Introduction

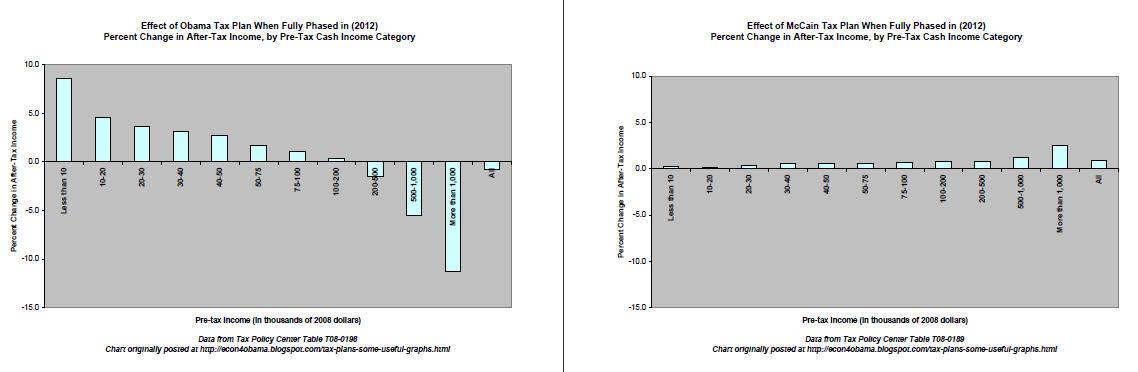

The above diagram highlights certain important aspects of the Obama’s administration policy of introducing tax cuts and what could be the consequential effect on the domestic economy. In the above diagram, there are large percentage increases, around 8.6 percent falling within the after-tax income for those households with pre-tax income below 10,000 USD. Added to this is the fact that the tax cuts increase for those households whose after-tax income is blew 200, 000. Obama’s proposed tax cut would reduce the after-tax income by 1.5 percent of those making 200-500,000 USD , by 5.6 percent of those making 500-1 million USD, and by 11.3 percent of those making 1 million USD and more.

Main body

What came across was the fact that on average Obama cuts the net tax bill by 549 USD. Also, if one was to examine the federal budget plan, what comes across is the fact that Obama would be able to reduce it much more than the proposed plan of McCain. However, what has come across has been criticism from certain democratic quarters regarding these proposed tax cuts as the eventual effect is minimalistic and what has been proposed instead has been investment on sectors which would allow the creation of job opportunities instead of offering these welfare services.

The Obama plan aims as shown by the above graph, to increase the taxes on the highest-earnings Americans which although represent a small share of the American population, but the tax earnings are quite high. As for the rest of the population, the tax reductions are ranging from the moderate to large ones.

These reductions were welcomed to a great extent by the population of the American nation as it would provide necessary relief to the consumer in order to purchase the required goods and services, at the same time it would involve loss of valuable government revenue. Therefore, before declaring this proposed tax cut as the answer to the problems of the American nation, it has to be viewed in terms of the government revenue losses which could have been used in order to provide the necessary employment.

The following graph outlines the proposed tax cut relief plan in detail and it would be analyzed in terms of the effect that it has had on the economy and it’s bearing on the American nation as well.

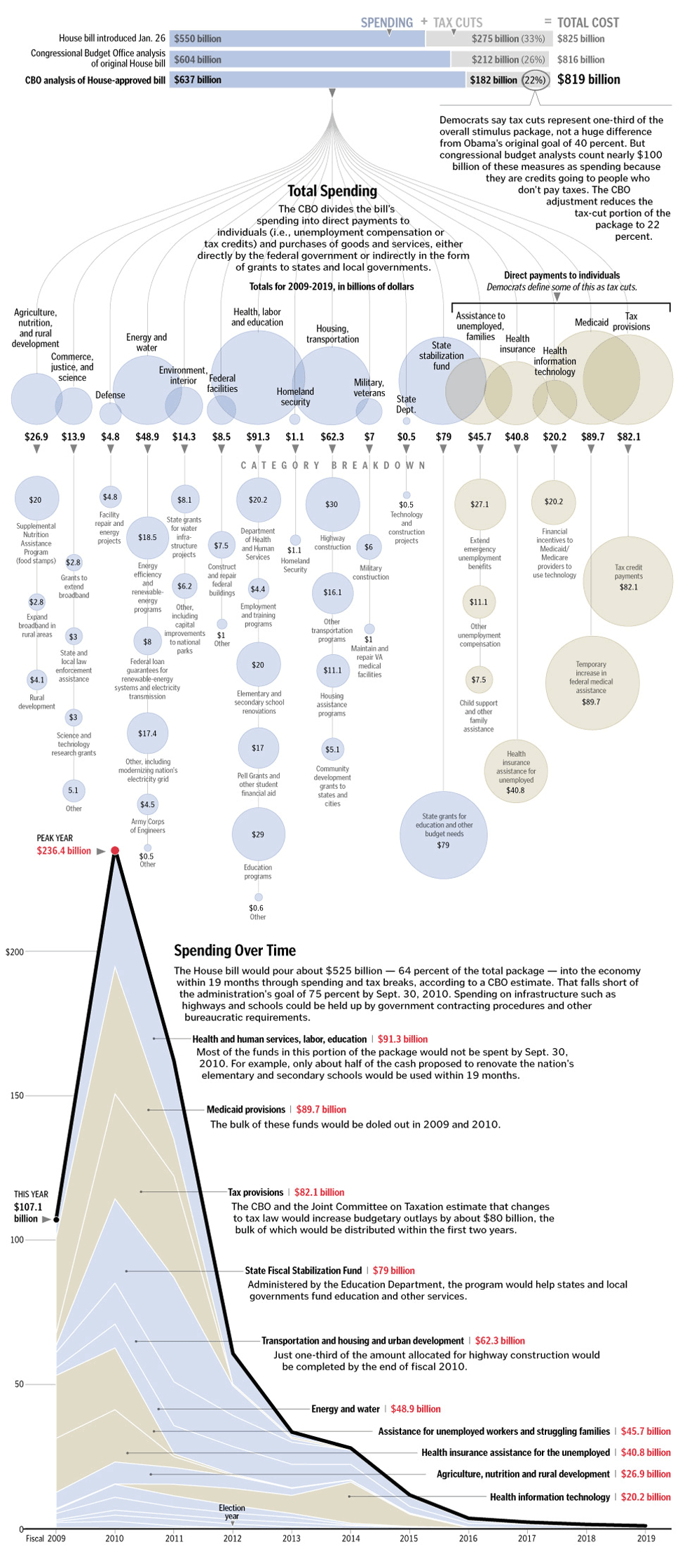

The above diagram outlines in detail the proposed tax cut in the economic stimulus plan which has been proposed by Obama. Now if one was to analyze the benefits which could be gained from the proposed tax cut plan would include a number of tax benefits such as the make work pay tax credit, mass transit tax breaks, expanded child tax credit, early release of AMT exemption amounts, 8000 USD first time home buyer tax credit, and the first 2400 USD employment benefits would be free.

The first tax cut is a method of adding to the workers paychecks over a period of time and those married workers who would have AGI below 150,000 USD would be eligible for a tax credit as well which would allow these consumers the necessary relief to purchase their products and all. The rest of the tax breaks would further alleviate the economic burden of the consumer who is already major economic issues due to unemployment and rising prices. Also, the first time home buyer tax credit would go a long way in aiding those purchases which would have been impossible otherwise considering the present economic situation and scenario.

Another important provision and part of this proposed plan is the American jobs tax credit which would allow the existing businesses to receive a refundable tax credit of each additional person hired which in fact would allow the companies to hire the necessary personnel at a price which would become profitable for them. Hence, this plan is not only aiding the consumers but from what can be ascertained from the above graph is the relied that would be provided to the employers at a time when the entire American nation is facing serious economic crisis.

Conclusion

Hence, though this policy is not without its flaws yet it would some necessary assistance to the consumers and the employers as well and it would create a certain amount of economic activity which might not be the scale which was imagined by Obama. The American nation needs more than a simple tax cut to take it out of the present economic crisis but this tax relief would go a small way in alleviating some of the burden if nothing else.

References

Tax Plans: Some useful graphs (2008) Economists for Obama. Web.

Yourish,K Congressional Budget Office (2009) graphic by Laura Stanton – The Washington Post. Web.