Introduction

The purpose of this research is to analyze the case on the economics of OnePlus by using managerial economics standards; as a result, the paper has investigated a number of academic concepts in order to come up with an extensive response to some perplexing questions.

The paper thoroughly scrutinizes the case scenario to determine whether OnePlus should focus on survival or growth, and identifies the possible pricing strategies in the overcrowded smartphone market while ascertaining the ways in which the company could maintain its low-price policy and benefit from its scale of production. In order to analyze these issues, the paper has built conceptual frameworks on the market structure of perfect competition, monopolistic, duopolistic, and oligopolistic markets, along with certain assumptions, and identification of equations and graphs.

Background of the Company

Chinese smartphone manufacturing company OnePlus was established in 2013 with the intention to make a better smartphone. At present, it is a subsidiary of OPPO Electronics, and it has business operations in more than 35 countries all over the globe. This company is committed to attaining the utmost standards of professionalism, individualism, and morality. Therefore, it designs its products considering the geographical segments, local customs, and cultural factors to give the best value to the customers. At the same time, the board of directors is committed to using the best technology to create a liberal and collaborative platform. It recruits efficient human resources from all over the world, and they have different educational and social backgrounds, beliefs, and perspectives who work as a team (see tables 1 and 2).

Table 1: Overview of the Company.

Table 2: Products of OnePlus.

OnePlus in the Market

The situation described in the given case of OnePlus illustrates that the global smartphone market was under monopolistic competition, but now it has turned into an oligopolistic market, where global technology giants are under threat of losing their market share; however, small companies like OnePlus with high-end technology has penetrated in the market with strong pricing strategies. From the viewpoint of the economists, an oligopolistic industry consists of a few large-scale enterprises dominating with high sales, rigid prices, ‘non-conformity’ policies, serious entry barriers, and absence of price wars; however, in the global smartphone market, Apple, Samsung, Sony, and Nokia are the major players and OnePlus has just taken entry (Thomas and Maurice 377).

In the first generation of smartphone, Apple Inc with its iPhone has dominated the monopolistic market with imperfect competition and enjoyed the liberty of charging very higher price in order to maximize its profits, but now the market has gained oligopolistic characteristics, where Samsung, Sony, LG, and Nokia are competing aggressively with their respective brands (Andersen and Vetter 5). OnePlus uses paramount android devices, and has built the smartphones with premium quality hardware and improved open source software, which are similar to iPhone 6 or Samsung Galaxy S6; nevertheless, the company charges very low prices from the customers.

The cost-cutting policy of the company derived it to the unconventional production method of limited production by outsourcing for the invited buyers only, and it adopted solely online marketing through social media and online selling in order to reduce the cost of distribution and agents. Maley and Jason argued that the additional areas of local as well as national economics have enlarged and deeply linked with the global scale with increasing number of the oligopolistic market (244).

Thus, it is very difficult to distinguish between monopolistic competition and Oligopoly in the real-life practice. Thus, to illustrate the possible pricing strategy for OnePlus, it is essential to explain profit maximization under monopolistic competition, oligopolistic concentration ratios, and game theories, cartel formation, and then pricing strategy for OnePlus

Market Power or Price-Setting Ability of OnePlus

Although monopolistic competition has a similar characteristic of perfect competition, the unique feature is that a firm would be capable of generating demand for its differentiated product and the degree of this capacity is called ‘Market Power’ otherwise ‘Price-Setting Ability’ of that firm (Maley and Jason 219). In order to identify the market power or price setting capabilities of OnePlus to generate demand for its differentiated Smartphone, it is assumed that the firm goes through different three situations as follows.

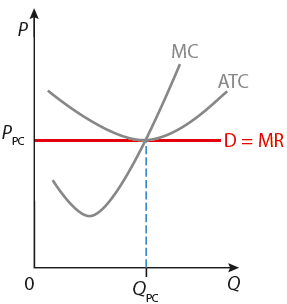

Assumption 1 – OnePlus with Less Market Power

It is found that OnePlus is a perfectly competitive player in the global Smartphone market with very least market power, being an undersized firm in the enormous market, its price and demand curve sets overall market while the demand curve is perfectly elastic (see fig. 1). In this situation as the Smartphone of OnePlus is under perfect competition with literal substitutes; thus, any effort to charging elevated price would be unsuccessful.

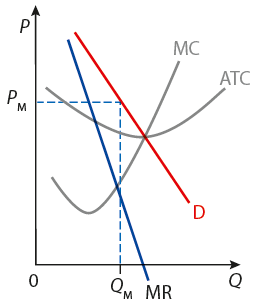

Assumption 2: OnePlus with High Market Power

There is the assumption that OnePlus is a monopolistic market. It is demonstrated that the demand curve is downward sloping, and it is moderately steep which indicates inelastic demand for its Smartphone and supposed that substitutions are absent and as a result, the demand for OnePlus is comparatively more inelastic as well as rigid (see fig. 2).

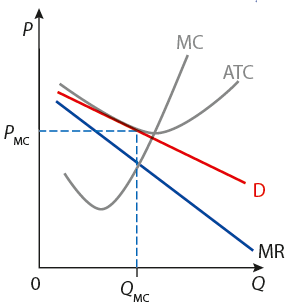

Assumption 3: OnePlus with Additional Market Power

The assumption that OnePlus under monopolistic competition or oligopolistic market where the situation is much hybrid than the previous two assumptions is proved (see fig. 3). Consequently, OnePlus enjoys moderate electricity where consumer’s behavior turns into ‘price sensitive’ due to the fact that most comparable smartphones are available from many other companies; thus, to what extend OnePlus could differentiate its Smartphone with better attributes, it could bring better success up to that extent. It is also identified from the above figure that a monopolistic competitor enjoys further market power with the demand curve that sharply slopes further and facilitates the process of settling higher prices for OnePlus profit maximizing.

From the primary viewpoint of economics, the necessary condition for price settlement of a firm is at its profit-maximized point and the condition of profit maximization is the stage where the marginal revenue would be equal to the marginal cost, but as an oligopolistic market has higher market power, it is essential to taking into account of concentration ratio. In an oligopolistic market few firms dominate the market where monopolistic competitive player functions underneath the same demand, revenue, costs and market situation just like a monopolist with extremely elastic demand curve where market entry and existence are easier.

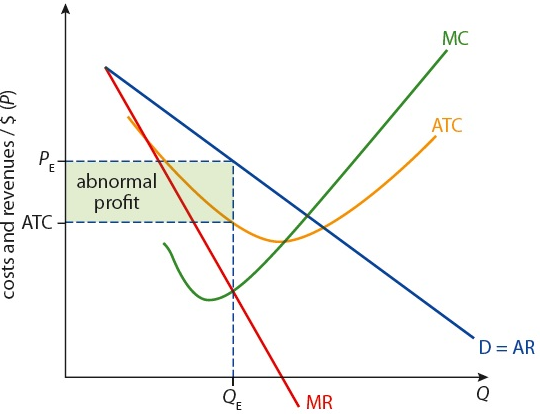

Short-Run Profit

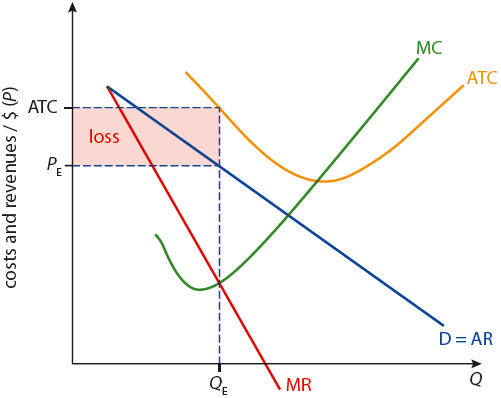

There are enough probabilities that the monopolistic competitor has a chance of generating profit (see fig. 4). For the production quantity of QE, the marginal cost of the firm is equal to its marginal revenue (MR), and, at the same time, the demand curve of the firm leads to settle price at PE. The diagram also illustrates that at the quantity of QE, the price PE takes the position under the average total costs (ATC) which can be indicated as an abnormal profit represented in the shaded rectangle and could be calculated by the formula of total profit = (AR – ATC) × QE (see fig. 4).

In short-term operation, a monopolistic competitor has the chance to account losses and the figure above identifies that the profit-maximizing point of a firm at MR = MC where the marginal revenue curve intersects marginal cost curve with a total output quantity of QE. Consequently, the firm would settle its price at the highest point where the demand curve permits at price level PE but this price level lies under the average total cost (ATC) for its output level QE and it clearly indicates that the firm has been experiencing losses which is the shaded rectangular part (see fig. 5).

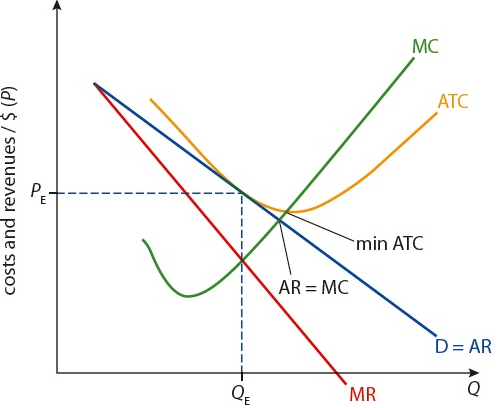

In the market situation while a firm is losing its money, it would be strained to shutting down and the remaining demands of the firms that would be closed for not making the expected profit would be divided among the fewer existing firms (Thomas and Maurice 376). As a result, the demand curve of the remaining firms shifts to the right (for increasing demand) and the firms experience a new MR=MC with increased output (see fig. 6). This shifts the equilibrium to the right and triggers a continuous repetition of this process that may lead the weaker firms and increase profit for the remaining.

SWOT Analaysis

Strengths

- Pricing strategy: As a comparatively new company, it was able to capture a significant market share in smartphone industry only by means of its pricing policy. Now, customers get smartphones with high specifications at a very low price;

- Partnership: Successful implementation of this strategy brought outstanding financial gains for this company. For example, a partnership with Amazon;

- Sales volume: This company sold thirty thousand units of OnePlus 2 in the national market within a minute of product launching (Qazi 45)

- Financial position: It has a number of big investors that can turn it into one of the fastest growing smartphone manufacturers within the shortest time frame;

- Technology: the ‘Never Settle’ motto of this company inspired the employees to use advanced technologies to manufacture high-quality smartphones for their customers;

- Other strengths of this company include an excellent Android platform titled Oxygen OS, an in-depth understanding of market demand, the company’s brand image, a trustful customer-company relationship, and so on.

Weaknesses

- Reliance: The customers of developed countries do not have enough confidence in the Chinese products, and it is difficult for the latter to create a strong brand image in some prospective business places;

- Many other issues affect the performance of this company such as limited production capacity, the minimization of operating costs, a decrease in customer satisfaction rate, the lack of after-sale service quality, and the inability to utilize assets properly.

Opportunities

- Business expansion: OnePlus has the opportunity to widen the geographical market base by using different entry mode strategies since its products are extremely clicked in many areas. For example, India is a proven prospective market for this company;

- Change features: As it experienced success using new features, it should continue developing specific products that cannot be bought from other manufacturers;

- Adverting: It has the opportunity to alternate product promotional strategies in order to increase market demand in overcrowded zones.

Threats

- Competitors: Multinational smartphone manufactures along with other new companies also offer products at small prices;

- Chance to make a loss: It was already stated that OnePlus follows price discrimination strategy to some extent. Therefore, it increases the value of its products in the EU even though it was intended to hit the low-profit margin. However, the rationale to increase price was to survive in the high market as the euro continued to drop.

Other factors: To survive in the market, it needs to upgrade technology, which requires a large investment in the adoption of innovations. This means that OnePlus has to concentrate on financial risks.

Question One: Possible Pricing Strategies for OnePlus in the Overcrowded Smartphone Market

The numbers presented by the previous analysis provide important predictions for price changes in different scenarios. As it stands, however, OnePlus remains at an odd position – the company presents its products as exclusive gadgets for a niche customer, while at the same time maintaining low prices for the smartphones. The uniqueness of this position lies in the invite-to-buy marketing strategy, which means the customer would need to be referred by another in order to be allowed to buy the product.

Therefore, it can be speculated that not the price is the driving point behind OnePlus’ sales, but the feeling of exclusivity the customers get, which is similar to the effect Apple aims for when marketing their smartphones as elite products meant to for the cream of the crop. Nevertheless, the effects of exclusivity, quality, and availability have made OnePlus stand out. Such a unique blend of qualities cannot be ignored or allowed to be wasted.

The current pricing strategy is very efficient as it is. OnePlus sales during the following year amounted to 1.5 million units (Qumer and Pukayastha 6). However, now that OnePlus brand has existed in the market for several years, it is possible to pay alteration to its pricing strategy in order to increase profits and claim additional market (Qumer and Pukayastha 4).

Premium Pricing Strategy

Premium pricing strategy stands for artificially increasing the price for a product in order to gain favorable perceptions among the customers. It also provides a sense of entitlement and class, separating the owners of a “premium product” from the general public. Apple has been using a similar strategy to great success, ever since the introduction of the first iPhone. The company had a history of promoting its products as premium due to their high quality and niche specifications, in addition to high price. OnePlus has a similar vibe to its products in that it is exclusive. Now that the initial customer base is established, it would be possible to transfer the products to a new pricing model.

By providing a new, exclusive product to the market, the company could turn its brand into a premium brand, thus aiming for the same market share as Apple and other top-tier competitors, such as Samsung, Sony, Huawei, and others. However, ramping up the prices as this strategy suggests holds significant risks for OnePlus. It goes against the product’s best-selling combination, which is cheapness, quality, and exclusiveness.

Higher prices will diminish OnePlus’ target market, which consists out of low to middle-income customers who seek an exclusive niche product in order to “stand out” like the iPhone owners. At the same time, the introduction of a vast array of premium products may attract customers from the upper bracket, who can afford two or even three fancy phones. As the graphs show, finding a balance is difficult.

Premium Decoy Pricing Strategy

Premium Decoy Pricing strategy suggests selling one product at a high price while keeping the rest of the prices low (Marsh 95). In the case of OnePlus, this strategy can have an interesting effect. The presence of a high-end product that does not dominate the entire line of OnePlus smartphones would not be seen by the loyal customer base as “betrayal of the company ideals” thus would not cause a significant market share loss among the budget and middle-range smartphones.

At the same time, the premium product would also attract premium buyers (Qazi 11). They would be lured by the exclusiveness of the OnePlus club as well as the element of high-end prestige similar to top-line products of Apple, Sony, Samsung, Huawei, and other major competitors. OnePlus smartphones, while retaining characteristics similar to their competitors, would have the advantage of having an exclusive club to themselves, while the rest of the models could be bought freely.

High-end smartphones do not require large sales numbers in order to pay for themselves and bring the company profit, and the invite-to-buy has proven to be an advantage rather than an obstacle to popular demand. As a result, OnePlus could be expected to retain its marketing positions among mid-range and low-end customers, while at the same time gaining a following in the premium sector.

Variable Pricing Strategy

Companies often use this strategy in order to ensure the returns from a project would be enough to afford to develop another one. The basis of this pricing strategy is that the prices for products will vary by region depending on demand, sales, regulations, transportation issues, and a myriad of other factors that affect price establishment (Longenecker et al. 440). This strategy can be used in conjunction with one of the two strategies mentioned above, as long as the overall separation between low-cost and premium merchandise remains.

This strategy will ensure that OnePlus would have enough returns from domestic sales and sales abroad to develop new products and continue the struggle against its primary competitors, which are Apple, Samsung, Sony, and Huawei. The vulnerability of this strategy, however, lies in the fact that competitors with more a more stable pricing strategy would adjust to the company’s prices in order to force them to sell the product at decreased profits or risk losing market share. In addition, this strategy requires the existence of a chain of retail stores, whereas OnePlus makes its sales mostly through online purchases.

Question Two: Survival and Growth Implications of a Current Business Model for the Future of OnePlus

From the very beginning, the management of this company concentrated on the survival implications of business model as the global smartphone market was highly competitive where all the new entrants faced several challenges associated with the capability of sustaining their position in the market and developing a strong brand image. This smartphone manufacturing company produced a limited number of goods at a marginal cost and sold them at reasonable prices so as not to influence the market price. This report has already scrutinized the pricing strategies and market competition of OnePlus that also support the viewpoint of the management of this company.

Price Decisions and Survival

As the customers of the smartphone industry are not loyal, OnePlus should analyze different market to fix their prices before estimating the exact demand. Specifically, this company is placed in the geographical market where the relationship among sales can be described as x(p,θ) and the price the monopolist charges can be represented as (p). Thus, the random expression of the equation would be as follows-

![]()

In this case, θ is an uninterrupted random variable with a predictable rate of zero and the variance of δ θ2. However, the management of this company realizes the distributional characteristics of θ where it is ignorant regarding the accurate comprehension of the random variable while it fixes the price of the company’s devices. As the price has already specified, the sales forecast of this company is equally correct crosswise the realizations of the random innovation due to the hypothesis that is uncertainty additive in terms of make the process easier. It emphasizes such kind of a manufacturing technology where it fixes the cost defined as F, and the constant marginal cost represented as ‘c.’ Thus, the equation for production cost would be the following:

![]()

At this stage, the realized income, defined as , can be considered a random variable that can be specified like this:

![]()

There is no doubt that when this company designs a pricing structure, its attitudes regarding the anticipated value of income along with the variance of that profit are equal to the price function. In particular, the predictable value of earnings as well as the variance are represented through the subsequent equations:

![]()

![]()

From the above-mentioned equations, it could be seen that the real earnings can be pessimistic even when the anticipated income is optimistic. For instance, it can be presumed that pπ maximizes the estimated income, and let that π(pπ) is positive. Evidently, the real earnings are pessimistic while the shock satisfies the following condition:

![]()

As allocation of the company’s profits depends on the implementation of proper pricing strategies, the selection of a proper policy may cause certain financial risks (Baye and Jeff 6). For the standard variation of profit

![]() (in the case where OnePlus selects profit maximizing at

(in the case where OnePlus selects profit maximizing at ![]() ), the real profit would be

), the real profit would be ![]() if the profit was adequately allocated. Moreover, the probability equation would look like this –

if the profit was adequately allocated. Moreover, the probability equation would look like this – ![]() and the profit would turn out to be negative. However, this company can avoid such situations by means of maximizing the value:

and the profit would turn out to be negative. However, this company can avoid such situations by means of maximizing the value:

![]() . Accordingly, when OnePlus will pursue the safety-first attitude, the related optimization dilemma would correspond to the following equation:

. Accordingly, when OnePlus will pursue the safety-first attitude, the related optimization dilemma would correspond to the following equation:

![]()

If the second-order stipulation is fulfilled and anticipated profits are non-negative for ![]() , where

, where ![]() , the analysis of the equation 6 can lead us to the conclusion that OnePlus could anticipate profit while the selection of price variance could remain unchanged. It can be represented by the following equation:

, the analysis of the equation 6 can lead us to the conclusion that OnePlus could anticipate profit while the selection of price variance could remain unchanged. It can be represented by the following equation:

![]()

At the same time, if the price goes up, the difference among expected sales will be ![]() . However, OnePlus should focus on the safety margin for which it will adopt such survival strategy where optimum price satisfies the following condition:

. However, OnePlus should focus on the safety margin for which it will adopt such survival strategy where optimum price satisfies the following condition:

![]()

Now, while comparing the two conditions, assume that ![]() or

or ![]() . If the average profit is positive (

. If the average profit is positive (

![]() ), then

), then ![]()

![]() . In this situation, the company’s expected profits would be positive.

. In this situation, the company’s expected profits would be positive.

Question Three: Steps for OnePlus Being Taken Immediately

The company has a number of existing schemes through which it is striving to preserve its low-price policy and benefit from its scale of production. However, it is necessary for the business to come up with some sustainable tactical arrangements immediately in order to confront the toughest economic and competitive challenges. To keep the prices low, the company has already implemented certain policies (see table 3).

Table 3: Existing Policies Designed to Keep Prices Low.

However, in the upcoming years, it would no longer be easier for the business to keep its costs low by producing only a few pieces of gadgets, and selling them online in order to eliminate costs of intermediaries and retail outlets. By avoiding the formation of outlets, the company is not only preventing a huge number of consumers from getting the benefit of low priced devices but also failing to reach the mass market due to ‘invite only sales,’ which, in turn, is lowering the annual revenues significantly.

As a result, the company must come up with some tangible solutions instantaneously in order to retain its low price and profit from the scale of production.

It would be possible for the business to benefit from its production scale and offer sustained low prices to the customers by attaining internal economies of scale – this idea seems feasible because OnePlus has plans to sell smartphones at larger scale in the upcoming years and raise its production levels, in order to allow a fall in component costs. Economies of scale occur when higher quantities of products are manufactured at larger-scale, but with less production-costs; therefore, OnePlus must grow and amplify its productivity to get a better opportunity to reduce the overhead expenses – in fact, it is the only possible method by which it can have the utmost benefit from its scale of production (Rasmussen 116).

In addition, economies of scale would allow economic growth within the firm, and OnePlus can achieve this through specialization, skill-based training, division of labor, research and development, and efficiency enhancement; in addition, the company must also focus on improving the transportation network and the supply chain, boosting supervisory expertise, and shifting towards bulk purchases of the key production components.

At this point, OnePlus would be able to achieve extraordinary cost advantages over its competitors, exclusively by full exploitation and efficient extension of its resources and capabilities. Another advantage of this policy is that financial markets label the bigger companies as ‘credit-worthy’ while endowing them with greater access to credit facilities along with the feasible borrowing rates. On the other hand, small-scale companies confront superior interest rates in case of overdrafts or loans, which again increases the overhead costs, compelling such businesses to impose higher prices on the customers.

By means of the growth strategy, the company can anticipate to decrease its average overhead expenses and turn into a more competitive organization. Therefore, if it is not possible for OnePlus to switch to large-scale production through its existing facilities or by expanding its production units or creating new plants, it can seek external economies of scale instead of internal economies of scale. It is essential to note that external economies of scale can be achieved by means of the expansion of the production capacities of the firm through vertical or horizontal integration – that is, through mergers, takeovers, or acquisitions of smaller rival businesses or major supplier companies existing within the industry.

If OnePlus vertically integrates with a supplier company, this would be greatly advantageous because it will endow better control in the lean production methods (such as ‘just in time’ approach and stock management systems) while some of them are already adopted by the company. On the other hand, integration with retail firms would also be a profitable technique meant to attain external growth since proximity with retail outlets while lessening the transportation costs and enhance supply chain management.

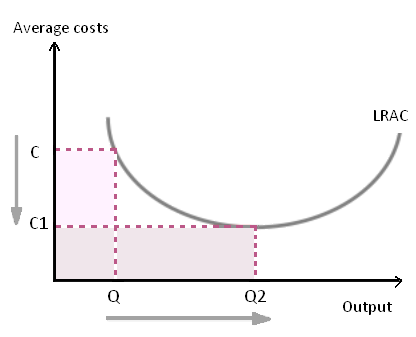

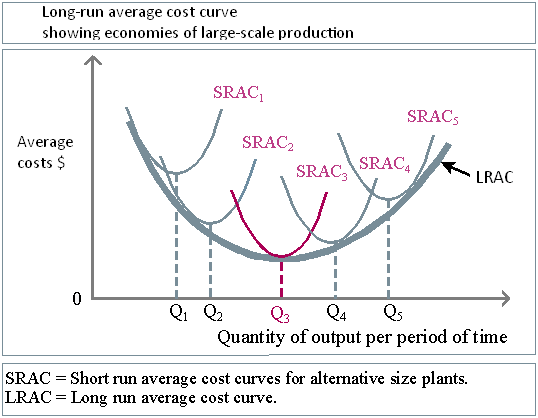

In order to reach economies of scale, the most essential step for OnePlus should be to raise its scale of production significantly, since this would allow a fall in component costs. When scale of production rises from Q to Q2, the average-costs decline to C1 (see fig. 7).

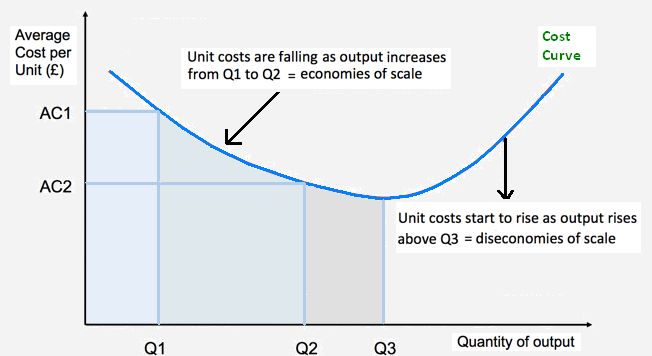

Another step for OnePlus should be to closely observe its production scale – because in order to perform at economies of scale, the production limit must be optimal (that is, to an extent in which it would be able to utilize its resources and capital fully). If the production limit is too high (or beyond its capacities), this would have the same effect of having a very poor rate of production, and diseconomies of scale would occur as a result. When productivity augments from Q1 to Q2, average-costs drop to AC2 (see fig. 8). However, when output rises above Q3, average-costs begin to rise again:

Moreover, whilst increasing the size of the business to reach the optimal production target, OnePlus should focus on its ‘short-run average cost-curves’ to meet the long run targets – in fact, the SRAC curves would allow the company to decide the best possible adjustment or extension required for each of its production plants. To be very precise, no tangency points would appear between the LRAC and SRAC curves unless the ‘minimum efficient-scale’ or MES is obtained. Therefore, when the output is estimated at Q3 (that is, the ‘economies of scale’ point), OnePlus would adjust the size of its production facility at SRAC3, since the costs are in the minimum point here (see fig. 9):

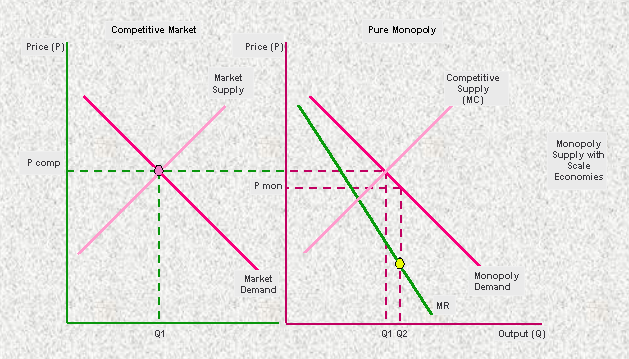

Economies of scale can be easily enjoyed by monopolies, but larger firms can attain this even at the competitive markets. Large companies can constrain marginal costs over a longer period and allow really low prices for the customers. As a result, OnePlus must fully exhaust its existing reserves and raise the market share to diminish expenses (see fig. 10):

It is important to argue that in order to achieve cost leadership over the longer period within the present scale of production, OnePlus must come up with a number of well-grounded strategies. Taking into consideration the resources of the company and the recent improvements in the fields of business and management, it is possible to develop a list of steps for OnePlus being taken immediately (see table 4).

Table 4: Sustainable Policies for Long-Run Cost Effective Systems.

Works Cited

Andersen, Per, and Henrik Vetter. “Pricing as a Risky Choice: Uncertainty and Survival in a Monopoly Market.” Economics, vol. 9, no. 29, 2015, pp. 1-22.

Baker, Robert L., and Birgitte R. Mednick. Influences on Human Development: A Longitudinal Perspective. Springer, 2012.

Baye, Michael, and Jeff Prince. Managerial Economics & Business Strategy. McGraw-Hill, 2016.

Longenecker, Justin G., et al. Small Business Management: Launching & Growing Entrepreneurial Ventures. 18th d., Cengage Learning, 2016.

Maley, Sean, and Jason Welker. Economics. Pearson Education, 2015.

Marsh, Clive. Financial Management for Non-Financial Managers. Kogan Page Publishers, 2012.

Qazi, Faheem. “Company Analysis of OnePlus.” SlideShare, 2017. Web.

Qumer, Syeda Maseeha, and Debapratim Pukayastha. Economics of OnePlus. IBS Center for Management Research, 2017.

Rasmussen, Svend. Production Economics: The Basic Theory of Production Optimisation. Springer, 2013.

Thomas, Christopher, and Charles Maurice. Managerial Economics. McGraw-Hill, 2015.

Wisner, Joel, D. Operations Management: A Supply Chain Process Approach. SAGE, 2016.