Executive Summary

The latter paper is an extension of the American Express (Amex) insurance services portfolio through auto insurance. The company has a strong brand name and high-quality service that have been perfected through centuries of experience. These factors imply that the company is ready for such a venture.

A situational analysis of the company indicates that there are several issues that can either undermine the venture or boost it in the future. For instance, because it has already been offering insurance-related services, then it is likely that expansion into auto insurance would be fairly smooth. This product package will be extended to persons already doing business with Amex thus implying that very minimal revenue will be spent on garnering new clients. Additionally, there are several new things that the company will bring into the auto insurance market that have never been seen before. On the other hand, this product’s major weakness is that it is only restricted to persons with Amex cards. The most important opportunities for the company come through internet technologies that can ease transactional costs, time, and flexibility. Success will also be possible if the company tackles the problems of auto insurance agents who may outcompete them.

Through marketing, the company will position itself as a lucrative auto insurance provider with several policy bonuses to choose from. Also, it will market itself as a sound insurance premium provider whose main client base will be the high end of the auto insurance market. This will consist of all clients uninterested in dealing with agents and with no upper limit on their credit cards. The most important demographic trait in this regard is income status as those with high annual incomes will be the ones who are most likely to be interested in what is on offer.

The product itself is auto insurance cover in which consumers have the choice of picking two types of policies. The first will consist of auto coverage without service bonuses while the second will contain several additions. This innovation is new to the company generally but not the world. Nonetheless, some of the elements in the product offering have never been heard before. Since insurance companies are usually ranked in accordance to their size, their convenience, use of technology as well as product portfolios, then this product has been designed to encompass all the latter elements in one way or another. This product will offer a differential advantage from other auto insurance offers because it will cover family members, will only target card providers and it will offer bonuses for using the commodity.

In terms of the pricing strategy, the company will set a value that is slightly above prevailing market prices so as to portray an image of quality to potential clients. Promotion will mostly be done through television and the internet as online selling is rampant in the auto insurance business. On the other hand, the company will also make use of celebrity promotions as well posters. This media mix will be covered through a budget of two million dollars annually. Distribution will be done through the internet through online selling. Also, nationwide distribution through the company’s various branches will also be done.

The budget will last for five years and evaluation will be done through a team leader in the auto insurance department as well as the marketing group. Monthly reviews will be carried out during the first year and annual reviews done subsequently. Evaluation will be done to ensure that initial objectives laid out in the budget have been achieved. Online monitoring will also be another method of making the most of this respective product.

Introduction

The company under analysis is American Express bank. It has been in operation since 1850 and therefore boasts of one of the greatest levels of customer experience in the corporate arena. In fact, this long period of operation is the reason behind the latter company’s strong brand name, quality of products and services as well as its treatment of employees. (Grossman, 2006)

The company under analysis has several core values that form part of its overall strategy. American Express is driven by a deep commitment to its clients through strong relationships. Additionally, it is committed to the provision of quality services that add tangible value to its clients’ lives. Teamwork is another driving force in this company’s core values as it has led to continuous success. It respects its people and rewards them accordingly based on their performance. Amex largely prides itself in good corporate citizenry driven by the need to improve the communities that it serves. However personal accountability is one of the building blocks within this firm because without it then the company would never have delivered on consumers’ expectations. (American Express, 2009)

American Expresses’ mission statement can be summarized as follows: to become and remain a leading international financial service provider. This is large because the company has several locations in different parts of the world such as within the US, UK, and other parts of Europe.

Amex was formed in 1850 as an express mail company. It was located in the State of New York but gradually began nationwide expansion through collaboration with another railroad, steam, and express companies. However, its real entry into the financial service sector started thirty-two years after its formation when the company introduced money order services. This was shortly followed by a traveler’s cheque service in which clients could obtain cash in various parts of the world especially in Europe. The company has grown by leaps and bounds today. Amex is mostly known for its credit card service in which it has to a wide range of products designed to cater to the diverse credit card market. It also offers traveler’s cheques to clients in different parts of the world and is also popularly associated with its charge card service. There are a number of insurance portfolios covered by American Express and these will be the main focus of the paper. (Grossman, 2006)

The product category that the project will focus on is auto insurance. This is a product line extension as Amex deals in homeowner insurance, accidental life insurance as well whole and term life insurance.

Situational Analysis – strengths, weaknesses, opportunities, and threats

One of the major strengths of this product line is that it is being introduced by a company that has already established itself in the financial services sector. (American Express, 2009) This implies that it has a large asset base and market base to choose from already. Besides that, auto insurance will only be extended to preexisting clients thus solidifying their link to Amex and also reducing costs required to attract new clients into the company’s offerings. Also, the product is unique in comparison to what other auto insurance companies are offering since it offers rewards that are automatically charged to consumers’ Amex cards. This instant system will definitely be a reason to make the company stand out from the rest. Also, because the auto insurance rate will not rise irregularly, then chances are that more clients will be drawn to it.

One major problem with this product is that it will only be available to gold, platinum, and black Amex cardholders. This implies that other clients who have never carried out business with this company have been closed out of the offer. Taking such an approach may prevent the company from accessing a large client base which eventually reduces its revenue collections. Aside from that, benefits of the auto insurance plan are extended to family members and this may become very costly to the company if a client has a very large family.

Numerous auto insurance firms are harnessing the power of technology in making themselves more competitive. In other words, the internet can offer this firm an invaluable marketing source. One way in which this can be done is through online price quotations for the new auto insurance service. Other insurance companies are doing the same in order to allow customers to make varying comparisons. It is also necessary for American express to provide their auto insurance clients with claim filling, customer service as well account information online. This allows the company to continue offering its services even during unofficial working hours. Also, it substantially reduces their business costs over a long period of time. However, this is not the only opportunity that the latter product can offer the company. There is also a way in which the company can use the web to record consumer information in real-time and thus empower its underwriters to change prices quickly or immediately. (Stevenson, 2005)

One major threat to this product line extension is the issue of agent networks. The latter groups of individuals play an important advisory role owing to the fact that they are highly competent in auto insurance and they fully understand the intricacies of this service offering. Also, there are several companies in the market that deal with various policy bundles. For instance, motorcycle insurance, as well as auto insurance, have become increasingly lucrative. What this means is that such competitors have managed to sell more and also increase their revenue opportunities. American Express will have to deal with competition from such groups (Grossman, 2006).

Marketing Planning

Marketing Objectives

This product line extension is intended on boosting market share in American express. After the implementation of this marketing plan, then it is likely that the auto insurance providers may increase the company’s market share by ten percent over the next five years. However, achieving such a goal can be very challenging especially given the fact that there are numerous brands competing for a large market share in the auto insurance industry. However, because of repeat product cycles in which consumers keep coming back to the company after a period of one year, then this is likely to boost consumer retention rates within the industry. Market share will be increased by pursuing two strategies which are customer retention as well as customer attraction. The latter overall objective will be achieved through increased advertisement spending within the organization. This will also boost the company’s ability to inform potential consumers about what they can get from the firm. (Ephron, 2007)

The auto insurance product on offer will position itself as the super product with lucrative premiums as well as many bonus offers. The company will use its already established brand as a platform to market its new product offering. Although many small firms are springing up in various parts of the world, most of them are using the issue of solid premiums as competitive force. This aspect will be captured and will be the major positioning strategy for the company.

Customer satisfaction will be the sole driver as well in that the best customer service will be offered to those who enroll in the program. Insurance underwriters will continuously be available to tackle any question or problems facing these respective clients.

Target Market Analysis and Profile

Given the fact that the auto insurance product package will only be feasible to those with unlimited credit rating, then it is likely that the most important demographic trait in this marketing strategy is income level i.e. the high end of the consumer market will be targeted. Also, it is likely that such persons may have a high level of education as this denotes their financial abilities.

The product will target consumers interested in looking for a competitive auto insurance product as most consumers require a wide array of service options which is what will be offered. Also, it will be targeting those consumers who want to deal with companies directly instead of working with insurance agents. Users who are skeptical about the use of insurance premiums from already established companies will be targeted and informed about what they can get in this company compared to all other options out there. It is likely that their usage rate will be annual if there is no other event that crops up in the midst of the policy coverage. The main aim of marketing the product will be to get consumers to switch from their current insurance systems to the mode of coverage in American Express. This is particularly achievable owing to the fact that there is a declining number of high-risk drivers in the market today. (Dayananda, 2002)

Marketing Mix

Product Strategy

- Description of the product that you will introduce or improve.

The company will offer Auto Insurance for those customers who have gold, platinum, or black American Express card. These are the preferred customers who tend to spend more money than other clients, therefore do not have a specific credit limit on their card. The full comprehensive and collision insurance will be a very competitive set price per month that will not rise with any incidents (i.e. speeding tickets or any type of accident). It will only change yearly by 2% if the customer’s driving record changes due to a traffic violation or accident claim.

The nature of innovation would be an optional benefit through the customer’s membership to American Express. This benefit will give the customer reward points towards their American Express card when charged every month, free scheduled and unscheduled maintenance to include car repairs up to 100K miles, depending on the policy that they choose. There will be two policies, standard and premium. The standard policy will only offer full coverage to include towing and car rental. The premium policy will offer full coverage, scheduled and unscheduled maintenance, and car repairs up to 100K miles. The customer may have as many family members on the plan.

The way in which American Express will pay for the customer’s scheduled and unscheduled maintenance is by having the customer charge the maintenance to their American Express Card. The system will automatically recognize the charge due to the fact that the customer’s information will already be recorded into American Express’s networking system. Not only will the customer receive reward points for the charge, but they will also automatically have the charge reimbursed on their credit card.

American Express would be considered a new entrant into the market of automobile insurance. Some of its competitors would be companies like GEICO, Progressive, State Farm, Nationwide, USAA (for military members), Met Life, and All-State. American Express would have a competitive advantage over its competitors due to the fact that it only charges a set rate per vehicle, per policy chosen. It will not raise its rates as long as there are no traffic violations or accident claims incurred by the customer. Even if they do happen to have a traffic violation or accident claim, their premium rate will only go up by 2% that year.

Description of the nature of your innovation

The product being introduced is auto insurance. This is a product line extension owing to the fact that the company has already engaged in other types of insurance before. Auto insurance is not new to the world as the industry is one of the most influential economic drivers, however, American express has never offered this before and the world will therefore receive auto insurance from Amex for the first time. Some elements of the product offerings are also new to the world such as the concept of charging their rewards directly to their cards and offering them no limit to the number of family members insured.

A Master Profile listing all major features and levels for the product category

Auto insurance products belong to the larger insurance sector. There are a number of divisions in this category and they are ranked according to four major components. The first is in accordance to size and stability. In other words, on the basis of the insurance provider’s market share. The second is purchase options where insurers target providing convenient insurance either through phone or through the internet. Thirdly, insurance firms base their offerings on the availability and flexibility of their service offerings. Here convenience is the major issue. Lastly, insurance products may also be ranked in accordance to the issuance of a variety of insurance packages, for example, some may deal with homeowner insurance, auto insurance, or others.

How the product (product concept) is derived from this Master Profile

The auto insurance product is a combination of various elements in the latter Master’s profile. For instance, since American Express is already offering other insurance services, then this will simply be an addition to its diverse offerings. Secondly, the company will work towards making the product convenient and flexible through online services. This will also be combined with the company’s stability and its huge size.

The differential advantage offered by the product over competing products

The product being offered is different from others because American Express will only be dealing with established cardholders alone, it will allow an indefinite number of family members some bonus services and will give consumers options on what type of auto insurance policy they can choose from. (Dayananda, 2002)

Indication of product positioning

The auto insurance service will be positioned as a high-end product with numerous benefits; also it will be regarded as a convenient, technologically advanced, as well as reliable service.

Development of Service Processes for services

The company will first inform existing consumers about the potential that the new auto insurance cover can offer them. It will also work on new high-end consumers who can apply for their respective cards and hence benefit from their insurance program. The company will ensure that rewards are given duly, premiums are administered fairly, and that consumers are well aware of the payments that they are expected to make. One area that could potentially fail is the provision of sound and effective underwriting services. This will be mitigated by allowing clients immediate access to a member of the team day or night. In so doing, customer service will go up and such failures can be dealt with immediately.

Price

The unit upon which the price will be based in the insurance policy being taken. The type of policy will eventually determine insurance premiums being paid and other additional charges that will be related. Since the product will be targeting the high end of the market, then premiums will be slightly higher than prevailing market prices. Statistics show that such customers tend to gauge a products’ quality through its price. Besides that, these consumers have an unlimited amount charged to their credit cards so they will not be overly concerned with price. (Sundem & Stratton, 2002)

Promotion Strategy

- Budget. Marketing will be restricted to two million dollars annually. There are a number of issues that must be addressed and they include market research, advertising, promotion as well as assessment of markets after implementation of the product itself. The budget will be annual and will therefore be repeated throughout the next five years (Sundem & Stratton, 2002)

- Indicate the media mix.It will combine the use of a number of media outlets. Online advertising and television will take the greatest precedence. Additionally, these will be backed up with celebrity-backed campaigns, radio ads, and also through a number of posters.

Distribution Strategy

A national distribution strategy will be adopted. The company will take advantage of its various outlets throughout the United States. Here, its representatives will deliver the services directly to their consumers.

The internet will be important as well. It will be essential in letting consumers know about the product offering and will also provide them with a platform for purchasing or selecting the auto insurance policy of their choice as soon as they make up their minds.

Implementation and Control of the Marketing Plan

The marketing plan will last for a period of five years. However, most of the elements will be reviewed on an annual basis in the second and subsequent years. During the first year, monthly reviews will be carried out just so that the company can ensure that its members stick to the expected plan. There will be a detailed outline of how the marketing plan will be carried out so as to ensure that everyone in the company fully understands the implications of such a strategy and that that they do what is expected of them. The newly formed product will have a team leader who will be responsible for the implementation of the marketing plan. He will work hand in hand with members of the company’s marketing team as this will provide an important guideline during the treatment of such an issue. (Jones, 2005)

Summary

American Express has been a highly successful company over the past two centuries. However, diversification into another product line would go a long way in boosting the company’s revenue. This product has been chosen because it will offer certain new elements to the insurance world that have never been seen before. Examples include offering coverage to cardholders as well as offering them an allowance for coverage of family members.

Marketing of this product line would require a budget of two million dollars in marketing and could generate positive returns after a period of about five years. The marketing mix will entail a combination of previous strategies used by Amex such as celebrity campaigns. On the other hand, the company may have to embrace several new forms such as online advertising.

Appendix – Financial Analysis

Sales Potential and Sales Forecast of your product for the next five years

The following is a summary of expected revenue over the next five years. It should be noted that each unit represents an insurance policy.

It is likely that during the first year, more than five hundred insurance units will be sold, however, in order to make the sales forecast more realistic, a lower figure has been selected as a reference point. These estimates have been based on company performance for the past seven years. The company has recorded greater revenue streams in other segments other than insurance. Consequently, these estimates have been well informed.

Break-Even and Profitability Analyses

- List of the fixed and variable costs

Fixed costs likely to be encountered include:

Computers – 6 million

Internet networking – 7 mil

Building – 20 mil

Taxes – 5 mil

Interest costs – 4 mil

Overhead expenses – 3 mil

Total – 45 million dollars

The variable costs can be summarized as follows in the 1st year;

Power costs – 5 mil

Marketing – 1 mil

Salaries – 60 mil

Underwriting services – 1 mil

Other transactions – 5 mil

Internet service provider – 3 mil

Security – 2 mil

Total in the first year – 77 million dollars

- Break-Even and Profitability Analyses

The following formula will be useful in the calculation of the underlying expenses, profits, and break-even points that the company under consideration will record.

Total fixed costs → do not change

Variable costs → proportional to the output

Total Costs= Total Variable costs + Total fixed costs

Revenue →Units sold * price per unit

Profit = Revenue – total costs (Sundem & Stratton, 2002)

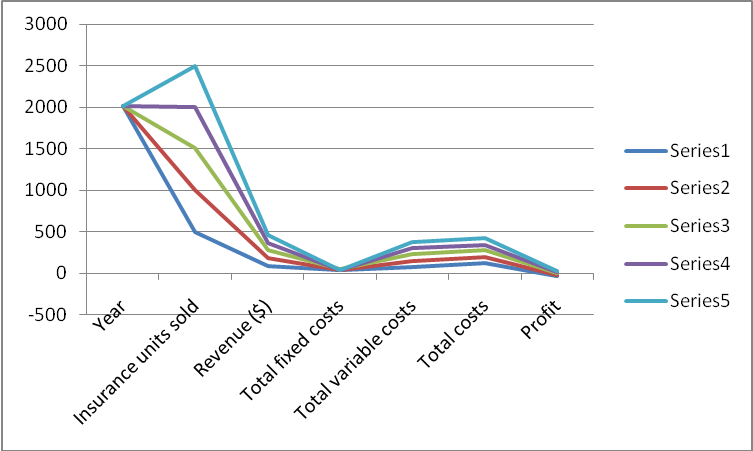

The table below summarizes the break-even and profit analyses for the next five years

(Sundem & Stratton, 2002)

- A plot of Break-Even and Profitability Analyses

The following is a representation of the break-even and profitability analyses

References

- Grossman, P. (2006). American Express: Unofficial History of People Who Built a Great Financial Empire. New York: Beard Publishers

- American Express (2009). Official company website.

- Sundem, H. & Stratton, W. (2002). Introduction to Management Accounting. New York: Prentice Hall

- Dayananda, R., Irons, S., Harrison, & Herbohn, P. (2002). Capital Budgeting – Financial appraisal of investment projects. Cambridge: Cambridge University Press

- Jones, J. (2005). When Adverts Work: Proof that Advertising Triggers Sales. New York: Lexington Books.

- Ephron, E. (2007). “Recency Planning.” Advertising Research Journal, 37(3), 66.

- Stevenson, V. (2005). Communications Industry Forecast 2005-2009, A report for the City of New York.