Abstract

The challenges that multinational corporations face often shape the strategies they use to enter and operate in foreign markets. They face unique challenges compared with firms operating in the domestic market. The paper focused on investigating how uncertainties in foreign markets may shape a multinational corporation’s entry strategies. The findings show that most of these firms often conduct thorough research of the market to identify challenges that they may face. They would then select an entry strategy that is aligned with its vision in foreign markets and reflects its financial capacity. The success of a large company in the new market will depend on how well it has aligned its operations with the identified local forces.

Introduction

Uncertainties in the market often shape the strategy that multinational corporations use to expand their operations beyond the national border. According to Jiang and Gong (2019), the move to explore an international market exposes multinational corporations (MNCs) to greater risks than their domestic counterparts. Each market has its unique characteristics and traits based on its social, economic and political structures. To succeed in these markets, a firm needs to develop an effective entry strategy and understand the local forces and how its operations can be streamlined accordingly.

Schlegelmilch (2016) argues that a firm’s choice of the market entry strategy is justified given the certain level of foreseen risk and uncertainty. It means that the strategy that a multinational corporation uses to enter the United States market may not be effective when entering the Japanese or Indian market (Saunders and Lewis, 2017). In this paper, the researcher seeks to investigate how uncertainties in a given region or country often shape multinational corporations’ entry into new markets

Discussion

It is always the desire of many companies to expand their operations beyond their national borders. Marchewka (2015) argues that many entities often consider it successful to have their products available in a larger market. It helps in improving the revenues. It also helps in enhancing the sustainability of a company. For instance, when one market is affected by socio-political or economic forces, operations in other countries would ensure that there is a steady revenue stream. However, Power and Ferratt (2019) warn that making an entry into foreign markets may be a challenging process. It is not just as simple as setting new offices, plants, or distribution centers.

It involves understanding the market based on socio-cultural factors, purchasing power, the level of competition, government policies and regulations and any other factor that may have a direct or indirect impact on the firm’s success. Uncertainties in the market should influence the decision of the firm. For instance, the Middle East and North Africa (MENA) region is a very attractive market for any multinational corporation such as Alibaba. Despite the attractiveness of this market, various uncertainties posed by the regional political instability make it difficult to enter this market. It would require a unique strategy for such an MNC to make a successful entry.

Firm’s Market Entry Strategy

When planning to enter a new market, the management of the corporation must ask critical questions that will enable it to decide on various issues. As Bagley (2019) observes, sometimes it may be necessary to avoid certain markets for a given period because of the numerous risks that the firm will have to face. In other cases, it may be necessary to work closely with some of the local players to facilitate a smooth entry into the targeted market. The decision should always be based on thorough initial market research that focuses on understanding all the potential threats against opportunities presented to the firm (Terje, 2016). The following are the factors that a firm should consider when defining an entry strategy into foreign markets in light of risks and uncertainties within a given country.

Where to Make an Entry

One of the critical questions that the management of the multinational corporation must answer is where to make an entry. Prange and Kattenbach (2019) explain that these corporations do not just open up branches in new markets for the sake of doing so.

There must be a thorough feasibility analysis of the various markets to identify those which are the most attractive (Charles and Anderson, 2016). When Alibaba.com made the decision to go global, one of the most attractive markets that it identified was North America. The United States specifically was very attractive because of the high purchasing power of its citizens, the huge population and the stable political environment. The firm also noted that the government of the United States does not interfere with private business entities as long as they follow the laid policies and regulations (Ahmeti and Vladi, 2017).

Another attractive market for the company was the European Union. Like the United States, it had a huge potential that would enable the firm to achieve the desired growth beyond the home market in China. When choosing the market, the management must ensure that the opportunities outweigh risks and uncertainties. The goal is to choose a market with limited uncertainties and major opportunities.

When to Make the Entry

The next question that a multinational corporation would need to answer is when it is appropriate to make an entry. According to Rehacek and Bazsova (2018), timing is always critical when getting into foreign markets. A firm should ensure that there is political calmness in the country and that the economy has a positive outlook. It is often unadvisable for a new firm to enter a country that is in an electioneering period (Jovanović et al., 2016). The uncertainties associated with the campaigns and events that may follow may have a devastating impact on the success of the multinational corporation in the new market. Zeisberger (2017) explains that there are some unique cases where it may be more profitable to enter into an economy that is in recession.

During such times of distress, small and medium-sized firms struggling to survive may opt to merge with foreign firms to overcome the challenging economic condition. It may be easy for foreign companies to acquire local firms with popular brands (Chakrabarti and Sen, 2019). Timing is critical at such times to ensure that the firm turns such uncertainties to its favor. It is advisable to enter into that economy when the recession is approaching its end to ensure that the company is also not subjected to these negative economic forces for long. Internally, the management should ensure that it goes global at a time when it has the financial muscle to meet various obligations in the new market. It should not consider expanding at a time when it is also experiencing economic challenges.

How to Make the Entry

When the management has identified the right market and chosen the right time, the third step is to determine how to make an entry. According to Calvelli and Cannavale (2019), choosing how to make an entry into foreign markets is one of the most challenging tasks for multinational corporations. As Madura (2016) observes, various approaches exist that these companies can use. Each of these methods has its advantages and disadvantages and is suitable under different circumstances.

A firm’s financial capacities, the level of rivalry in the market, government policies and regulations, the level of political interference and loyalty to local brands are some of the factors that must be considered before choosing the right model of market entry (Yang, 2017). The following are some of the popular market entry strategies that a multinational corporation such as Alibaba.com can use to make an entry into foreign markets.

Direct exporting is one of the strategies that this company can use in its expansion strategy. In this approach, a multinational corporation such as Alibaba.com will sell its products directly to the chosen market (Kucuk and Flouris, 2017). It is often a costly strategy because it will force the firm to have distribution channels in foreign markets. It will have to work with the local distributors or retailers to enable it to reach customers. One of the greatest benefits of this strategy is that it gives the multinational corporation the freedom to define its operational strategies. It will not be operating under any firm (Yang, Ishtiaq and Anwar, 2018). However, it can only be successful if the firm conducts thorough research and understands the local market. The firm must bear all the costs of operations just as much as it will enjoy the profits.

Franchising is another market entry strategy that has gained popularity over the recent past. In this case, a firm will need to license specific firms in the selected market to run under its name and embrace its organizational culture and the approach to product delivery (Kotabe, 2020). The franchiser may need to train the franchisee on how to develop specific products and deliver services to the customers to ensure that there is a uniform way of operation.

Once the franchisee meets the expectations of the franchiser, it will operate under the brand of the parent company and enjoy the strong brand. In return, the franchisee will pay the franchiser a certain percentage of its revenues based on a predetermined arrangement (Ginter, Duncan and Swayne, 2018). The strategy has been popular among large corporations in the fast-food industry.

Mergers and acquisition is another effective way of making an entry into a new market. In cases where a firm realizes that it will be time-consuming and less productive to embrace direct exporting, mergers and acquisition is always the best alternative. For instance, the multinational corporation will identify a strong brand in the targeted market. It will then make a deal based on various factors (Schmid, 2018). The two firms can merge to form one large company in that market.

Alternatively, the foreign firm can opt to acquire the local firm. The management may opt to retain the brand name of the acquired firm for sometimes it will help in enhancing its growth. The strategy enables the foreign company to make a seamless entry into the market, especially when all the current employees are retained, especially those in critical positions and known to deliver good results. However, the cost of acquisition may be high depending on the firm that has been targeted.

Having a joint venture is another alternative that multinational corporations can use in foreign markets. As Zhou and Lianqian (2020) observe, the foreign firm can opt to have a joint venture with a local company or another foreign firm. The goal is to share resources in a way that will make it easy to overcome the challenges in the market (Prange, 2016). This concept is based on the premise that it is easier for two firms to face and overcome challenges in the market than when an individual company has to undertake these ventures as a single entity (Zhongming, et al., 2019).

The challenge is always to find a partner with a shared vision and willingness to make the right compromises for the mutual benefit of both parties involved. Both parties will share profits based on factors such as their financial contributions and level of involvement in terms of human capital. A multinational corporation may also use licensing, partnering, or piggybacking as a strategy to enter foreign markets, though these are rarely used by the majority of multinational corporations.

The Scale of the Entry

When the management has chosen the right strategy of entering foreign markets based on the identified risks, the final step is to determine the scale of the entry. The firm must decide on the amount of money it is willing to invest in the expansion strategy in foreign markets. Dionne (2019) explains that when uncertainties are significantly high, it may be necessary to make a relatively small amount of investment as the firm monitors the market as chances of failure are often high. However, when risks are low, the firm can make a massive investment to ensure that it makes the right impact in the market.

Resulted Performance

The performance of a multinational corporation in foreign markets depends on the strategy that is used and its ability to address uncertainties and other challenges that may emerge in its operations (Gupta, 2017). Using various theoretical concepts, it is necessary to evaluate the resulting performance of a firm that makes a successful entry into a new market using any of the strategies discussed above (Makdissi, Nehme and Chahine, 2020). The following concepts and theories can help in enhancing the performance in the new market.

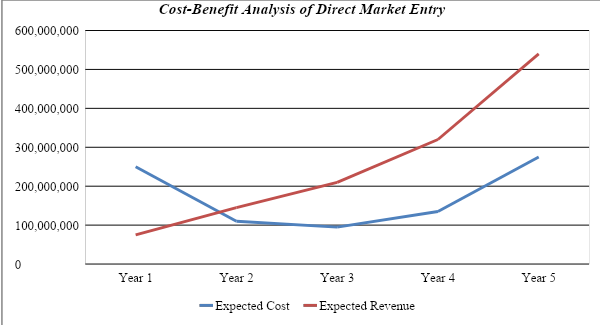

Transaction cost refers to the expenses that a firm incurs in its normal operations. It is important for a firm to ensure that its cost of transaction reflects the potential profitability in the new market. Using the transaction cost model, it is possible to determine the possible cost of making a direct market entry against the revenue in a cost-benefit analysis. As shown in figure 1 below, the initial cost during the first year will be significantly high while sales may below. However, sales revenue will rise significantly, as shown in the graph. In so doing, it should understand its real options. The analysis above-identified various investment strategies that a firm can select depending on a number of factors that it has to address.

International diversification is another concept that the management can embrace to enhance its chances of success. A firm like Alibaba.com can enhance its performance by entering more than one nation. The approach is to ensure that the firm will reduce the impact of risks that it may face in one or two of the targeted nations (El-Karim, Elnawawy and Abdel-Alin, 2017). The strategy may require a significant amount of investment, but it has numerous benefits, especially if the firm achieves success in most foreign nations. Imitation is a possible alternative way of expanding a firm’s operations (Whitman and Mattord, 2018).

In this context, the multinational corporation may opt to follow the approach that another firm embraced and achieved success (Hadzisalihovic, Pruckner and Kern, 2019). For instance, Alibaba.com can imitate strategies that Amazon.com is using to expand its operations beyond North America and Europe.

Conclusion

Multinational corporations face various uncertainties in foreign markets that often define their strategies. It all starts will identify the right market entry strategy. The management must make the decision about when to enter a new market, the strategy that it should use in the process and the scale of entry. Once a successful entry is made into a new market, various factors will influence the operations of the firm. As shown in the discussion above, the ability of a firm to achieve success in the highly competitive global market depends on how well it understands the local forces and its ability to adapt to them within the shortest period possible. Successful firms have learned how to capitalize on these uncertainties and turn them in their favor.

Reference List

Ahmeti, R. and Vladi, B. (2017) ‘Risk management in the public sector: a literature review’, European Journal of Multidisciplinary Studies, 2(5), pp. 323-328.

Bagley, C. (2019) Managers and the legal environment: strategies for the 21st century. Melbourne: South-Western.

Calvelli, A. and Cannavale, C. (2019) Internationalizing firms: international strategy, trends and challenges. Cham: Palgrave Macmillan.

Chakrabarti, G. and Sen, C. (eds.) (2019) The globalization conundrum: dark clouds behind the silver lining, global issues and empirics. New York, NY: Cengage.

Charles, G. and Anderson, W. (2016) International marketing: theory and practice from developing countries. Newcastle upon Tyne: Cambridge Scholars Publishing.

Dionne, G. (2019) Corporate risk management: theory and applications. Hoboken, NJ: John Wiley.

El-Karim, M., Elnawawy, O. and Abdel-Alin, A. (2017) ‘Identification and assessment of risk factors affecting construction projects’, HBRC Journal, 13(2), pp. 202-206.

Ginter, M., Duncan, J. and Swayne, L. (2018) Strategic management of health care organizations. Hoboken, NJ: Wiley.

Gupta, A. (2017) Project appraisal and financing. New Delhi: Delhi PHI Learning.

Hadzisalihovic, A., Pruckner, J. and Kern, A. (2019) ‘Concentration risk indicator’, Journal of Financial Risk Management, 8(1), pp. 92-105.

Jiang, Z. and Gong, X. (2019) ‘Research on issues of budget performance management on the process of budgeting by game theory’, Journal of Financial Risk Management, 8(1), pp. 193-199.

Jovanović, F. et al. (2016) ‘Risk management impact assessment on the success of strategic investment projects: benchmarking among different sector companies’, Acta Polytechnica Hungarica, 13(5), pp. 221-236.

Kotabe, M. (2020) Global marketing management. Hoboken, NJ: John Wiley.

Kucuk, A. and Flouris, T. (2017) Corporate risk management for international business. Singapore: Springer Singapore.

Madura, J. (2016) International financial management. Mason, OH: South-Western.

Makdissi, R., Nehme, A. and Chahine, R. (2020) ‘The influence of financial culture on sme’s financial performance’, Journal of Financial Risk Management, 9(1), pp. 1-22.

Marchewka, J. (2015) Information technology project management: providing measurable organizational value. Hoboken, NJ: John Wiley & Sons.

Power, J. and Ferratt, T. (2019) The real-time revolution: transforming your organization to value customer time. Oakland, CA: Berrett-Koehler Publishers.

Prange, C. (2016) Market entry in China: case studies on strategy, marketing and branding. Cham: Springer International Publishing.

Prange, C. and Kattenbach, R. (2019) Management practices in Asia: case studies on market entry, CSR and coaching. Cham: Springer.

Rehacek, P. and Bazsova, B. (2018) ‘Risk management methods in projects’, Journal of Eastern Europe Research in Business and Economics, 18(1), pp. 1-11.

Saunders, M. and Lewis, P. (2017) Doing research in business and management. London: Pearson Education Limited.

Schlegelmilch, B. (2016) Global marketing strategy: an executive digest. Cham: Springer International Publishing.

Schmid, S. (2018) Internationalization of business: cases on strategy formulation and implementation. Cham: Switzerland Springer.

Terje, A. (2016) ‘Risk assessment and risk management: a review of recent advances on their foundation’, European Journal of Operational Research, 1(4), pp. 1-13.

Whitman, M. and Mattord, J. (2018) Principles of information security. Melbourne: Cengage Learning.

Yang, S., Ishtiaq, M. and Anwar, M. (2018) ‘Enterprise risk management practices and firm performance, the mediating role of competitive advantage and the moderating role of financial literacy’, Journal of Risk and Financial Management, 11(35), pp. 1-17.

Yang, Y. (2017) ‘Comparison and analysis of Chinese and United States stock market’, Journal of Financial Risk Management, 9(1), pp. 44-55.

Zeisberger, C. (2017) Private equity in practice: case studies from developed and emerging markets. Chichester: John WILEY.

Zhongming, T. et al. (2019) ‘On the nexus of credit risk management and bank performance: a dynamic panel testimony from some selected commercial banks in China’, Journal of Financial Risk Management, 8(1), pp. 125-145.

Zhou, M. and Lianqian, Y. (2020) ‘Quantitative stock selection strategies based on kernel principal component analysis’, Journal of Financial Risk Management, 9(1), pp. 23-43.