Agricultural enterprises seeking to employ management accounting techniques

Proper management accounting strategy is crucial for effective cost and price control in an organization. Farming, like any other industry, requires proper accounting for a rewarding business. In the case of John and Mary, the partnership needed to have an effective accounting system that can handle their business. Farming is unique in its way thus it requires a customized managerial accounting system to address its issues. When other companies in the farming industry engage such a system, it will be a breakthrough in proper accounting in the sector.

The main strength of the system is that it recognizes different income and expenses heads that farmers have to incur when arriving at their gains. The system has assisted to forge their way forward in the business (Horngren 2008). When doing business especially in small and medium-sized businesses, it has always been a challenge for managers to separate business and personal activities. It is rare to find an entrepreneur in such a business separating his income and expenses from that of the business. The farming industry of the nature of John and Mary falls in this category however with such a management accounting system like the one portrayed, then the management is likely to be more easy and effective.

The main benefit that farmers are likely to get from the managing accounting system is control of activities in their business; when professional managerial accounting systems are implemented in farming then there will be the practical improvement of linkage between financial analysis and strategic decision making. Managerial accounting is likely to assist farmers to identify different cost drivers and understand a broad range of technical issues and concepts that can assist them to improve their businesses (Horngren 2008). One area that has been quoted to have been the source of business failures is the lack of proper accounting methods. With an effective managerial accounting system, it will improve the design of record keeping and management information systems to mirror the management structure of the farm (Horngren 2008).

The main challenge likely to face farmers in their trade and the adoption of managerial accounting policies is the costs associated with the system. To maintain an effective system requires the management to keep track of issues and deploy highly competent staff, this might be seen as an extra cost to the management.

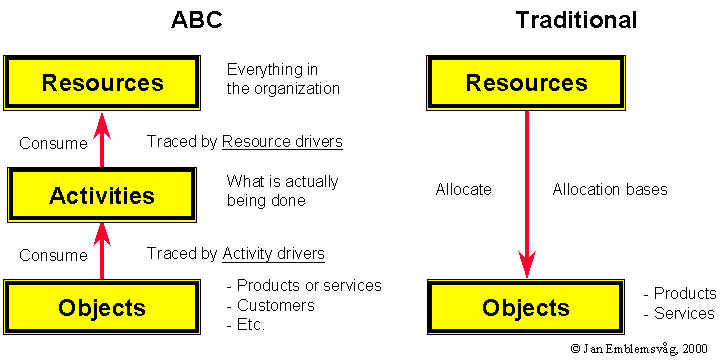

Main dysfunctional decisions of using traditional costing method over and above activity-based costing

When using the traditional method, the company is likely to misunderstand how costs should be distributed across different products. When such misunderstanding occurs, then it happens that some products will be sold lower than their actual price. This might lead to losses (Horngren 2008). On the other hand, some products might be sold at a high price than what they should be priced; this is likely to lead to loss of customers and competitiveness.

According to the Farm Council Case, it was better than decisions that were made using an activity-based costing approach. The reason lies with the advantages that the method has over the traditional method of costing, the following are the benefits that the firm enjoyed:

The method offers a better understanding of overheads and thus it ensures that all costs incurred during production have been accounted for when costing the commodity. The method does not only considers the costing element but involves other areas like efficiency, performance management and scorecards

The approach of unit cost rather than bunch cost ensures that costs are allocated to the specific units they have incurred thus a better costing method.

The final suggestion is superior in that it will have addressed all areas necessary for making effective strategic decisions.

Discussion on the assertions in terms of variable and fixed costing and why ABC may make more sense in these types of settings

According to the author, contemporary business management should go further than just classifying costs of operation on a fixed and variable cost basis. They should adopt an effective method through which different areas will be addressed; the suggested method by the author is activity-based costing: under the system, the costs associated with a certain product is calculated by addicting up the apportionment of the costs of all activities that have been incurred in the production of the commodity (Horngren 2008).

Under the system, every cost that has been incurred that can be attributed to certain sections, departments or activity is considered to be the cost of the products as a result. The method is more common in those companies that produce different products under the same roof, but the costs can hardly be disintegrated into different areas.

For example, a farm may incur some research and development costs to advice on the best products that they should undertake; however when though the costs are incurred for the benefit of the entire company, there may be more costs attributed to the research of the performance of particular crops/produce (Horngren 2008). The idea behind activity costing is that the company will apportion the costs and attribute those associated with laptops to laptops and have the portion on phones the same. The methods are superior as it does not assume that the cost is common thus should be attributed to all commodities at the same rate. (Please see appendix for a comparison of ABC and traditional form of costing)

Reference

Horngren, T. (2008). Cost accounting: a managerial emphasis, New York, Pearson Prentice Hall.

Appendix