Saudi Arabia is considered to be one of the best places in the world for doing business. It is a big free market that has low energy prices and is rather stable, as no crucial changes were seen in its exchange rates for the last several decades. Mutual agreements are likely to be made within its territory, as the inflation rates are low, and investments are promoted. Moreover, the country improves its investment environment and develops new laws that allow foreign investors to benefit and be sure that the operations will be conducted with regard to the accepted rules. A range of financial programs is in the free access for the foreign investors, which makes them more willing to enter the market. Thus, it is not surprising that there are lots of investment companies in Saudi Arabia.

Generally, an investment company is considered to be “a company (corporation, business trust, partnership, or limited liability company) that issues securities and is primarily engaged in the business of investing in securities” (“Investment Companies” par. 1). The amount of money that different investors provide is gathered by the investment company. These people can gain and lose funds in proportion to their interest in the organization. Today, there are three main types of investment companies:

- “open-end companies – they are also known as mutual funds (a fund that gathers money to purchase securities);

- closed-end companies – also referred to as closed-end funds (a particular number of shares that are not redeemable is used);

- unit investment trusts – usually mentioned as UITs (a mutual fund that has limited life)” (“Investment Companies” par. 3).

The most popular companies in Saudi Arabia refer to mutual funds (MF). A MF is “a collection of investments, such as stocks, bonds and other funds owned by a group of investors and managed by a professional money manager” (“Mutual Funds and Segregated Funds” par. 2). The investment can be made in different ways, for example, in the stocks of a particular country and a number of various investments at the same time. The individuals who become engaged in MFs, pool their funds along with those that belong to other people. To become an investor one should buy units or shares of the MF. It means that their number increases with the number of investors. The operations are conducted not by the investors, but by a manager who deals with day-to-day work and defines what to do with the investments referring to the objectives of the MF. Thus, the manager is the person who makes the majority of the decisions.

There are seven main types of MFs:

- Money market funds: the safest kind of investment that is not long-term and has particular income securities. They can include “government bonds, treasury bills, bankers’ acceptances, commercial paper and certificates of deposit” (“Mutual Funds and Segregated Funds” par. 3);

- Fixed income funds: they have a fixed rate of return and tend to receive money regularly. They are different bonds (government, corporate);

- Equity funds: made for stocks. There may be an obligation to pay high dividends, or no payment may be required. The risks to lose money are very high, but positive results are seen in a short period of time, which is attractive.

- Balanced funds: they are called in this way because they tend to balance profit and losses. Investment is made in “equities and fixed income securities” (“Mutual Funds and Segregated Funds” par. 3).

- Index funds: they monitor the performance of an index. Can be considered regarding active and passive management.

- Specialty funds: They are made on the basis of particular mandates, for example, socially responsible investing.

- Fund-of-funds: they are seen as investments in investments and resemble balanced funds.

Needless to say that the investors of MFs want to be sure that it is going to bring success. That is why they tend to value the performance of the MF rather often. To do this, they can utilize several methods:

- In a case of equity funds: the evaluation can start with the looking at the absolute returns from the fund and comparing them in different periods of time.

- Returns against benchmark: the equity fund’s returns can be also considered regarding the different period of time. They should also be referred to the benchmarks that may include various indexes (interest rate, for example). It is critical to “compare the latest Net Assets Value (NAV) with the unit value during the time of purchase” (Gupta par. 4). NAV shows a per-share price of one share of the investment that is to be paid when buying it. It can be defined when calculating the value of investment vehicles, assets, and liabilities. As it is computed once a day, the investor can see the results even for a short period of time.

- Portfolio of fund: it presents the quality of investments and is expected to yield the returns. When considering it, the mandate is to be referred to. The allocation of the fund across sectors should also be underlined.

- Portfolio turnover ratio: performs the extent of portfolio movements so that 100% refers to the complete change every year, 50% – every two years, etc. The more changes are seen, the more risks are present.

- Portfolio maturity: “the average tenure of the bond portfolio of the debt fund” should be calculated to distinguish the alterations in interest rates (Gupta par. 9).

When speaking about the investment, the process of decision making should also be considered. It allows gaining return and finding out what is the possible risk that can be faced. The decision making can be done in regard to various approaches, but still it consists of two main steps.

The investment decision process in a MF begins with the security analysis on the individual level. This process requires a deep understanding of the peculiarities of different securities and the things that can have an influence on them (both positive and negative). To define their price, the valuation methodology can be referred to. In this way, the future profit can be predicted as the possible risks. The economic factors and others that relate to the company play a huge role on this stage. The second step of the decision-making process includes the portfolio management. Having analyzed the securities, one can make a portfolio for them easily. Then it should be applied to a particular period of time. The investor can utilize a passive or active investment strategy when approaching to portfolio management. In other words, one can implement minimal changes to gain profit or maintain a huge amount of them (Mahakud 19). It is critical to make an adequate comparison of return and risks not to be misled. It means that one should not just believe what people say and promises made by managers.

When measuring the performance of the portfolio, many investors pay attention only to the returns, which is a misleading approach. They should remember that it is critical to take into consideration the risks also. The performance can be measured with the help of three ratios (indexes) that are known as the Treynor, Sharpe, and Jensen ratios. Being used for one and the same purpose they are similar, still, a range of differences between them exists.

The Treynor measure is said to be the first one presented to the public. Its formula can be seen as (return – risk-free return) / beta. Thus, two components of risk are considered: on individual and market levels. Beta represents the volatility of portfolio and market. The Treynor measure defines the systematic risk-adjusted performance. In its framework, the systematic risk is treated as the market one while unsystematic risk is not taken into consideration.

The Sharpe index has much in common with the Treynor one, but “the risk measure is the standard deviation of the portfolio instead of considering only the systematic risk, as represented by beta” (Pareto par. 10). The equation can be seen as (portfolio return – risk-free rate) / standard deviation. Thus, the square root of variance is to be taken instead of beta. This formula can be used to define the total risk, which was not possible when using the previous one.

The capital asset pricing model is the foundation not only of the Sharpe ratio but also the Jensen measure of return (alpha), which can be seen as portfolio return – benchmark portfolio. Benchmark return can be found in such a way: “risk-free rate of return + beta (return of market – risk-free rate of return)” (Pareto par. 14).

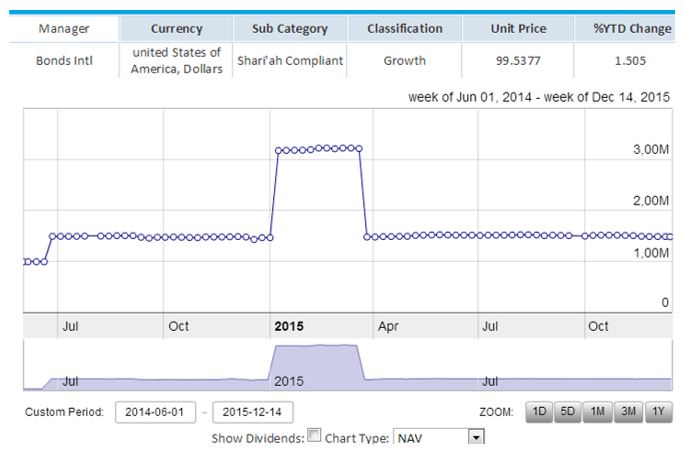

The market in the Saudi Arabia is rather large. More than 40 MFs traded in it, according to the information that can be found on Tadawul. The majority of them are equity funds that are made for stocks (Stock Local, Stock ASIA, etc.). Of course, there are also money market funds, fixed income funds, balanced funds and others, but 48% are different equity funds. One of the examples of this type of MFs can be the Al-Khair Capital Saudi Equity Fund. It is an open-ended investment fund (MF) that started operating on 25th September 2013. It works under the regulations that are considered by Capital Market Authority and owned by the Unitholders. It is an income accumulation fund managed by Al-Khair Capital. The objective of this fund is to “provide a medium to long-term capital appreciation and income distribution returns by investing in a portfolio of Shariah compliant income producing investments and securities” (Tadawul par. 3). This MF is governed by the regulations that are accepted and followed in the Kingdom of Saudi Arabia. The performance of the fund regarding NAV is measured two times a week (on Monday and Wednesday), and the results can be seen in the Chart 1. When just being found, this MF gathered the funds and its performance was rather poor. No gradual movements are seen, which presupposes rather stable and static work. The situation altered greatly in 2015, as more changes were implemented. Generally, the performance of the Al-Khair Capital Saudi Equity Fund is decent. Its qualities allow the manager and investors predict the profit and possible risks.

References

Gupta, Ashish. How to Evaluate a Mutual Fund? 2010. Web.

Investment Companies 2013. Web.

Mahakud, Jitendra. Security Analysis and Portfolio Management. n.d.

Mutual Funds and Segregated Funds 2015. Web.

Pareto, Cathy. Measure Your Portfolio’s Performance 2008. Web.

Tadawul. Mutual Funds 2015. Web.