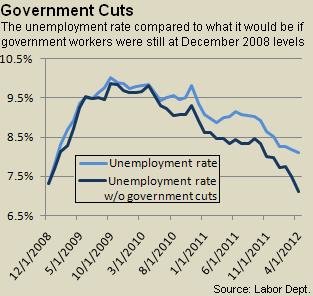

It is surprising that developed nations are the ones which are nowadays most affected by harsh financial crisis. The United States is on its way recovering from a financial crisis it experienced in 2008. In less than 5 years European Union Member Countries are in great economic problems with an unemployment rate of 10.7%. Spain is the most affected nation with approximately 5.3 million unemployed that represents unemployed rate of 23.3%. Greece is also equally affected by the menace with a 40% rate of unemployed.

The issue of unemployment in Europe is greatly affecting the residents much more than the effects of inflation. Most Europeans are nowadays more worried by the issue of t employment deficit than they care about the huge budget deficit. Appropriate use of the fiscal policy is very instrumental in regulating, aggregate demand, economic growth as well as employment.

One of the most common measures of economic performance of countries is the level of employment. For a country to develop and have a strong economy, it should be in a position to create enough jobs for its residents. A country that has a low unemployment rate is in a position to get adequate revenues through direct taxations and indirect taxes that it receives from taxable income and Value added tax respectively.

From the revenue generated from taxation the government is in a position to use it to spur economic acuities during instances of economic downturn. European Union Member Countries are experiencing an economic recession. It is the recession that has triggered the current high unemployment in the region (Quintos, 1995). It is surprisingly that the concerned parties are not implementing appropriate measures to counteract the situation.

The political elites are continually blaming the over-borrowing limit, fiscal compacts as well as treaty changes for the high unemployment rate in the region. Instead they should advocate for the use of economic stimulus to spur economic activity in Europe. They should stop using fiscal consolidation to remedy the situation but instead adopt the fiscal expansionary policy.

The European Member States should recommend the use of economic stimulus package in order to spur economic activity in the region. The use of economic stimulus package assists the private sector to create more job opportunities for the unemployed. When the unemployed people get jobs, the government is able to get more revenues from the tax they pay from their taxable income. In addition, these people will have money to spend and this will increase the aggregate demand further.

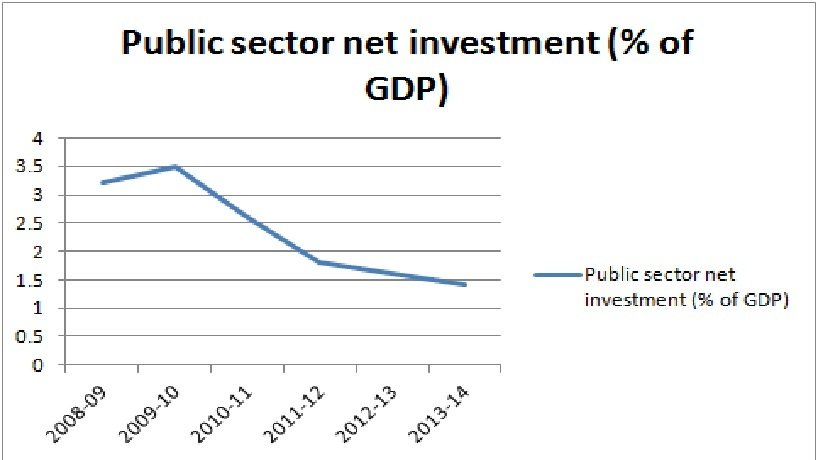

The Europe Member States governments should in addition cut down the interest rates. This will encourage people to spend money which is essential in stimulating the economy. Moreover, Europe Member States governments should increase government spending in order to create employment opportunities for their residents.

During economic recession, concerned governments are advised to increase their spending in order to create job opportunities for the unemployed. These governments can opt to increase their discretion spending, recurrent spending or transfer of payments to spur the economy (Hubbard, Garnett, Lewis & O’Brien, 2009).

It is a common assumption for modern economic theorists to believe that during normal economies labor markets are best represented by the assumption of imperfect competition just like product markets. However, in times of crisis, market laws do not apply at all. The consequence of the existing financial crisis is an increase in the unemployment rate in most European Union Member countries. Nonetheless, concerned governments have failed to implement appropriate strategies to stop the menace.

The concerned European governments should have increased their spending in addition to using economic stimulus package in order to spur economic activity and create employment opportunities for their residents. Basic economy indicates that the best strategy to cut on borrowing is to take people back to working (Heyne, 2010).

Therefore, the finance minister of the European zone should stop imposing threats on those states such as Spain that will fail to meet their budget deficit targets. Instead, the minister should recommend the use of stimulus package and an increase in government spending plus reduction in taxation in order to spur economic activity in the area. Once the economy has been stimulated, affected governments will get adequate revenues to offset the current huge budget deficit (Larch, 2009).

European Member States countries should make sure that they use the fiscal policy accordingly to increase aggregate demand, production and employment rate. The use of fiscal policy affects the aggregate demand, employment output as well as the overall economy of countries. It either results to expansionary or contraction of the economy. Governments use expansionary fiscal policy to end a recession.

The expansionary fiscal policy entails an increase in government spending, an increase in transfer of payment and a decrease in taxation. When this is not regulated appropriately it can result to inflation. An Expansionary fiscal policy results to an increase in the budget deficit that can be controlled by using a contraction fiscal policy when the economy is vibrant.

A contraction fiscal policy decreases government spending and increases taxation. The latter result to a reduction in fiscal deficit which is the best strategy to adopt in order to reduce the current over-borrowing that is present in European nations (Eslake, 2011). Thus, European Member States countries should use the fiscal policy to bring to an end the high unemployment rate prevailing in the zone.

List of References

Eslake, S 2011 Fisco Consolidation Gives Way to 2012-2013 Surplus, Prentice Hall, New York.

Heyne, P 2010, The Economic Way of thinking, Prentice Hall, New York.

Hubbard, G, Garnett,A, Lewis, P, & O’Brien, A 2009 Essential of Economics, Prentice Hall, New York

Larch, M 2009 Fiscal Policy in the European Union, Cambridge University Press, Cambridge.

Quintos, C 1995 Sustainability of Deficit Process with Structural Shifts, Journal of Business and Economic Statistics, vol. 13, no. 2, pp.409-417.