Introduction

The banking industry is just part of the much larger financial services market. Like all large retail banks, ANLG has had the task of improving the performance of its operational processes which are responsible for generating and providing the bank’s services.

This has had to be achieved while at the same time keeping some factors constant; the service delivery to the banking clientele remaining top notch and the costs incurred in the process kept to a minimal. In looking at this particular case of ANLG, the entire operational process yields both inputs and outputs which are based on the various activities involved in the process.

The operational process is basically a link between inputs, outputs and resources and how the various activities involved transform the inputs into outputs. The subject of managing processes and projects basically looks into a system which is made up of various processes.

In each process, inputs are transformed into outputs and all this involves planning and designing the production, the actual production of the item in question, delivery and all support variables, all which translate into the success of the objectives being met.

The core functions are the development of the services and products that will be the outputs of the operational processes, the operations involved in the entire process as well as the marketing function which is somehow a subsidiary factor in the entire operation process.

Support functions include the accounting and finance aspect, the technical factor, human resources function which looks at personnel or staff, and the function that relates to acquiring any relevant information to the given process. These are just a few examples which will vary with each operational process.

Operational Processes

The Call Centre Department

This is a department run by the Call Centre Manager and its main operations are cantered on dealing with customer service enquiries which are basically requests for information on products or services that they need clarification on.

The calls received by the Call Centre Agents many times overwhelm them during the day and this is mainly because these are the operational hours for the banks. At night, not many people will think of making enquiries. The customers will want information on loans, their debit cards, various accounts operated by the bank and any services the bank may be providing (Ackoff).

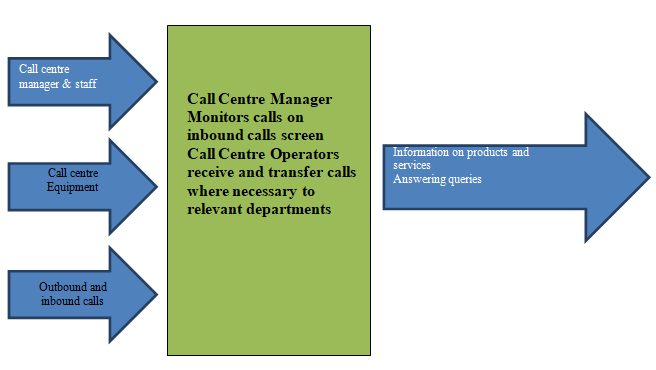

Fig. 1: Showing the operational processes in the Call Centre Department

Facilities and staff are the major resources that are classified as inputs. In this case we have the call centre manager who manages and plans for the centre, the call centre agents who operate the calls, and equipment used to handle the calls such as the telephones and computers.

The operator receives the call from the customer and first captures the caller’s details which may include, but are not limited to the customer’s name, customer’s account number if they have an account with the bank, their address and contacts. The queries presented by the customer are then entered into the system.

Depending on what subject the caller wanted information on, they are given a feedback and in case the agent can’t provide satisfactory answers, they are rerouted to a more qualified person to handle the call, or are told to hold the line as their request is processed.

For some cases, the Call Centre agent may have to call the customer back at a later time. Deliverables include providing the customer with answers to their enquiries and feeding the system with any information that may need to be looked into so as to improve the service delivery (Davenport).

Limitations

The Call Centre Manager can clearly view all the calls being received by the operators and those that are yet to be received. Any customer calling continuously for a given amount of time will eventually give up if their calls are not answered and may assume they are being ignored. With a limited number of operators, not all calls can be attended to and this cuts down on the efficiency of the department in satisfying their callers.

Some of the callers fail to have their queries answered while others will probably receive unsatisfactory replies because the operators are trying to attend to the large number of callers. At night the exact opposite scenario is played. Operators are practically redundant with hardly any calls being received (Deming).

Filling in any vacancies in this department is no mean feat. It is both time and resource consuming. An operator has to have knowledge of the banking operations and should be able to handle 15 simple banking enquiries. The entire recruitment process and training of the operator takes up to 8 weeks, and in the meantime the Call Centre strains the meagre staff and resources it has.

Recommendations

An automated system could be put in place to capture incoming calls where the callers would leave their details and queries so that they can be contacted at a later time. This way, the operators running the Call Centre in the night can make a follow up of these enquiries. Customers are left feeling happy and well attended to and definitely and the bank retains its clientele.

The Personal Credit Control Department

The Manager of this department is tasked with overseeing that the staffs attending to customers, who have surpassed their overdraft amounts, either bounce any cheques that may have been drawn or send a letter informing the customer about the state of their account or transaction.

This department only deals with individual accounts because those belonging to corporate entities need more interpretation. They are therefore handled by a different

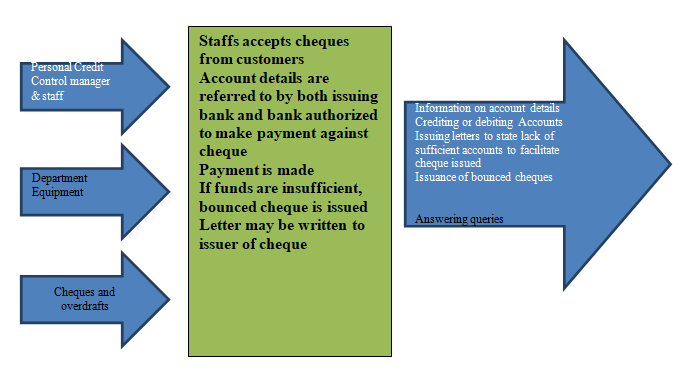

Fig. 2: Showing the operational processes in the Personal Credit Control Department

Depositing cheques and drafts is actually a form of credit exchange. If the cheque drawn is valid, then the person whose name and details appear on the cheque is paid following instructions to the bank indicated on the cheque. When a draft is moved by authorization to a specific bank, it is deposited there and is equivalent to a cash deposit.

In both cases, no actual money in the form of notes and or coins is used in the transactions so it is entirely of a credit nature. In the cases where the account against which the cheque is drawn has insufficient funds, the cheque bounces and as a result the bearer of the cheque is not credited.

The department I thus tasked with informing them of the state of the transaction. Such a transaction is not detailed and involves very few components as opposed to dealing with corporate accounts which could have many transactions in one particular account (Jams hid).

Limitations

Having each line of business operation, in this case, personal credit control and corporate credit control running as separate entities means that the activities are not centralized.

More resources are needed to effectively run each entity yet the outputs are similar. Without restructuring the back office operations, operating costs are exponentially increased. The same methodology of running the processes is employed in all processes and efficiency is reduced.

Recommendations

Most banking institution has developed into target retail institutions in as far as the operations of the bank are concerned. Many of the operations are centralized and are structured such that particular service centres have both shared functions and services. All operations run by the bank are part of this structure. As a result you will find that whether it is personal banking or corporate banking, they will all be part of the shared Services Centre.

The only exemption probably might arise in cases where one service for example, personal banking has just been introduced. It may operate remotely for a period of time, but should be merged with other centralized operations within a given time frame.

Another solution to having similar operations running with up to half the cost would be to manage operations, for example IT Operations, that sustain back office processes as a distinct and separate function that needs a separate structuring (Juran).

The Voucher Processing Centre

The centre is equipped with machines that translate cheques. The cheques are delivered to the centre from various branches of the same bank in a given location. Since the banks are closed during the weekend, Mondays, which mark the beginning of the business week, are quite hectic as they record a large number of deposits.

The fact that the machines have such a big work load, they are likely to breakdown more often and this greatly affects the running of the centre. With fewer machines to work with, many customers’ transactions are left pending and this creates a backlog.

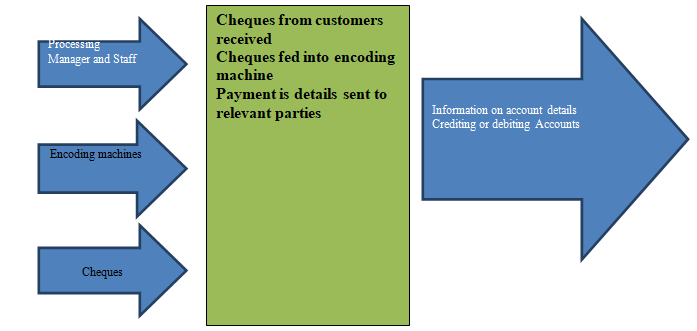

Fig.3: Showing the operational processes in the Voucher Processing Centre

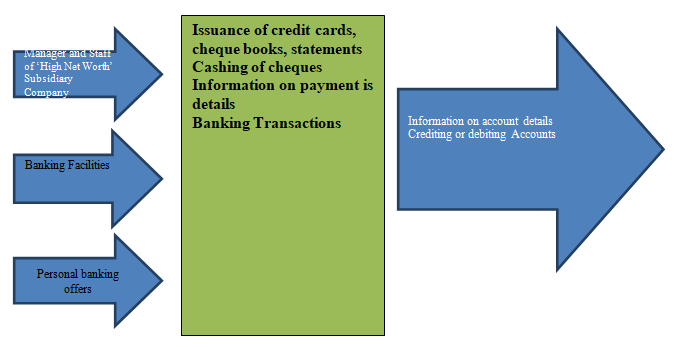

Fig.4: Showing the additional operational processes in the Voucher Processing Centre

The cheques are received and the information displayed on them is encoded or converted. The output which still comes in form of the processed cheques enables the relevant accounts to either be credited or debited.

Limitations

The inputs in this particular process are limited and this greatly affects the entire process because the transformation aspect is greatly restricted. The encoding machines are the main facility that runs the entire process, apart from the staff that operates them. Having even one machine down affects the outputs and as such customer feedback is not expected to be encouraging.

Recommendations

Another system apart from wholly relying on the voucher encoding machines should be introduced. This way, even if one of the machines breaks down, or even when the workload is large, the entire process is not affected. In the end, the output is what matters, I this case, that the customers receive the services they expect.

High Net worth Banking

In some cases, it is also referred to as prestige banking. A service provided by the bank for its wealthy clientele who pay to have all the banking services offered at their beck and call. The bank therefore has to be extremely flexible to meet their demands.

To give the entire aspect of High Net worth Banking, the personal touch it is characteristically defined by, particular banking personnel is assigned a number of accounts to attend to and this way gets familiar and “personal” with the customer, but maintains all the professionalism expected.

Limitations

Banking personnel just like any other employee will be required to have leave days or probably attend training sessions organized by the bank. In such cases, when a particular customer calls wanting the services of a particular agent who is either not in office, or engaged elsewhere, the “personal” factor is subject to being affected.

Some customers may become adamant and even threaten to withdraw their accounts, citing that they are not getting their money’s worth. Other times, their demands may seem too much when they force their contacts within the bank to run all over the place to attend to them, be in at their homes or places of work.

Recommendations

Customers should be made to understand that the entire theme of personal banking means that the bank gives then extra attention, but maintains that any available personnel can attend to them. Two or even up to three people can be assigned to one particular account. This way the personal theme is not entirely corroded.

The ‘4vs’ approach looks at four factors in the operational process and these are volume, variety, variation in demand and visibility. Looking at the above back office operations in terms of volume, the Call Centre is swapped with very many calls and each staff of the centre is kept bust especially during the day when the volume of calls is highest.

As a result there is a low unit cost in the department, higher systemization and high repeatability of processes which involve the calls received and the information exchanged. The Credit Control department specializes in cheques and drafts so their volume is only relevant to these two processes. It is relatively low and each staff member performs more as pertains to the task at hand and less to do with the entire system.

As such there are higher unit costs. The voucher processing centre handles only cheques, but at a high volume and therefore experiences the same implications as the Call centre. The Prestige or “High Net worth’ subsidiary company experiences fewer customers, hence a fewer volume of operations. The implications are similar to the credit control department (Ludwig).

With regard to variety, the call centre and voucher processing centre is more complex and flexible and as much as they may incur higher unit costs, they are able to meet customer demands. The credit control department and subsidiary company dealing with rich clients on the other hand both handle less in terms of variety. They experience well-defined routine, properly standardized procedures that are regular and all at low unit costs.

Variation in demand in the call centre and voucher processing centre is dependent on the capacity that can be handled. This is also affected by the facilities in place and personnel available. One main advantage is that any changes in demand can be anticipated, though a downside is that it all comes at a high unit cost.

The credit control department and subsidiary company dealing with rich clients on the other hand, experience a stable schedule of events, high use of available resources, resulting to low unit costs.

Visibility focuses on the outputs of each process. There is a very short time frame between requesting of services or products and when they are expected to be delivered and this causes a short tolerance in relation to what is expected. In the call centre and ‘high net worth” company, contentment by the customer is based on what they observe and perceive.

Personnel in these departments should be equipped with the relevant skills needed to handle customers in these instances. Proper communication skills are an asset in both cases. A high unit cause is however realized. The voucher processing centre is also reliable to a great extent on the visibility aspect which will bring about similar implications as seen in both the call centre and prestige banking company.

In the credit control department there is a time frame between production and delivery of the services to the customer. Low skills in customer handling are required and most of the process doesn’t really rely on the input of the staff. Higher unit costs are expected. Other similarities that can be noticed in all the four back office units are the fact that all operational processes make use of some form of technology.

For all the operations, some form of telephone activity or computer related task is involved though to different variations and volumes. The voucher processing centre also incorporates encoding machines. All four back office units have response issues of some kind. These are either within the department or between one department and other.

In other scenarios it also involves the customer who in most cases is the final recipient in the complete process. These four operational processes also forecast on demand, otherwise the performance objectives cease to be relevant. Measures are also put in place to monitor capacity and location concerns that directly affect the operations of the departments.

These of course vary from one back office to another. for instance, the call centre doesn’t have to be near the customers calling in to handle their enquiries, but the “high net worth” subsidiary company has to put capacity and location in mind to be able to provide that personal touch it thrives on to maintain its clientele.

All operations have both contractors who provide the products and services needed to be able to meet their objectives as well as customers who are the final recipients of the products and services after they have undergone the transformation process.

In the For the call centre it is telephones and computers, whereas the credit control and voucher. All these back office operations also have planning and recruitment issues in relation to their activities and staff.

Common sets of principles therefore apply only when the performance objectives of any given process are similar in respect to certain factors. The quality of services or products has to be even. Some services like the call centre are to all customers of the banking institution irrespective of the account you hold or how wealthy you are. The “high net worth” department on the other hand is for only the rich clientele.

Another factor is that the speed at which the services or products are delivered has to be at par. For some it is fast depending on the customer being attended to, while others it is slow. Dependability is another element. Some services are dependent on time, others facilities, staff or other resources.

Flexibility should also be considered. Some processes follow a fixed routine and schedule while others can be manipulated with to suit the output required. Cost is a very important component as well because it is directly proportional to how productive a given process is and whether at the end of the day it was a worthwhile venture (Senge).

To “fine tune” the improvement of business processes in relation to the operations the different skills and approaches that are probably being referred to are the “4vs”; volume, variety, variation in demand and visibilty as well as the common sets of principles.

This is because if flexibility, quality, speed, dependabilty and cost are considered, the capturing, transformation and delivery of services ad products will be greatly improved because these factors greatly affect operation processes.

Works Cited

Ackoff, Russell. Ackoff Centre for Advancement of Systems Approaches, 2009. Web.

Davenport, T. H. Process Innovation: Reengineering work through Information Technology, Harvard Business School Press, 1993.

Deming, W. Edwards. The New Economics for industry, government and Education. Second Edition MIT Press, 1994.

Jamshid, Gharajedaghi. Systems Thinking: Managing Chaos and Complexity A Platform for Designing Business Architecture. Elsevier Inc., 2006.

Juran, J.M. Juran on quality by design. The Free Press, Division of Macmillan Inc., 1992.

Ludwig, Bertalanffy. General Systems Theory George Braziller Inc., 1968.

Senge, Peter M. The Fifth Discipline, The Art and Practice of the Learning Organization. Random House, 2006.