Multinational corporations aiming to operate in China as a joint venture with a local Chinese company have to face several challenges which need to be taken into account before entering into any such deal. The most common problems with setting up a joint venture in China include difficulties in negotiation, understanding of the legal framework, financial arrangements, poor infrastructure in certain areas etc. Also, the Chinese companies have structures and culture that are viewed as extensive bureaucracies and difficult to change (Blake, Salas & Wraith, 1997).

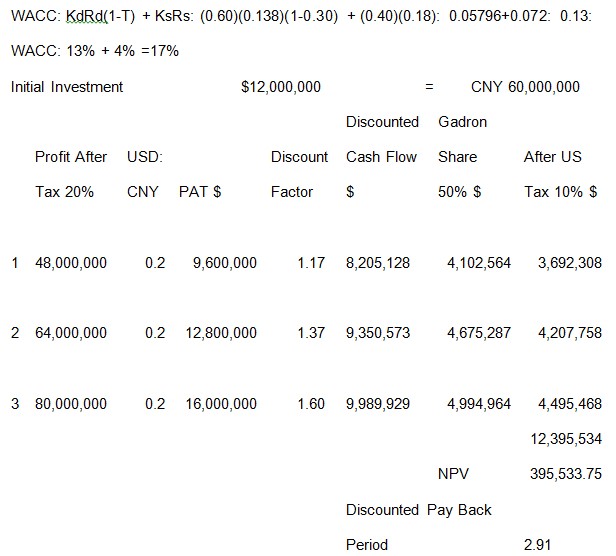

The most important factor which is more likely to affect the profits remitted from the joint venture is considered to be the tax policy which both the US and Chinese regulatory bodies implement. The profit shared by the foreign MNC is subject to corporate income tax of 20% which is expected to be increased to 40% by the Chinese government.

In addition to this, the US government has imposed 10% tax on profits received from China. It is also likely that the Chinese government will put additional 10% WHT on the profit remittance made to the US which will further shrink the profits generated from joint ventures in China. The negative implication of tax collection for Gandor Co. can be seen as per figure below.

In addition to this, the Chinese government from time to time impose different taxes to protect and promote local industry for example Intel which specializes in chip manufacturing received set back when the Chinese government impose 17% tax on their sales in China and provided 14% rebate to local Chinese manufacturers which affected Intel’s sales in 2004 (Madura, 2006).

One way for a multinational corporation to raise funds for a joint venture is to borrow in local currency from financial institutions operating in the target market. It is suggested that borrowing in local currency can be beneficial if there is a fixed exchange rate between MNC’s own base currency and the other currency as the elimination of exchange rate risk somewhat reduces the cost of borrowing and risks associated with it (Kaminsky, 2006).

For example, if a company in the US requires funds for initial investment it can approach a local US bank for $100,000 which would be converted in Chinese currency Yuan at a parity rate of 8.62 to be invested in the Chinese joint venture. However, if it was floating exchange rate mechanism and CNY depreciated to 9.00 then the company would have to remit more of CNY for repayment of $100,000 thus reducing the net profit of the business; Whereas in fixed exchange rate mechanism the repayment amount would remain the same and even lower when compared to other option.

There are also tax benefits associated with borrowing in other currencies which are implemented by the government to keep the demand for its currency sustainable and reduce pressures on its currency’s value. The multinational corporations operating in different countries can also take advantage of fully hedged borrowing through fixed-to-fixed currency swaps. Once companies develop a strong reputation with financial institutions they can also easily obtain financing to finance their operating activities. The repayment of loan does not fluctuate as the exchange risk eliminates any up and down movement in the required amount.

Therefore, the initial investment amount can be obtained at terms which may be more realistic and appropriate for the business. However, there are few difficulties in borrowing from Chinese financial institutions as companies do not have high credit rating with these institutions. This could also cause borrowing rate to be higher for local current denominated loan despite of the fixed exchange rate regime. Furthermore, financial institutions require further commitment from multinational companies which would add a commitment charge to the cost of borrowing (Mehta & Fung, 2004).

Reference List

Blake, J., Salas, O. A., & Wraith, P. (1997). Joint ventures in China – a Spanish Case. European Business Review , 155-161.

Kaminsky, G. L. (2006). Financial Cycles, Contagion, and Liability Dollarization: Do Exchange Rate Regimes Matter? Ankara: Central Bank of The Republic of Turkey.

Madura, J. (2006). International financial management. New York: Cengage Learning.

Mehta, D. R., & Fung, H. (2004). International Bank Management. New York: Wiley Publishers.