Penfolds is a winemaker operating in Australia and has its headquarters in Melbourne. This company was created in 1844 by Christopher Rawson Penfold and has a significant market share in the Australian market. The founder was initially a physician who made wine for medicinal assistance. Over its years of growth, this corporation has developed significant collaborations. For example, it partnered with American airline Boeing to celebrate its 100th anniversary. Moreover, it has collaborated with National Geographic to uncover stories behind rare wines, and it has also won various international awards. In essence, it is considered one of the best wineries in Australia.

Penfold’s recommended approach to selling wine in the United States is by incorporating an importer and distributor approach for several reasons. The preferred merchant would be Southern Glazer’s Wine and Spirits. This company is based in the U.S. and is considered one of the largest, with operations in more than 44 American states. Moreover, in 2016, this corporation managed to transport more than 150 million cases of wine (Gilinsky et al., 2018). It also has an excellent call capacity accompanied by an exceptional product experience and customer satisfaction. Southern Glazer also has a diverse cultural marketing team which makes it a preferred choice.

Having selected the potential distributor, Southern Glazer’s Wines and Spirits, Penfolds will sell its wine cases to the merchant. Therefore, the distributor will be responsible for promoting these products in the United States to attract supermarkets, retailers, and restaurants. This process is beneficial to Penfolds because distributors facilitate international market penetration. Moreover, the US merchant will also take charge of shipment, customs formalities, and documentation, thereby reducing costs (Kostrzewski, 2017). Lastly, Southern Glazer will manage warehousing and inventory control of the purchased stock (Kostrzewski, 2017). In essence, this strategy will be cost-effective for Penfolds as its exporting initiative.

Sea freight is relatively cheaper than air shipping and also gives the consigner the chance to transport large quantities of goods. It starts from the Port of Adelaide to the United States Port of Miami. The cost of overseas transportation is approximately 15-18 cents per liter of wine (Rickard et al., 2018). Moreover, the US also incorporated a policy to impose 25% tariffs on wine products with 14% alcohol levels (Rickard et al., 2018). Lastly, over four liters of wine are subject to an import duty of 4.8 cents per liter and excise tax of 28.27 per liter (Amiti et al., 2019). In essence, sea freight is the most feasible means of transporting wine to the United States.

Sea freight transportation is adopted due to several reasons. For example, wine is transported via ISO tanks due to its large size. Moreover, these containers have air-tight seals, which will help in preserving the delicate flavors and aromas of the wine (Rainer et al., 2019). While they may be acquired at a hefty fee, these containers are vital for wine transportation because they offer excellent security while preventing cross-contamination of wine. Generally, water transportation is considered cheap and feasible for shipping wine its large quantities (Varsei & Polyakovskiy, 2017). In essence, Penfolds should consider incorporating these strategies in its exporting approaches.

The cost of transporting wine from Australia to the United States involves the following. For example, the transport process will incorporate loose shipping of wine in ISO tanks. The cost of purchasing a 25,000-liter inter-modal container is approximately US$ 11,000, accompanied by a $2.1 per kilogram for shipping (Varsei & Polyakovskiy, 2017). Moreover, the tariffs involve are approximately 25% for wine products with alcohol levels above 14% (Amiti et al., 2019). Lastly, Penfolds will incur costs associated with bottle packaging of the wine by the distributor.

In the first stages of market expansion, Penfolds will adopt an exporting strategy. It is because this is a low-risk approach for collecting market data for a potential long-term investment (Samiee & Chirapanda, 2019). Moreover, this enables Penfold to consider expanding its product line to include other alcoholic and non-alcoholic beverage products. In addition, Penfolds will also increase its geographic coverage to include other emerging markets. Lastly, the winery will formulate a strategy for incorporating a unified and extensive distribution network to support its product mix. In essence, the company will be able to evaluate the possibility of long-term investment.

A horizontal FDI involves purchasing a foreign company that manufactures the same products as the buyer. It is a recommended approach because it helps avoid trade barriers and gain better access to domestic markets (Samiee & Chirapanda, 2019). Moreover, Penfolds adopts a geographic segmentation by developing diverse consumer profiles. In addition, it also establishes different stores to support its geographic strategy. Research and development will be vital for improving its product mix while also implementing selective distribution approaches. This strategy is a combination of both intensive and exclusive distribution systems.

The recommended strategy is foreign direct investment for long-term benefits to the winery. This approach is cost-effective and will help Penfolds eliminate trade barriers such as exporting fees incurred in its short-term strategy (Samiee & Chirapanda, 2019). Moreover, the winery will become a multinational corporation by assuming simultaneous production in its home and foreign countries. In the long run, the winery will successfully overcome entry barriers to the United States’ domestic markets. Moreover, it will also increase its global market share considering that it implements horizontal foreign direct investment (Samiee & Chirapanda, 2019). In essence, Penfolds should consider the long-term benefits that emanate from incorporating these strategies.

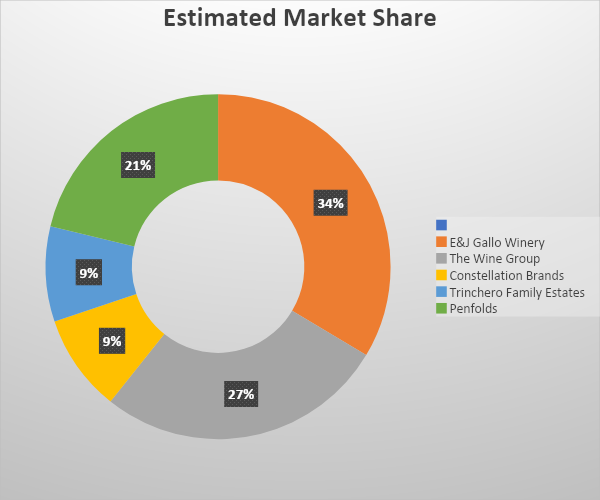

The wine industry in the United States has been gradually growing. As such, several wineries are operating in this market segment, and they have also generated considerable sales of wine cases. Examples of some of the leading brands in this market are E&J Gallo Winery, Constellation brands, Trinchero Family Estates, and The Wine Group (Gilinsky et al., 2018). An estimation finds that E&J Gallo Winery has the most significant portion of the market share. According to the financials of Penfolds in Australia, its estimated market share in the United States would be 21% ahead of some wineries. Therefore, the company will have to improve its marketing approaches to gain more market share.

The table above indicates the projected financials of Penfold’s sales of wine in the United States from years one through five. The winery expects to generate $850,000 in sales revenue in its first and second years of product introduction. The cost of goods sold in these respective years would amount to $500,000 with a gross margin of $400,000. The total operating expenses would amount to $15,000 due to the marketing and promotional campaigns to create awareness of the wine products. Penfolds is expected to make a net profit of $25,000 in each of the respective years. Moreover, the rest of the projected financials are indicated in the table above as derived from Penfold’s current financials in the Australian wine market.

Penfolds is one of the leading wineries in the Australian market. The company intends to invest in United States marketing to expand its geographical coverage. It adopts a distribution strategy of exporting its wine cases to this market, and the preferred merchant is Southern Glazer’s Wines and Spirits. In addition, it utilizes sea freight transportation due to its cost-effectiveness and capacity to ship large quantities of products. In essence, Penfolds opts for horizontal foreign direct investment, which involves purchasing a foreign company with its industry in the United States.

References

Amiti, M., Redding, S. J., & Weinstein, D. E. (2019). The Impact of the 2018 Tariffs on Prices and Welfare. Journal of Economic Perspectives, 33(4), 187–210. Web.

Bhattacharyya, S. S. (2020). International business strategy: Development of an integrated framework and typology. Review of International Business and Strategy, 30(3), 345- 373. Web.

Gilinsky, A., Newton, S., & Eyler, R. (2018). Are strategic orientations and managerial characteristics drivers of performance in the US wine industry? International Journal of Wine Business Research, 30(1), 42-57. Web.

Kostrzewski, M. (2017). Implementation of distribution model of an international company with use of simulation method. Procedia Engineering, 192, 445–450. Web.

Rainer, G., Pütz, R., & Steiner, C. (2019). The emergence of new wine design practices: Flexitanks and the assembling of bulk wine across global rural regions. The Geographical Journal. Web.

Rickard, B. J., Gergaud, O., Ho, S.-T., & Livat, F. (2018). Trade liberalization in the presence of domestic regulations: Public policies applied to EU and US wine markets. Applied Economics, 50(18), 2028–2047. Web.