Reflective Statement

In this study, there are a number of practical lessons and values learnt that are of the essence to a manager. Firstly, performance management is a process that is geared towards achieving objectives set by a business plan in order to realize success.

This work thus gives a manager an insight onto ways and methods that he or she can use to steer an organization towards performance. In this process, a manager learns soft skills in team management, team structure and team social relations as a creation of a “family setup” in business. This can only guarantee success if properly utilized.

Secondly, in performance management, there is a need to develop objectives and goals. Goals and objectives are developed using certain measures and strategies in order to get the organization on top.

These are skills that a manager learns that they give the right approach to the business. In this process, a manager gets certain knowledge, experience and practice to develop what right, recognize what is above of below the actual requirements of the organization.

In terms of team management, this assessment helps in the future appreciation on values embedded in human relations in the work place. As a manager one can develop the right environment in order to nurture different human perspectives, qualities and concerns.

The lesson is that as a manager one is needed to take the role of an evaluator of the interconnection of many systems and how effective they are. In case something goes wrong, a manager can take actions to provide solutions. This may include disciplinary measures as well performance appraisals for an effective organization.

Performance management recognizes the use of modern technology that is appropriate in the work place. The lesson for a manager lies in choosing what works where and how does it impact to an organization. This helps a manager in the future to determine the best technology to incorporate in the most efficient and effective manner.

Introduction

Performance management goes beyond the simplistic approach towards the employees only. In the book, “Field Guide to Leadership and Supervision in Business”, McNamara and McNamara (2002) argue that successful management focuses on the organization, departments processes, programs, products projects and teams (Bayazit and Mannix, 2003).

Performance is not about being busy; however, it involves delivering results in line with the survival of the business. A business has no choice, but to ensure that strategic processes opted for are only those meant to increase the effectiveness of the organization. This paper will take a detailed analysis method to explain performance management under the given highlights of this assignment.

Performance Management Background information

The definition of performance management includes various components, which are linked together in a cycle. In this cycle, business strategy forms the starting point of which the summary of the organization is outlined in fair details. Business strategy allows personnel in the organization to grasp the sense of direction. This is because it is clearly outlined and thus the objectives act as a guide to planning (Bacal, 2011).

Secondly, the goals or the objectives that are in an organization must emanate from the business strategy. The objectives or goals must be placed within a time framework where certain activities are guided by each step to the next. Following objectives is the structure of the organization. There must be systems established to work in line with the emerging and on-going strategic issues.

Modern technology and information systems provide competitive advantage if utilized properly. This approach enables the job descriptions to be designed, and the organisation to achieve the prescribed goals.

From these job descriptions, there is mutual agreement between the employer and the employee with certain targets put in mind. The targets, systems, and the organization can thus be expected to perform to the required standards hence the attachment of performance standards (TACK International (Africa) Ltd, 2009).

Developing objectives for Individuals and Teams

Emanating from this knowledge, personnel in the organization should be assigned duties that are detailed in the designed job description. For the organization to come up with a job description, job analysis must be conducted to ascertain the key competencies needed to achieve the set goals.

These competencies are explained in terms of knowledge, skills and capabilities. The goals in this line help to indicate the direction to be followed and do form the central frame work of reference and aid to identify success as well as clarify issues and expectations of the organization and the employees (Ridzi, 2004).

On the other hand, the team objectives start from the basic process of laying out the business strategy. A business plan in any organization must communicate its vision to its members. The objectives of the company and direction as directed by the overall strategic planning set the ground for team work.

If the systems in the organization are not incorporated in this aspect, then the sense of direction and objectives may not be a source of motivation to employees and thus this may pull the company vision to individual objectives (Warner, 2002).

Setting goals is a process that requires meetings between the various stakeholders in the organisation. In this process, the individuals form a team, which focuses on development of key attributes like positive attitudes on employees, morale, and job satisfaction. Through team social relations, team effectiveness and participation in decision making enhance in building a team that perceives the level of commitment as very high.

This aids in formation of team objectives that are in line with individual objectives due to the sense of togetherness and positive attitude. By developing such groups of individuals in a team, then every person understands his or her roles and responsibilities and thus adequate resources are provided for it (Cammann, et al., 1983).

The SMART plan is a concept that is used by quite a number of organizations. SMART stands for Specific, Measurable, Attainable, Relevant, and Time framed. The plan makes goals conform to the best ideals and strategies in making objectives.

The links between individual, team, and organization perspectives are put into consideration by allowing individuals to participate in the decision making process through meetings. Through mapping, the process can incorporate performance planning where the profile roles are reviewed to determine the appropriateness and the expected behavioural requirements (Riccucci, 2005).

Assessing performance and providing feedback

During the planning stage, as a leader, it is important to identify and reach an agreement on the criteria that should be used to measure how far the objectives have been achieved.

In this section, the assessment should be focused on the objective chosen by the individual in collaboration with a manager, and evaluate how well it has been performed. It is important to put in mind that the objective may be focused on a task, a project, behaviour, values, developmental or performance improvement as well as on going role objectives (Talbot, 2005).

When performing assessment, the following measures should be used to evaluate individual and team performances. Finance as a performance measure seeks to check whether value has been added either to shareholder’s or even income.

On the other hand, output seeks to assess whether new accounts or sales have reached the agreed target. Impact checks the quality of standards, behaviour changes and completion of identified task or project or even innovation.

The measure of reaction seeks to ascertain the judgment gotten from other colleagues who may be internal or external like customers. In terms of time, the assessment analysis refers to the records of the speed taken to respond to something, or to assess the time taken in the process of delivery marketing and retrieval of data in regard to the set timetable (Cummings & Worley, 2009).

Assessment largely involves evaluating what has been achieved in comparison to established standard. Secondly, documenting recorded results in the most appropriate manner and finally communicating the results as feedback to the individual or groups follows.

Feedback in cases of performance management is either positive or negative. One important thing to note as a manager is that feedback must be timely and specific with regard to the objectives established thus acting as standards. When the space between time of performing and feedback is prolonged or hurried untimely, then the appreciable effect is never realized.

With this in mind, the methods of providing feedback must be carefully chosen upon the most relevant communication methods available and used by an organization. The major modes of communication include oral, writing and nonverbal communication systems. Each system has its disadvantages and advantages (Moynihan, 2008).

The writing mode of communication involves the traditional writing of letters, memos reports, manuals, forms and critical summaries. In modern forms, a manager must understand that emails, e-memos, social websites and mobile texts form the most common and advanced usage of writing as a method of communication.

Oral communication involves the use of meetings, forums, and discussion groups that are meant to deliver solutions or chat the way forward through the mechanics of voice variation, tone setting, pitch adjustments and body postures and attitudes (Armstrong, 2006).

Thirdly, the nonverbal method of communication includes all the elements that do not include written or oral expressions of communication. These may be facial expressions, physical movements. Facial expressions may be indicated by a number of things including eye contact.

Therefore, a manager has will use the appropriate communication network for individual and team performance feedback. For teams circle communication method should be the best method of providing feedback and line network is the best for individual feedback (Radin, 2006).

However, the two types must incorporate all modes of communication at the same for purposes of clarity and review. Feedback gives the personnel the window to assess his or her importance in an organization. At the same time, it allows management to come up with rewards for everyone. Individuals and teams are able to identify skills and abilities they should work on and the organization can assess the skills needed for success.

In the process of assessment, conflicts may arise if the program is marred by ineffective strategies or poor planning. Three issues in particular that may bring conflict are, who does the assessment, how often is the evaluation done and thirdly how is performance measured.

Inadequate think through processes may result to lack of diversity in the performance evaluation. Environment, available structures and other issues like gender must be taken into consideration during assessment to avoid or minimise conflicts (Griffin & Moorhead, 2011).

Therefore, the person who does the assessment must put these questions in mind and promote truthful accounting of feedback. The instruments used for assessment like graphs, charts, behaviour observation, forms, questionnaires and calculation indexes must be standard.

In this case, they should be acceptable universally or have international bearing, and provide competent results across the spectrum. The frequency and timing of measure should be stipulated in reasonable periods according to the organizations period of operation.

Performance support for improvement

In the development of objectives like in the MBO plan, managers guide the teams, and individuals to develop objectives in line with what the organization has laid out. In this process, planning, performance review and evaluation have to be backed by the development of the interrelationship between managers and the group.

This development should be based on trust, social interactions, and social relations, which enhance team structure (Heinrich, 2000).

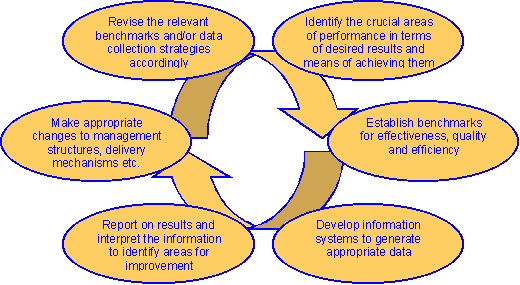

Since goals are developed in line with problems or outlined objectives, the performance improvement cycle involves planning for improvement as the first step. Secondly, the implementation of the improvement follows after review, which is followed closely by evaluation of success of the improvement program.

Finally, from the results, the next step involves making decisions. Therefore, in this cycle, the principles move from the plan, then to check and finally to act (Avis, 2009).

As a manager, one need to support the efforts of teams and individuals should be guided from the top going down. Support should be of different forms in order to enhance performance since changes keep on happening in the management process. The support on performance from management is advantageous since communication is enhanced and during difficult periods.

The support may involve verbal encouragements to individuals or teams from managers. On the other hand, the management as an organization should support the individual and team by providing systems that are needed.

The support systems for teams may include efficient inventory and schedule systems, better hiring systems, improved information systems and appropriate compensation systems. Team leaders and managers must ensure growth of the team and individual towards the outlined objectives (Lussier, 2011). The following is a sample of the performance improvement cycle diagram:

Source: Joint Commission Resources, Inc. 2001, p. 36

Philosophy in disciplinary and grievance procedures in an organization

Grievances are common in work places and court processes often return to an employer after an ex-employee sues an organization. The philosophy of discipline in an organization revolves around evaluation of work performance.

The process of assessing how much has been gained, as projected in the goals and objectives of individuals, teams and organizations, lead to performance review through continuous performance improvement cycles (Grifffin and Moorhead, 2011).

From the assessment feedback and review, an organizational can determine the right employee suited for a certain job, as well as the needed skills. At the same time, employees are able to identify their areas of improvement using measures like 360 degrees self-feedback mechanism and other measures.

The management takes keen interests in both those who have performed and underperformed. For those who have performed above or as expected through the objectives, rewards, incentives and compensation follow from as a process of support from the organization (Falcone, 2002).

In cases of underperformance, the organization, teams, individuals and managers work together in review meetings to analyse the results and possible failure in the support process or the development of unrealistic objectives. This results to performance improvement cycles until the performance is satisfactory.

However, in situations where the individual consistently espouses underperformance due to lack of ability skills in the presence of necessary supportive systems, then disciplinary actions must prevail (Grifffin and Moorhead, 2011).

The philosophy of disciplinary measures must put in mind the “work place due process” concept. This involves recording of documents that “indicate threefold” warnings to an individual who constantly under performs. These records serve to help the individual assess the procedures and ways she or he can use to improve in order to avert the chance of losing the job.

In this process are the principles of progressive discipline. These principles attempt to indicate to the employee that they stand a chance of losing a job. Therefore, legally, probations, suspensions precede termination which must be founded on just cause (Brousseau, 1978).

Therefore, as a manager, the role is to first support the individual or team found to have underperformed. This is done through various measures of support improvement.

In the progress of serious mistakes or grievances as a manger, I should record the warnings and expressly offer information that places the concerned personnel informed. These roles must fall in the stipulated procedures as stipulated in the Fourteenth Amendment and thus respect the rights of employees and employers.

In summary, an organization must first assess and measure performance of teams or individuals using the appropriate procedures and methods. At this stage, information must be recorded and documented for future purposes and references. In the process, appropriate feedbacks are communicated using the relevant procedures through performance review meetings and forums.

Following this the organization takes to the drawing board to plan and redevelop or assess the objectives laid out in the previous plan. This makes a performance improvement cycle which enhances achieving of objectives.

In case there is under performance, the manager and team leaders refer to documented information and continue to support the areas that need development in an individual. These from the background warnings must accumulate to three or more than three times.

If the performance falls less than below the set goals for three improvement cycles then suspension, probation and summons should precede termination. If these fail, then the manager has the power to terminate on an acceptable cause (Cardy and Leonard, 2011).

For those who perform to the expected goals the organization promotes them to desired levels in order to help the organization to train others in the area or department. Secondly, the organization reviews the performance remuneration to commensurate with the new results hence the profitability of the organization.

Conclusion

Organizations should incorporate performance management strategies in the management process in order to realize the benefits of optimal resource utilization. The human resource in an organization forms one the factors that an organization has the power to use to realize goals and objectives. It is thus paramount that performance management should be regarded positively and accepted by managers worldwide.

Increased improvement and success in organizations has often been attributed to efforts in the team work. The measure of success used to assess teams can have more impact when performance management is put in place. It is thus important for organizations to include performance management in order to achieve success.

References List

Armstrong, M 2006, Performing management: key strategies and practical guidelines (3rd ed), Pentoville Road, London: Kogan Page.

Avis, J 2009, P2 – Performance Management, Managerial (6ed), Jordan Hill Oxford: Butterworth-Heinemann.

Bacal, R 2011, Performance Management (2/E), Burr Ridge New York: Mcgraw Hill Professional.

Bayazit, M and Mannix, EA 2003, Should I stay or should I go? Predicting team members’ intent to remain in the team. Small Group Research, 34(3): 290-321.

Brousseau, KR 1978, Personality and job experience. Organizational Behaviour and Human Performance, 22: 235-52.

Cammann, C, Fichman, M, Jenkins, GD, & Klesh, JR 1983, “Assessing the attitudes and perceptions of organizational members”, in SE Seashore, EE Lawler, P. Mervis and C, Cammann (eds), Assessing Organizational Change, New York: Wiley, pp. 125-175.

Cardy, LB and Leonard, B 2011, Performance Management Concepts, Skills, and Exercises. Business, Park Drive, New York: M.E. Sharpe.

Cummings, TG and Worley, CG 2009, Organization development & change, Australia: South-Western/Cengage Learning.

Falcone, P 2002, The hiring and firing question and answer book, New York: AMACOM Div American Mgmt Assn.

Grifffin WR and Moorhead, G 2011, Organizational Behaviour: Managing People and Organizations, Boulevard, Mason: Cengage Learning.

Heinrich, CJ 2000, Organizational form and performance: An empirical investigation of nonprofit and for-profit job-training service providers. Journal of Policy Analysis and Management, 19: 233–61.

Joint Commission Resources, Inc. 2001, Using performance improvement tools in ambulatory care, Oakbrook Terrace, IL: Joint Commission Resources.

Lussier, NR 2011, Management Fundamentals: Concepts, Applications, Skill Development (5ed), Boulevard, Mason: Cengage Learning.

McNamara, C and McNamara, T 2002, Field Guide to Leadership and Supervision in Business, New York: Authenticity consulting, LLC.

Moynihan, DP 2008, The dynamics of performance management: Constructing information and reform, Washington, DC: Georgetown Univ. Press.

Radin, BA, 2006, Challenging the performance movement: Accountability, complexity, and democratic values, Washington, DC: Georgetown Univ. Press.

Riccucci, N 2005, How management matters: Street-level bureaucrats and welfare reform, Washington, DC: Georgetown Univ. Press.

Ridzi, F 2004, Making TANF work: Organizational restructuring, staff buy-in, and performance monitoring in local implementation, Journal of Sociology and Social Welfare, 31:2.

TACK International (Africa) Ltd, 2009. A briefing note on Performance Management. Web.

Talbot, C 2005, “Performance management”, in E Ferlie, LE Lynn and C Pollitt (Eds) The Oxford Handbook of Public Management, Oxford: Oxford Univ. Press.

Warner, J 2002, The Janus performance management system: A complete performance management support process for individuals, teams, and the entire organization, Amherst, Mass: HRD Press.