Introduction

This work aims to conduct an analysis of Philip Morris International Inc., which operates in the manufacturing industry, which includes subsector beverage and tobacco product manufacturing. The selected business occupies a leading position among competitors in the American tobacco production market. However, the main goal of the company is to limit the amount and harmful effects of smoke on people and the environment and work on the development of a healthy future. Thus, Philip Morris International is attempting to develop products for the long-term outside of the tobacco and nicotine sector.

About the Company

The best-selling product that the company produces is Marlboro cigarettes, which are famous all over the world. Other well-known tobacco products of this business are Bond Street, Chesterfield, L&M, Lark and Philip Morris (“Philip Morris International Inc.,” n.d.). As for the number of subsidiaries in other countries, the company operates in 1,175 countries (“Frequently asked questions about cigarettes and smoking,” n.d.). Moreover, the study showed that “in 2019, the net revenue of Philip Morris worldwide exceeded 77 billion U.S. dollars” (“Phillip Morris International net revenue 2021”, n.d., para. 1). One of the strategies used by businesses that directly concerns the manufacturing industry is the transition from cigarettes to tobacco-free devices. This implies reducing the negative impact on nature. Such environmentally-friendly policies attract new investors, which helps the company to grow and develop.

Phillip Morris International Inc. pays excellent attention to its suppliers and customers, as these are the aspects that largely determine the success of the company. It is worth noting that the business is recognized as a leader in the field of sustainable development precisely for the actions that the company takes to attract suppliers (Levy et al., 2019). Consequently, Philip Morris International focuses on the teamwork and well-coordinated work of all involved parties in order to have a long-term impact on the environment and society. Among the three main competitors, Phillip Morris International ($31.41M) There are such businesses as Imperial Brands Plc ($42,550.65M), Japan Tobacco Inc. ($20,036.27M), and British American Tobacco ($16,453.92M) (“Tobacco Manufacturing Industry,” n.d., para. 4). These manufacturers in the industry under study also occupy pretty high positions in the rating and have good indicators. The main buyers of the brand are adult men and women. The company’s suppliers comprise many organizations, some of which are the chemicals, packaging, paper, and machinery manufacturing industries.

Analysis

Risk

Negative Effect on Society

Risk assessment, research, and prediction are an integral part of operating any business. This fact also concerns the tobacco production industry, as it can have some negative consequences on society and the environment. One of them is air pollution by smoke and burning products from cigarettes. Phillip Morris International sets the main objective of its risk management strategy to develop an innovative range of less harmful products that are alternatives to continuing cigarette smoking (“Assessing risk reduction,” 2019). In other words, the cigarette manufacturer aims to reduce the risk to nature and human health through the introduction of alternative options.

In order to ensure the reliability of the data and to have an accurate understanding of what risks the production may have, the company conducts specialized checks. Thus, practices in the field of toxicology are applied, and the mandatory compliance of the “US Food and Drug Administration for the use of Modified Risk Tobacco Products act (MRTPA)” (“Assessing risk reduction,” 2019, para. 2) is taken into account. Thus, the business complies with international standards and practices to ensure the safety of the results of its activities.

Insufficient Data

Risk factors are managed properly to reduce the risk of having insufficient data, and the possibility of their occurrence is reduced at all stages of production, which gives creativity to the company’s approach. Hence, already at the stage of developing a future product, the company pays careful attention to the design of the product and ensures strict adherence to standards. Despite the fact that tobacco products initially cause a high level of harm to society, Phillip Morris International Inc. makes an attempt to reduce this factor. In addition, various laboratory tests are carried out, which further ensure the limitation of risks from business activities. It is especially worth noting the additional clinical and consumer use research (“Assessing risk reduction,” 2019). The last stage on the way to risk reduction and management is a long-term assessment to determine possible outcomes and results.

Public Discontent

The main risk for the company may be public discontent due to the lack of less harmful alternatives to smoking like its competitors. However, it is worth noting that the study of the company’s web page showed that it is gradually working on the development of this issue. Compliance with the Foreign Corrupt Practices Act (FCPA) becomes an important component of making changes to the company and assessing and avoiding risks. This legislative document implies a ban on the submission of fees for acquiring or retaining business. Thus, the risk analysis showed that the main goal of Phillip Morris International should be to resort to a faster process of innovation.

Common-Sense Approach

Another strategy of the company under study is a common-sense approach. Thus, business is well aware of the need to impose certain requirements on tobacco products that limit the range of buyers. Thus, the company complies with all the countries’ laws to which it supplies the goods. In addition, Philip Morris International carefully treats the process of hiring new employees and conducting the necessary interviews. Therefore, the business tries to maximize the level of transparency in the organization to increase the loyalty of customers, suppliers, and investors.

Competition

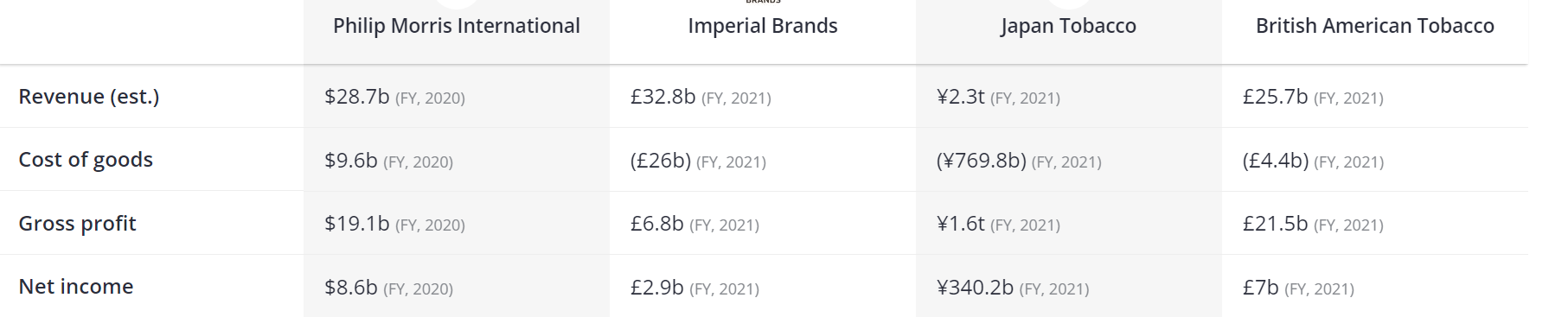

The study of rivals within the industry can provide valuable insight into what changes a business may need to improve efficiency and improve its competitiveness in the market. Companies that compete for the same customers as Philip Morris International are Imperial Brands Plc., Japan Tobacco Inc., and British American Tobacco (Fig. 1). Below is a table that shows the difference in profit, product cost, gross profit, and net income of all listed companies. Thus, the first manufacturer requiring attention is British American Tobacco.

Henceforth, British American Tobacco is one of the main competitors in the industry under study. The main advantage of this business is that it focuses a lot of attention not only on reducing the negative impact on nature but is also client-centered and uses market-leading technology. All these aspects have a beneficial effect on the productivity and popularity of the company. The second competitor is Japan Tobacco Inc. which focuses on innovation and sustainability as the main drivers of business development. Among the company’s innovations are unique vape systems that are designed to reduce harm and risk to the environment. Moreover, the company’s strategy was able to reduce CO2 emissions from its activities by 28 percent (“About Us,” n.d.). This is a significantly important indicator of the successful implementation of innovations in production.

The latest competitor of the investigated business in the beverage and tobacco industry is Imperial Brands Plc, which is the market leader. First of all, the company focuses on the priority markets of combustible materials. Further, instead of covering a large number of markets at once, the business directs its main forces only to a few. The rest do not go unnoticed and are implemented with less productivity than the larger ones. Even though they are not as big, they have an advantage in the involvement of margins and narrow investment requirements. Additionally, this company is engaged in the development and design of next-generation products basing them on consumer preference research (“Our Strategy,” n.d.). Thus, all of these strategic actions help the company to maintain its position.

Recommendations and Conclusion

Therefore, based on the analysis of the beverage and tobacco industry in which Philip Morris International operates, it is possible to come to some conclusions. The business has the primary task of constantly maintaining competitiveness to fight against such significant competitors as Imperial Brands Plc., Japan Tobacco Inc., and British American Tobacco. Research states that a “better understanding of the interaction between market structure and government regulation can help develop effective policies” (Levy et al., 2019, p. 167). The study of their strategies showed the need to introduce innovations into the company. This way, the no-smoke products “release no smoke because the tobacco leaves are heated rather than burned, with no tobacco combustion” (Jenssen et al., 2018, p. 1). Moreover, it should be sustainable and creative ways to reduce the degree of risk factors. Therefore, it is necessary to develop an action plan to improve the company’s actions. It is worth noting that Philip Morris International Inc. is already making attempts to design and develop new products to reduce the amount of smoke in the environment from tobacco products.

References

Assessing risk reduction. (2019). Philip Morris International. Web.

Frequently asked questions about cigarettes and smoking. (n.d.). Philip Morris International. Web.

Philip Morris International competitors. (n.d.). Craft. Web.

Philip Morris International Inc. (n.d.). Dun & Bradstreet. Web.

Tobacco manufacturing industry insights from D&B hoovers. (n.d.). Dun & Bradstreet. Web.

Jenssen, B. P., Walley, S. C., & McGrath-Morrow, S. A. (2018). Heat-not-burn tobacco products: Tobacco industry claims no substitute for science.Pediatrics, 141(1). Web.

Levy, D. T., Chaloupka, F., Lindblom, E. N., Sweanor, D. T., O’connor, R. J., Shang, C., & Borland, R. (2019). The US cigarette industry: An economic and marketing perspective. Tobacco Regulatory Science, 5(2), 156-168. Web.

About us. (n.d.). JTI. Web.

Our Strategy. (n.d.). Imperial Brands. Web.