The Bank of Thailand was promulgated on 16th April 1942, and started operations on the same year. According to the BOT’s Act B.E. 2485, the objective of the bank was to develop a strong monetary and fiscal policies through printing, issuing out and regulating flow of banknotes and other security documents; promoting the stability of monetary strategy together with formulating money policies; managing the assets of the BOT; providing banking facilities to the government as well as acting as the registrar for the government bonds; it was also involved in provision of banking facilities to the financial institutions; establishing or supporting the payment system establishment; supervising and examining the financial institutions; managing the foreign exchange rate of the country in relation to the foreign exchange system together with managing the assets in the currency reserve with regard to the Currency Act; and finally controlling the foreign exchange with regard to the exchange control act (Monetary and Capital Markets and Asia and Pacific Departments, 2008).

Over the years, the bank’s operations have evolved with the current money environment and several changes have be effected in its operations, for instance an amendment on the Bank’s act. B.E.2485 was made, aimed at emphasizing on BOT’S social responsibility which was targeted on creating a mechanism in guarding against the economic crisis. In addition the amendment was entitled to setting up a process of decision making that would ensure good governance as well as transparency in the organization, increasing public knowledge concerning its operations.

The Bank of Thailand introduced the unremunerated reserve requirement (URR) on 18 December 2006 after the country’s economy largely suffered on economic instability, particularly at the time when demand or consumer consumption was minimal pushing the economy to relay on the robust export growth. This was attributed to the “short-time capital inflows” as well as “one-way speculation” which was observed on the Thai baht which contributed to its excessive volatility. As a result, the URR was provided to deal with this situation by determining how the Thailand bank conducts its services. Consequently, the URR measures resulted to reduction of pleasure of the baht speculation and have ensured that the stability and movement of baht goes in line with the regional currency. However, the BOT realized that URR measure had unfavorable effects on the financial costs of those businesses that needed to raise their funds from foreign investors in Thailand, hence reduced the measure over a period of time (Gyntelberg et al, 2009).

However, after consideration of the changes in the environmental and other related factors, the BOT decided to resume the URR measures judged due to a number of reasons. They included; the healthy domestic demand, with sustained robust export growth, moderating trade account surplus intended to make the foreign exchange inflows and outflows more impartial to increase the amount invested abroad, to enable the real sectors together with the exporters to cope well with the rising of baht in order to enhance the improvement of foreign production through diversification of market. In addition, the bank intended to manage the currency liquidity and strategize plans for adjusting its structure and management, with consideration of improving the balance of capital flows by the Public Dept Management Act (Communications and Relations Office, 2004).

The URR created a condition on which 30% of the funds from abroad to be deposited in commercial banks with no interest for one year, for the purpose of loan and debt security. As a result, the cost of funding from abroad through these channel were raised, which was relatively high at short-run and decline at the long-run. However, Thailand’s liquidity was ample in its banking sectors enabling the sustenance of the firms that might want to switch to external financing with no different in the fund cost. As a result the external financial market had their link to the Thailand’s market disturbed lowering the value of their currency since the fund require in Thailand was readily available. In addition, the minimizing of the interest rate by the URR from 5% to 3.25% as well as allowing the investor to chose the fully hedge for their foreign exchange instead of putting 30% in reserve lowered the exchange market on the neighboring countries as majority choose the full hedge option. As many foreign investors filled the country, from the attraction of a relative low P/E ratio, the value of the baht’s currency increased at the expense of the foreign currency which resulted to vast accumulation of baht as a net-buy position (Chantapong, 2006).

Most importantly, to assist in management of inflows and outflows of capital on lifting the URR, supportive measures were deemed by the BOT, which included: increasing the foreign investment in the sector of Securities and Exchange Commission in order to encourage the portfolio investment abroad. Also, improving the measures in preventing Thai baht speculation, by revising the domestic financial institution rules, as well as rules regarding these institutions’s provision of Thai baht liquidity was a measure undertaken by BOT. Lastly, BOT emphasizes on the measure of involving revision of the Non-resident baht Account structure by segregating this account into Non-resident Baht Security Account and Non-resident Baht Account for good flow of fund monitoring.

After the provision of URR, the baht upward pressure intensified as a result of both capital and the current account. In the current account the exports expansion was satisfactorily maintained while the imports declined piercingly a factor that was attributed to the abolishment of the prices of oil financial support programme, and the softened demand in the domestic as owing to the raising concern over political doubt. Therefore, the currency deficit which was $7.6 billion upturned to a surplus of $2.2 billion. However, most of the pressure in baht was contributed by the capital account. This was as a result of the raise of the private non-bank’s amount of inflows which had risen from more than $4 billion to $13 billion, or 6.6% of GDP. The equity and the debt flows increase were the reason of the increase in the flow to the non-bank private sector. The outflows of the banks sector was a reflection of an increase in the bank holdings of foreign currency deposit or the short term instruments to maintain the foreign exchange state because of the counterparty to the Baht/Kip Swap agreements between BOT and BOL(Bank of Lao). This agreement entailed that the BOT will facilitate the BOL in the sale or swap of USD/Baht with the BOT, an agreement aimed at strengthening economic and financial relationship between the two nations. After the provision of URR, the outflows associated with the swap agreement between BOT and the BOL showed that the adjusted figure of capital account was higher on USD/Baht than BOL currency Kip/USD swap. There was a sharp raise of payment surpluses from $5.4 billion to $12.7billion, and most of these surpluses came from the capital account. Accordingly, a rapid baht incline of more than 16% against the US dollar was experienced, and as a result this made it the world’s most promising currency in 2006 (Monetary and Capital Markets and Asia and Pacific Departments, 2008).

Before the implementation of URR, baht was under an enormous pressure which was leading to an abnormal appreciation that could have resulted to negative effects on the real sectors. Nevertheless, on the implementation of URR pressure, the situation stabilized, but the imposition of URR didn’t reverse this trend completely because the currency appreciation didn’t go back to normal as a result of the growing currency account surplus. Despite this, the appreciation pace was more favorable as compared to the time before the imposition of the measure and was in line with the currencies of Thailand’s major trading partners as well as competitors. Gradually the baht strengthened both in Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) terms, by 9.8% and 11.3% respectively which was a good indication of export price competitiveness decline. This trend was significantly maintained on the subsequent years (Chantapong, 2006).

The inflows of capital to the non-bank private sectors, was the cause of the net flows reduction which declined from $13.6 billion in 2006 to $6.2 billion to early 2007. Additionally, the net flows which included loans and dept security which were subjected to the URR or full hedge requirement showed a big drop from $4.6 billion to $1.3 billion. In the interim, the net equity flows in the non-bank sectors exempted from the URR measure were not affected but they remained large at an almost 6% GDP. This implies that the equity flows in terms of both FDI as well as portfolio investment was not much affected by the implementation of the URR. On the other hand the equity flow from the non-residents into the stock market have been buttressed by the P/E ratio of the Thai markets as well as the foreign investor’s anticipation concerning the resolution to the continuing political uncertainty (Communication and relations Office, 2007). Nevertheless, the implication from the BOT’s figure does not totally indicate the contribution of the URR measures and full hedge requirement to reduce the upward pressure on the baht. This implies that the inflow at which the investor decide on the full hedge option do not pressurize the baht during the time of converting the currency funds into baht since the accompanying forward purchase of dollars cancels the pressure on the baht. As a result the investors were more inclined in choosing full hedge option with enormous funds being fully hedged to cover the foreign export positions, which had eased the pressure on baht by at least $4.4 billion by 2007. However it is hard to estimate the amount of fund that would flow into Thailand without the URR and full hedge measures. However, judging on the market intelligence and what has transpired in regional financial markets, it was estimated that the pressure reduction of the currency would result at around $10 billion (Australia and New Zealand Banking Group Limited, 2008).

In conclusion, the provision of the URR measure aimed at stabilizing the country’s economy had a great outcome. The country’s economy vulnerability was greatly handled, saving Thailand from potential losses both on the internal and external markets. The exchange rate off baht with other currencies particularly the US$ was significantly improved as well as local exchange rate. In addition, both the Thailand’s and neighboring nation’s financial market were affected by the imposition of URR measure, with the baht’s market being more favored than the neighbor’s. As a result, Thailand has been a core determinant of the liberalization of the flows of the capital in assisting the progression of financial incorporation with the global market.

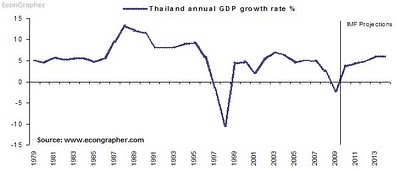

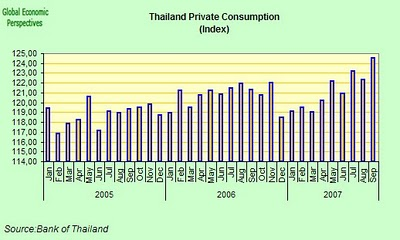

Here are some graphs taken from the Bank of Thailand archives:

Reference list

Australia and New Zealand Banking Group Limited. (2008). Thailand Update. The onshore and offshore Thai Baht converge. Web.

Communications and Relations Office. (2004). Bank of Thailand News. The signing Ceremony of Financial Agreements Between The Bank of Thailand and The Bank of Lao. Web.

Chantapong, S. (2006) Economic Change and restructuring. Comparative Study of Domestic and foreign Bank Perfomance in Thailand: The Regression Analysis. Web.

Communication and relations Office. (2007). Bank of Thailand. Option on Unremunerated Reserve Requirement. Web.

Gyntelberg, J., Loretan, M., Subhanij, T & Chan, E. (2009). Bank of Thailand. Private Information, Stock Market, and Exchange Rates. Web.

Monetary and Capital Markets and Asia and Pacific Departments. (2008). International monetary fund Thailand. Financial System Stability Assessment. Web.