This paper looks into the Reserve Bank of Australia in terms of the bank setting the cash rates with accordance to several factors with regards to the decision made by the RBA in April 2012. In the case where the RBA lowered the interest rates by 25 basis points, Australian banks are expected to reduce their interest rates by a similar margin.

This paper investigates and explains the reasons as to why the commercial banks did not match their interest rates with accordance to the cash rate set by the RBA. On the other hand, the reason as top why the treasurer believes that the banks ought to pass rate cuts on to the public is broadly discussed.

When studying the Australian RBA in terms of it determining cash rates, it is vital to also look into other regions and determine their cash rates. This paper has thoroughly looked into the economic markets as well as interest rates of banks in Europe, India as well as China.

The Reserve Bank of Australia (RBA) which is Australia’s central bank, has the role of formulation and implementing of the monetary policy as well as carrying out its operations with the aim of maintaining a sturdy fiscal system and it also carries out the duty of issuing the country’s currency.

Not only is the Reserve bank of Australia the sole issuer of the country’s banknotes, it is also in charge of managing the country’s foreign and gold reserves as well as acting as a banker to the Australian government. The RBA has the duty of setting the target cash rate. The official cash rate is the interest rate that is normally paid by banks in Australia in an all night money market.

The cash rate can only be affected by transfers that may have occurred between the Reserve Bank of Australia and the other banks. By raising and lowering the cash rate, the RBA has tried to influence the Australia economy with the intention of keeping some economic parameters in a constricted range. In November 2011, the RBA undertook the action of cutting official interest rates by 25 basis points.

The Reserve Bank of Australia takes into consideration a variety of factors before it raises or lowers the cash rate this is vital since any change in the cash rate impacts several aspects in the Australian economy. In April 2012, the RBA board opted not to change the cash rate and hence left it at 4.25 per cent (Reserve Bank of Australia, 2011).

The RBA takes into account the monetary policy since it has a major influence on the housing market. In the housing market sector, the house prices are first looked into so as to determine whether the cash rate should be adjusted because the house prices have a probable impact on future inflation. The house market plays a significant role in the economic growth of the country as well as in the general welfare of its citizens.

It is, therefore, necessary for the RBA to consider house marketing as a determinant in determining the cash rates since any change/surge in the house prices, a ripple effect occurs through an increase or decrease in the rate of inflation. Since the housing prices in Australia gave away some indications of gaining stability and the housing market remaining soft, the RBA decided to leave the cash rate as it previously was.

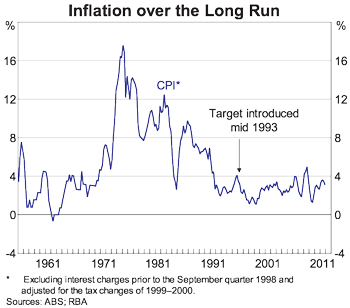

The rate of inflation in Australia is a key determinant in cash rate determination by the RBA. This is evident since a negative change in the inflation rate would force the RBA to adjust the cash rate in a bid to counter this occurrence and maintain economic growth.

The monetary policy stance in Australia fixed an inflation target and the tool that would be used to achieve this objective was the cash rate since a change in the cash rate would influence the inflation rate. The RBA left the cash rate unchanged since they expected a fall in inflation rate in the forthcoming quarter or two and an inflation rate of 2-3 per cent was anticipated.

General economic growth as well as the lending rates aids the RBA in determining the cash rate. As for the case of Australia, there is an expectation that the growth will be close to trend while the lending rates are near the average mark hence no change for the cash rate was deemed fit by the RBA (Bindseil & Ulrich 2004, 87).

The four big banks in Australia despite reporting ever-growing profits; have been blamed for not passing on the Reserve Bank’s cuts. Australian banks are being pressurized by the government, consumer associations and other relevant parties to reduce their lending rates in response to the RBA’s interest rate cuts. However, they have given many reasons as to justify their position:

Long term credit such as mortgages as funded by long term debts while short term credit is funded by the money market. Banks claim that the interest rate cuts only affects the short term credit since they cannot borrow short term funds to fund long term lending as this would expose them to greater risks.

Thus, they cannot match the RBA’s interest rate cuts. Due to the risks exposed by funding long-term debts wholly with short-term credit, banks have to branch out their lending sources.

Bankers argue that almost half their cash comes from domestic deposits, a quarter from domestic bonds and the other from the international markets. Since there is inadequate savings to fund all the loans, banks have to get the deficit from out of the country and therefore present themselves to the international market conditions.

Although the Reserve Bank may have some control on the local short-term money market rates, definitely they have no control over the international market (Whitesell & William 2006, 1180). Banks claim that they are being squeezed by offshore capital markets as they are paying more money on international markets while at the same time moving further towards a domestic funding base.

Banks fear that bad debts accruing in the future could increase given that lending rates are relative to the default of the loans. Thus, their reluctance to respond to RBA’s cuts could be an indication that they are pricing in more risks on their loans.

Banks argue that with inflation expected to remain for some time, economic growth in the long run trend and unemployment generally sturdy, thus it is not necessary to maintain interest rates slightly restrictive.

Lending rates are about 30% points over their long-term averages and cuts in the RBA cash rate would take them back to around those averages. Reserve Bank anticipates that the inflation to range between 2-3% marks in the next one to two years before it can turn down again. Thus, as expected, banks could even increase borrowing rates quick enough to safeguard their profits.

The banks also claim that the high borrowing costs are eating into their margins and they also want to rebuild their margins after the financial crisis.

Banks have cited increased operating costs and could even impose almost double rate hikes after the RBA lifted rates.

However, banks like the Westpac, Australia and New Zealand Banking Group, and Commonwealth Bank have at least responded to the RBA’s move slashing their variable loan rates by 25 basis points (Reserve Bank of Australia 2008).

The RBA treasurer, Wayne Swan, believes that major banks should cut their rates in full to match the central bank’s move, so as to tame the spiraling inflation and to support the suppressed local economic growth (Ellis 2002, 31; Obstfeld & Alan 2009, 46).

The treasurer cautioned the banks not to use the European debt crisis as a pretext of not passing the cuts fully to the customers. He argues that banks should help in easing the financial pressures in Australia.

I concur that banks should pass on fully the interest rate cuts. Going by the Prudential Regulation Authority report that indicates that an additional $12.3B has been put into bank deposits since 2011, banks are in a position to push on the savings fully as this comes at a time when international economic uncertainty is still looming with more savers seeking protection.

Going by figures, bank deposits in the Commonwealth Bank went higher up by 2.6 per cent, National Bank deposits up 1.1 per cent and Westpac deposits up 1.2 per cent, while ANZ maintained its deposits. The total increase in deposits of 0.9 percent is well over the growth in lending of 0.6 per cent.

The fact that banks are unwilling to respond to the RBA interest rate cuts suggests that the RBA cash rate is losing ground in its significance as a cause driving the cost of being a bank (Grenville 1997, 103).

Europe

The global lenders are one after the other pulling their money out of Europe and consequently the borrowing costs in Europe are on the rise quick and so are cash lending rates. Since the second big challenge with the Euro train wreck is that European’s banks have Euro debts coming out of their ears.

Britain’s banks have taken off their lending risk to peripheral euro zone counterpart by a quarter as concerns have expanded about the worsening crises in Europe.

The Financial Times has reported that the big 4 Britain banks have reduced cash loan amounts by more than 24% to £10.5B in the three months to the end of September 2011, showing a quick increase in anxiety among lenders across the euro zone. The biggest cuts were in the volume of credits to banks in Greece and Spain (Boge & Wilson 2011, 47).

HSBC, the main lender of credit to other banks in Europe, also reduced its exposure more drastically with a 40% total reduction in cash lending to Europe, for instance it cancelled lending to Greek banks, and sliced Spanish and Irish amounts by almost two thirds.

The bond markets have closed for longer term bank borrowing, the reduction in cash lending rates will put in to worries of a credit crisis as banks fight back to retain present loan obligations, let alone furnish new ones. This added to the decline of cash lending rates and regulatory weight on banks to increase capital reserves has forced banks to caution of a worse credit crisis in Europe (Fabbro & Hack 2011, 40).

China

As witnessed in other parts of the world, the big banks in China have gradually been depositing excess funds with the reserve bank and reducing their cash rates as they try to cover market risks. At the time of the beginning of the economic meltdown in 2008, cash lending came to an end as there was mistrust among the banks.

The market for cash rate in China yuan is international. Many banks in Europe, US and in other countries have some yuan-denominated assets and obligations and hence have to occasionally borrow and lend in yuans.

The People’s Bank of China has allowed trading in the yuan against the sterling in its cash rate market in spot, forward and swaps deals. Sterling will be allowed to move within each day 3 percent trading mark, to match the trading ranges presently accepted for the euro, yen and Hong Kong dollar.

India

In India cash rate lending is hampered even after the reserve bank is putting actions to improve the Indian market’s liquidity. The Reserve Bank of India in addition raised the cash reserve ratio (a volume of deposits that banks should keep with the reserve bank) by 1.5% points, from 0.5% point cuts, a decision that was projected to boost 600B rupees ($12.2 billion) into the bank system (DeLong 2001).

Conclusion

The Reserve Bank of Australia indeed serves an important role of setting the cash rate hence it may raise or lower the basis points and this factor is determined by a couple of factors such as the housing market, the inflation rate as well as the economic growth of the country.

In event, once the basis points have either been raised or lowered by the RBA, the consequential result is for the commercial banks to take the initiative to either lower or raise their interest rates with regards to the cash rate.

In this case, the banks did not match the interest rate cuts and this is due to several reasons such as the fact that if they cut their long term lending rates they will endure high criticism to increase them again in case of further disruptions in the international credit market.

References

Bindseil, L & Ulrich, H 2004, Monetary Policy Implementation, Theory – Past and Present, Oxford University Press, Oxford.

Boge, M & Wilson, I 2011, The Domestic Market for Short-term Debt Securities. RBA Bulletin, pp. 39–48.

DeLong, B 2001, Preliminary Thoughts on India’s Economic Growth. Web.

Ellis, L 2002, ‘Interest Rates and the Transmission Mechanism of Monetary Policy: Theory and Australian Experience’, Economic Research, pp. 25-93.

Fabbro, D & Hack, M 2011, ‘The Effects of Funding Costs and Risk on Banks’ Lending Rates’, RBA Bulletin, pp. 35–41.

Grenville, S 1997, The Evolution of Monetary Policy: From Money Targets to Inflation Targets, John Wiley, New York.

Obstfeld, G & Alan, T 2009, Financial Instability, Reserves, and Central Bank Swap Lines in the Panic of 2008, Sage, CA.

RBA (Reserve Bank of Australia) 2011, Submission to the Inquiry into Access for Small and Medium Business to Finance. Web.

Reserve Bank of Australia 2008, Measures to Enhance the Functioning of Financial Markets. Web.

Whitesell, R & William, G 2006, ‘Interest rate corridors and reserves’, Journal of Monetary Economics, vol. 53(6), pp. 1177-1195.