Overview of the Company

Philips 66 is an American multinational company that specializes in energy manufacturing and logistics. Its headquarters are located in the city of Houston, Texas. The business is a part of the fuel industry; it stores, refines and processes natural gas and crude oil. It also transports and trades in raw materials, polymers, and plastics, various types of fuel, including petrochemicals, natural gas, and natural gas liquids, around the world, but mainly in the U.S. and Europe, under a number of brand names (“Company Overview,” 2016).

Phillips 66, in its present form, emerged in May 2012. However, the history of the company began as long ago as in 1875, when the inception of Conoco (Continental Oil and Transportation Co.), a predecessor of today’s enterprise, took place; the company became one of the first marketers that dealt in petroleum in the West. The history of the business is rich and eventful; it gradually grew and expanded, spreading to more and more regions and places, and providing innovation in the industry.

It also merged with other companies; for instance, in 1929 it merged with Continental Oil and Transportation Co. At the same time, the company of Phillips, another predecessor of today’s enterprise, was created in 1917.

It is noteworthy that a number of inventions can be attributed to the latter business; for instance, in 1941, the organization designed the HF Alkylation process. This invention allowed for producing high-octane fuel for aircraft, which supplied the aviation of the Allies to more effectively battle the enemies in World War II, thus providing aid in winning the war. In the newer history, an important event occurred in 2002, when Phillips and Conoco officially merged, creating ConocoPhillips. ConocoPhillips, however, carried out a corporate spin-off in 2012; one of the companies that emerged as a result of this act is the today’s Phillips 66 (“Our History,” n.d.).

Nowadays, according to the official website of Phillips 66, the company consists of four main segments: Midstream (gathering, processing, and marketing of natural gas in the U.S.), Refining (refines crude oil), Chemicals (produces petrochemicals and plastics), and Marketing & Specialties (markets the refined products from oil, mostly in the U.S. and Europe) (“Our Businesses,” n.d.). 10-K report for the year 2015, however, indicates the existence of another segment that is responsible for technological development (United States Securities and Exchange Commission [SEC], 2016).

The enterprise provides employment for nearly 14,000 workers around the globe. In addition, it is stated that the business possessed approximately $49 billion of assets on December 31, 2015. The company sells its stocks on the New York Stock Exchange; the ticker symbol for the organization is PSX (“Company Overview,” 2016).

Key Financial Information

Income Statement

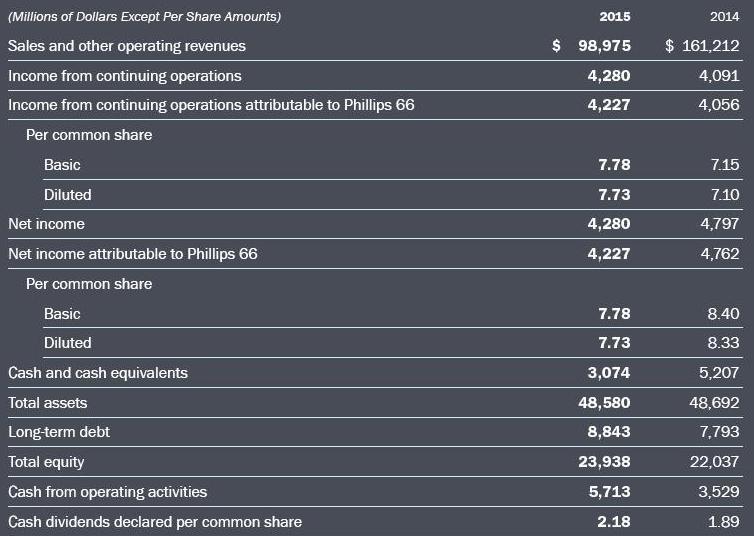

Phillips 66 reports a decrease in the values of the income statement in 2015 (the year ending on December, 31). In particular, it is shown that the total revenues and other income of the firm totaled for $100,949 million in 2015. This value is drastically lower than the respective sum that was gained in 2014 ($164,093 million); the total revenues and other income of 2014, in turn, is lower than that of 2013 ($174,809 million) (SEC, 2016). Therefore, it is possible to see that the company has been experiencing a decrease in revenues and income over a few years.

Out of $100,949 million of the total revenues and other income of 2015, $98,975 million (or nearly 98.04%) were gained via sales and other operating revenues; simultaneously, $1,573 million (≈1.56%) were earned as equity in earnings of affiliates, $283 million (≈0.28%) were obtained as net gain on dispositions, and $118 million (≈0.11%) were received through other means (“other income”) (SEC, 2016).

The total costs and expenses of 2015 ($94,905 million), similarly, are significantly lower than those of 2014 ($158,348 million) and of 2013 ($169,283 million). The main part of costs and expenses in 2015 is comprised of costs used to buy crude oil and products ($73,399 million, or ≈77.34%), as well as of taxes other than income taxes ($14.077 million, or ≈14.83%), and operating expenses ($4,294 million, or ≈4.52%). Other items include selling, general and administrative expenses; depreciation and amortization, interest and debt expense; and a few others (SEC, 2016).

Having taken into account the revenues and expenses, it is possible to see that the income from continuing operations before income taxes accounted for $6,044 million in 2015. $1,764 million of income taxes were paid, thus leaving $4,280 million of income from continuing operations, which in this case is equal to the net income of 2015. Upon subtracting the $53 million of net income attributable to noncontrolling interests, it can be seen that Phillips 66 gained $4,227 million of net income in 2015. It is also interesting to point out the fact that this sum accounts for approximately 88.77% of net income in 2014 (which was $4,762 million), and is nearly 13.45% higher than the net income of 2013 ($3,726 million) (SEC, 2016).

Balance Sheet

On December 31, 2015, the total assets of Phillips 66 accounted for $48,580 million, which was slightly lower than the respective value on December 31, 2014 ($48,692 million). The sum calculated for December 31, 2015 is comprised mainly of total current assets ($12,256 million, ≈25.17%), investments and long-term receivables ($12,143 million, ≈24.94%), net properties, plants and equipment ($19,721 million, ≈40.50%), goodwill ($3,275 million, ≈6.73%), as well as of intangible assets ($906 million), and other assets ($279 million) (SEC, 2016, p. 72).

On December 31, 2015, the total liabilities accounted for $24,642 million (less than on December 31, 2014, which was $26,655 million). It is important to emphasize that these total liabilities consisted mainly of total current liabilities (accounts payable, short-term debt, etc.) ($7,531 million, ≈30.56%), long-term debt ($8,843 million, ≈35.89%), and deferred income taxes ($6,041 million, ≈24.52%); it also included employee benefit obligations, asset retirement obligations and accrued environmental expenses, and other liabilities (SEC, 2016, p. 72).

Thus, it can easily be seen that the total equity on December 31, 2015 was $23.938 million (it consisted of total stockholders’ equity, $23,100 million, and noncontrolling interests, $838 million). It also should be stressed that Phillips experienced a growth of ≈8.63% in equity on December 31, 2015 in comparison to December 31, 2014, for the total equity on the latter date was $22,037 million (SEC, 2016).

Profitability

The income statement allows for the assessment of the profitability of Phillips 66, and its dynamics over the course of the last three years. It can easily be seen that, despite the drastic decrease in the quantity of the operations, the company was mainly able to retain its profitability. Indeed, the total revenues and other income of the business in 2015 accounted for $100,949 million, which was only approximately 61.52% of the respective sum for the year 2014, and only nearly 57.75% of the respective sum for the year 2013. In addition, the costs and expenses of the company in 2015 ($94.905 million) accounted for about 59.93% of these in 2014, and for roughly 56.06% of these in 2013.

At the same time, it was already pointed out that the net income of Phillips 66 in 2015 was $4,227 million, which accounted for approximately 88.77% of net income in 2014. However, if one compares the net income of the firm in 2015 and 2013, it can be seen that the net income grew by nearly 13.45% in 2015 despite the significant drop in operations in comparison to 2013. Therefore, even though the performance was worse in 2015 than in 2014, the year 2015 was more profitable than 2013.

Accounting Issues

It is stated that the creation of accounting documents complying with the commonly used principles of accounting dictates the need for the company’s leadership to choose accounting policies; this choice may be crucial and lead to differences in financial amounts due to different methods of assessment and possible subjective judgment (SEC, 2016). The choice of the policy may lead to material differences when estimating:

- impairments;

- asset retirement obligations (i.e., obligations to dispose of equipment and return the land to a certain form after conducting operations);

- environmental costs (e.g., difficulties with assessing future cleanup costs, the time when such costs will be needed, etc.);

- intangible assets and goodwill (for instance, there exist intangible assets that are supposed to have indefinite lives, which means that they are not amortized; in addition, such assets need constant assessment as the time passes);

- tax assets and liabilities (due to possible mismatches in tax estimations by the firm and different authorities, issues may arise);

- project benefit obligations (e.g., unknown exact dates of retirement or other similar happenings) (SEC, 2016).

Therefore, it is important to choose the accounting policy carefully and properly.

Tax Issues

The operations of the company that are taxed may become a source of uncertainty due to the fact that the tax liabilities of the firm are recorded according to the internal estimation of the existing tax regulation; this estimation, for instance, might in some cases not coincide with that of the currently active authorities.

It is stated that, while assessing its own income tax provision, Phillips 66 estimates the probability of its deferred tax assets being recovered for the future use to reduce taxation of the future income. Such valuation increases the likelihood of being able to realize deferred tax assets. However, the valuation also involves judgment, which means that mistakes in estimating the deferred tax assets can also lead to uncertainty and unexpected spending. If the deferred tax assets estimation often obtains imprecise results, the methods for valuation might require renewal (SEC, 2016).

Audit Issues

The financial statements of Phillips 66 were audited by Ernst & Young LLP, which is an independent accounting company. The audit firm found out that the “consolidated statements of income, changes in equity, and cash flows for each of the three years in the period ended December 31, 2015… present fairly, in all material respects, the consolidated financial position of Phillips 66 at December 31, 2015” (SEC, 2016). The “internal control over financial reporting” was also found efficacious in all material respects (SEC, 2016). Therefore, no specific audit issues arose.

Corporate Social Responsibility

According to the official website of the company, the enterprise’s vision (“Providing Energy, Improving Lives”) and values (“Safety, Honor, and Commitment”) serve as an approach to corporate responsibility (“Our Vision & Values,” n.d.). It is stated that the business strives to conduct its activities in a safe, efficacious, and reliable manner; provide contributions to the flourishing of the society, and economize and protect the planet’s natural resources and the environment (“Our Vision & Values,” n.d.).

It is also asserted that the corporation strives to carry out its operations in a manner that would be compliant with the highest ethical standards, participates in philanthropy, etc. Indeed, some external sources highlight that the company is among the most socially responsible enterprises in the U.S. (“Phillips 66 Earns High Marks,” 2013; Dividend Channel, 2013).

Transfer Pricing and Taxation

Transfer pricing is the process of creating the prices for goods that are to be purchased and sold by different structural divisions or other legal entities that exist inside one company. The area of transfer pricing may become a potential way to avoiding paying the proper taxes, for instance, when goods are sold at low prices by the divisions of the company located in regions where there are higher tax rates to the divisions situated in the regions with lower tax rates, thus artificially decreasing the income of the high-taxed divisions and increasing the income of low-taxed entities. However, it is apparent that the SEC 10-K report for Phillips 66 for the year 2015 does not contain information pertaining to transfer pricing and the related taxation issues (SEC, 2016).

The attempts to find this information elsewhere also yielded no success. Because of the positive assessment provided by the auditors, as well as the reputation of the company as a socially responsible enterprise, it is only left to suppose that Phillips 66 did not engage in unfair transfer pricing and use as a method to avoid paying taxes.

The Company’s Competitive Environment

It is stated that Phillips 66 operates in a market where there exist numerous rivals; for instance, the Midstream segment of the company engages in competition with petroleum businesses and gas transmission and distribution enterprises. At the same time, the Chemicals segment is ranked as one of the ten best manufacturers of the products if its lines. The Oil Refining and the Marketing & Specialties segments mostly conduct their operation in the U.S. and Europe, which means that the rivalry that they are faced with comes from these markets.

At the same time, according to some statistics, Phillips 66 is among the largest companies in the U.S. that refine oil products. It is also stressed that the company and its departments participate in the competition by the means of enhancing the products they provide, serving their customers in a high-quality way, providing a dependable supply, advertising, and striving to obtain their customers’ loyalty (SEC, 2016). In addition, the company’s official website emphasizes that among the competitive strengths of the enterprise are its robust portfolio and financial strength (“Competitive Strengths,” n.d.).

The main competitors of Phillips 66 are the Tesoro Corporation, Marathon Petroleum Corporation, Holly Frontier Corporation, and Valero Energy Corporation; all of these are based in the United States. At the same time, there exist other rivals not only in the U.S. but also in Europe, Japan, China, etc. However, Phillips 66 remains one of the leading companies in the world in its branch of industry (Morningstar, 2016).

References

Company overview. (2016). Web.

Competitive strengths. (n.d.). Web.

Dividend Channel. (2013). Phillips 66 a top socially responsible dividend stock with 2.0% yield (PSX). Web.

Morningstar. (2016). PSX: Phillips 66 top competitors and peers. Web.

Phillips 66. (2016). 2015 annual report. Web.

Phillips 66 earns high marks for corporate social responsibility. (2013). Web.

Our businesses. (n.d.). Web.

Our history. (n.d.). Web.

Our vision & values. (n.d.). Web.

United States Securities and Exchange Commission. (2016). Form 10-K. Phillips 66. Web.