According to an orthodox definition, it is known and assumed that monetary policy is about the manipulation of interest rates. However, there is more to it than just controlling the interest rates of an economy.

As a matter of fact, the monetary policy of any country could be deemed responsible for a wider category of three forms. This would include, controlling the money supply, maintaining the amount of credit allowed by banks and controlling the country’s interest rates (Sloman 556).

Monetary Policy is set keeping in mind the targeted inflation rate and achieving the target set for the exchange rate and growth of money supply. For these reasons, it is to be decided as to which organization is to set the policy; the government or the central bank or the latter with respect to rules put forward by the government itself. Thus, it would rather seem impossible to keep a correlation between political behavior and outcomes without acknowledging both the institutions’ roles (Morris 31).

Governments aim at controlling the money supply from growing extensively in the long term so that inflation could well be kept under control. While for the short term, the purpose of setting up the monetary policy is to ease out business cycle fluctuations.

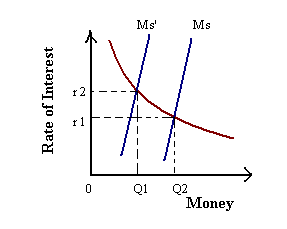

Let’s take an example of the Federal Reserve being in favor of operating a tight monetary policy in order to reduce the aggregate demand (Sloman 558). According to the diagram below, there exists an equilibrium interest rate for the supply of money, ‘Ms’, here ‘L’ denotes the demand for money where it equals the supply. In order to practice a tighter monetary policy FED can reduce the supply of money, ‘Ms’ and let any equilibrium interest rate pave way. Therefore, if a left shift is witnessed and money gets reduced to ‘Q2’, this would account for a comparatively higher interest rate as denoted by ‘r2’. On the contrary, rather than reducing money supply, interest rates could be increased first to have a shift and eventually reduction in the present money supply.

Similarly, the government would want to keep the cost of investment low especially in the present scenario of aggressive recession. For this, it would aim to have low rates of interest (This would be at r1 where the money supply would also be down at Q2) and reduced money supply. However, such a situation would result in what is known as ‘disequilibrium’ (An unstable situation resulting from not being able to control the money supply. The demand for money exceeds it’s supply. ‘Credit Rationing’ is required) as it is almost impossible to have low interest rates while having the money supply down.

The Federal Reserve was established in the year 1913 as a result of The Act of Congress 1913 and at it’s inception there were only seven members from the Board of Governors (Rabin and Stevens 308). Likewise, Fed was structured in a way that the people taking responsibility of the money supply would be kept independent from those governing the country, which is why it is deemed to be one of the most credible in the world.

Furthermore, there are three known features which facilitate the independent stance of the Federal Reserve. These are ‘appointment procedure for reserve bank presidents’, appointment procedure for governors’, and ‘funding’. The Fed is earns interest from the security portfolios which further facilitate the funding of operating expenses (Rabin and Stevens 308).

Secondly, as far as the appointment procedure for governors is concerned, the United State’s President appoints seven of them which happen to get confirm by the Senate. Thirdly, the Board of Directors elects the president to a five year term who then eventually gets confirmed by the Board of Governors.

The 12 member Federal Open Market Committee (FOMC) makes decisions about monetary policy which is then constantly viewed and discussed during meetings held eight times annually (Frank and Bernanke 626).

‘Open Market Operations’ is one of the tools used as part of the monetary policy. In order to facilitate banks reserves thereby increasing bank deposits, The Federal Reserve buys financial assets which include buying government bonds from the general public (Frank and Bernanke 626). It happens to be a continuous cycle whilst the government prints more money to pay for these bonds, the public in return deposits the money in commercial banks as receipts of selling bonds.

The ‘reserve requirement’ is characteristic of the minimum value of bank deposits commercial banks are allowed to keep. Similarly, if the Fed wants to facilitate a contractionary monetary policy, it would increase the reserve deposit ratio which would then lower down deposits and eventually the money supply. Likewise, a decline in this ratio would raise the supply of money (Frank and Bernanke 627).

Another way of manipulating the monetary policy is through ‘discount window lending’ (Frumkin 66). Commercial banks can resort to borrowing from the Fed at a discount rate when they are short of funds. This further facilitates increase in money supply as a result of an increase in bank deposits.

Fiscal Policy and the Tools used by Fed

Like monetary policy, the fiscal policy also aims at controlling aggregate demand; however, here the said manipulation is done through maintaining a balance between taxation and government expenditure (Sloman 542). Since, this is not part of daily activities, it would take a longer period of time to implement and changes take place even before policies could be implemented.

Similarly, ‘deficit’ is the term used to describe when governments’ spending is more than tax collection, whereas, when less is spent as opposed to the collected amount in the form of taxes it is known as ‘surplus’ (Frank and Bernanke 443).

According to Lee, Johnson and Joyce (694), the most important tools used for the manipulation of fiscal policy are the surplus or deficit arising as a result of budgeted expenditure versus the taxes, the revenues and expenditures themselves.

Recently, as witnessed, the US economy has been the worst hit after the Great Depression, especially when we talk in terms of unemployment levels and deficits. While talking in terms of unemployment, it is believed that it would hit an aggravating figure of 9.7% (Lorber and Phillips, The Early Word: Unemployment Rate Goes Up), thus paved way by 230,000 redundant people.

However, the speed of job losses has been decelerating indicating that the worst nightmare is at the verge of the beginning of it’s end. Therefore, the government needs to have a sound control on spending giving the pressure mounting on unemployment benefits.

Furthermore, the fiscal stance of government determines whether an expansionary of a contractionary policy is being implemented. Also the aggregate demand is always expected to be lower as compared to former years if the deficit has been comparatively low too. Thus, it would be implied that there would have been a decrease in injections or an increase in withdrawal such as taxes (Sloman 545).

According to John Maynard Keynes, the actual reason for recession is insufficient demand (Lee, Johnson and Joyce 695) and a decline in purchasing power as a result; therefore, it should be enhanced by government spending. According to many economists till the 1970’s the point of view emerged that the actual problem lied in the supply side as opposed to the demand side. Thus, the argument is characteristic of the fact that high taxes lead to a declining economic activity. In simple words, when tax burden is high, it leaves behind discouragement in terms of being able to carry out private investment and production.

Hence, the stimulus package was introduced by the Obama administration. However, according to a survey, it has been revealed that there seems to be no need of another stimulus package. In order to avoid the financial system from falling apart $787 billion worth of tax cuts and spending was introduced as part of the stimulus package. This was a major step towards tampering with discretionary fiscal policy in order to see national income rise or rather be rescued.

Malthusian Theory: Opponents’ and Proponents’ Point of view

Reverand Thomas Malthus suggested a theory explaining how economic development is related to growing population while highlighting his concerns in an essay written in 1798. However, this theory could be deemed obsolete for developed countries while related to developing countries (Todaro and Smith 309).

He devised a universal theory for population suggesting a twofold increase every thirty to forty years. At the same time, as population rises, each person’s marginal contribution towards food production is expected to decline in terms of diminishing returns related to land and food.

Similarly, due to rising population levels, the population could be expected to be present just above the subsistence level as Malthus suggested. It is because of this reason that per capita income is expected to decline since the rise in food production would not be able to match the rising levels of population. Therefore, he indirectly suggested for birth control.

The term ‘subsistence levels of income’ is often coined by economists as ‘Malthusian Population Trap’. This theory has been broken down into various stages of population growth where it is expected to have a stable population at the lowest levels of income per capita (absolute poverty). At this stage, the death rates are assumed to be equal to death rates.

At the first stage as suggested by Malthus, birth rates start mounting up in the presence of increasing death rates while the per capita income is thought to substantiate living. Stage two witnesses burgeoning population rates. Likewise, at the completion of stage two and at per capita income in a given period of time when population would have reached it’s maximum, birth rates would yet again decline. The Malthusian population trap would have thus reached a saturation point.

Similarly, the higher the level of per capita income, the higher would be the level of aggregate income. Therefore it is realize that countries having higher income per capita are capable of having a better investment stance as facilitated by better rates of saving (Todaro and Smith 310).

However, beyond a certain level of per capita income, the growth in aggregate income level is thought to reach a maximum level and then start declining due to the fact that resources are scarce and land is fixed as more individuals would be needed to work with the same limited number of resources available to them. Thus, as penned by Malthus, this is the time when ‘diminishing returns’ are observed.

Moreover, he devised a thought that poor nations would find it extremely difficult of going beyond their subsistence levels and being able to eke out an affluent life until and unless they undergo ‘preventive checks’ of controlling population (Hughes 38), for instance, birth control. Hence, failure to abide by these preventive measures makes malnutrition and poverty inevitable. He further argues that no increase in food would be able to cope up with the ever increasing level of population and that land is highly finite.

Birth control activists fid this theory as a means of support for their quest of trying to logically control population growth in developing countries where starvation, clean water and poverty are a few of the major issue challenging the rest of the world.

On the other hand, there are arguments in against Malthus’s theory. First of all, it was suggested more than 200 years ago when it seemed more appropriate to the rest of the world. However, Malthusian model fails to take any technological advance into consideration which might be of assistance in controlling scarcity of resources as compared to the ever increasing levels of population (Todaro and Smith 312). For instance, the quality of land could be enhanced as a result of a facilitating technological impact. Also due to this reason, high income levels could be achieved resulting in high per capita income.

It is also argued that national rate of population increase is not always proportional to national level of per capita income. This holds true for developing and less developed countries and due to better health care, death rates are under much control than at the time of the suggestion of this theory. Thus, it’s more of a matter of the stance of the income being distributed properly and the level of income per household.

Basel Accord

Basel Accord was based on an agreement for regulating international commercial banks and dates back to July 15, 1988 when minimum levels of capital were decided for them (Risk Financial Manager 643).

At the initial stage the capital requirements to be held by these private commercial banks were based on a standard set by Basel Committee on Banking Supervision (BCBS). A few years back, rules were revised by the Basel Committee under Basel II in the year 2006. This has prompted far more risk sensitive capital requirements while operational risks have been charged against so that losses are minimized. Similarly, banking group parents maintain the surety that risks are distributed and among entire banking groups at the same time double gearing is avoided.

It is based on the three pillars, namely, ‘minimum capital requirements’ as discussed above, ‘supervisory review process’ and ‘market discipline’.

According to the first pillar, minimum capital requirements are devised comprising of three elements such as risk weighted capital assets, minimum ratio of capital to these assets and the gist of regulatory capital. Similarly, for credit risk rating, banks can either use the devised standard or their own internal ratings, however, depending at the discretion of the bank supervisor.

Further elaborating on it, the Basel Accord requires capital to be at least equal to 8% of total risk weighted assets of the bank (Value at Risk 55). It further consists of two components, where ‘tier 1 capital’, also known as the core capital includes stocks and reserves from post tax earnings, and ‘tier 2 capital’ (supplementary capital) comprises of undisclosed reserves and perpetual securities (Value at Risk 56).

As far as the second pillar is concerned, the supervisory review process aims at helping banks develop better risk management techniques and capital management. Capital targets are set and internal assessment procedures are encouraged. Likewise, supervisors can arbitrate for issues that they deem appropriate.

Talking in terms of the third pillar, disclosure recommendations and bank requirements are made and it is decided on the basis of materiality as to which disclosures can be made.

The Basel Accord has been criticized at a number of occasions as it is argued that institutions may resort to haphazard lending where expected returns are higher than regulatory costs so that regulatory capital is maintained at an equal level with economic capital (Value at Risk 59). It has also paved way to the deterioration of the loan books’ credit quality due to securitization according to which loans can most readily be transformed into tradable securities or moved into trading books. As a result the capital requirement is lowered.

Work Cited

Frank, Robert and Ben Bernanke. Principles of Economics. New York: McGraw Hill Irwin, 2001. Print.

Frumkin, Norman. Tracking America’s Economy. New York: M. E Sharp, 2004. Print.

Hughes, Jonathan R. T. Ecology and Historical Materialism. Cambridge: Cambridge University Press, 2000. Print.

Jorian, Phillippe. Risk Financial Manager Handbook. John Wiley & Sons, 2007. Print.

Jorian, Phillippe. Value at Risk: The Ne Benchmark for managing Financial Risk. McGraw Hill Professional, 2007. Print

Lee, Wayne and Philip G. Joyce. Public Budgeting Systems. Jones & Bartlett Publishers, 2007. Print.

Lorber, Janie and Kate Philips. The Early Word: Unemployment Rate Goes Up. New York. Web. 2009.

Morris, Irvin. Congress, the President, and the Federal Reserve: The Politics of American Monetary Policy Making. Michigan: University of Michigan Press. 2002.

Rabin, Jack and Glenn L. Stevens. Handbook of Monetary Policy. CRC Press, 2002. Print.

Sloman, John. Economics Fifth Edition. University of West England, 2005. Print.

Smith Stephen and Michael Todaro. Economic Development. California: Addison Wesley, 2003. Print.