Introduction

Capital is the heart of a business. Every decision is taken based on capital. The financial managers must think about the cost of capital and the expected rate of return while choosing a project for investment. The cost of capital is a bridge between the firm’s decision of investing in a long-term project and the assets owned by the stockholders. It plays a vital role to decide whether a proposed investment will push up or push down the firms’ stock price. Gittman (2003) defines the term “cost of capital” in his book named “The Principle of management Finance” as ‘the rate of return that a firm must earn on the project in which it invests to maintain the market value of its stock’.

The Weighted Average Cost of Capital

There is a question here is what does the ‘weighted average cost of capital and ‘cost of capital’? Before proceeding on it should be noted that a firm can arrange its entire finance with common equity. But almost all the firms arrange several capitals calling capital components including:

- Common Stock

- Preferred Stock

- Post Stock

These three components have a common character and that is every investor wants to have a positive rate of return from this investment.

Example on ‘National Computer Corporation

NCC has a plan to finance 30 percent debt capital, 60 percent common stock equity, and 10 percent preferred stock. It is the target capital structure of NCC. A company may decide to issue common stock if the market is strongly efficient. Next, about the very important flotation cost. It is fixed to large extent, so it would be higher if the capital amount is small. So it will not be wise to issue comparability small amount debt, common and preferred stock. Therefore, it would be wiser and relatively efficient for a company to issue common stock for one year, use debt capital for the next couple of years, and preferred stock for the following years. It can be a confusing situation for a manager and it may lead to a serious error. To make it more clean let’s set an example. NCC (National Computer Corporation) is planning, raise capital to finance for the project of next year and they also have set up a target capital structure. They can use the debit and equity combined but if they want to minimize flotation cost they should use either debt on equity. Suppose, the NCC is planning to issue debt for 8 percent cost. As there is only debt at the cost of 8 percent to be used, so one can think wrong that the capital cost of this year is only 8 percent. Now, assume, the company borrows at the cost of 8 percent during 2005 using the debt capacity for supporting the project which yields 10 percent. In the year 2006, it finds new projects at yielding 13 percent which is much higher than the return on 2005 projects. As it used the capacity of debt up 2005, it issue equity costing is 15.3 percent. Here the company might not accept the project of 13 percent because in this project the financing cost is 15.3 percent. However, the total process of capital budgeting might be incorrect, because it is wiser for the company to accept 10 percent projects only one year, and then 13 percent projects for the next year. Brigham and Enrhardt (2003) made this sense clear in their book as:

“To avoid such errors, managers should view companies as ongoing concerns, and calculate their costs of capital as weighted averages of the various types of finds they use, regardless of specific source of financing employed in a particular year”

Every firm plan for an optional capital structure which is a combination of debt, preferred stock, and common stock which leads to maximizing the stock price. Every penny of new capital which is obtained by NCC would be at the average consisting of 30 percent debt with 6.6 percent after-tax cost, 10 percent preferred stock with 10.3 percent cost and 60 percent common stock with 14.5 percent cost. The weighted average cost is 11.7 percent. One thing can not be left unmentioned and that is the WACC is affected by the level of interest rate, Market rise premium, and tax rates.

Adjusting the Cost of Capital for Risk and Final Decision

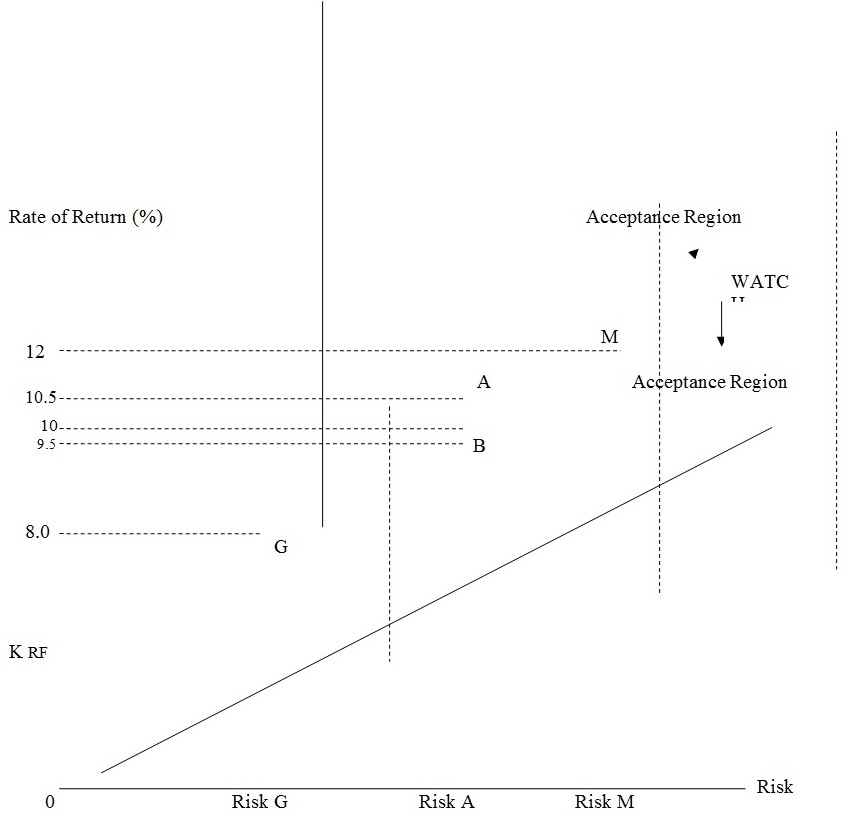

The following figure will show a composite, WACCs for every organization and will present the difficulty rate of a typical project for every business organization. Every project has different risks. The rate for every project could show the risk of the project itself, for example, the firms G and M are taking into account the same project A, the risk of the project is more than typical firm L what less risky than that of H. as shown in the following figure:

As per the figure, the expected return of project -A is 10.5 percent which is higher than its 8 percent WACC (Weighted Average Cost of Capital) and less than M’s 12 percent of WACC. So firm H should turn the project down. Both firms should accept project – A. Next, the expected return of project – B is 9.5 percent which is higher than its 10 percent hurdle rate. So project – B should be rejected.

References

Brigham, Eugenef. and Enrhardt, C. Michel. (2003). Financial Management Theory and Practice. International Student Edition.

Gittman, J. Lawerance, (2003). Principle of Managerial Finance. 11 ed. Princeton Hill.