The Working Capital Trade-Offs for Each Company

In working capital management, two vital tradeoffs are present. The first one is profitability which diverges in reverse with liquidity. If the financial managers increase the quantum of investment in the current assets, then, it will result in an increase in the liquidity of the business but minimize the probable profitability as determined by the return on investment (ROI= Net Profit / total assets).

On the contrary, if a business takes more risk, then there is a chance of higher profits or revenues. If a business is meeting its business needs by availing more credits from its suppliers, then it will run the risk of being not able to cater the fiscal commitments when the current liabilities become due, losing its loyal customers due to restrictive credit policies and there can be a decline in sales due to stock-outs. Prudent management attitudes towards these tradeoffs can be accomplished by maintaining opt level of current assets (Baker and Powell 2009:159).

If we analyze the balance sheets of Tesco, Sainsbury and Marks and Spencer (M&S), we can find that these supermarkets are efficiently managing their working as their suppliers offer the major junk of finance which has in fact assisted them to fund their further growth, expand their operation and fund the non-current assets.

In a conventional business, the working capital is defined as the quantum needed to finance debtors and stock after adjusting the credit extended by the suppliers. However, working capital management is entirely diverse in the supermarket business. In the supermarket business, at the check-out counters, the stock turns into cash but suppliers are paid not immediately but with liberal credit periods extending more than three or four months.

Further, in the supermarket business, debtors are comparatively irrelevant due to cash/credit card sales and creditors surpass inventories by a huge margin. Hence, almost all the supermarket balance sheets in the UK will reveal a negative working capital need. For investment in fixed assets or non-current assets by supermarkets, generally, liberal trade credit provided by suppliers has employed the source of providing finance for the same (Plender et al 2005).

For example, Tesco’s group sales for the year 2012 were £72 billion and its UK sales were £42.8 billion which is about 66% of the group sales which is rising much quicker than the UK’s economy. It is to be noted that the amount to be paid by Tesco, Sainsbury and M&S to their trade creditors has soared at a rapid speed as compared to their inventory value or sales in recent times (Plender et al 2005).

Inventory vs Trade Payables of Tesco, Sainsbury and M&S

In fact, suppliers of these giant supermarkets in the UK have turned to be bankers to these supermarkets on a noteworthy scale, thereby, tendering a major share of finance in a period where the cash flow from depreciation has just covered a fraction of their combined investment plan. Thus, the credit offered by suppliers on a large scale has helped these giant supermarkets in the UK not to look upon their bankers for financing facilities or to enter into capital market to meet their financial requirements thereby mitigating the strain on their balance sheets (Plender et al 2005).

The research study carried over by the UK’s Competition Commission in 2000 found that trade credit as compared to days’ sales stayed stable over the period from 1990 to 1999 and Tesco’s number was 23.4 days whereas Asda’s was 30.7 days of credit period (Plender et al 2005).

Further, the sudden increase in creditors as opposed to the inventory in Tesco, Sainsbury and M&S was mainly due to the fact that the sales of their non-food items have grown thrice than that of their food sales. Thus, these supermarkets are paying their perishable suppliers like meat processors faster than their suppliers of non-perishables.

It is to be noted that for the UK supermarkets, suppliers are compelled to extend more credit facilities to fund the business of the giant supermarkets which connotes that the worsening in the supplier’s balance sheets which makes them more susceptible to the crumbling down of the supplier’s business (Plender et al 2005).

Critical evaluation of the strategy applied for financing working capital for each of the companies.

The trade-off between investing in working capital thereby minimizing the returns and assuming risks by not making an adequate investment can be termed as a working capital strategy perused by a business. If supermarkets adopt a very tight credit policy mainly to manage their debtors would very well frustrate other marketing efforts of the business and hence, such activities are required to be controlled and coordinated. Further, supermarkets have to maintain extra inventories for each of the new outlets which are to be opened by it in the near future (Bender and Ward 2012: 225).

In the supermarkets, the strategy applied for working capital management is slightly different from that of other industries. Since, the supermarkets are the retail businesses that are selling to end customers directly and, hence, there are very few debtors. Further, they function with minimal inventories and they are having strong buying power to have considerable long credit periods particularly from their suppliers and in almost all supermarkets, the net working capital will be always negative (Bender and Ward 2012:224). This is evidenced by the following table:

If we analyze the working capital strategy adopted by the above supermarkets in the UK, they adopt the strategy of having longer credit period with its creditors as all the three supermarkets have negative working capital. They have strong bargaining power with their suppliers and thus enjoy a longer credit period and hence their financing cost would be considered very less and their net profit margin will always be higher. Out of three, Tesco is having strong bargaining power with their suppliers as it is having the highest negative working capital as compared to Sainsbury and M&S.

Further, the above three supermarkets with their aggressive financing policy, fund their permanent assets or non-current assets mainly with the short-term debt. As a result, they are enjoying higher anticipated revenues as the cost of the short-run debts will always be less than that of long-term debts but it would be very risky. These supermarkets use the tradeoffs achieved through their working capital management mainly to open new stores, to invest in non-current assets and expand their operations globally (Ogilvie 2008:78).

Analyze the Working Capital Efficiency for All Three Companies

In determining the level of working capital, the operating efficiency of the management plays a crucial role. Through operating efficiency, the management can contribute to a vibrant and sound working capital position. Though the controlling of rising in prices is not in the hands of the management, it can make sure the efficient usage of company resources by minimizing waste, enhancing the coordination, and by exploiting the present resources of the company to the maximum level, etc.

Thus, the efficiency of operations speeds up the velocity of the cash cycle and improves the turnover of the working capital. Operating efficiency relaxes the pressure on working capital by enhancing profitability and thereby improving the internal accruals of funds. Further, the level of working capital that is needed by a business is decided by a wider range of issues which are partly external (environmental) and partly internal to the business. Competent working capital management needs prudent planning and a regular review of the requirements for a suitable working capital strategy.(Chakraborty 2004 720).

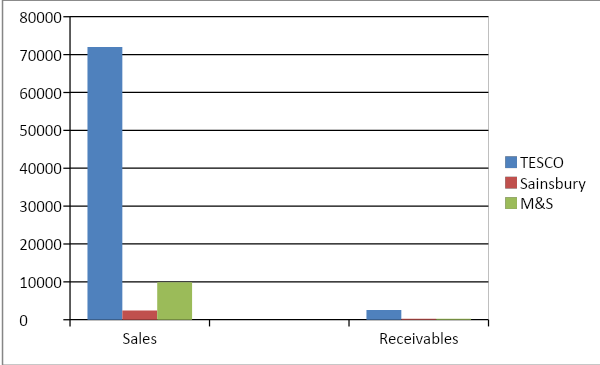

Receivables Management

Source: ( Tesco, Sainsbury & M &S Annual Report 2012).

All three supermarkets are managing their debtors prudently as they are able to collect the money so fast from its customers and in the supermarket business, cash sales are made at the check-out counters and the stock turns into cash at the point of sale. Further, as these supermarkets are enjoying almost 90% cash sales, they incur very less financing costs for their working capital credit facilities.

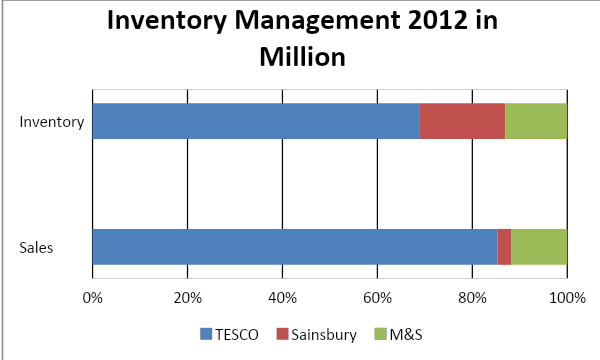

Inventories Management

Source: ( Tesco, Sainsbury & M &S Annual Report 2012).

Tesco’s investment in inventory is relatively high in the industry but if we compare its sales and number of stores, it is essential to maintain such high stock else it may encounter a stock out issues and may lose its valuable customers to its competitors. Prudent management of inventory is essential as it would minimize storage and warehousing cost. Further, Tesco is prone to higher stock loss mainly due to obsolescence and damage.

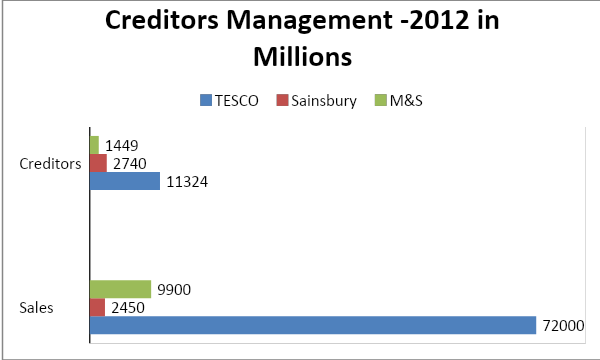

Creditors Management

Source: ( Tesco, Sainsbury & M &S Annual Report 2012).

All the supermarkets in the UK are able to enjoy liberal credits from their suppliers. Further, there is a close association between the market share of a supermarket and their capability to obtain more constructive terms from their suppliers. Since Tesco is the market leader, it is able to enjoy high credit from its suppliers. As per the Competition Commission report of 2000, the supermarkets in the UK had enhanced their buying power to such magnitude that they badly impacted the competitiveness of their suppliers and had twisted the competition in the market. The above report also demonstrated that Tesco, which is the industry leader in the UK, which is able to obtain discounts from their suppliers at 4% below the industry average in addition to the promotional discounts already enjoyed by these supermarkets which are around 5 to 10% of the value of their sales (Schnedlitz 2010:191).

In the UK, all the supermarket retails will be having negative working capital and Tesco is no exception to this. Tesco has raised loan funds by issuing a bond deal for £1.2 billion, thereby, securing the loan for its business purposes with a commitment for 42 years. This can be regarded as an illustration of negative working capital which is employed for financing the short-term needs and the matching financing of non-current assets which includes long-term assets. Thus, in the UK, negative working capital is available to all retailers, as a retailer like Tesco can able sell to its customers in cash and while making payment to their suppliers later. Thus, retailers in the UK who are having a high volume of sales like Tesco would be definitely reaping higher benefits (The Treasurer 2008).

Hence, in view of the above, it can be concluded that Tesco is efficiently managing its working capital as compared to Sainsbury and M&S.

The Balance Sheet of Each Firm and Calculate the Value of Shareholder’s Equity

Shareholder’s equity can be defined as a privilege or a claim or an interesting one has over the net worth of the company. The claim of all shareholders of a company can be defined as equity. Equity is normally symbolized by some guise of shares pointing out how much of the aggregate claim arises to each of the investors encompassing the group of shareholders. As per ISAB 1989, §49, equity is nothing but the reminder in the total assets of the company after subtracting all its liabilities (Stolowy and Lebas 2006: 45).

Financial analysts always compare the ratio of the book value of the shareholder’s equity with that of the market value of the shareholder’s equity which is also known as the “market–to–book–value ratio in evaluating the current market prices. Both the theoretical and empirical research findings advocate that the quantum of the market-to-book-value ratio is associated with (a) a company’s capability to generate a greater volume of profitability as contrasted to its competitors, (b) its velocity of growth, (c) its use of dependable guidance in evaluating liabilities and assets which net to the book value of the shareholder’s equity (Stickney et al 2009:142).

The market-to-book ratio which is also known as the ratio of book and market value can be calculated as follows:

Market-to-book ratio = Market price per share / Book value per share

For the two primary reasons, the market to book ratio is generally more than one. First, due to management application of accounting standards or as a result of accounting standards itself, this leads to book values of individual assets that are normally equivalent to or lower than their fair value. For instance, if a business operation contains a major part of research and development which is accounted immediately as expenses under the US GAAP, the unaccounted economic assets ushered by such expenses make the book value per share be lesser than their fair value.

Further, the growth opportunities in the future will enhance the market price per share but that may not be mirrored in the accounting treatment of its book value.

Both IFRS and U.S GAAP need that transactions have occurred or those undetermined future happenings can be predicted reliably for recognizing the book value in the financial statements. Hence, for this reason, the book value of the shareholder’s equity seems to lag market value (Wahlen et al 2010: 459).

The return on equity ratio also informs us how much profit a business earned as compared to the book value of shareholder’s equity. ROE is calculated by dividing the net profit by the book value of the shareholder’s equity (Bodie 2008: 111).

As regards to the value of the shareholder’s equity, Volkswagen registered an increase of 77% in the year 2011 as compared to the year 2010. This is a substantial and notable increase and it denotes Volkswagen’s total assets have registered a substantial increase in the year 2011 and it has adequate liquidity to meet both its long term and short-run liability. The increase in both non-current assets and current assets in the year 2011 over their aggregate liabilities reveals that Volkswagen has a great future. Further, Volkswagen’s book value per share is around 9929 whereas its market value is around just 159.88. Shareholders who want to reap benefits, in the long run, can without hesitation invest in Volkswagen shares.

As regards the value of the shareholder’s equity, Daimler AG registered an increase of 15% in the year 2011 as compared to the year 2010. This denotes a slight increase and it denotes Daimler total assets have registered a normal increase in the year 2011 and it has adequate liquidity to meet both its long term and short-run liability. The increase in both non-current assets and current assets in the year 2011 over their aggregate liabilities reveal that Daimler AG has a good future. Further, Daimler’s book value per share is around 6698 whereas its market value is around just 51.48. Shareholders who want to reap moderate benefits, in the long run, can invest in Daimler AG shares.

As regards the value of the shareholder’s equity, Renault AG registered an increase of 8% in the year 2011 as compared to the year 2010. This denotes a slight increase and it denotes Renault AG’s total assets have registered a normal increase in the year 2011 and it has adequate liquidity to meet both its long term and short-run liability. The increase in both non-current assets and current assets in the year 2011 over their aggregate liabilities reveals that Renault AG has a sleek future. Further, Renault’s book value per share is around 5412 whereas its market value is around just 41.62. Shareholders who want to reap reasonable benefits, in the long run, can invest in Renault AG shares.

Volkswagen’s share price was 56.50 as of January 3, 2000, and its share price is being quoted at 159.80 as of December 20, 2012. There has been an increase of 282% of the increase in share price in a span of 12 years. Since there is a three-fold increase in the share price in the span of 12 years, investors who are keeping these shares, in the long run, would be definitely reaping many benefits. In arriving at this conclusion, the dividend declared, any bonus issue made or other benefits extended to shareholders have not been considered (Yahoo finance.com 2012).

Daimler AG’s stock price is 54.20 as of December 20, 2012. Its market cap is around 57.85 billion. On October 26, 2008, its stock price quoted was 51.47. Daimler AG’s stock price has registered a meek 5% increase over the span of 4 years. Despite its strong book value, investors who want to reap larger benefits may switch to other high-yielding shares as its share has shown a meek increase in the last five years (Yahoo finance.com 2012).

Renault AG stock price was quoted at 41.62 on December 20, 2012. Its market cap is around 41.22 billion. On January 10, 2010, its share price was quoted at 37.19. The share price has registered a just less than 1% increase in the span of two years. Despite its strong book value, investors who want to reap larger benefits may switch to other high-yielding shares (Yahoo finance.com 2012).

Volkswagen

Volkswagen is a leader in the automobile industry and has its operations around the world and functions in two segments namely automotive and financial services. It manufactures, both fuel-efficient small cars and also luxury vehicles targeting high-income groups. The group occupies 11.3% of the global passenger car market share and is having a 30% market share in the European passenger car market. Since their IPO, the Volkswagen share price has demonstrated a distinct positive growth. Among the listed companies on the Deutsche Borse and since the introduction of the DAX in July 1988, Volkswagen has been seen as the most top-selling company. As of March 2011, its market capitalization stood at €51 billion with 2.67% weighting in the DAX.

All the three companies, namely Volkswagen, Daimler AG and Renault AG, are in the automotive industry. The basic features of the automobile industry namely, the automotive industry is highly cyclic in nature as they totally depend upon the consumer’s choice to buy a car and are chiefly dictated by the overall economic scenario. Further, the automotive industry is highly volatile in nature due to anticipation about prices of fuel, changing tastes of its customers, awareness about the reliability and quality.

Further, the scenario is aggravated by excess vehicle production capacity that is available in Europe as of date. Due to this excess production capacity, there remains cutthroat price competition among car manufacturers. Further, the automotive industry is a capital intense industry where the players need huge investments to manufacture and design and to adhere to the increasing level of various laws specific with regard to emissions and automotive industry is subject to a high level of fixed costs resulting in a high magnitude of operating leverage (Standard & Poor 2012:6).

Daimler AG

A German car manufacturer which is occupying the 13th position among the world’s top car manufacturers and also possesses the top position in truck manufacturing in the world. Daimler AG is one of the biggest manufacturers of commercial cars and premium cars with a worldwide reach. Daimler financial services offer leasing, financing, insurance, fleet management and novel mobility services. Daimler prolongs to shape the future of mobility today as a pioneer of automotive engineering in the world. Daimler is constantly spotlighting green technologies and fuel-efficient cars and superior and safe cars and trucks that make fascination and craze its clients.

Daimler is constantly investing huge amounts in making emission-free automobiles in the long run. It is also manufacturing electric cars which are emission-free powered by fuel cells and batteries. This demonstrates how Daimler willingly acknowledges the confronts in catering its accountability towards the environment and the society. Now, Daimler also dominates both the Chinese and Russian markets with its premium and modern domestic trucks. Daimler has planned for the manufacture of 1.34 million vehicles during the year 2012. It is continuously achieving capacity utilization of its manufacturing plants (Daimler.com 2012).

Renault AG

Renault AG is a midsize car producer from France with an emerging global presence. In Europe, in 2011, Renault occupied the 3rd position in the passenger car manufacturing sector in terms of the number of cars sold with a 9.5% market share in the automotive industry in the EU. As regards to LCV sector, Renault maintains a poignant 16.7% market share in the EU market. 2.72 million Renault vehicles were sold around in the year 2011. Renault generated 64% of its revenue in 2011 from the European market. Renault is also engaged in financial services and in consulting. In the small car and entry segments, Renault is having a good market positioning. It has further potential to enhance its geographical presence and to enlarge its operation with strategic cooperation with Nissan. It has a profitable financing subsidiary that is maintaining enough asset quality and stable cash flow (Standard & Poor 2012: 6).

Summary

Among the three companies, namely Volkswagen, Daimler AG & Renault AG, it is advised to invest in Volkswagen. Volkswagen is having a 63354 million value of shareholder’s equity and its book value of shares is 62 times higher than the market value of shares.

Volkswagen share price was 56.50 as of January 3, 2000, and its share price is being quoted at 159.80 as of December 20, 2012. There has been an increase of 282% of the increase in share price in a span of 12 years. Since there is a three-fold increase in the share price in the span of 12 years, investors who are keeping these shares, in the long run, would be definitely reaping many benefits. In arriving at this conclusion, the dividend declared, any bonus issue made or other benefits extended to shareholders have not been considered (Yahoo finance.com 2012).

The other two companies’ value, namely Daimler AG and Renault AG, remains constant or shows only a marginal increase. In view of the above, it is advised to prefer Volkswagen shares for investment purposes as compared to Daimler AG and Renault AG.

References

Baker, HK & Powell, G 2009, Understanding Financial Management: A Practical Guide, John Wiley & Sons, London.

Bender R & Ward K 2012, Corporate Financial Strategy, Routledge, London.

Bodie Z 2008, Financial Economics, 2nd Edition, Pearson Education India, New Delhi.

Chakraporty, S K.(2004). Cost Accounting & Finance Management.New Delhi: New Age International. Daimler.com 2012, Company. Web.

Ogilvie 2008, CIMA Official Learning System Management Accounting Financial Strategy, Elsevier, London.

Plender J, Simons, M & Tricks H 2005, Cash Benefit: How Big Supermarket Fund Expansion. Web.

Schnedlitz P 2010, European Retail Research: 2009, Springer, London.

Standard & Poor 2012, Rating Direct. Web.

Stickney CP, Well RL, Schipper C & Francis J 2009, Financial Accounting: An Introduction to Concepts, Methods and Uses, Cengage Learning, New York.

Stolowy, H & Lebas, MJ 2006, Financial Accounting and Reporting. A Global Perspective, Cengage Learning, New York.

The Treasurer. (2008). Winner A Landmark Bond-Tesco. Web.

Wahlen, JM, Stickney, CP, Brown, P, Baginski, SP & Bradshaw MT 2010, Financial Reporting, Financial Statement Analysis and Valuation, Cengage Learning, New York.

Yahoo.finance.com 2012, Daimler AG Summary. Web.

Yahoo.finance.com 2012, Renault AG Summary. Web.

Yahoo.finance.com 2012, Volkswagen Summary. Web.