Introduction (Problem, Objectives, and Resources)

L’Oréal is one of the most famous and purchased cosmetic brands in the world. The company produces many popular brands of cosmetics, perfumes, as well as hair and skincare products, including L’Oreal Paris, Garnier, Maybelline New York, Lancome, Giorgio Armani, Vichy, and others. This Group is represented in 130 countries all over the globe. The given case study focuses on the expansion of the mentioned company in China and presents three essential challenges that it encountered on the way to success. Namely, consolidation with the local market, integration issues, and differentiation may be noted among the problems.

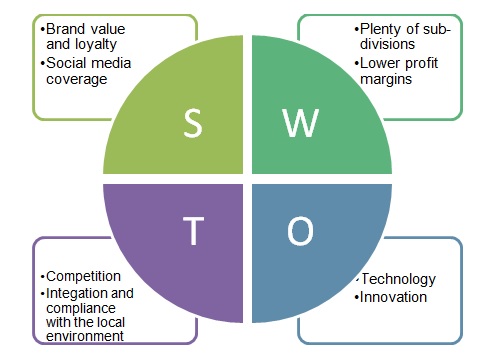

The objectives of this paper are to analyze the case of expansion based on the current literature and provide reasonable solutions to the identified problems along with feasible recommendations. The paper will be based on the critical review of the existing evidence in the field of strategic management and L’Oréal’s brand management. In addition, the resources will include scholarly articles, books, and official websites presenting reliable statistics and any other important data. Such tools as strengths, weaknesses, opportunities, and threats (SWOT) and benchmarking will be employed to present the results of an in-depth analysis.

Case Study Analysis

Background

“Because you are worth it” is a famous phrase used in L’Oréal’s advertisement at the dawn of almost 40 years, and its authorship belongs to the advertising agency of McCann Erickson. Since then, the screen with a beautiful French accent was played by actresses Catherine Deneuve, Jennifer Aniston, Mila Jovovich, Beyonce Knowles, Kate Moss, and others. The men’s L’Oréal line was advertised by the Formula One pilot, Michael Schumacher, and the football player David Ginola (Hong and Yves 117). In 1996, there was an acquisition of Maybelline, a leader of the decorative cosmetics of the mass market in the US, which had strategic importance. It not only positioned L’Oréal as the undisputed leader of the key market all over the world but also turned the corporation into the world leader in the field of makeup tools for mass demand. Moreover, Maybelline was an entrance ticket for L’Oréal to the Asian market, especially in China, where there was a factory of this brand.

To engage consumers interactively with the products, L’Oreal has released the Makeup Genius application, which allows users to do makeup online. Girls use a smartphone as a mirror and try various make-up variations likewise filters on Instagram to find out the best option. This application was already downloaded more than 14 million times. In today’s China, goods and services for personal care, healthy lifestyles, and entertainment are quite popular. Three factors affect consumer behavior, including large families, bad ecology, and general Asian trend for personal hygiene and care. It should be stated that there are more men than women, but the female half of the population makes more purchases.

Traditionally, girls, even the younger generation, use cosmetics. Being in serious relationships, they often buy something for the family, parents, children, and husband. As for the age, the target audience is composed of people from 17 to 36 years old, who are called the generation of two thousand people or the generation of the millennium. This is a young generation of Chinese consumers who are versed in modern technology, who make 66 percent of all purchases on the Internet. All of them use social networks, and they are interested in new ideas as well as trying something new. Currently, L’Oreal Group follows a comprehensive strategy of promotion on Weibo and Wechat platforms.

Issues Underlying the Problem

In partnership with Suzhou Medical College, one of the oldest Chinese universities, L’Oréal created Suzhou L’Oréal Beauty Products. In 1996, the industrial complex of Suzhou began the construction of the plant, which was opened in 1999, while two other factories were opened in the next decade to serve the rapid development of the Chinese market. Furthermore, to accelerate the development of the Garnier brand in China, which is already marketed by the Nutrisse brand, L’Oréal acquired Mininurse in 2003. This local brand, a leader of skincare products of a mass-market, already enjoyed great popularity and a powerful presence in the market. The first means of leaving Garnier were issued under the name Mininurse.

One of the challenges to entering the Chinese beauty market was associated with the overall value of the existing brands. In response to Chinese preference for these brands that take into account the specific nature of Asian skin type, L’Oréal acquired Yue-Sai – an affordable luxury brand of skincare and decorative cosmetics Yue-Sai that personified a modern resident of China and became a successful addition to the collection of the international portfolio of L’Oréal Group. However, the review of the literature shows that the company needed research and innovation to meet customers’ quality expectations and remain in-demand. In this regard, a new research center in China was launched. The main project of L’Oréal’s fourteenth research center in Pudong, near Shanghai, was the achievement of the perfection of knowledge about the skin and hair of the Asian type. Its paramount goal was to develop products that meet the needs of Asian descent around the world as well as the production of real geo-cosmetics that can cover the diversity of cultural and climatic features of Asia.

In August 2001, the face of the French company was the Chinese movie star Gong Li. Ginsheng Lan, PR Manager at L’Oréal in China, stated that over the past five years, the Chinese women’s attitude to beauty had changed dramatically since they began to spend a lot of money buying the products of Western cosmetic giants. The market was developing very fast, showing a growth of 10-20 percent per year. L’Oréal began to conquer the Chinese market in 1997, much later than Japanese cosmetics companies (for example, Shiseido). Fashion ideas are changing rapidly, and if earlier only black hair was considered beautiful, now Chinese women are experimenting with color, and L’Oréal is helping them in this with their products. When in 2002, L’Oréal began its expansion into China, its incomes grew by 61 percent, while the entire cosmetics market of this country grew by only 14 percent.

Today, almost all Chinese consumers use mobile payments every day, and many of them make up to eight payments a day. This is convenient since the payment can be made with one finger, with the help of voice commands, or even codes. There are also many commands for the cancellation of transactions, which provides security. The international brands that have already entered the Chinese market should focus their efforts on maintaining and developing the image of the brand through social media. Without this, one cannot be competitive in the market.

Desirable Solutions

To resolve the mentioned problems, L’Oreal also launched its largest Asian plant in China. Namely, the French manufacturer of cosmetics and perfumery, L’Oreal opened a new plant, the production facility of which was worth 200 million yuan ($32 million) and was located in Hubei Province. The plant, which area was about 70 thousand square meters was the largest manufacturing facility of a cosmetic company in Asia. Annually, it produces about 250 million units of cosmetic products and is expected to ensure the growing demand for care products. At the moment, China is the third-largest market in L’Oreal. Earlier this year, L’Oreal reported on the agreement on the acquisition of Chinese Magic Holdings International, specializing in cosmetics, for $ 840 million (Expansion from France to International Markets). In addition, the company stated that it is conducting exclusive discussions with the Japanese cosmetics manufacturer Shiseido about buying the cosmetics brands such as Decleor and Carita that belong to it.

By announcing the company’s new commitment to sustainable development, L’Oréal mentioned that a new type of customer has emerged that makes its choice, guided not only by the price of the product or brand but also by environmental friendliness. It seems that consumers are concerned about this because they are increasingly becoming conscious citizens. They have more information that is now open to absolutely anyone, and they understand the danger of depletion of natural resources, reduction of water quantity, environmental pollution, and degradation of biodiversity. In the cities of China, the situation is rather complicated. Therefore, the state of the environment becomes very important. Consumers understand that they are part of the world, and they cannot just forget about it when they make purchases.

Therefore, the consideration of sustainable development and some initiatives in this area is a useful way to attract more customers and also protect the environment. The problem is that there are many products on the market that are called eco-friendly or natural, but they are either quite expensive or not so good. By 2020, L’Oréal expects that 100 percent of its products will be environmentally-friendly or socially-oriented. At the same time, it is not proposed to create a new category of products that will be greener and more expensive, et cetera, but change the way of work. Until recently, the priority was to create effective and safe products of high quality. Now, the company adds one more property that seems to be valuable such as eco-friendly innovations and production.

Suggested Solutions

Product diversification is a relevant solution to market integration. L’Oréal’s target audience in China may be described as follows: 18 -year-old Miss Yu, who lives with her parents and wants to have a pink lipstick; Mrs. Lee, who is more than 20, she has a good job and a deposit in the bank; a 30-year-old Mrs. Wong is married, she has one child and uses skincare products more than cosmetics. Even the mode of transport matters: if Miss Yu drives a car, she is a consumer of the premium brand L’Oréal – Lancôme, and a bicycle symbolizes a more democratic brand such as Maybelline, for example.

One of the most feasible strategies to apply refers to research and innovation. In this regard, it is possible to point out L’Oréal’s initiatives in the field of skin reconstruction. L’Oréal is the first cosmetic company in the world to develop a method for laboratory skin reconstruction from donor cells. Anti-aging serums, bleaching creams, and cleansing lotions are developed specifically for customers of the fastest-growing market. According to the research company Euromonitor International, the volume of cosmetics sales in China will exceed the amount of $ 40 billion by 2021, leaving behind the United States. Chinese consumers are the most demanding, and this applies to virtually all categories of our products. L’Oréal strives to preserve the status of the most profitable cosmetic company in China, but the local brands also tend to gain popularity among customers. Previously, cosmetics manufacturers thought that the Chinese will always give preference to European brands, but the situation is changing. According to the estimates, L’Oréal’s revenue in China increased from 2012 to 2017 by 40 percent, reaching 2.2 billion euros. To realize the great potential of the Chinese market, L’Oréal should adapt its products to residents as much as possible.

The evidence shows that the skin of representatives of different races reacts differently to incentives such as sunlight. On the skin of the Europeans, wrinkles appear under the influence of ultraviolet, while that of the Chinese begins to intensively produce pigment. The interaction with cosmetic products is also different. For example, the basis for make-up, suitable for a representative of the European race cannot be put on the face of a Chinese woman as the increased activity of sebaceous glands can become frozen in the form of an unpleasant crust. L’Oréal began to grow skin cells a few decades ago, yet the first success with samples from China scientists from the subsidiary division of EpiSkin was achieved only in 2005. Nine years later, the EpiSkin laboratory opened in Shanghai. Here, researchers test various ingredients on gelatin-like reconstituted skin. The results of the experiments are used to adapt creams, lotions, and shampoos to the characteristics of the organisms of residents.

L’Oréal does not disclose the number of funds invested in the Chinese direction. However, according to Vivien Qin from Euromonitor, no matter how large the company’s expenses, they are justified due to the promising prospects of the Chinese market, in particular, the growing demand for anti-aging cosmetics. Having opened a branch of EpiSkin in Shanghai, L’Oréal has established supply channels for images of the restored skin, which are provided free of charge to universities along with laboratories, and are also sold to competitors. Due to the development of this direction, companies that previously refused to attend the Chinese market because of the requirement of the local legislation on compulsory animal tests may come to China. Giants such as L’Oréal, Estée Lauder, and Shiseido, already working in China, will be able to label their products with a cruelty-free sign. It is possible to expect that shortly, Chinese regulators will decide on the possibility of using reconstituted skin for appropriate tests.

Implementation Plan

The development of the Internet should be considered as one more factor affecting the company’s strategy. L’Oreal’s consumers have almost completely changed their habits in buying cosmetics and finding information about them. Beauty and everything connected with composing one of the most hotly debated topics in social media. For the company, this opens up new opportunities in interaction with customers. The digital revolution has created an unlimited space for consultations, serving people, and offering them new services. L’Oreal can form a new level of interaction with its consumers, who want to be able to make a purchase anytime and anywhere. The majority of customers still buy in traditional stores, but more and more shopping is tracked through websites and mobile applications. Many of L’Oreal’s brands have e-commerce platforms that present great potential for a serious increase in sales. For some brands, for example, Kiehl’s, the share of e-commerce is about ten percent of the total turnover in the world.

It is additional values that form loyalty to the brand, thus making it successful. The band performs the following functions for the consumer: it provides a value proposition and confidence in the firm’s branded products. In L’Oreal, the essence of the brand is the central idea presented to a consumer. It reflects the most important meaningful signs of the brand, that is, it represents a core of brand content. Therefore, it is advisable to consider the brand as a dialectical unity of its form and content. If the external identifiers shape a form, then the internal identifiers, by which a consumer determines the correspondence of the brand values to their settings, constitute the content of the brand. To ensure brand effectiveness, the company needs to strive for compliance between the form and content of the brand. Modern successful brands are empirical brands that are the result of empirical marketing. In empirical marketing, the emphasis is transitioned to the experiences of a client, which generates values of the sensory, emotional, cognitive, and behavioral nature.

With the development of technologies, it becomes increasingly difficult for companies to maintain the functional values of brands for a long time as the benefits-oriented on functional properties become relatively simple to copy. Without a strong brand, a company cannot move forward. Therefore, one should ensure seamless communication with customers on all possible platforms. A consumer expects companies to be available at three in the morning on Sunday in his favorite application, for example. Companies that plan to sell their products to the Chinese market from other countries should start building relationships with the local bloggers and opinion leaders. The SWOT table can be created to summarize the analysis (see Figure 1).

The potential implementation plan may be based on the method of benchmarking. An important feature that determines the conduct of business in the context of globalization is the intensification of competition. A significant challenge for L’Oréal is the search for new ways and tools to improve competitiveness as a strong competitive position is a basis for its successful operation in the long term. Benchmarking helps to identify problems in the organization of the company’s activities and areas of backwardness as well as identify ways to overcome them. In this case, L’Oréal itself can serve as a standard, and its practices will be used for subsequent implementation. It is useful to apply benchmarking to improve business processes, the characteristics of their products, reduce costs, and achieve the best performance indicators based on a benchmark comparison of their activities with that of other leading companies.

Benchmarking implies comparing a company’s activities with those of others that have the best practices in the areas of business that are of interest. The first stage refers to the collection of the required information. This phase involves not only the collection of qualitative and quantitative data but also the study of the content of the market along with processes or factors that explain productivity (Hill et al. 109). Identifying potential partners for benchmarking is another step in the research phase. It is more coherent to apply the experience of enterprises operating under similar conditions, steadily setting high goals for themselves. To identify a potential partner, several methods may be used to find who best satisfies the needs of consumers and have the best processes to be evaluated. The most obvious would be to look for the industry leaders among direct competitors. The difficulty of this situation is that some companies are not yet ready to share the experience with their competitors and did not realize that such a procedure is mutually advantageous.

The next stage of benchmarking is the analysis of information. This stage puts forward great demands on the creative and analytical abilities of the participating sides in the process of analysis of superiority, thus promoting awareness of the similarities and differences and understanding their relationship (Hill et al. 110). In addition, it is necessary to identify effects that can complicate comparisons and falsify results. The purposeful implementation of the information received, namely, not only the implementation of the developed opportunities for improvement but also further development of the organization of the enterprise should be followed. In this case, the point is not copying yet creating an incentive for further innovative development of the company.

The analysis of only one category of data will not give a complete picture of the company’s activities, while every indicator should be compared with a similar one of the partner company’s performance. In this regard, there are two questions: how critical is the dissimilarity between the compared companies, and how much technology does the partner apply (Hill et al. 109). In case the data regarding the partner firm can be compared with similar data on the initiating company, the benefits of the results obtained are great. Even if the initiator company outperforms the partner on most indicators, there will always be something to be learned. Nevertheless, as a partner in benchmarking, it is more logical to choose a company that exceeds in this or that field of activity. Repeating the analysis results in an adjusted manner completes the process of benchmarking.

Legal and Ethical Considerations

The media and current literature support the image of a growing high-potential cosmetics market in China, but its effectiveness does not always depend only on the size. The customers should not only want to buy but also have to have money for this. Although there are many buyers in China, and their incomes are rising, many people remain below the poverty line and are unable to acquire what they want. First of all, it is clear that the aspirations of customers are growing, the desire is ahead of opportunities, and the traditional areas of modernization are not always applicable. Taking into account the vastness of China’s territory, ethnic diversity, and a rapid pace of change, it should be noted that China’s traditional culture is not respected all the time and in all places. Today, Chinese business ethics should instead be seen as a so-called “pot” of modern Western ideas and traditional Chinese values with several paradoxes. The ethical considerations should consider the superficial Western framework that is built on deeply entrenched Confucian values, while the goals of economic efficiency are created by people who are oriented towards the ideology and the traditions of social responsibility.

As for legal considerations, it is rather important to register the product and then export it. Contacting Chinese representatives and getting a license for a product from the State Food and Drug Administration (SFDA) requirements. Now, China has simplified rules for the import of goods into the country, which allows foreign retailers to sell their products on the territory of ten free trade zones without passing checks and customs clearance. According to the law from June 30, 2014, ordinary cosmetics testing on animals, which is produced and sold in China, becomes optional. However, there is no answer to the question of whether products are to be sold in China, but it is evident that Chinese law no longer forces to test cosmetics on animals. In the article of Humane Society International, it is explained that the changes in the Chinese legislation of 2014 will largely affect all cosmetic companies. According to these changes, some products are not required to be tested on animals by law, but this does not guarantee that they will not be tested. Companies can also decide to test animal cosmetics in China because this is legal.

My Role

Speaking of my role as a researcher of the given case study, I would like to emphasize that my role is mainly theoretical. Namely, I can analyze this case and apply various strategies in an attempt to suggest some relevant strategies and use appropriate tools. At the same time, this may provide essential grounds for conducting scholarly research regarding the current situation of L’Oréal in the Chinese market. The review of the existing evidence demonstrates that the company moves forward and tries to follow the current trends in social, economic, and cultural issues. Therefore, it seems that the new research would contribute to the theory of strategic management associated with the expansion to foreign markets.

Lessons Learned

In my point of view, this assignment is rather useful as it provides the opportunity to understand and interpret a real-life situation on the example of L’Oréal’s acquisition of the Chinese cosmetic brands. I have learned that it is significant to pay attention to a full range of factors that may either improve or weaken the company’s condition in terms of a foreign market. I have understood that it is essential to figure out what attracts the Chinese as their cosmetic tastes and needs are different from Western addictions. For example, Europeans and Americans prefer to purchase artificial tan cream, and the Chinese adore bleaching (Xie and Zhang 540). In other words, all the local specific cultural, ethical, and legal peculiarities are to be taken into account.

More to the point, this assignment allowed integrating information presented by the case study and those obtained from the recent evidence. Based on the credible sources, I have suggested several strategies to resolve the problems outlined in the case and also offered several recommendations on how L’Oréal may enhance its positions in China, focusing on technology, social media, and brand awareness. It should be stressed that writing the report about this case study required following a specific format that is important for an academic style.

Conclusion

In conclusion, one should emphasize that L’Oréal is a large and promising company that operates in the field of cosmetics. On the Chinese market, it encountered both challenges and opportunities, which may foster its expansion and improve the positions. Consolidation with the local market, integration issues, and differentiation problems were revealed in the course of the analysis. It was determined that the company should follow the current trends and apply technology and innovation to remain competent and competitive. Brand management strategies and social media coverage were recommended as the relevant ways to resolve the above problems. More to the point, it should be stressed that proper investigation of the local customer preferences may significantly contribute to the expansion of this cosmetics company.

Feasible Recommendations

Given the mentioned issues and solutions, it is possible to suggest several recommendations that may improve the performance of L’Oréal in the Chinese beauty market. The company should change a lot in production, focusing on the concept of products as well as the choice provided to customers. It seems that this is what is now expected from manufacturers all over the world. Since it strives to increase the number of loyal consumers, people who buy this product should be fully confident that they make a responsible choice. China is an extremely important beauty market for the whole world. L’Oreal in China has been present for many years and it is successful there. What is important, the market has great potential as there is a tradition of beauty.

Speaking about new consumers, in the presentation of the company for employees and investors, one may note the statement that the company should follow the current changes in the world. In particular, one of the economic trends such as the formation of the middle class, the main request of which is a good and affordable product. With the recent development of countries such as Mexico, China, Brazil, and others, a middle-class stratum appears in them, and people need access to good products as buying safe and effective cosmetic products is a very simple way to improve the quality of life. Therefore, the company should gain an audience by being where customers are looking for the identified cosmetic products.

There is a huge offer of different brands on the market, every year it becomes more difficult to stand out, and a consumer seems to be simply disoriented. To manage to compete, L’Oreal should understand that this is the price of this game – in free markets people have a choice. The cosmetic industry provides the widest range of products, which is generally good, but a brand can be successful only if it is a product of high quality. Without this, it can be popular for a very short period. Therefore, it is necessary to constantly focus on research, innovation, and science to constantly improve and anticipate customers’ expectations. For example, environmental friendliness and as well as skin reconstruction may be recommended as the areas for development. Some part of turnover should be invested in research and development more than competitors can do. This will allow being sure that by trying products, a consumer will return to them again.

Another recommendation may be formulated as follows: be active on the Internet. It is possible to run a blog and write articles regularly to allow consumers to receive the latest news promptly. The posts should inform about the company and its products, and also contain reviews of satisfied customers to prove that the brand can be trusted. Activity in social networks is another part of this recommendation as the Chinese do not part with their smartphones, and they need innovation and authenticity. Of the 630 million Internet users in China, about 90 percent use social networks to gather information about brands. The most popular social networks in China are Weibo microblogging and WeChat messenger, which have a news line. This popular platform will allow turning the target audience into the brand’s followers.

Opinion leaders are popular bloggers and stars who advise about the skincare and selection of a suitable product. To make the company’s positions even more stable, it is possible to consider concluding a partnership with them. If the leader of opinion tells about the brand, it will become a well-known brand among numerous followers. For example, the Chinese are deeply in love with the British actress Emma Watson, who is the face of the Lancôme brand. She has fair skin, and all Chinese women want to be like her. When expanding to the Chinese market, it is important to know exactly what the target audience is. By examining customers’ needs and expectations, it is essential to regularly update information about the brand along with the current trends.

Works Cited

Expansion from France to International Markets. 2018. Web.

Hill, Charles WL, Gareth R. Jones, and Melissa A. Schilling. Strategic Management: Theory: An Integrated Approach. Cengage Learning, 2015.

Hong, Hae-Jung, and Yves Doz. “L’Oreal Masters Multiculturalism.” Harvard Business Review, vol. 91, no. 6, 2013, pp. 114-118.

Tao, Zhigong. L’Oreal: Expansion in China.Harvard Business Review. 2018. Web.

Xie, Qinwei, and Meng Zhang. “White or tan? A Cross-Cultural Analysis of Skin Beauty Adv ertisements Between China and the United States.” Asian Journal of Communication, vol. 23, no. 5, 2013, pp. 538-554.

Appendices