Abstract

This essay is about the oil giant British Petroleum and one of the world’s worst environmental disasters in history, the Gulf of Mexico oil spill. The aim for this paper is to provide a backdrop for the oil spill and to picture the management change due to the oil spill.

The Gulf of Mexico oil spill symbolised a breakdown of more than mere environmental law and the work of institutions tasked with administering deepwater drilling, business law, governance, and corporate social responsibility principles can also be blamed for the environmental catastrophe (Cherry & Sneirson 2011, p. 984).

As a result of the oil spill and tragedy, BP’s safety programs and mistakes became noticeable. Many of these safety concerns have been ignored by management. The company did cover up these problems by portraying an image as an advocate of CSR and funding a $200 million advertising campaign to promote it.

Since 2002, there have been doubts about BP’s CSR practices in the context of safety and security. By corporate standards, the practices were considered “brand exuberance,” a term that refers to a corporate aspiration that is impossible to attain (Balmer, Power, & Greyser 2011, p. 7).

BP’s maintenance record, vision and training performance have been heavily criticised because they were not in accordance with industry standards. Carolyn Meritt, a U.S. government spokeswoman, commented that there was something wrong with BP management (Verschoor 2010, p. 15).

However, BP and many of its stakeholders are optimistic that there could be a light in the horizon. Revenues and shares prices are gradually showing signs of recovery. This essay will try to show how this is attained.

Introduction

The company British Petroleum had to introduce change management after the Gulf of Mexico oil spill in 2010. New directions included the upstream operations, from a single division to three departments to handle sensitive programs of ‘exploration, development and production’ (Bryant & Hunter 2010, para. 5).

BP’s valued shareholders and investors were briefed on future plans and new initiatives after the oil spill as the organisation was heading for further explorations after its worst performance in the year and throughout its history as a prime oil-and-gas company.

This essay will talk about management change in BP after the oil spill. Everyone was asking, particularly investors, as to what kind of management would resurrect BP. A knee-jerk reaction was change the leadership and management. CEO Tony Hayward was forced to resign, along with second in command Andy Inglis, to appease angry investors (Chazan 2010, para. 2).

The stiff decline in BP’s stock value (Chazan 2010) due to the oil spill prompted the board to conduct change management and appoint Robert Dudley whose mission was to restore BP’s tarnished reputation. Three new divisions were created and contracts were given focus in which top-management portfolio was assigned to manage contractors who are working on sensitive and important upstream operations.

Restructuring and upstream operations are now separate and given emphasis in order to provide long-term advancement of BP’s pool of expert engineers and scientists and strengthen risk management responsibilities. One of the flaws of the old system was that contractors working upstream were not effectively managed. (Bryant & Hunder 2010, para. 4)

Literature review

Leadership and organisational change

Leadership literature that can be applied in the context of BP change management is outdoor leadership with a focus on transactional-transformational leadership. Leadership theory evolved in several stages (Straub, 1980 as cited in Brymer & Gray, 2006, p. 13). Leadership concept started with the ‘inborn principle’. It evolved into the idea of leaders having special attributes.

The next phase is about those having power or authority. The fourth stage emphasised relationships, and the fifth one focused on leaders who became concerned with the world around them and adapted their behaviors according to those situations.

The outdoor leadership theory refers to situational leadership. Ford and Blanchard (1985 as cited in Brymer & Gray, 2006, p. 14) focused their leadership research on the relevance of leadership theory to the outdoors. Leaders demand of their followers certain attributes while followers require some characteristics of their leaders.

Followers would like their leader to assume responsibility, which is very important as most followers trust their leader to take responsibility for their actions. Followers would require their leader to have more experience than them and should know how to get along with them (Ford & Blanchard, 1985 as cited in Brymer & Gray, 2006, p. 14).

Leaders should possess skills on socialisation which may be team-related, for support or empathy; psychological aspects, like trust, stress, motivation, emotions; judgment, like dangers, problems, expectation; and creativity which is about ideas and inventiveness.

Transformational and charismatic leaders focus their attributes on creativity, effective communication, motivation of followers and working out a vision and a goal, among others (Groves 2006, p. 566).

Visionary leadership positively influences ‘net profit margin’ (Waldman et al., 2001 as cited in Groves, 2006, p. 567), stock value and leadership effectiveness. Visionary leaders can effectively communicate goals that inspire subordinates.

Ethics in organisational management theories

The management literature has focused on the subject of business ethics due to the many high-profile ethical violations in corporate America. Many giant firms have suffered malfunctions due to unethical business practices of even top managers of these large corporations.

Because of these incidents, much of the studies have focused on the importance of ethical behavior and to emphasise the call for a more understanding of moral decision-making processes. Gilbert (2001 as cited in Geiger 2010, p. 40) argued on the relative connection between ‘strategic management process and ethics’. Ethics influences this aspect of management.

An important subject of organisational theory is legitimacy which refers to the public’s reactions pertaining to the behavior of the organisation (Suchman 1995, as cited in Matejek & Gössling 2014, p.571).

The question here lies in BP’s moral legitimacy in building its values and norms pertaining to the construct of corporate social responsibility (CSR), the other types of legitimacy being pragmatic (pertaining to the importance of oil and gas to society), and cognitive (pertaining to its accessibility as an organisation).

Legitimacy emphasises organisation and community relations and the ethics in business.

According to this concept, organisations lose legitimacy if they transgress culture and mores while organisations that promote culture and beliefs of the community are rewarded. Organisations that have trouble with civil society and environmental organisations have problems with their legitimacy (Palazzo & Scherer 2006, as cited in Matejek & Gössling 2014, p. 572).

Case study analysis

BP has a moral obligation to acquire environmental legitimacy. Some experts have commented that if BP encounters another oil spill with the scale of the Gulf of Mexico spill, it will not only lose legitimacy, it will become bankrupt and will not have chance to recover.

After the Deepwater Horizon accident or negligence, it is under pressure by its ‘corporate stakeholders, the media, including social media, NGO watchdogs, and governmental regulators’ to bear ‘corporate environmental responsibility’ (Matejek & Gössling, 2014, p. 572). BP has to strive to walk along this line of operations, and work to maintain ‘environmental legitimacy’ (Matejek & Gössling, 2014, p. 572).

Corporate environmental legitimacy refers to society’s general observation or assumption that an organisation’s environmental programs are attractive, right and fitting, and generally approved by the public. This definition emphasises that environmental legitimacy is provided by stakeholders through their awareness according to their perceptions (Matejek & Gössling, 2014, p. 572).

CSR refers to the moral and ethical practices and organisations that malign social institutions lose their legitimacy status. What society might do is boycott the company’s products and services, including shares of stocks, and employees withdraw their commitment and lose motivation to work (Gössling 2011 as cited in Matejek & Gössling, 2014, p. 572).

Corporate social responsibility (CSR) reporting is usually done to attract investors (Spence 2009 as cited in Mobus, 2012, p. 36). If you look at BP website, you will be amased with their CSR programs and recovery efforts, particularly on restoring the lives of those affected by the oil spill. But websites are websites. They are always painted ‘green’ and any attractive color to attract investors.

The introduction of change management

‘Deepwater Horizon’ was a large ocean rig that sank at the bottom of the ocean when the Macondo well exploded.

This was one of the wells BP acquired. By 2010, BP successfully acquired several growing companies, making it one of the world’s largest corporations in terms of revenue, with a daily oil production of more than four million barrels. The Gulf of Mexico provided approximately 10 percent of BP’s oil output (National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drill 2011, p. 2).

Before the Macondo well blew up, BP had a corporate brand positioning pictured by its management as highly ethical and environmentally emphatic. When the Deepwater Horizon accident occurred, these ethical and environmental standards were questionable.

BP’s previous ethical standards were not supported by an ethical distinctiveness and philosophy, but it was trying to picture to the public that CSR was a common practice and that it cared for the public and its needs. BP’s corporate behavior did not reflect that of its purported mission. There was a misalignment in BP’s ‘identity modes’ (Balmer, Power, & Greyser 2011, p. 7).

After the environmental debacle, BP faced a class action lawsuit and an allegation that it ‘misled investors’ by purporting to show that it had the capability for safety operations in the Gulf of Mexico (Amernic, Craig, & Tourish 2012, p. 6). Two years before the disaster, the health and safety goals were only 80% attained, and environmental risk management was said to be ‘gold plated’ (Verschoor 2010, p. 13).

BP’s management change was aimed to regain the trust and confidence of stakeholders, particularly its investors.

Robert Dudley essentially introduced his brand of management with a vision of safety in the operations, placing great power and responsibilities in the hands of the safety division, now under Mark Bly, who has the authority to stop the operations if he and his team deemed that operations are not following the standards.

Bly and his team directly report to Dudley and recommendations are immediately acted upon (Chazan 2010, para. 3). Dudley had been in the oil business for years and was with Amoco before he joined BP just eighteen months before the environmental disaster. The merger of Amoco and BP in Russia was termed a mega-merger but Dudley had to return to the United States after Russian authorities refused to renew his visa (Macalister 2010, para. 5).

Dudley’s “new” brand of management was regarded a rehash of Hayward’s programs when the latter was appointed as CEO some years back to take over Lord John Browne who was involved in a personal scandal. Hayward proposed for safety programs during his initial years but still, BP experienced major environmental disasters resulting into some deaths of workers (Bryant & Hunter 2010, para. 3).

The U.S. Occupational Safety and Health Administration (OSHA) has recorded more than seven hundred violations of refineries attributable to BP and the violations were ruled intentional (Bryant & Hunter 2010, para. 6).

The pipeline corrosion in Texas that caused an oil spill, costing approximately $2 billion in suits and damages, was the result of cost-cutting measures introduced by Hayward who had to impress investors asking for positive gains for their money.

However, some commentators have tried to give Dudley a chance. Dudley’s safety programme was a welcome development, according to Nigel Bowker (as cited in Bryant & Hunter, 2010) who once worked for BP, but he argued that the new measures must be accompanied with management support, resources and cooperation from everyone in the company, and it must not only to appease the BP investors.

BP under Dudley has introduced the technology-enhanced ‘Well Advisor’ that assists drilling teams in different countries to check the progress of oil and gas explorations with novel clearness through consoles connected online, to strengthen safety and security in the explorations.

BP has relied on digital technology that gathers and analyses data and other variables. Although this is still in its pilot stage, BP is going to that point where the data could be transformed into valuable information to provide safety and competence.

Meantime, BP is on its way to providing the capability for its engineers, scientists and contractors to put together all these data and the various points produced by the data to influence decisions in the field. The data points are fed to a software, to be transformed into fine graphics and made available to engineers in the field. (BP: Trusted advisor 2014, paras. 1-4)

Notwithstanding BP’s thrust for corporate social responsibility, CEO Dudley has been able to introduce green marketing philosophy, which is not just about consumers but about the environment, a rallying cry for BP’s organisational culture. BP is building a culture that respects the environment.

Another principle it has applied is internal green marketing which aims to ensure that the organisation’s employees integrate the ecological factor into their programs and activities (Zaharia & Zaharia 2012, p. 162). BP has ensured that that top management and HRM functions collaborate to enforce green business strategies.

BP revenues before and after the change

Before the management change, i.e. before the oil spill, revenues were up, $120 billion. It went down after the spill but with the new management, revenues rose 5%, which meant it climbed to $98 billion in October 29, 2013, from $94 billion (£58.4 billion) the year before. After the oil spill, BP has sold some $38 billion of assets and has plans to sell about $10 billion this year.

The company’s replacement cost profit rose to $3.7 billion for the last quarter of 2013, from the previous $2.7 billion. BP also wanted to buy back its shares worth $8 billion, but has started with $3.8 billion. (Haslett 2013, paras. 3-6)

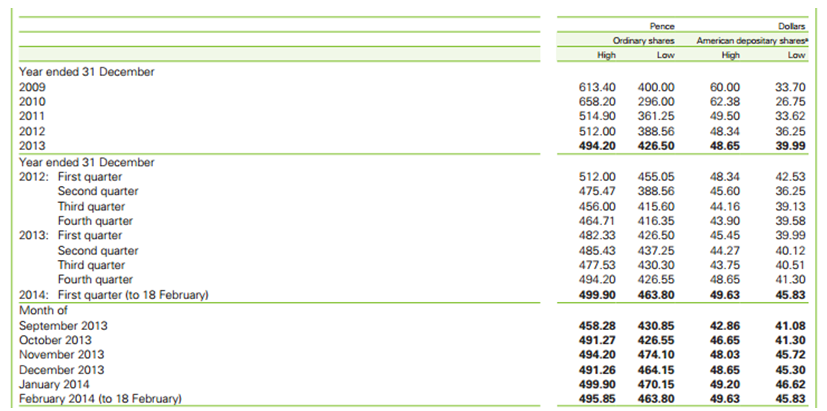

Figure 1 is a listing of the shares prices for the period from 2009 up to 2013. It is shown here that the shares prices before the Gulf of Mexico oil spill were high. In 2009, ordinary shares cost 613.40 high and 400.00 at low; for American depositary shares, high was 60.00 and low was 33.70.

There was slight difference for the next year 2010 and prices slid down after the oil spill with new management, which attained low prices for BP shares and gradually slid down up to 2013.

For the different quarters from 2012 up to the first quarter of 2014, shares prices have not fully recovered but are slowly going up: i.e. 49.63 high and 45.83 low for American depositary shares, and for the first quarter of 2014, from 48.65 high and 41.30 low for the last quarter of 2013. This is supported by their advertising published Wall Street Journal (see appendix).

BP stock prices in the market before and after the change

Conclusion

It is understandable that Dudley’s new administration is trying to paint a better picture, but obscuring the real risk BP is facing may not do any good for the company. Organisations aim their ‘propaganda,’ i.e. CSR reporting, at their employees as they try to relay messages about their image.

Is BP ‘greenwashing’?

Greenwashing is a form of ‘information propaganda’ by a company or organisation for the purpose of portraying that it is following the standards of environmental benchmarking.

By greenwashing, a firm tends to improve sales or enhance its brand image through ‘environmental rhetoric, but at the same time either pollute the environment or decline to spend money on the environment, employee welfare, or otherwise honor its commitments to other constituencies’ (Cherry & Sneirson 2011, p. 985).

This can be perceived as fooling the public, particularly the stakeholders and the shareholders. According to Mobus (2012, p. 37), it can be viewed as such if there are no ways to verify the truth of the company’s CSR programs. BP’s environmental programs can be verified and, at first instance, there seems to be no fraud in their application of restoring the sound environment before the spill.

According to investigation (the Commission Report or CR), the Macondo well blowout where Deepwater Horizon sank, was the result of management’s indecision, lapses in the communication processes, and risk management failure) leading to incontrollable situations on the Macondo well (Mobus 2012, p. 38). In other words, safety measures, a primary requirement for oil explorations and one of BP’s so-called pride, failed.

Management failed in those instances, along with failure of communication (CR 2011 as cited in Mobus, 2012, p. 38). Engineering and well design were approved by regulators but were not followed. Execution of the design and processes were opposed to BP guidelines and industry benchmarks.

Moreover, there were lapses in communications among those working in the downstream and BP managers allowing for a possibility of a blowout (Mobus, 2012, p. 38).

BP must prove its worth and the sincerity and expertise of the new management. After being prohibited for a year from bidding U.S. federal contracts, it has now won 24 new bids but one of the conditions is to implement stricter safety rules, including a remodeling of its governance principles. BP will be audited by an independent auditor chosen by the U.S. EPA. (Toor 2014, para. 2)

It seems, however, that BP has gained the trust and confidence of the U.S. federal government. Before 2010, it was the country’s largest oil supplier and fuel for transportation but was suspended for one year due to the oil spill. Four years after that worst oil spill, BP won 24 bids to explore oil and gas over the Gulf of Mexico once again.

Recommendations

The three divisions focusing on upstream operations should have effective and coordinated management. BP should have trained organic personnel to focus on upstream operations, instead of hiring contractors.

One of the flaws of the old system is that most upstream operations are performed by contractors who are not BP personnel. During the critical minutes when the Macondo well was about to explode, there was no more effective management, prompting the personnel (who were working for a contractor and not for BP) to decide by themselves.

The thrust of new management to focus on contractors is a good sign but works to be assigned to contractors should be minimal and not major tasks.

BP’s CSR practices should not be mere practice for advertising but have to be given focus. Many giant firms practice CSR for the purpose of enticing investors to the detriment of the organisation. This was one of BP’s mistakes that might lead to its loss of legitimacy.

References

Amernic, J., Craig, R., & Tourish, D. 2012, ‘Reflecting a company’s safety culture in fairly presented financial statements: the case of BP’, CPA Journal, pp. 6-10, via ProQuest database.

Balmer, J., Power, S., & Greyser, S. 2011, ‘Explicating ethical corporate marketing. Insights from the BP Deepwater horizon catastrophe: the ethical brand that exploded and then imploded’, Journal of Business Ethics, vol. 102, no. 1, pp. 1-14, via ProQuest database.

BP: Shares prices and listings 2013.

BP: Trusted advisor 2014.

Bryant, M. & Hunter, T. 2010, BP and public issues (mis)management. Web.

Brymer, E. & Gray, T. 2006, ‘Effective leadership: transformational or transactional?’ Australian Journal of Outdoor Education, vol. 10, no. 2, pp. 13-19, via ProQuest database.

Chazan, G. 2010, BP’s new chief puts emphasis on safety. Web.

Cherry, M. & Sneirson, J. 2011, ‘Beyond profit: rethinking corporate social responsibility and greenwashing after the BP oil disaster’, Tulane Law Review, vol. 85, no. 4, pp. 983-1038, via EBSCOHOST, Academic Search Complete database.

Geiger, S. 2010, ‘Ethics content in strategic management textbooks: a longitudinal examination’, American Journal of Business Education, vol. 3, no. 10, pp. 39-44, via ProQuest database.

Groves, K. 2006, ‘Leader emotional expressivity, visionary leadership, and organizational change’, Leadership & Organization Development Journal, vol. 27, no. 7, pp. 566-583, via ProQuest database.

Haslett, E. 2013, BP sets the markets alight as revenues rise $4bn. Web.

National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drill 2011, Deep water: the Gulf oil disaster and the future of offshore drilling: report to the president, January 2011, Government Printing Office, Washington D.C.

Macalister, T. 2010, Bob Dudley: profile of the new BP chief executive. Web.

Matejek, S. & Gössling, T. 2014, ‘Beyond legitimacy: a case study in BP’s green lashing’, Journal of Business Ethics, vol. 120, no. 1, pp. 571-584, via ABI/INFORM complete database.

Mobus, J. 2012, ‘Corporate social responsibility (CSR) reporting by BP: revealing or obscuring risks?’ Journal of Legal, Ethical & Regulatory Issues, vol. 15, no. 2, pp. 35-52, via EBSCOHOST, Business Source Complete database.

The Wall Street Journal: BP Plc ads 2014. Web.

Toor, A. 2014, BP wins new US oil contracts four years after Deepwater Horizon disaster. Web.

Verschoor, C. 2010, ‘BP still hasn’t learned ethical lessons’, Strategic Finance, vol. 1, no. 1, pp. 13-15, via EBSCOHOST, Business Source Complete database.

Zaharia, C. & Zaharia, I. 2012, ‘Green values concerning the social responsibility of companies’, Economics, Management, and Financial Markets, vol. 7, no. 2, pp. 161-166, via ProQuest database.

Appendix