, p.9) indicates that sixty percent of the respondents employ business development specialists as well as marketing strategies in order to fit into the new market. He adds that the size of the firm determines whether the firm is in need of the non-lawyer specialist or not. It is therefore noted that the larger the size of the firm the bigger the need to employ more dedicated non-lawyer specialist to solve the problems in question.

Young (2008, p.6) argues that legal firms are not able to make use of the proposed new strategies because lawyers lack the skills of implementing them, since the education system of the law profession does not take their students through the courses of marketing. It is therefore argued that legal firms have an obligation to ensure that their lawyers acquire the necessary skills through trainings and tutorials.

In transition

This report gives an analysis on how the law profession is reacting to the reforms in the current market. The report indicates that forty percent of the respondents who participated in the research have changed their business structures as a result of the 2007 legal service act. Forty five percent of the remaining population reported that they are planning to implement such structures within the next six months (Jaworski & Kohli, 2009, p.8).

Chan & Mauborgne (2011, p.19) argue that if a legal firm is not spending its efforts and resources in developing the proposed new business structures then the firm is losing a golden opportunity. He adds that such firms should not expect any good returns for their businesses since they have failed to implement the recommended changes in response to the legal deregulation in the legal market.

Jaworski & Kohli (2009, p.10) observe that the management structure of traditional law firms are not similar with other normal businesses in terms of authority and power management. The issue of publicly traded firms which involves reporting to the financial sectors requires much disciplined leaders who understand better the issues of forecasting than those working in the private sectors.

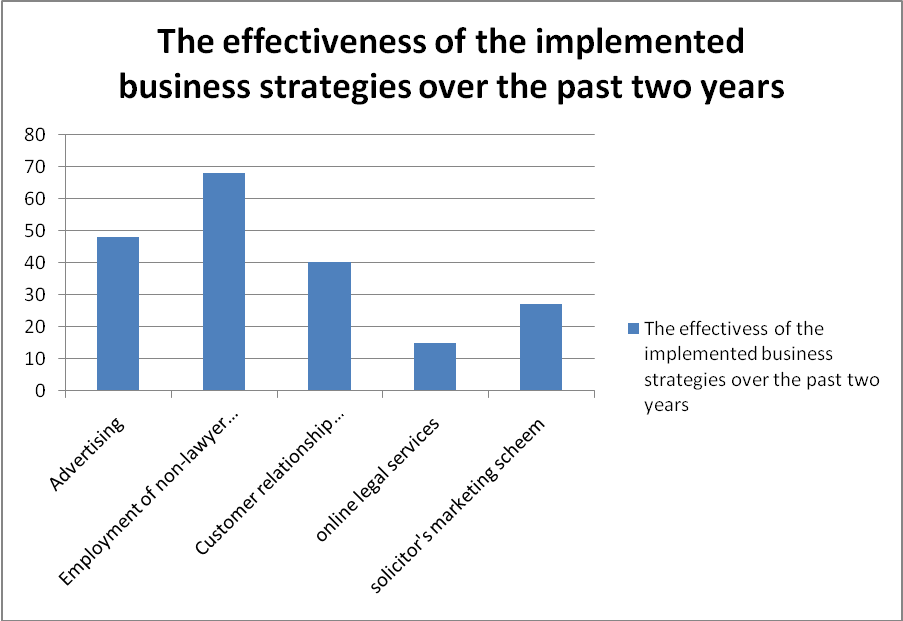

Law firms have a federal structure which dictates that lawyers are bosses of their own. This makes it difficult for legal firms to implement the proposed structures (Ogus, 2010, p.12). The graph below represents the analysis of the information discussed on collective approach, online presence, business development perspective and in transition.

The future of the legal industry

The analysis of the study indicates that the legal industry market has transformed to an extent that there are no hopes of going back to the ancient times. Just like other industries, legal industry is compelled to incorporate other disciplines like marketing and business development in its operations for it to cope up with the current reformed market. As much as there is growth in the current economy, legal firms are still experiencing and will continue to experience the stiff competition in the marketplace due to the deregulation changes which are still present in the market (Badenoch & Clark, 2011, p.19).

Chan & Mauborgne (2011, p.19) and Jaworski & Kohli (2009, p.10) suggest that law firms need to focus on visibility and differentiation in the marketing strategies employed as well as focus of the broadening and innovation of the services they render to their clients.

The new systems of operation which have been introduced into the legal industry like the use of online services to deliver legal services disrupt the traditional ways of operating the legal businesses. It is due to the fact that lawyers no longer charge for their time since the production of legal documents is generated within minutes through online procedures Javalgi & Rajshekar (2010, p.31).

Conclusion

The new technique of knowledge management is considered as a tool that improves the productivity returns of a company. Knowledge management is therefore a management issues that needs to be addressed with a lot of concern. The legal industry should therefore take an initiative of implementing the procedures and strategies of introducing knowledge management programs in their firms. In addition to that, legal firms are required to improve on the quality of the services they offer to their clients in order to regain their market shares.

References

Angus, L, 2012, ‘Predicting a diverse future: directions and issues in the marketing of services’, EUR. J. MKTG., vol.36, no.23, pp. 479-494.

Annelise, A, 2013, ‘Professionalism under the legal services Act 2007’, International Journal of the Legal Profession, vol.17, no.24, pp.195-232.

Annelise, R, & Takashi, U, 2010, ‘Reforming knowledge? A socio-legal critique of the legal education reforms in Japan’, Drexel Law Review, vol.24, no.2, pp.31-81.

Anson, W, 2008, The Attorney’s Guide to the Business Mind: An Expert Explains Corporate Clients, Finance, and the Instincts of an MBA, Kaplan Aec Education, Chicago/ US.

Ashish, N, 2011, ‘Strategy and positioning in professional service firms’, HARV. BUS. SCH., vol.9, no.24, pp.904-1060.

Badenoch, T, & Clark, G, 2011, Times Demand In-House Legal Renaissance, Upper Saddle River, NJ., Prentice Hall.

Bedlow, D, 2006, ‘From zero to hero’, The Law Society Gazette, vol.16, no.11, pp.36-46. Web.

Boonghee, Y, & Naveen, D, 2009, ‘Cultural Influences on Service Quality Expectations’, SERV. Research, vol. 32, no.14, pp.178-198.

Bowles, R, 2009, ‘The structure of the legal profession in the UK’, Oxford Review of Economic Policy, vol.12, no. 5, pp.18-33.

Burnham, T, Frels, J, & Mahajan, V, 2009, ‘Consumer switching costs: a typology, antecedents, and consequences’, ACAD. MKTG. SCI., vol. 32, no.16, pp.109-110.

Byron, S, 2011, ‘Marketing orientation: more than just customer focus’, INT’L MKTG. REV., vol.20, no. 2, pp.20–25.

Carole, S, 2011, ‘The variable value of U.S. legal education in the global legal services market’, Georgetown Journal of Legal Ethics, vol.24, no.1, pp.1-58.

Chan, K, & Mauborgne, R, 2011, ‘Strategy, value innovation and the knowledge economy’, Sloan MGMT. REV., vol.24, no.12, pp. 124-148.

Choi, B, & Headley, D, 2012, ‘Achieving service quality through gap analysis and a basic statistical approach’, SERV. MKTG., vol.5, no.8, pp.25-36.

Clementi, D, 2004, Review of the Regulatory Framework for Legal Services in England and Wales, London, Department of Constitutional Affairs.

Colman, A, 2009, ‘Do you know what companies really want?’, Marketing the Law Firm, vol. 28, no.15, pp. 46-68.

Cowdroy, G, 2009, Incorporated Legal Practices – A New Era in the Provision of Legal Services, Sage Publications, Thousand Oaks, California.

Creswell, J. 2004, Research design: Qualitative and quantitative approaches, Sage Publications, Thousand Oaks, California.

Cunningham, J, 2011, ‘Getting the most out of outside counsel’, Midwest in-House, vol. 3, no. 4, pp. 34-46.

DavidWade, J, & Hitchens, R, 2009, ‘The directional policy matrix – tool for strategic planning’, Long Range Planning, vol. 8, no. 8, pp. 76-88.

Dezalay, Y, & Bryant, G, 2010, Asian Legal Revivals: Lawyers in the Shadow of Empire, University of Chicago Press, Chicago.

DiMaggio, P, & Powell, W, 2011, ‘The iron cage revisited: institutional isomorphism and collective rationality in organizational fields’, AM. Social REV., vol.48, no.23, pp.147-189.

Douglas, S, & Yoram, W, 2009, ‘Environmental factors and marketing practices’, EUR. J. MKTG., vol.24, no.13, pp.155-156.

Ellis, N, & Watterson, C, 2012, ‘Client perceptions of regional law firms and their implications for marketing management’, SERV. INDUS. J., vol.21, no.12, pp.100-109.

Embley, J, & Godchild, P, 2013, Legal Systems and Skills, Oxford University Press, Oxford.

Flood, J, 2013, What Do Lawyers Do? An Ethnography of a Corporate Law Firm, Louisiana, Quid Pro Books.

Fortney, S, 2011, ‘Are law firm partners islands unto themselves? An empirical study of law firm peer review culture’, Georgetown Journal of Legal Ethics, vol. 23, no.14, pp.271-316.

Gillian, H, & Newholm, T, 2010, ’Crises of confidence: re-narrating the consumer-professional discourse’, Advances in Consumer Research, vol. 34, no. 26, pp. 514- 564.

Gray, J, & McAllister, G, 2009, ‘How will changes in business models for law firms affect organization, governance and regulation of legal services?’, University of New South Wales, vol. 8, no. 6, pp.24-32.

Harper, R, 2008, Global Law in Practice, Brill, Leiden.

Heintz, B, & Smock, J, 2010, ‘Attracting Clients with Marketing’, ABA J., vol. 69, no. 24, pp.1432-1478.

Hodgart, A, & Temporal, D, 2010, ‘On the art of being perceived as better, reflections on marketing legal services successfully’, Vickerstaff, vol.12, no.11, pp.46-64.

Hofstede, G, 2010, Culture and Organizations: Software of the Mind, Intercultural Cooperation and its Importance for Survival, Upper Saddle River, NJ., Prentice Hall.

Ikechi, E, & Sivakumar, K, 2011, ‘Foreign market entry mode choice of service firms: A contingency perspective’, ACAD. MKTG. SCI., vol.26, no.21, pp.274, 274.

Javalgi, G, & Rajshekar, J, 2010, ‘Strategic challenges for the marketing of services internationally’, INT’LMKTG. REV., vol. 35, no.18, pp. 563-587.

Jaworski, B, & Kohli, A, 2009, ’Market orientation: antecedents and consequences’, J.MKTG., vol. 21, no. 6, pp. 53-66.

Juny, H, 2009, ‘The European single market and the regulation of the legal profession: An economic analysis’, Managerial and Decision Economics, vol.23, no. 24, pp.115-125.

Kian, G, 2012, ‘Twenty tumultuous years: the highs and lows of the UK legal profession’, Technology, vol. 24, no.15, pp.187-232.

Kotler, P, 2010, Marketing: How to Create, Win, and Dominate Markets, Harper & Row Publishers, New York.

Lorsch, J, & Mathias, P, 2009, ‘When professionals have to manage’, HARV. BUS. REV., vol. 7, no. 8, pp.78-89.

MacEwan, B, & Regan, M, 2010, ‘Law firms, ethics, and equity capital’, Georgetown Journal of Legal Ethics, vol.61, no. 21, pp. 434-468.

Malcolmanderson, M, 2009, The Priesthood of Industry: The Rise of the professional Accountant in British Management, Upper Saddle River, NJ., Prentice Hall.

Marcus, B, 2013, ‘But it works on paper, the impediments to marketing in the 21st century’, The Marcus Letter on Professional Service, vol12, no.23, pp.25-34. Web.

Mauborgne, R, 2010, ‘Deregulation of conveyancing markets in England and Wales’, Fiscal Studies, vol.15, no. 23, pp.102-112.

McArdle, E, 2010, ‘Harvard Launches ambitious study of legal services purchasing’, Midwest in-House, vol. 6, no. 6, pp.24-36.

McKenna, J, 2007, ‘Law firm leaders define the transformative forces’, counsel to counsel, vol. 26, no.12, pp.167-203.

McMurray, D, & Susskind, G, 2012, ‘Extranets and beyond’, Law Practice Management, vol.5, no.8, pp. 25-27. Web.

Morgan, N, 2012, ‘Corporate legal advice and client quality perceptions’, MKTG. Intelligence & Plan., vol. 8, no. 6, pp. 33-43.

Muris, C, & Shoham, A, 2011, ‘Antecedents of international performance – a service firms’ perspective’, EUR. J. MKTG., vol. 36, no. 29, pp.1103-1289.

Nollkamper, E, 2013, Fundamentals of Law Office Management, 5th edn, US, Cengage Learning.

Ogus, A, 2010, ‘Rethinking self-regulation’, Oxford Journal of Legal Studies, vol. 15, no. 21, pp. 97-108.

Otter, H, 2011, ‘Deregulation and professional boundaries: evidence from the English legal profession’, Business and Economic History, vol. 34, no.18, pp.234-268.

Porter, M, 2010, Competitive Strategy – Techniques for Analyzing Industries and Competitors, 4th ed., Upper Saddle River, NJ., Prentice Hall.

Poynton, C, 2011, ‘The case for marketing’, Strategic Marketing in the Legal Profession’, vol.11, no. 5, pp.62-78.

Ribstein, L, 2010, ‘The death of big law’, Wisconsin Law Review, vol. 67, no.12, pp.749-815.

Ribstein, L, 2011, ‘Practicing theory: legal education for the twenty-first century’, Lowa Law Review, vol. 96, no. 22, pp. 649-676.

Robinson, J, 2012, ‘Marketing’s role in the knowledge economy’, BUS. & INDUS. MKTG., vol.17, no.12, pp.204-235.

Roger bird, M, 2009, Starting in Practice: A Guide for Articles Clerks and Trainee Legal Executives, Harper & Row Publishers, New York.

Schneyer, H, 2010, ‘Collective sanctions and large law firm discipline’, The Georgetown Law Journal, vol. 25, no.17, pp.234-285.

Sechooler, A, 2009, ‘Globalization, inequality, and the legal services industry’, International Journal of the Legal Profession, vol. 15, no.10, pp.231-248.

Slorach, S, Embley, J, & Godchild, P, 2013, Legal Systems and Skills, Oxford, Oxford University Press.

Soderlund, M, 2012, ‘Business intelligence in the post-modern era’, MKTG. Intelligence & Planning, vol. 8, no. 3, pp.23-36.

Stickel, A, 2010, ‘Assessing the field: how legal departments use lists’, Counsel to Counsel, vol. 24, no.18, pp.247-341.

SusskinD, R, 2009, The End of Lawyers?: Rethinking the Nature of Legal Services, Harper & Row Publishers, New York.

Tevfik, D, 2009, ‘Dissemination of market orientation in Europe: a conceptual and historical evaluation’, INT’LMKTG. REV., vol. 45, no.18, pp.145-198.

Theodore, L, 2010, ‘The globalization of markets’, HARV. BUS. REV., vol. 61, no. 6, pp. 245-289.

Weiner, S, 2012, 21st Century Solicitor: How to Make a Real Impact as a Junior Commercial Lawyer, Hart Publishing Ltd, London.

Wetherly, P, & Otter, D, 2014, The Business Environment: Themes and issues in a Globalizing World, 3rdedn, Oxford University Press, Oxford.

Yates, B, 2012, Managing for the Future: The Client-Centric Relationship, Quid Pro Books, Louisiana.

Young, L, 2008, Marketing the Professional Services Firm: Applying the Principles and the Science of Marketing to the Professions, Prentice Hall, USA.