Executive Summary

The Saudi Arabian economy is experiencing an economic boom with historical government expenditure on infrastructure projects. It is the expectation that this will continue throughout the next few years and that it will lead to the anticipated positive gains on the Saudi Stock Market. Saudi Arabia is a rapidly growing banking market. The level of competition in the kingdom’s banking sector is facilitating the creation of a banking scenario characterized by commercial banks, which are improving their efficiency through investing in technology and exploiting favorable government policies.

Within the Saudi Equity Market, the banking sector offers a lucrative opportunity for investors as it plays a major role in the massive economic activities in the country. Financial experts are on record saying that they anticipate that the Saudi Arabian banking sector will in 2013 maintain the growth momentum it exhibited during the year 2012.

They anticipation as its based on the favorable financial conditions that the banks are currently operating in as well as the regulatory boost they are receiving from governmental financial institutions. So favorable are the financial conditions that just recently the kingdom produced a monumental banking merger between Emirates Bank and the National Bank of Dubai to form Emirates NBD. Another factor fuelling the growth of the sector is the rate at which the banks are improving customer service through adopting various banking technologies e.g. mobile and internet banking. Currently, Saudi Arabian banks are the strongest banking systems in the Middle East region due to efficient use of their assets.

On a global scale, Saudi Arabian banks rank as the safest systems of banking. Standards & Poor’s, a rating agency upgraded the Kingdom’s banking system rating assigning it a BICRA rating of 2. This rating positions the Saudi Arabian Banking system as the least risky in the Middle East region. Generally, the outlook for the Saudi Arabian banking sector is promising for both local and international investors.

As such, we present this proposal that recommends SAR 300 million from SHB’s Investment portfolio be invested in selective Saudi Bank shares.

Introduction

Global Economy Forecast

The global economy, according to the IMF, is on a steady recovery from the recent global financial crisis. The IMF forecasts that in 2013 the global economy’s GDP will grow by 3.3%, which is an improvement of 0.1% from 2012. This value will improve to 4% in 2014. Possible hindrances to this recovery and growth are collapse of the Euro and the fiscal cliff in the U.S. Financial policies formulated by advanced economic policymakers and which are now in place are successfully defusing the effects of these hindrances.

The finalization of the Basel III standard on 1st June 2011 is further good news for the global economy. The Basel III standard is a regulatory framework aimed at ensuring that in future global banks have adequate capital, as this is a critical step in averting a recurrence of the global financial crisis. The Basel III promises bilateral trade characterized by banks and banking systems that are more resilient.

These developments are facilitating improved financial stability, which is another projection by the IMF. The growth momentum will reach its peak when advanced economies begin to benefit to the same extent from the improved financial market conditions and confidence. Olivier Blanchard, the IMF’s chief economist and director of the IMF’s Research Department has said of the progress made so far that the Global economy has moved from a two- to three-speed recovery.

Discussion

Saudi Economy

The kingdom’s GDP growth rate in 2012 of 6.8% surpassed expectations. A rise in government spending, consumer spending, and a pick-up in oil output due to the turmoil in the oil market fuelled this growth. If the turmoil in the oil market persists through 2013, the kingdom is likely to maintain this growth rate. Economic expansion in the kingdom will remain robust supported by strong domestic demand growth, and a host of planned industrial projects. The stimulus financial packages announced by the King in 2011 will stimulate further economic growth especially in the financial sector. The two stimulus packages account for 30% of the total GDP growth in 2012.

It is the expectation that government capital spending will rise rapidly through 2013. As mentioned above, a rise in government spending is one among the factors that facilitated the GDP growth witnessed in 2012. Consumer spending is also expected to rise as various real estate and educational projects take off in the Kingdom. The private sector will benefit from infrastructural projects already underway e.g. the expansion of the kingdoms’ rail network.

The construction of four new economic cities in the kingdom will further facilitate private investment growth. Major projects in the kingdom’s oil industry that include the creation of three refineries, the enormous Sadara integrated petrochemicals complex, and three gas fields and an aluminum smelter at Ras al-Khair are expected to keep economic growth robust, at an average of 4.7% in 2013-17. The effects of a possible deficit in the kingdom’s budget expected to be realized as from 2015 will be mitigated by the massive government reserves of over SAR 2.5 trillion.

The kingdom’s banking sector is to elicit positive financial performance due to the prevailing favorable conditions and subsidy support from the Kingdom’s financial institutions. Global recognition of the kingdom’s banking system as the lowest-risk banking system in the world today is expected to attract foreign and international banking customers. The confirmation of Saudi Arabian banks to the Basel III standard has ensured that the banks have sufficient capital to tackle credit valuation risk.

The importance of this is that these institutions are now positioned to become key players in bilateral trade transactions, which are expected to increase as globalization takes shape. In addition to these, Saudi Arabian banks are adopting mobile and internet banking technologies. As such, they are improving customer service significantly. This is to work to their advantage in the immediate future, as it will most likely attract domestic and foreign banking customers. These facts will continue to position the kingdom’s banking sector at the heart of its economic growth.

Monetary Policy

The Saudi riyal’s relationship to the US dollar, which is likely to hold throughout the forecast period, means that the kingdom’s monetary policy-development rate must roughly track movements in US interest rates, although this can lead to economic distortions when the two countries’ growth paths become misaligned. The US Federal Reserve (the central bank) is to keep interest rates low until 2015. Thereafter the interest rates are to start rising. In an effort to boost lending growth (and ultimately to promote entrepreneurship), the kingdom’s government has extended financial guarantees to banks offering loans to SME-sized enterprises.

The kingdom’s first mortgage law has recently been approved after a period of delay. Further lending activities are aimed for the private sector and include the formation of the five, state-backed specialized credit institutions. The kingdom’s monetary policy is to ensure that interest rates remain low as a means of ensuring that these lending activities achieve their intended purposes. Maintaining the interest rates low will also align them to those of the US.

2012 Banking Sector Performance Review

The monetary package formulated and supervised by the Saudi Arabian Monetary Agency (SAMA) has enabled the kingdom’s banking sector to withstand the recent global financial crisis whose effects were still felt through 2012. Furthermore, the monetary package that is based on the Basel III standard will ensure that the Kingdom’s banking sector does not in future suffer from a similar crisis. In 2012, the kingdom’s banking sector remained stable due to a decrease in bank deposit costs and strong operating performance, which enabled the banks to absorb banking-related losses. In 2012, the SAMA monetary package additionally enabled the banks to achieve high capital efficiencies and an overall sector revenue growth of 10%. The growth in net revenue in the sector reached 8%. Interest rates did stabilize in the kingdom in 2012, however, at historic low levels. As such, the sector’s operating expenses grew to 11%.

Profitability

In 2012, the core profitability of all Saudi Arabian banks rose significantly. The total profit of the 12 major Saudi Arabian banks was SAR 35.1 billion. This value represents a year-on-year growth of 11.02%. At almost 41%, Al-Rahji Bank and NCB contributed the largest chunk of the kingdom’s banking sector net profit. The profitability of the two banks grew to 7% in 2012. Through a combination of investing and financing activities, Al-Rahji Bank was in 2012 able to achieve a satisfactory income level which reached a ceiling of SAR 9.5 billion, which translates to a growth of 4.75%. In 2012, the bank Al-Bidad grew its bottom line by an impressive 186.08%. In 2011, the bank had a bottom line of SAR 329.6 million which grew to SAR 942 million in 2012 thanks to a lucrative land sale transaction.

Operating Income

In terms of operating income (OI) value, Al-Rajhi Bank remained a major contributor in the kingdom’s banking sector, contributing a total OI of SAR 13.98 billion. This value represented a yearly increase of 11.85%. Riyad Bank and Samba also contributed significant OI in 2012. Both banks recorded a total OI of over SAR 6.7 billion, which surpasses the value for 2011 by 7.4% for Riyad Bank and by 2.0% for Samba. In terms of OI growth, the Bank AlJazira with a yearly OI growth of 32.52%, which translates to an OI of 1.6 billion, topped the list of highest growers followed by Alinma Bank, which had a yearly OI growth of 31.53% that translates to an OI of SAR 1.83 Billion.

Total Assets

In 2011, the 12 major banks of the kingdom had a total asset value of SAR 1.5 trillion. In 2012, this figure grew to SAR 1.71 trillion representing a positive total asset growth of 14%. The 2011/2012 asset growth was the highest year-on-year growth since 2007. The rest of the kingdom’s banks also recorded a positive total asset growth. NCB topped the list of the largest banks by asset value in 2012. The bank’s asset value at the end of 2012 was SAR 345 billion, which was a yearly growth of 14.64% and approximately a fifth of the sector’s estimated value. In terms of total asset growth, Alimna Bank topped the list. In 2012, the total assets for Alimna Bank grew by 46.84% to reach a ceiling of SAR 54.01 billion from SAR 36.78 billion in 2011.

Deposits

At the end 2012, the deposits of the 12 major commercial banks of the kingdom reached SAR 1.32 trillion. This value represents an impressive deposit growth of 15.52%. This growth was attributed to deposit mobilization activities and branch network expansion projects. The major contributor to this gain was NCB. Deposits at NCB grew by 14.43% to reach a value of SAR 274 billion. In terms of growth in deposits, Alimna Bank with a deposit value of SAR 32.21 billion topped the list with an impressive growth of 81.22%. It was followed by Bank AlJazira, which recorded a growth of 30.54% at a deposit value of SAR 40.67 billion. Al-Rahji Bank came in third with a growth rate of 27.43% at a deposits value of SAR 221 billion from SAR 173 billion in 2011.

Loans and Advances

Generally, in 2012 Saudi Arabian banks expanded and increased their lending activities. In terms of loans and advances, the kingdom’s banking sector registered a growth of 17.85%. In 2011, the total value of loans and advances was 855 billion. This value rose nearly to SAR 1 trillion through 2012. In terms of lending growth in the case of loans and advances, Alimna Bank topped the list with a growth of 47.22% that translates to a value of SAR 37.18. In terms of funding in the case of loans and advances Al-Rahji Bank topped the list with a value of SAR 172 billion.

Stock Market

Through 2012, the kingdom’s banking sector has been performing positively at the SSM. Banking sector shares supported SSM’s rally that lasted for several consecutive weeks. At the first quarter of 2012, the sector’s index had achieved a strong return of nearly 24% surpassing the 18,000 points level. At the end of 2012, the sector index had dropped to the 14,645.38 point mark. During the year the sectors index dipped lowest to 14,073.4 points and rose highest to 18,125.34 points. This means that during 2012 the sector’s index operated inside an interval range of 4000 points. Bank AlJazira emerged as the highest gainer in the sector with a share value of SAR 26.10, which represented a gain of 54%.

The second and third gainers were Bank ALbilad and Alinma Bank with a gain of 42.5% and 37.4% respectively. Investors took advantage of the sector’s positive performance and liquidated their shares. As such, the average daily share turnover for this sector was SAR 650 million during 2012. This value was an impressive 119% increase compared to the 2011 value of SAR 296 million. In 2011, the average daily volume of traded shares was 18.9 million. In 2012, this value rose to 37.8 million, which was an increase by 99.37%.

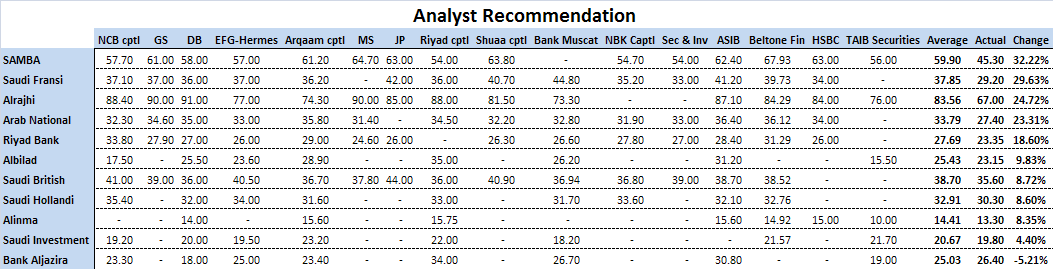

Summary of Analyst Recommendation Table

One conclusion that can be drawn from the analyst recommendation table in Table 1 is that the most predictable stock in SSM’s banking sector in 2012 was Saudi Investment. This stock deviates from its projected target value by 4.40%, which is the smallest deviation in the table. Another conclusion that can be drawn from this table is that the second and third most predictable stocks are Bank Aljazira and Alinma Bank respectively. Bank Aljazira deviates from its predicted target value by -5.21%, which the second smallest deviation whereas Alinma Bank deviates from its projected target value by 8.35%, which is the third smallest deviation.

Another conclusion that can be drawn from the analyst recommendation table is that the most unpredictable stock in SSM’s banking sector is SAMBA. The SAMBA stock deviated from its predicted target value by 32.22%, which is the highest deviation in the table. The third and fourth most unpredictable stocks are Saudi Fransi and Al-Rajhi respectively. Saudi Fransi deviated from its predicted target value by 29.63%, which is the second-highest deviation whereas Al-Rajhi deviated from its predicted target value by 24.72%, which is the third-highest deviation.

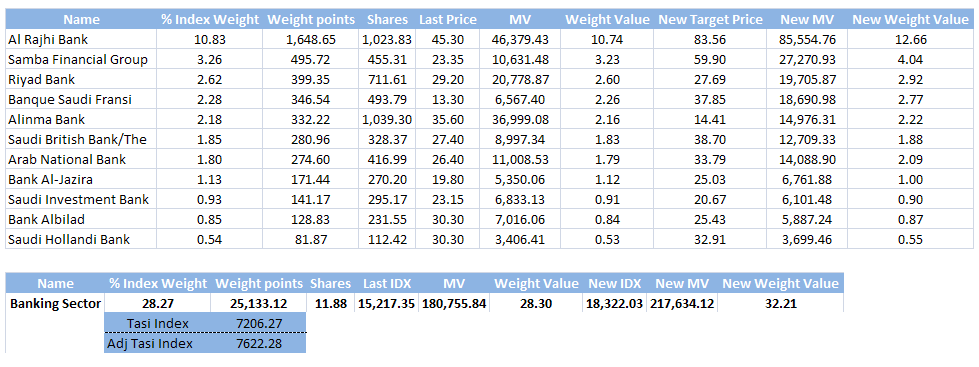

Summary Regarding Adjusted TASI Index

Exclusively using the adjusted TASI index in Table 2, the best investment decision would be to buy Al-Rajhi stock. The reason for this being that this stock has the highest “new target price” in the list, which is 83.56. The second best investment decision will be to buy SAMBA Financial Group stock. The reason for this being that this stock has the second highest “new target price” in the list, which is 59.90. Continuing with this logic the worst investment decision will be to buy Alinma Bank stock since it has the lowest “new target price” (of 14.41) in the adjusted TASI index list for the banking sector.

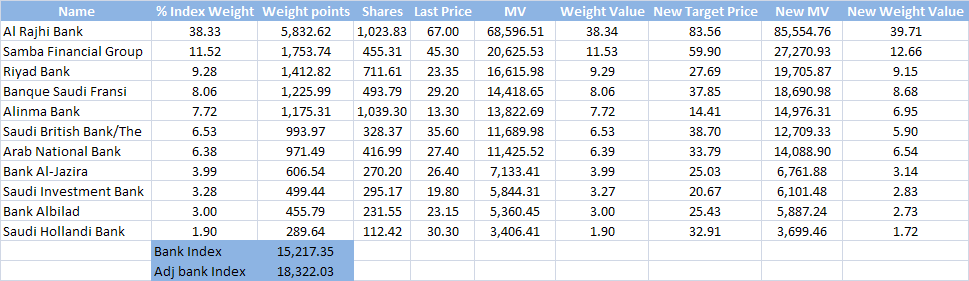

Summary Regarding Adjusted Banking Index

Exclusively using the adjusted banking index in Table 3, the bank that will benefit significantly from its stock will be Al-Rajhi. This conclusion has its basis on the fact that the stock for this bank has the highest “new market value” in the adjusted banking index list, which is 85 554.76. The second bank that will benefit significantly from its stock is SAMBA Financial Group. The reason for this being that its stock has the second-highest “new market value”, which is 20625.52. Continuing with this logic the bank that will not benefit significantly –relatively speaking- from its stock is Saudi Hollandi Bank, the reason for this being that its stock has the lowest “new market value” in the list, which is 3699.46.

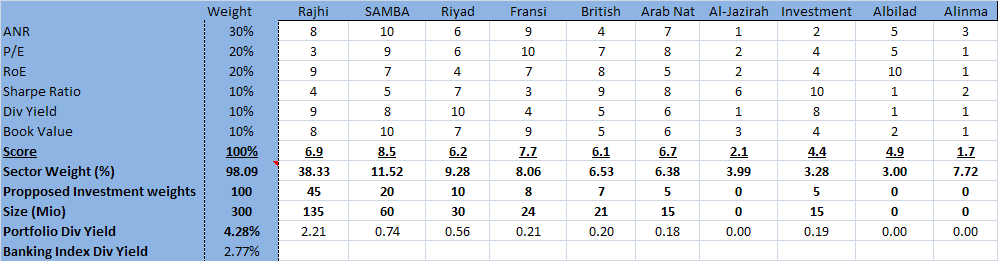

Summary of Backtesting Table

Using the backtesting table in Table 4 only. The best investment strategy will be to purchase Al-Rhaji stock as this has the highest portfolio dividend yield of 2.21. The second best investment strategy will be to purchase SAMBA Financial Group stock has this has the second highest portfolio dividend yield. Continuing with this logic the worst investment strategy will be to purchase AlJazira, Albilad, and Alinma Bank stocks as these have no portfolio dividend yield.

Recommendations

The main and only recommendation of this proposal is SHB’s Investment portfolio expand to include a SAR 300 million share investment in selected Saudi Banks shares. Possible bank shares include those of Al-Rajhi and Samba Financial Group. Possible risks to this investment include the projected oil price drop, possible budget cuts in the kingdom, rising bad debt provisions targeting banks, and increased liabilities resulting from impaired investments by Saudi Arabian banks. Market drivers favoring this investment include the planned massive infrastructural projects in the kingdom, continued investment in Saudi Arabian Bank equities, and opening up of the SSM to international investors.

Terms of Reference

- BICRA…………….Banking Industry Country Risk Assessment.

- NCB……………….National Commercial Bank.

- SAR……………….Saudi Arabian Riyal.

- SHB……………….Saudi Hollandi Bank.

- SSM……………….Saudi Stock Market.

- SME……………….Small and Medium Enterprises.

- OI…………………..Operating Income.