Definition

A mortgage-backed security (MBS) is a type of investment that is similar to bonds. Its value is secured by pooling several mortgages, which are then sold to investors (Mishkin & Eakins, 2012). The security is a derivative element. The reason is that its value is tied to that of another asset.

The investor does not pay for the actual mortgage. On the contrary, they are paid on the basis of the pooled returns over time. The principal and interest from the mortgage pay for the principal and interest of the MBS (The Bond Market Association [BMA], 2002).

Why MBS are Used

The primary objective of this security is to help people own houses. The plan was introduced in 1968 (BMA, 2002). The introduction of MBS allowed other financial institutions to venture into the risky mortgage business (BMA, 2002).

Before its introduction, only banks had the ability to offer long-term credits to purchase houses. According to Mishkin (2001), MBS also ensured that lenders got their money right away. It also protected them if the owners defaulted on their payments.

Types of Mortgage-Backed Securities

Pass-through

It is the most basic type of MBS. It is also called participation certificates. The mortgage payments collected are passed to the investors (BMA, 2002). It is further categorized into residential and commercial MBS. The former is backed by residential property while the latter is secured by commercial assets.

Collateralized mortgage obligation (CMO)

It is a complicated form of MBS (Mishkin & Eakins, 2012). Unlike the pass-through, CMO is made up of many securities called tranches. Each tranch operates independently. As such, there are different cash flow patterns (Mishkin & Eakins, 2012).

Financial Crisis and Decline of Economic Activities

A financial crisis can either be systematic or non-systematic. The former affects the entire financial system while the latter only involves a few markets (Mishkin, 2001). An economic crisis is associated with a series of events. The sequence is analyzed below.

Financial Crisis – Sequence of Events

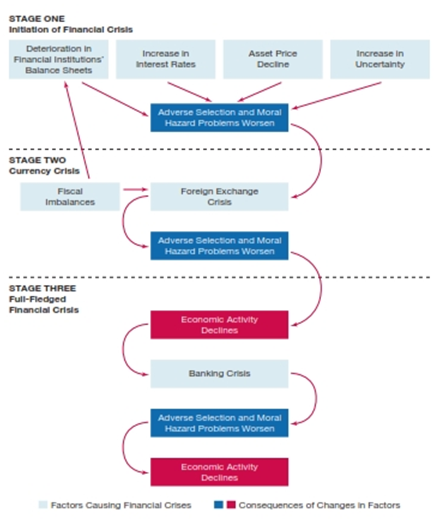

The figure below illustrates the sequence of events associated with a financial crisis:

Figure 1: Development of a financial crisis

Source: Mishkin and Eakins (2012)

Initiation

It is the stage where the financial crisis is triggered. It can be caused by a combination of many factors. One of them is mismanagement of economic liberalization. Liberalization helps the economy by promoting financial development. A credit boom can occur where institutions lend significant amounts of money (Mishkin, 2001). The uncontrolled lending may eventually overwhelm loan regulators. The resulting risky lending leads to losses (Mishkin, 2001).

Another factor that may trigger the crisis includes fiscal imbalances. It results from overspending on the part of the government. Authorities react variously in case of economic imbalances. For example, they may prompt financial entities to absorb their debts. The faith of the investors is lost. Consequently, the price of stock plummets (Mishkin, 2001).

Currency crisis

The difficult business conditions result in the insolvency of some institutions. As such, their net worth is reduced (Mishkin & Eakins, 2012). Creditors and banks are unable to pay off their depositors. Most of them go out of business, causing a financial panic.

Full-fledged financial crisis

Most emerging economies hold their debts in foreign denominations, mostly the US dollar. The situation leads to currency mismatch. When the local currency depreciates, the debt burden increases (Mishkin, 2001).

As a result, the value of these financial obligations increases. The situation leads to a decline in economic activities. Depreciation of the local currency also raises the price of imports, destabilizing the economy further.

References

Mishkin, F. (2001). Financial policies and the prevention of financial crises in emerging market countries. Cambridge, MA: National Bureau of Economic Research.

Mishkin, F., & Eakins, S. (2012). Financial markets and institutions. New York, NY: Prentice Hall.

The Bond Market Association. (2002). An investor’s guide to pass through and collateralized mortgage securities. New York, NY: St. Michael’s House.