Executive Summary

Primerica successfully competes in the insurance industry of the United States and Canada, but the company needs to improve its position in the market in order to address customers’ growing interest in insurance and financial products. The external and internal analyses of Primerica’s current strategy and performance have indicated that the company needs to apply a new strategy for the purpose of responding to the market trends.

On the one hand, Primerica should focus on diversifying its products and services to expand the range of proposed life and health insurance plans and financial assistance. On the other hand, Primerica should develop an effective expansion strategy in order to cover oversea markets. As the development of an expansion strategy is rather prolonged and challenging, the implementation of the diversification strategy is recommended as a cost- and time-efficient decision leading to the company’s financial progress.

According to the proposed strategy oriented toward expanding the range of offered products, the following steps should be completed: the analysis of customers’ needs, expectations, and market demands; the determination of the required resources; the development of new products; and promotion. The implemented strategy associated with the diversification of products will lead Primerica to the better position in the market because of offering both quality and diverse products that are interesting to customers. As a result, Primerica’s sales will be steadily growing during the next five years according to the financial projections for the company.

Introduction to the Company

Description of the Firm

Primerica specializes in offering insurance and financial services, operates in financial and healthcare sectors, and it is headquartered in Duluth, Georgia. Currently, Primerica promotes its diverse financial products according to the principles of multi-level marketing in the United States and Canada, having more than 2,000 full-time employees, not including independent representatives (“Primerica, Inc.,” 2019). Products and services of the company consist of life and long-term care insurance plans, auto and home insurance types, managed accounts, financial management plans, and different types of funds monitoring.

Company History

Primerica was founded by Arthur L. Williams in 1977 to provide clients with opportunities to receive financial protection and insurance, and initially, the company mainly offered insurance plans. During the period of the 1970s-1990s, Primerica merged with different financial corporations, including Citigroup. In 2009, Primerica was separated from Citigroup according to the principles of the initial public offering, and in 2011, Citigroup sold all its remaining shares. Currently, the company’s management and leadership are represented by D. Richard Williams, Chairman of the Board, and Glenn J. Williams, CEO of Primerica (“Primerica, Inc.,” 2019). The company’s key competitors in the sphere of insurance are Metlife, Allstate, Haven Life, Transamerica, and others.

Vision and Mission Statements

Primerica is focused on becoming a leader in the US, guaranteeing protected future for all social classes. Managers need to clearly formulate what Primerica wants to become in the future to guide the strategy. The company’s mission is to assist different families in becoming carefully protected, financially independent, and free of any debt (“Primerica, Inc.,” 2019). This mission statement does not allow for distinguishing the company among its competitors because it does not reveal Primerica as environmentally responsible, and it does not include such components as the product, market, technology, profits, public image, and employees (David & David, 2017).

The provided statement is broad in scope; it is focused on customers and philosophy. From this perspective, Primerica’s mission can be revised and re-written in order to guarantee that all the elements of good mission statements are included in it to provide an effective background for formulating appropriate strategic goals to achieve. Specific strategies that are based on these goals will be used for completing the company’s vision and mission.

External Assessment

EFE and CPM Matrices

The influence of external factors on Primerica’s position in the market should be assessed with reference to the External Factor Evaluation (EFE) matrix and the Competitive Profile Matrix (CPM) (Tables 1-2). Associated strategic implications include the necessity of reconsidering approaches to realizing the MLM strategy.

Table 1. EFE Matrix for Primerica.

Table 2. CPM for Primerica.

Analysis of the Competitive Position, Opportunities, and Threats

Primerica’s final score is higher than the average in 2.5, indicating that the company can successfully use available opportunities for its progress and address potential threats. Much attention should be paid to addressing the increased demand for insurance and financial services among customers to improve profitability. Furthermore, it is also necessary to continue promoting the positive image of Primerica as a trustworthy financial company despite applying the MLM strategy. The current competitive position of Primerica should be improved while evaluating its performance in the context of competing with other insurance companies as its score is the lowest. Primerica needs to apply more effective marketing strategies to fight competitors.

Thus, the analysis of the competitive position, as well as the company’s opportunities and threats, is important in order to demonstrate what potential risks and benefits Primerica can face in the future. Additionally, the organization will reveal a particular direction for changing ineffective strategies in order to achieve the set goals. It is important to note that, in spite of being among the leaders in the market, Primerica needs to continue the regular analysis of its position to decide regarding new projects to develop and changes to implement in order to improve its current position in the industry.

Internal Assessment

Financial Ratio Analysis

Primerica’s current ratio is 4.94, the profit margin is 17.09%, and the return on assets is 2.46% (“Yahoo Finance,” 2019). These ratios indicate that Primerica can successfully address its short-term liabilities, and its profit ratio is rather high to generate much profit for received revenues (Katsioloudes & Abouhanian, 2016). Additionally, the comparably high return on assets indicates that the company successfully utilizes its resources to get profit. Therefore, the strategy should not be revised depending on these ratios.

IFE Matrix

Table 3 represents the Internal Evaluation Matrix (IFE) for Primerica, and related strategic implications include the necessity of focusing on increasing the customer base, expanding the company’s services in North America, and improving the MLM approach.

Table 3. IFE for Primerica.

Analysis of Internal Capabilities and Implications for Strategic Decisions

The financial analysis of Primerica’s performance and profitability, as well as the analysis of its strengths and weaknesses, indicates that the company remains profitable for many years because of attracting many customers. The analysis of internal capabilities and implications allows for finding out whether the observed performance of the company in terms of its profitability, competitive advantage, and other strengths and weaknesses can reflect executives’ visions and purposes regarding the company’s future development.

On the one hand, using services of thousands of independent representatives in the US and Canada, today Primerica can address millions of people to insure their lives and provide financial assistance. On the other hand, the limitations of the MLM strategy in terms of increasing customer loyalty do not allow the company to become a leader in the industry. Along with promoting expansion strategies, the revision of the MLM approach will lead to Primerica’s growth.

Current Strategy and Use of Technology

Currently, Primerica works to improve its strategy related to representatives’ operations. The focus is on designing tools for representatives that can be used in order to facilitate their contacts with managers and potential customers using online and offline resources. As the success of the company’s operations and sales depends on the efficiency of the information exchange model used by representatives and customers, much attention is paid to offering certain technologies for employees to improve their performance and increase their productivity. Thus, Primerica uses Primerica Online as a web-based resource in order to organize the work of representatives (Primerica Online, 2019).

Furthermore, technologies and online resources are used for advertising services and products as well as for recruiting new employees in order to make the MLM model work effectively, providing all representatives and recruiters with bonuses (Primerica Online, 2019). The use of technologies for supporting Primerica’s strategies is important because the company’s profitability highly depends on the number and performance of representatives.

SWOT Matrix

The Strengths-Weaknesses-Opportunities-Threats matrix allows for generating strategies for a company at the matching stage of the strategy analysis in order to demonstrate how an organization can address weaknesses in its course and potential threats with the help of available internal strengths and available opportunities. As a result, it is possible to formulate certain SO, ST, WO, and WT strategies to implement them in the selected organization (Sarsby, 2016). Table 4 represents the lists of the proposed SO, ST, WO, and WT strategies for Primerica.

Table 4. SWOT Matrix.

The strategic implications for the company include the following steps among others: the development of new variants of insurance plans and financial services. As a result, it will be possible to address the increased demand for insurance- and finance-related services for individual clients. In addition, it is also necessary to develop an effective expansion strategy for the company in order to propose its products not only in North America. Much attention can also be paid to educating potential customers and representatives regarding MLM models to accentuate the advantages of such strategies for both representatives and clients. The focus should be on the development of the positive image of the company with reference to the applied MLM strategy.

BCG Matrix

The Boston Consulting Group (BCG) Matrix allows for analyzing Primerica’s business portfolio based on the proposed services and products. Figure 1 demonstrates how different types of products offered by the company can be viewed as its Question Marks, Stars, Cash Cows, and Dogs (Pruschkowski, 2018).

The application of this matrix has the following strategic implications: Primerica needs to continue horizontal integration, product development, and diversification in relation to its Stars and Cash Cows, including life insurance products and financial services. Question Marks (auto and homeowner insurance) need to be analyzed in order to decide on the further investment in this sector (“Primerica Inc. (PRI),” 2019). Dogs (debt solutions) need to be evaluated to conclude regarding the change or liquidation of this sector.

Figure 1. BCG matrix.

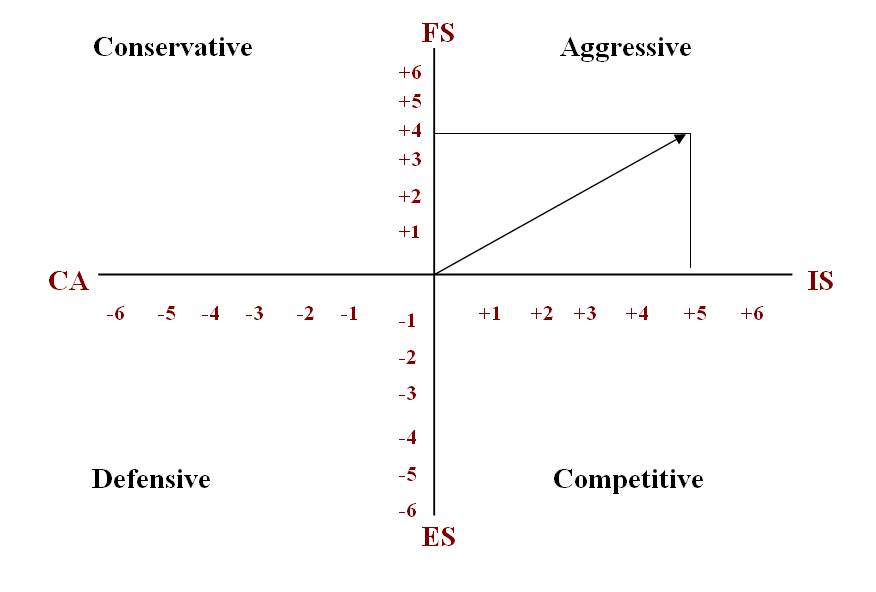

SPACE Matrix

The Strategic Position and Action Evaluation (SPACE) Matrix is an effective tool to indicate what type of a strategy (aggressive, conservative, competitive, or defensive) is currently followed by a company. The axes of the matrix allow for creating the dimensions regarding a company’s financial, competitive, stability, and industry positions to focus on during analysis (Ansoff, Kipley, Lewis, Helm-Stevens, & Ansoff, 2018).

Certain variables were identified for characterizing Primerica’s financial, competitive, stability, and industry positions. Thus, the company’s financial position is determined by the following variables: profitability, liquidity, the current ratio, the profit margin, and the return on assets that have been identified during the financial ratio analysis.

The company’s competitive position can be described with reference to the product quality, customer loyalty, and market share. According to these parameters, Primerica’s competitive position is high. The company’s stability position is determined by market risks, market competition, and the impact of technologies. Primerica’s industry position can be discussed as high, and it depends on such variables as the utilization of resources, profitability, growth, and productivity. Figure 2 represents the company’s directional vector being in the Aggressive Quadrant according to the variable analysis.

The strategic implications of the analysis of this matrix for the company are the following ones: Primerica can be described as a financially successful firm that effectively competes with its rivals using comparably appropriate strategies. To improve its performance, the company can apply strategies for companies having Aggressive profiles: horizontal integration, diversification, and market and product development (David & David, 2017). The application of these strategies will lead the company to further progress.

Strategic Alternatives

The analysis of the completed matrices indicates that Primerica can focus on realizing a range of possible strategic alternatives in order to improve its current position in the market in comparison to rivals. Thus, Primerica can concentrate on product development, diversification, and differentiation in order to offer customers more insurance plans and financial services meeting the market demand. Different types of insurance plans and investment and savings products remain to be the company’s Stars and Cash Cows that need to be further diversified to gain more profits. Additionally, Primerica can further apply technologies in order to expand and attract more representatives and clients while increasing the public’s awareness of features of the MLM strategy with reference to its advantages.

Evaluation of the Current Organizational Structure

Primerica’s current organizational structure can be described as divisional by the product and geographic area. Divisions by products and services were built in order to organize the focused work of satisfying clients’ needs. Thus, the following divisions currently exist in Primerica: Primerica Financial Services, Inc., Primerica Life Insurance Company, PFS Investments Inc., and Primerica Financial Services Home Mortgages, Inc. (“Primerica Inc. (PRI),” 2019). Employees in these divisions are responsible for providing different types of high-quality products and services to customers depending on their needs. Additionally, Primerica operates in Canada as Primerica Life Insurance Company of Canada and PFSL Investments Canada Ltd.

Recommended Changes and Values to Create the Desired Culture

The values to create the desired culture in Primerica include integrity, ethics, innovation, and respect. The current culture of the company is based on these core values, and no changes are required because Primerica guarantees the fair and ethical treatment of its employees and clients. Furthermore, stakeholders are treated with respect, and their needs are addressed with the help of innovation and new tools.

However, it is still possible to recommend some changes to the organization’s processes and the use of technologies. As Primerica applies the MLM strategy, it is important to improve Primerica Online in order to provide representatives with an easy communication and support tool. Furthermore, it is also possible to recommend such changes in processes as providing more education for representatives in order to improve their productivity and educate remote representatives in European countries in the case of the company’s expansion.

Strategic Analysis, Choices, Impact, and Measurement

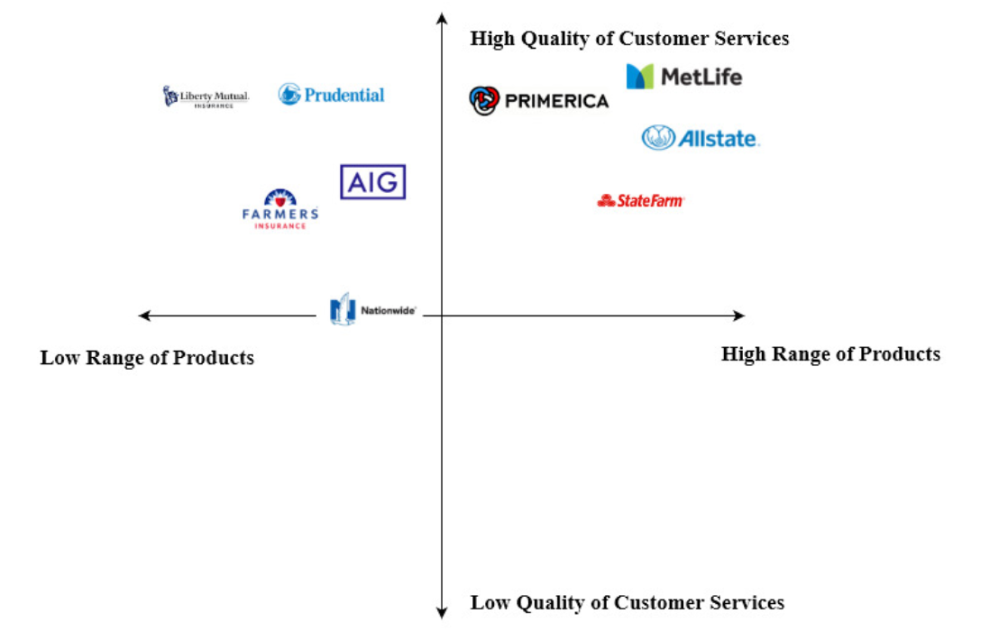

Product-Positioning Map

Such criteria as the quality of services proposed to customers and the range of products or insurance plans offered by insurance companies have been selected for determining the market position of Primerica against its competitors. Figure 3 represents that Primerica successfully competes with such its rivals as MetLife, Allstate, and State Farm in terms of offering diverse high-quality products. However, in spite of the fact that Primerica’s position in the market is rather high according to customers’ perceptions, it is still possible to broaden the range of products and insurance plans offered by the company in order to compete with the organization’s rivals (“Primerica, Inc. (PRI) balance sheet,” 2019).

The vacant niche for the company in this case is the area of expensive but high-quality diversified products that are currently proposed by MetLife and Allstate in the market. In this context, the focus should be on expanding the variety of insurance plans related to life and health insurance.

Evaluation of Strategies and Objectives

In order to achieve the most favorable market position for Primerica, it is necessary to focus on developing certain strategies to implement. The preferred strategic position for Primerica according to Figure 3 is currently taken by MetLife as a leader in the insurance industry. Therefore, the annual objective for Primerica is to expand the variety of life and health insurance plans proposed to customers in order to improve its position regarding the range of products offered because the company’s position related to the quality of products is comparably high according to clients’ views and assessments.

The effective strategy for addressing this objective should include the following steps: a) the determination of customers’ needs regarding insurance plans; b) the examination of the market trends regarding actively purchased insurance plans and financial services; c) the determination of resources required for changes. The final steps are the expansion of the product range to address the identified needs based on the development of new insurance plans and advertising. This strategy can be discussed as appropriate in order to address the formulated objective and change the company’s position in the market. This strategy can also be viewed as feasible and advantageous for Primerica because it is mainly based on available resources.

Description of the Strategy Implementation

In order to apply the diversification and differentiation strategies, Primerica should refer to available financial and human resources it possesses. However, while focusing on proposing innovative insurance plans and financial services, Primerica is expected to recruit consultants in the insurance field in order to cooperate with the company’s marketers regarding the development of the most innovative and attractive range of products to meet customers’ demands. Additional funds are required for the development of new products and insurance plans, and much attention should be paid to attracting investors through promotion and advertising.

The number of representatives should also be increased in order to represent new products and influence the sales of existing services. Furthermore, additional training and education need to be proposed to representatives. From this perspective, the effective implementation of the strategy depends on extra financing in the following segments: product development, recruitment, training and development, and marketing and promotion. The time required for the strategy implementation is 12 months because of the necessity to develop new attractive insurance plans for customers in terms of their price and proposed options.

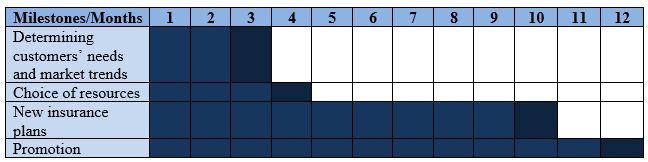

Milestones

During the strategy implementation process, several milestones can be identified. The first milestone is associated with the determination of customers’ specific needs and expectations regarding insurance plans and the examination of the market trends. The result of this stage will be observed in three months, and it will be the list of attributes to reflect in new insurance plans that address modern market trends. The next milestone is associated with the determination of particular human and material resources required for implementing the changes. The outcome will be observed in four months after starting the strategy implementation process.

The other milestone is the development of new insurance plans to respond to customers’ demands, and it will be completed in ten months. The next milestone is the development of an effective promotional and advertising strategy to be realized within two months. Figure 4 presents the timeline for milestones.

Specific Results to Achieve

Specific expected results include changes in the product diversification, the increased sales, and the improved reputation and brand loyalty among customers. The outcomes will be measured in one year after the start of the strategy implementation process with the help of customer-oriented surveys and the analysis of financial ratios. Thus, it is critical for Primerica to add more products and services to the proposed range and develop new insurance plans in the field of life and health insurance, as well as financial services, with reference to the most popular trends in the market and innovative approaches.

Financial Projections for Five Years

The implementation of the proposed strategy will potentially lead to certain changes in Primerica’s income statement and balance sheet for the following five years. The goal of the proposed strategy is to increase the sales and income of the company while minimizing overall liabilities and the company’s dependence on investors’ funds. The implementation of the strategy oriented toward the diversification of products and services can potentially lead to further improvements in Primerica’s financial state.

According to the projections presented in Table 5, the focus should be on the key financial highlights important to understand Primerica’s potential performance during five years (“Primerica reports third quarter 2018 results,” 2018). It is possible to expect stable increases in total revenues (sales) by about 8% annually (Primerica, 2018). Furthermore, it is also possible to expect the higher dependence on credits and shareholders’ capital during 2019-2020 because of the increases in expenses associated with the implementation of the proposed strategy.

Table 5. Financial Projections (in Millions).

From this perspective, referring only to the key financial highlights, it is possible to state that Primerica will gain benefits from implementing a new strategy. However, the overall growth will be gradual, and the more active progress will be associated with the implementation of other strategies oriented toward the company’s expansion into other countries and markets among other alternatives. The proposed strategy is mainly developed to improve the company’s current positioning in the market to effectively compete with rivals.

References

Ansoff, H. I., Kipley, D., Lewis, A. O., Helm-Stevens, R., & Ansoff, R. (2018). Implanting strategic management. New York, NY: Springer.

David, F. R., & David, F. R. (2017). Strategic management: A competitive advantage approach (16th ed.). Boston, MA: Pearson Education.

Katsioloudes, M., & Abouhanian, A. K. (2016). The strategic planning process: Understanding strategy in global markets (2nd ed.). New York, NY: Routledge.

Primerica. (2018). 2018 Annual report. Web.

Primerica Inc. (PRI) – Company profile. (2019). Web.

Primerica Online. (2019). What is Primerica Online? Web.

Primerica reports third quarter 2018 results. (2018). Web.

Primerica, Inc. – Home. (2019). Web.

Primerica, Inc. (PRI) balance sheet. (2019). Web.

Pruschkowski, M. (2018). The BCG matrix and its support of management decision making. New York, NY: GRIN Verlag.

Sarsby, A. (2016). SWOT analysis. London, UK: Leadership Library.

Yahoo Finance – Primerica, Inc. (2019). Web.