Perfect Competition

Perfect Competition refers to “the state of a market in which they are large numbers of buyers and sellers” (Hubbard, Garnett & Lewis 2014, p. 355). In this market, no single company has a monopoly as the product is standardized. There are no barriers to entry, and the demand for the product is perfectly elastic.

Product Price

Product price is “the price at which the company sells its product in a market” (Moschandreas 2000, p. 11). It is determined as a cost-plus margin by the company.

Marginal Revenue

Marginal Revenue (MR) is “the additional revenue generated by increasing the product sales by one unit” (Tewari & Singh 2003, p. 45).

Marginal Cost

Marginal Cost (MC) is “the additional cost incurred by increasing the production of a product by one unit” (Mankiw 2015, p. 250).

Average Total Cost

Average Total Cost is the total cost of production divided by the number of units produced (Mankiw 2015, p. 244). It is the cost assigned to one unit of the product produced by the company.

Price and Marginal Revenue

The price will be equal to the marginal revenue in a perfect competition where the firm is a perfect competitor (small in size), and its product’s quantity produced and sold does not affect the price (Tewari & Singh 2003). The profit is equal to the marginal revenue.

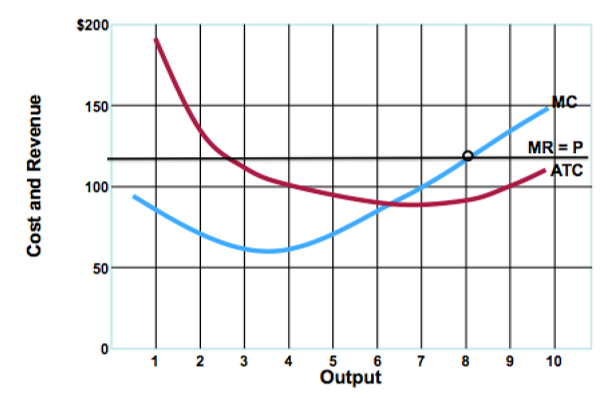

Price and Marginal Cost

The price will be equal to marginal cost in a perfectly competitive market. In such a market, the MR curve is horizontal, and it is equal to the price (MR = P). The production takes place “where the MC curve intersects the MR curve” (Hubbard, Garnett & Lewis 2014, p. 368). Therefore, the price becomes equal to the marginal cost (Hubbard, Garnett & Lewis 2014). The companies will make ‘normal’ profit.

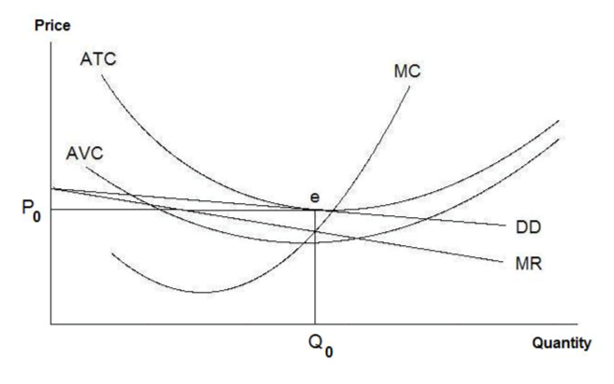

Price and Average Total Cost

When there is monopolistic competition in the market, the price will be equal to the average total cost in the long run (Mankiw 2015). There are no barriers to entry, and the demand curve is downward sloping that allows companies to maximize their profit. The profit becomes nil in the long run (Hubbard, Garnett & Lewis 2014).

Assessment 2

Based on the given information, the following table is prepared.

Table 1: Cost, Revenue, and Loss.

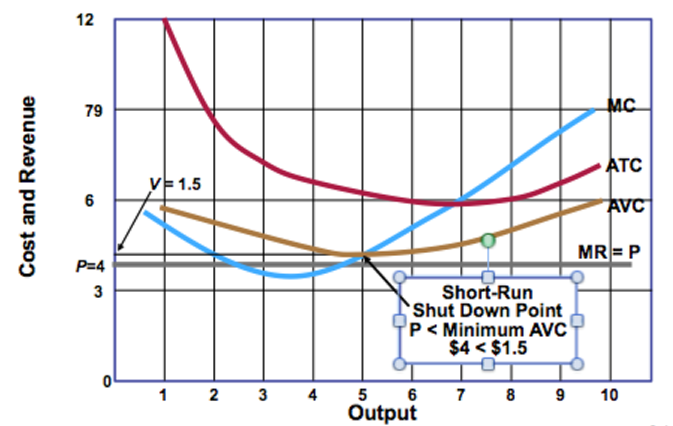

Using the total revenues-total costs approach, it could be indicated that the company will incur a loss of AED 380 in the short run. The company may decide to stop production of the product in the short term on the basis of this estimation. The company will continue producing the product in the short run if MR is equal to MC (Hubbard, Garnett & Lewis 2014). The companies make the decision to continue or discontinue the production of their products based on two criteria. Firstly, if the company’s loss is less than fixed costs, then it should not shut down. Secondly, if the company’s loss is less than fixed costs and its revenue covers variable costs, then it should not stop production (Hubbard, Garnett & Lewis 2014). However, these criteria are not met in the given case as the company’s loss is greater than its fixed costs, and its revenue does not cover variable costs. Therefore, the company should shut down in the short run.

Reference List

Hubbard, G, Garnett, M & Lewis, P 2014, Microeconomics, Pearson Australia, Frenchs Forest, NSW.

Mankiw, NG 2015, Principles of economics, Cengage Learning, Stamford, CT.

Moschandreas, M 2000, Business economics, Cengage Learning EMEA, London, UK.

Tewari, DD & Singh, K 2003, Principles of microeconomics, New Age International, New Delhi.