Introduction

British Petroleum (BP) is one of the largest oil companies in the world. Its mainly involved in the exploration (of crude oil and related products), refinement and selling final products in the global market. BP mainly operates in America, Europe, Africa, and Australia. It employs more than 220, 000 people both in the United States and other countries and has more than half a million shareholders.

The purpose of this business report is to analyze and evaluate the BP’s strategic position through using several technical business models. The analysis and evaluation should explain how the business has achieved its phenomenal growth and outline whether the current strategies used are appropriate to help the organization continue with its future strategy. It’s essential to understand the current intentional position of the company before appropriate strategies can be recommended and implemented.

Economic Theories

BP has integrated into the international market in terms of technology, trade, capital flows or investments. This is called economic globalization; it refers to the increase in national interdependence of economies through an increment in international trade. This is the process of promoting economic integration between economies of different countries with the aim of establishing a global market. According to Stiglitz (4), economic integration makes international trade easier through the removal of trade barriers and tariffs.

This can be through protection of investors in order to promote their capital investments. With economic integration, goods and services, labor and capital find their way in the country where they are be put into maximum use. This results in economic growth and development. Increase in the mobility of factors of production faces some negative challenges because of the economic pressures in the global market. Today, the global economy has increased to significant levels and all this has been facilitated by trade agreements. The following table shows the number of retail sites operated under BP brand.

Foreign Exchange Rates and Global Economic Conditions

Financial markets look into international capital flows, deficits in trade and international projects. International finance can be said to be a branch in international economics that studies the currency changes and the future of international trade. In recent years the international financial market has been experiencing increases brought about by globalization. In the early 1990s the international capital flows changed from 2 to 6 % of world gross domestic product. It later increased to 14.8% of gross domestic product in 2006 (Stiglitz, 23).

Nations with advanced economies have benefited from these increases and some from the developed countries have benefited from financial integration. The foreign exchange market is a worldwide financial market that is used in trading currencies. It aids international trade by allowing businesses to change their currencies into a foreign currency. Two exchange rates are used in the financial market; the fixed exchange rate and floating exchange rate. Countries using fixed exchange rates face limitations in using their monetary policy for macroeconomic stability. This is because if a country experiences a trade deficit it becomes very difficult to counteract it under the fixed rate as opposed to the floating rate.

Critical Success Factors for BP

The British Petroleum Company, most commonly known throughout the world simply as BP, has strong brand name. This is their upper hand, positioning itself in the world market. Other than the BP Company itself, the companies BP has acquired are also doing well. With these aforementioned facts alone, after entering into a new market, it will be easier for it to sell. The expertise that the company boasts of most often comes from the companies it has acquired and the positive developments made over the years (British Petroleum. “Annual reports and accounts 2009” 6). The company should come up with measures that are aimed at countering competition by offering quality to the clients. Other key issues include.

- Strong marketing operations- through vertical & horizontal integrations

- Technology development

- Global brand- reputation & reliability

- Has expanded its markets in the social and cultural contexts and this has contributed to its success

- An effective procedure is followed in order to establish new and attractive ideas for the success of the organization (Wong, 5).

Internal Analysis

Strengths

- Vertical and horizontal integration chain– effective distribution channels that reduces costs & improves cash flows.

- Effective management– training, motivating & reviewing staff. Also outsourcing

- Marketing power & growth- strong brand creation through cross-promotion.

- Strong balance sheet- stable liquidity & average debtor/creditor days reduced.

- Tax advantage in different countries- lower corporate taxes

- strong financial base

The following table shows dividends announced and paid by the company per ADS for each of the past five years

Weaknesses

- Disappointing financial returns– asset, investment & equity returns

- Debt to Equity financing– future risks of high borrowing & cumulative interest

- Geographical revenue decline- Saturated US markets.

- Inconsistent growth & income revenue- cyclical results.

BP’s HRM Strategy

The diversified organizational culture establishes an effective team of highly qualified and skilled people through;

- Effective training & development- ensures smooth business operations

- Management & motivation- extrinsic & intrinsic motivation.

- Teamwork- selection and combination of people to solve corporate problems

BP’s strategic position within the industry has strengthened through its resources and competencies. BP’s most important strength is the developed vertical & horizontal integration links between the experienced HRM, operations and marketing areas. These provide the company with unique resources/competencies which create a competitive advantage. The distinct competencies such as growing economies of scale, experienced work force and effective supply & distribution links all contribute to cost efficient (Environmental Economic 6). Managing a proficient workforce enables the firm to exceed objectives. Training & development investment benefits the business as employees drive the firm to future success. Outsourcing HR developing countries is also a cost saving. The following table shows employee share options granted (British Petroleum. “Annual reports and accounts 2009” 5)

External Analysis

This section investigates external factors that could affect the organization

PESTEL analysis

Political

- Political relationships boost company’s success

- Government decisions to turnaround corporations tax strategy

- Government restrictions on monopolistic control of foreign markets (Wong, 6).

Economical

- Factors affecting GDP – employment, inflation, government spending

- More disposable income –profitable countries amplify service demand

- High investment from foreign shareholders

- Interest & exchange rates –Inexpensive Set-up costs due to low rates

Sociological

- Change in consumer tastes/preferences alter market forces–technology change to suit customer busy lifestyles

- Cultural sensitivity –high demand from acceptable business ethics

Technological

- Reviewed technology

- Implementing efficient technology– that reduce Co2 emissions (British Petroleum, “BP recognizes the risk posed to the environment from spills and takes a range of measures to prevent any loss of hydrocarbon” 4).

Environmental

- Kyoto Agreement changes businesses operations

- Tough environmental laws (waste disposal, clean air, first environmental acts) leading to higher investment costs in efficient technology

Legal

- Competition commission restrictions

- Government restrictions on multinational control of foreign markets

The external environment influences the decisions and strategy of an organization, thus BP has to consider external forces in order to achieve its objectives. The company’s technological developments have helped the environment through the efficient use of energy. This has also had an impact on the sociological & cultural differences since consumers want firms to be more socially responsible. BP’s business operates in many developing countries, which bring economic stability, however, government & legal issues restrict the firm’s monopolistic behavior.

Threat (oil spill)

With the current status at the Gulf region in Mexico, most of the oil companies (such as BP) that depend on oil from the region will have to incur economic cost while seeking for alternatives. They have already incurred a lot of financial losses from reduced sales due to lack of sufficient supply of oil. This problem is going to continue until other wells are drilled since it will take a long time before the Mexican Gulf oil can be harvested (Mouawad 10).

The global petroleum industry is also expected to incur huge losses which are deemed to result in increased oil prices. As we all know, oil and gas are the major sources of energy in most manufacturing industries. Oil shortage has already led to a decline in production (in the short-term) consequently resulting in increased prices of goods. However, in this long-term, this problem will be solved by substituting Gulf oil by other global sources (Environmental Economics 5).

According to BP CEO Bob Dudley, BP mobilized hundreds of people, vessels and protective boom to work on the spilt oil. Many people volunteered to help BP in its bid to clean up the mess caused by the oil and prevent further loss of marine life and other animals (Wong 4). BP has injected a lot of money in setting up investment to help the economies that were affected to recover. This money has gone to the tourism and fishing industries as these were hit the most by the disaster. It has held close relationships with the American community, fish and wildlife service, NOAA, the EPA among other agencies.

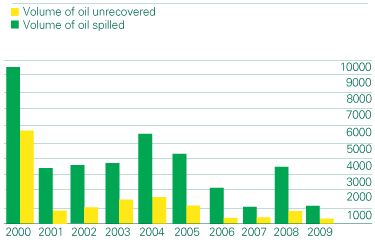

Dudley notes that BP has already learnt from the deepwater horizon disaster and it is in the process of putting tighter security measures to ensure that such a tragedy does not happen again (Wong 5). This is not the only oil spill that the company has experienced. There have been other oil spills although the volume of spilt oil has been on the decline since 1999 before the big disaster occurred (British Petroleum, “BP recognizes the risk posed to the environment from spills and takes a range of measures to prevent any loss of hydrocarbon” 3). The following charts show the volume of oil that has been spilt since 2000 and the volume that has been covered out of the spilt oil.

Other threats that influence the expansion of BP into other foreign markets includes Policy/regulations, for instance Government laws in Asia which prevents future operations and Global competition from Globalization. The threat from competition due to globalization can be reduced through the horizontal integration, as BP has done. The expansion into growing economies through the use of existing unique resources and core competencies would benefit BP and continue its expansion. Further need to invest in more sophisticated technology would ensure that services are protected, reliable and efficient. This would also overcome new environmental laws to reduce carbon emissions.

A line chart representing the number of BP’s oil spills equal to or greater than one barrel of oil (1 barrel = 159 liters = 42 US gallons). It covers the period 2001 to 2009. In 2001 it was 810, in 2002 it was 742, in 2003 it was 635, in 2004 it was 578, in 2005 it was 541, in 2006 it was 417, in 2007 it was 340, in 2008 it was 355 and in 2009 it was 234.

Volume of oil spills recovered / not recovered

Opportunities

The oil and gas industry is known as one of the major industries that earns nations a lot of income. For a long time it has been considered as the best industry to raise a nation’s economic status in the global market. People have become dependent on this industry as a major source of energy for cooking, and driving automobiles, among others. With the level of industrialization all over the world, oil and natural gas will remain the leading source of energy. There is a lot of natural gas that has not been harvested because many companies are not able to produce it at a profit. This leaves BP as the only company that is able to produce and market natural gas at a profit (Wong 6). Also there are many areas in the world with many tons of oil which have not been harvested and BP will continue exploring oil in these areas as long the strong demand for oil remains.

Works Cited

British Petroleum. Annual reports and accounts, 2009. Web.

British Petroleum. BP recognizes the risk posed to the environment from spills and takes a range of measures to prevent any loss of hydrocarbons, 2010. Web.

Environmental Economic. “Political impacts of Deepwater Horizon.” Economists on Environmental and Natural Resources 2010. Web.

Mouawad, Jad. “BP has a history of spills and safety lapses.” New York Times. 2010. Web.

Stiglitz, Joseph E. Globalization and Its Discontents. New York: W.W. Norton & Company, 2003.

Wong, Amy. “BP (NYSE:BP), Deepwater drilling will remain in Gulf, and everywhere”, International business times. 2010. Web.