Introduction

The success of international market penetration is determined by a multitude of factors that need to be acknowledged in the development of an entry strategy (Tiwari, 2013). The following report provides a summary of relevant factors and a set of recommendations for Egyptian market entry by Motomachi Japanese Restaurant & Patisserie. The findings suggest relatively unfavorable conditions for entry and suggest joint venture as the most viable approach considering the resource limitations and a highly competitive environment. Polycentric approach to staffing and a transnational strategy for business operations are recommended to retain cultural competencies and sustain a competitive advantage and establish presence in the host country.

Company Background

Motomachi Japanese Restaurant & Patisserie is a company that serves Japanese cuisine in the UAE. The company focuses on ensuring the authenticity of the experience (“Motomachi Restaurant & Patisserie,” 2017). In addition to the diverse menu, the restaurant offers the takeaway service but does not provide delivery options. The company does not disclose its size, ownership, or history. Motomachi brand is largely unfamiliar to customers outside the UAE and the expansion potential is fairly limited.

Country and Market Analysis

External Factors

Political Stability

Currently, the political situation in the country is uncertain and can be evaluated as 4/10 in terms of suitability. The country’s current president has faced a host of political issues left from the Hosni Mubarak’s presidency. While there is evidence that an overall direction taken by the government is favorable for the country’s economic condition in the long run, the resilience of certain issues still poses a significant barrier to the profitability of businesses (Nasr, 2015). In addition, the government imposes strict regulations that restrict adaptability and flexibility (Nasr, 2015).

Free Market Systems

From a formal standpoint, Egypt’s economy is based on free market system and can be ranked 8/10 in terms of suitability. In the recent decades, the centralized control by the government was gradually transformed into a more liberalized approach (Nasr, 2015). This is especially important for the international players that do not need to rely on familiarity with local regulations and can operate using the internationally accepted principles.

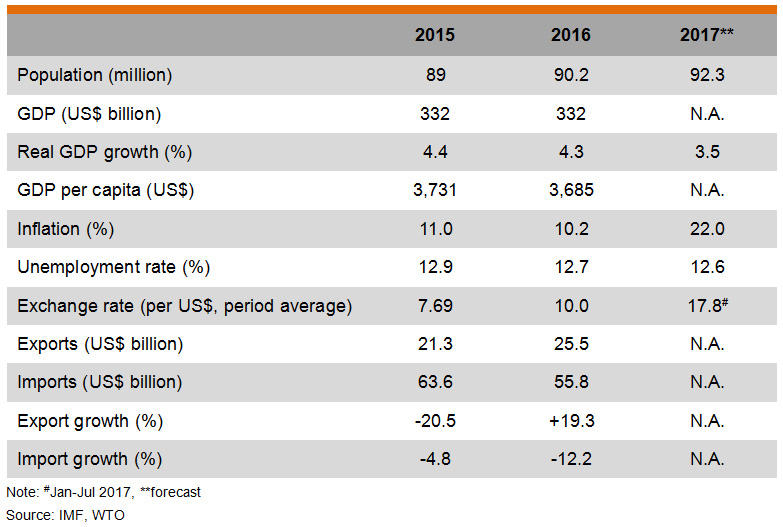

Inflation Rates

Inflation rates have remained high in the recent decade and can be evaluated as 5/10 in terms of suitability. The latest data indicates an overall rate as above 30 percent (see Figure 1). Such high rate is unfavorable for the business as it is usually associated with the uncontrolled increase in the cost of operation and production and has an adverse effect on capital expenditure. It should also be pointed out that high inflation rate is generally unfavorable for foreign exchange rates which is especially relevant for international businesses.

Corruption Levels

The level of corruption is relatively high in Egypt, which suggests a ranking of 4/10 in terms of suitability for business. The latest data from Transparency International provides a rank of 34/100 (Nasr, 2015). Such situation leads to lower predictability of business performance and should be considered before entry.

Customer/Competitor-Based Factors

Level of Existing Competition

The Japanese food segment of the restaurant industry is relatively well-developed in the country, suggesting a suitability score of 4/10. TripAdvisor lists 41 Japanese food restaurants in Cairo alone, with an average of 100 reviews per restaurant for the top ten entries (TripAdvisor, 2017). In other words, the segment is densely populated and popular among the local population, adding to the challenge of a new entry.

Efficiency and Value of Existing Competitors

The leading competitors in the Japanese food segment are Mirai, Kazoku, Shogun, Sachi Restaurant, Saigon Restaurant, and Tao (TripAdvisor, 2017). Of these, only two are Egyptian businesses whereas others are international companies with an established presence in other countries. Thus, the suitability of this factor can be ranked at 3/10 since the majority of the competitors have the opportunities and resource capacity for mitigating the country-specific barriers.

Industry and Business Factors

Suitable Labor Force Availability

The labor market in Egypt is largely unfavorable for the restaurant industry and can be ranked 5/10. On the one hand, the unemployment is relatively high in the country, ranging between 12 and 13 percent according to the official information (Export.gov, 2017). In addition, the majority of the unemployed population is comprised of the educated young citizens that are unable to find implementation for their labor skills. On the other hand, the public sector is relatively overstaffed whereas the private enterprises face significant shortage of specialists due to the mismatch between labor skills and market demand (Export.gov, 2017).

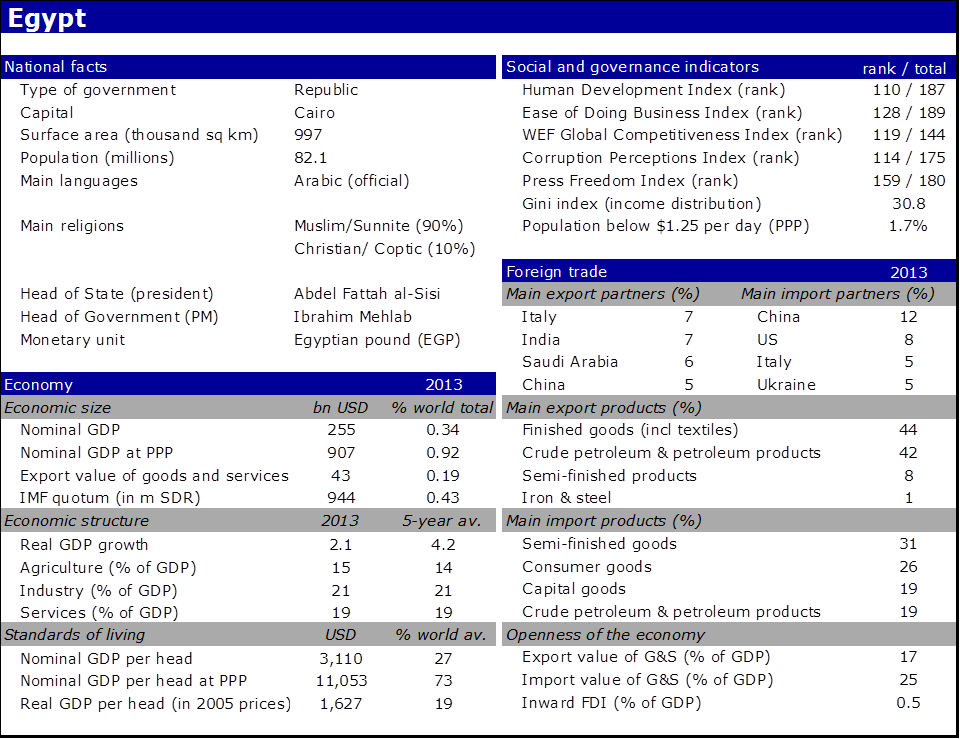

Trade Barriers

In its current state, the legislation of the country has an adverse impact on the transparency and accessibility for the international players and can be ranked 6/10 (Australian government, n.d.). The most significant barrier is the trademark registration for the licensees requiring a range of documents. Licences also influence trade practices (see Figure 2). In addition, at least some of the ingredients required for running a Japanese food business will be imported, which may require inspection for compliance with established specifications in order to obtain permission for import.

Transport Costs

The transportation system in the country has undergone a major redesign in the recent decades and can be ranked 8/10. Currently, the private sector handles the majority of maritime and air transportation services and has managed to update the key aspects of the industry, increasing the efficiency of operations and lowering the costs. Some public transportation costs have increased in 2017 in response to the changes in fuel and electricity prices (Ahram Online, 2017). However, the costs remain relatively low thanks to an ongoing renovation effort.

Costs of Establishment

The cost of establishing a new business is relatively high in the country and can be ranked 6/10 in terms of suitability. Despite a considerable effort from the authorities aimed at liberalizing the business environment, foreign investors are still discouraged from doing business in Egypt (Saif & Ghoneim, 2013). According to the rating reported by the World Bank, Egypt ranks 128th in terms of obtaining permits, getting credit, registering property, and paying taxes, among other factors (The World Bank, 2017).

Marketing Mix and Staffing Policy

The success of entry is largely determined by the appropriateness of the marketing mix created in accordance to the specificities of national culture, quality standards, and economic development. The company’s main product is Japanese food. In addition to sushi, the restaurant’s menu also includes a wide variety of other items. While it is reasonable to expect the former to be the most sought-after option, such diversity is expected to provide a competitive advantage for the restaurant.

The place/distribution strategy requires situating the restaurant in a location popular among the locals. Tourists and visitors will likely seek for a more authentic and country-specific experience, whereas the locals will be more interested in novel and exotic dishes. Since the majority of ingredients can be obtained in Egypt, the production will be located primarily within the restaurant whereas some of the more exotic ones need to be imported in the processed form. The distribution channel will include trusted food suppliers that can validate the quality of their products, advertisement, and Internet marketing.

The promotion of the restaurant needs to include web tools as well as traditional media. The former will be primarily oriented at the younger generation and may include social network promotion and the introduction of the VIP registration-based service that would be used for the distribution of coupons as well as special offers for important dates. The latter will expand the audience by including those individuals who have limited exposure to digital marketing means and prefer a traditional approach. Considering the relatively low cultural barriers and noise levels, pull strategy will be more appropriate due to high familiarity of the offered product.

The pricing strategy that is the most suitable for the company is the penetration pricing characterized with artificially low price for high-quality goods (Baker, 2014). Such strategy will ensure the establishment of the core audience and may create a competitive advantage early in the course of events. It should also be mentioned that the hospitality industry is characterized by a relatively high elasticity, which means that penetration pricing may cause some customers to change their preferred restaurant (Baker, 2014).

The most suitable approach to staffing is a polycentric one. There are two reasons for this. First, the high rate of educated and unemployed specialists combined with the presence of similar businesses suggest the existence of qualified individuals suitable for hiring. Second, and, perhaps, more importantly, the locals are more familiar with the specificities of the political and economic conditions as well as the cultural profile of the audience. This move will also contribute to local responsiveness of the business.

Market Entry Strategy

Some of the market entry strategies are inherently unsuitable for the restaurant business. For instance, exporting is largely unnecessary since many ingredients are readily available in the host country and the delivery of perishable products introduces additional challenge. Turnkey projects are unnecessarily complex for the purpose of opening a restaurant due to their generic nature and a relatively high cost.

Licensing offers a more cost-effective solution by providing the host businesses an opportunity to use brand names and intellectual properties. In addition, it has the least restrictive regulatory framework. However, it also erodes the means of control available to the owner (Vyuptakesh, 2013).

Franchising offers more control over the host business based on specific documented criteria. However, it requires a strong brand name for success. Joint venture is an approach associated with lower risk due to the shared resources and responsibilities between the stakeholders but opens up the possibility of the conflict of interest (Baker, 2014). Finally, a wholly owned subsidiary provides the strongest control and eliminates the majority of risks but requires substantial investment and is oriented at long-term profitability.

Based on these considerations, it would be reasonable to recommend joint venture as a preferred mode of entry. This mode will allow for readjustment of the local business models in a non-disruptive way. Admittedly, such approach may contribute to the increased debt (Vyuptakesh, 2013). To address this, additional resources need to be allocated to support the entry.

Strategy for International Business Operations

The current economic setting discourages the use of both international and localization strategies, primarily due to the presence of numerous competitors. Thus, the pressure for cost reduction is high. On the other hand, transnational strategy offers a more flexible cultural competence profile and allows accounting for the aspects of local conditions (Baker, 2014). In addition, the local partners will possess relevant market experience, familiarity with location economies, and competing pressures. At the same time, it provides sufficient space for expanding the market and a subsequent evolution of strategy.

References

Ahram Online. (2017). Cairo metro ticket prices to double by last quarter of 2018: Transport minister. Web.

Australian government. (n.d.). Export markets – Egypt. Web.

Baker, M. (2014). Marketing strategy and management (5th ed.). London, UK: Palgrave Macmillan.

Export.gov. (2017). Labor policies & practices. Web.

Motomachi Restaurant & Patisserie: About us. (2017). Web.

Nasr, S. (2015). Access to finance and economic growth in Egypt. Web.

Saif, I., & Ghoneim, A. (2013). The private sector in post-revolution Egypt. Web.

Tiwari, N. (2013). Managing human resources in international organizations. Global Journal of Management and Business Studies, 3(4), 355-360. Web.

TripAdvisor. (2017). Japanese food in Cairo. Web.

Vyuptakesh, S. (2013). International business: Concept, environment, and strategy (4th ed.). New Delhi, India: Pearson.

The World Bank. (2017). Ease of doing business in Egypt, Arab Rep. Web.