The economical processes in the modern world are very complicated and the problems which appear in the powerful countries come through the whole planet. The same deals with the strategically important products, which influence the economy of the whole world, one of which is oil. The importance of oil and its impact on the modern economy is very important. Considering the modern economical and political situation and that which existed almost 60 years ago, in 1950s, it is possible to assume that the aspects which influenced the oil price formation and modern one are absolutely different. If oil reserves seem to be about the same now as they were in the 1950s, the price drives of oil and particularly gasoline would be different as the reserves of oil are one of the main price drivers in the modern economy.

Before concentrating attention on the price drivers on the oil today with the 1950’ reserves, the economical and political situation of both periods should be considered. It is significant to remember that 1930 – 1940th were the years of oil discovery in the United States and with the combination of cheap Saudi Arabia oil, the reserves of the oil were great and could not be the reasons for the oil price rise (Gautier, 2008). To confirm this idea it could be useful to provide the analysis of the oil price rise in 1900s and 2000s (Table 1).

Analyzing the data, it is possible to mention that the price from 1970 to 1980 rose greatly (in several times), and from 2000 till now was unstable and the skips were great. The situation may be explained by inflation and unstable political position in the world.

Table 1. The price for oil for barrel, $. (Oil Price Touches high for 2009, 2009)

The factors which influence oil price have always been different, but there are always the issues which are always taken into account, without referencing to the political and economical position. The price of the gasoline depends on the price of the oil, so it may be said that the main gasoline driver is the oil price. Being more concrete, the latest information shows that 57% of gasoline price is oil price, than, 18% of the gasoline price is the distribution and marketing, 18% taxes, and 6% refining (Gautier, 2008). These activities are reduced to minimum, and in some countries, the dependence may be different. As it is seen from the numbers, crude oil is more than half influencer of the gasoline price, and the increase of oil leads to the gasoline rise. But considering the same numbers, it is also seen that the crude oil price is not the main driver of gasoline price.

The reserves of oil are one of the main drivers of the price. The supply of oil in XXI century was reduced by the USA (Eco-Restrictions Cap Oil Production), but talking about the driver of oil price nowadays with the condition that its reserves as if in 1950s, this condition is not taken into account. One of the drivers of price, which did not exist in 1950s, but exists now, is the ecological restriction. From this point of view, less oil should be produces, and the reduction of production leads to the price rise.

Following the historical rise of price o9n oil, it should be mentioned that price increase since 1950 till 1970 was caused by “significant aggregate supply shocks, risking unemployment and rapid inflation” (McConnell & Brue, 2005, p. 305). In 1950s, the oil price driver was that oil influenced the USA economy greatly, and now this influence is not so great. Moreover, the vice influence took place, when the state economy influenced the oil price and was one of the main its drivers. Having the 1950s supplies of oil and the current position of affairs, when oil is not the main economical affair, the economical situation is the country is not the main oil drives in the USA. Mentioning the inflation, it was noticed that the oil price was influenced by inflation in 1950, but not taken into account greatly nowadays (McConnell & Brue, 2005).

The economical situation in other countries, which influence the global economy also can either reduce or increase the price of oil in the USA. This effect is present nowadays and was visible in the discussed period, 1950s. The example of Asia may be taken into account, when the economical crisis there in 1998 caused “the oil price collapse” (Gautier, 2008, p. 102). Different political changes and economical rise or crisis influence the oil, and as it was proved, the gasoline prices greatly.

Oil production and demand influence the oil price, and the notion of reserves is not to the point in this question. The assumption that the rise of the oil price will lead to the reduction of the demand are not proved. Modern world is the world of cars. People have used to personal cars that even the oil (and as a result gasoline) rise does not reduce the demand (Gautier, 2008). Such situation was in 1950s, and remains in present times. So, it is impossible to say that the rise of price will reduce the demand, so demand may not be counted as the price driver in any situation (present time and 1950s).

The production of oil influence the price and it is the proved factor. When global factors influence the rate of production, the price of the oil rises, and gasoline as the result also goes up. The production of the oil does not depend greatly from he reserves, so this factor can be taken into account dealing with the price drivers for oil with the 1950s reserves.

Thinking logically, the modern crisis is impossible to miss, as the world crisis, which exists today, is one of the reasons why oil price increased and the reserves are not taken into account. The reason is not the oil shortage, but the change of the economical situation in the world, when all priorities and values have to be checked and evaluated from other points of view. The critical condition is some of the world companies, the change of the financing and other aspect has influenced the oil prices all over the world.

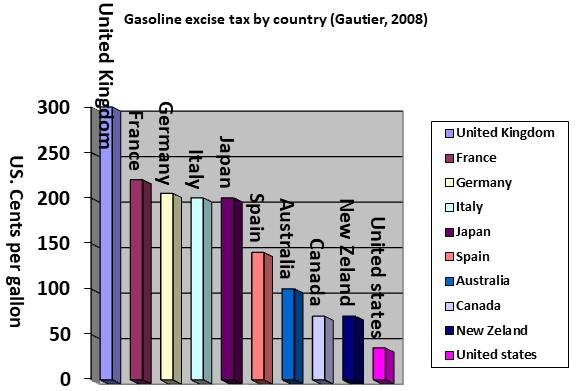

Taxes, as was mentioned above may influence the gasoline price without oil price change. To explain this, it is possible to look on the activities, according to which the taxation in different countries takes place. The diagram, which is offered below shows the different of taxation in different countries. Considering the activities, it is possible to say that taxation in the United States of America are the lowest among offered and that the taxation may not be the main influencer on the gasoline price in the USA.

So, considering all the information which was offered, the conclusion about the drivers of oil (gasoline) price in the USA today with the reserves of 1950s may be as follows. The oil price could influence (1) the economical position in the country and (2) in the world (the present crisis is meant in this situation). (3) The inflation, influenced the oil price in 1950s, and could influence the price now. (4) The rate of production of the oil, which does not depend on the reserves of oil, as it is two different activities which influence each other but not directly. (5) The ecological restriction, which demands to produce less oil as its production influence the ecosystem of the whole world and the problems in the environment appear.

Talking about the price of gasoline, the situation is not so different, as gasoline price for more than 50% consists out of crude oil price. Then the taxation and refining influence, but investigations show that he taxes in the USA are not so influential in the reference to other countries, where the taxation per galloon may consist out of 300 cents (in the United Kingdom). In contrast with the USA, this number is 35 cents per galloon. Refining also could influence the price as the technologies, which exist in modern world may reduce the costs on oil refining.

In conclusion, the oil and gasoline price in modern world with the reserves of 1950s would influence all the factors which influence the price of oil and gasoline nowadays, but without the problem of shortage reserves which exist in the United States today. The 1950’s were taken as the reserve example not by chance, but because the 1930-1940s were the years when the new oil deposits were discovered in the United States and 1950s were the years when its reserves were maximum in reference to 2009.

Reference List

Eco-Restrictions Cap Oil Production. (2008). BusinessWeek.

Gautier, C. (2008). Oil, water and climate: an introduction. Cambridge: Cambridge University Press.

McConnell, C. R. & Brue, S. L. (2005). Economics: Principles, Problems, and Policies. McGraw-Hill Professional, New York.

Oil Price Touches high for 2009. BBC News.