Introduction

The system is done via a process cost system adopted depending on the management style. These systems basically apportions average costs to each unit produced unlike in job costing where individual costs are allocated to each unit produced. Therefore, process-costing systems allocate costs to batches of products and not single units. Process costing systems are suitable in industries that produce similar products in large quantities. In such a case, it means that direct materials, direct manufacturing labor costs and manufacturing overheads will be uniform in the production process. The cost of manufacturing a product is critical in the computation of inventory, making pricing decisions and in analyzing the profit that is derived from the manufacturing process (Warren, Reeve & Duchac, 2011). Below are process cost systems that are commonly used in some industries.

Process costing systems are applicable to products that are different in nature and are produced on a continuous basis, similar in nature and are produced continuously and individual units that are tailor made. Therefore, they are applied to goods produced based on a customer’s specification and items purchased from vendors. Some of the costing methods under process costing are as below.

First in First out (FIFO)

This method is mostly used in the handling of materials and finished goods in a manufacturing company. Under this strategy, costs are charged in a chronological manner. This means that costs are charged depending on the time of arrival/acquisition of the materials or goods. For instance, if a company purchases raw materials in the order of A – $ 120, B – $ 150, C – 170, the same order will be followed during the allocation of expenses. These method is suitable since it utilizes goods/materials which were acquired earlier therefore reduces the risk of goods expiring or being out of date. Furthermore, during stocktaking, it means that the costs to be reflected in the balance sheet relate to recent purchases. It helps company during times of increasing costs to set a pricing strategy. By using first in first out, the company can delay increasing its sales prices until lower cost products are exhausted. The increase will then occur when it will start higher cost products.

Last in First Out

According to this process-costing model, the materials issued to the production process should reflect the most recent prices in the market. This may be regardless of the actual flow of the physical products. The method works on the assumption that the recent costs incurred in the purchase of the materials should be reflected in the prices and subsequently in the revenue obtained by the company i.e. matching cost with revenue.

The most recent costs are charged in the production process while the older costs in the inventory are ignored. The argument used by the proponents of the system is that current costs incurred during acquisition are aimed at facilitating current production (Warren, Reeve & Duchac, 2011). Therefore, the costs should be reflected in the current production. This method provides a cash advantage to company’s using it since they employ the recent costs to older inventory that may have had a lower cost.

Weighted Average Method

Under this method, costs are calculated based on equivalent units of work done to the reporting date regardless of the time taken for the production. This method seeks to even out units costs from one period to another. Additionally, this method determines equivalent units of production for a section of production by adding together the number of units produced and transferred out plus the equivalent units in the final work in progress inventory (Warren, Reeve & Duchac, 2011).

Illustration of the use of weighted average costing method

The following is an illustration on the use of the weighted average costing method in computing the average cost of a product. The fictitious company in this case manufactures potato crisps. The raw materials for the product are potatoes and cooking oil. DBC is a company in the manufacturing business. The company recorded the following activity for the month of April 2012 in the production department.

Percentage completed

To identify the number of units completed and transferred out of the department in the month of April.

Materials – 5,500

Conversion – 5,500

To identify equivalent units of production in production from the ending work in progress with respect to materials.

Work in progress April 30 – 1000

60*1000 = 600

Total units (Materials) = 600 + 5,500 = 2,100 units

Identification of equivalents units in the ending work in progress with respect to conversion.

1000 * 30 = 300

Add to 5,500 = 5,500 + 300 = 5,800 units

Assuming the following, costs were incurred by the company;

Beginning work in progress inventory: 400 units

Materials: 40% complete $ 5,000

Conversion: 20% complete $ 3000

Costs added to the production process

Materials $ 110,000

Conversion $ 80,000

Computation of Cost per unit = Cost of the beginning WIP inventory + Cost added during

Units produced

Materials Conversion Total Cost

Work in Progress April 1

5,000 3,000 8,000

Costs added

110,000 80,000 190,000

16,000 83,000 270,000

Apportionment of cost per unit = 16,000 /2,100 = $ 7.6

83,000/5,800 = $ 14.3

The two costs are then computed for each product to get the total value of product produced.

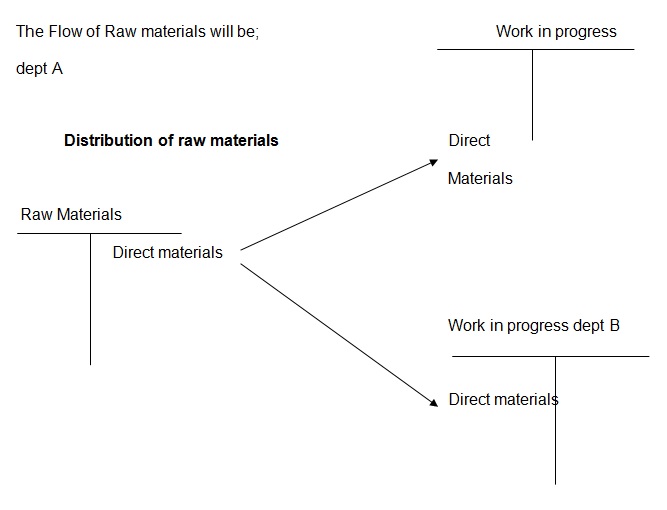

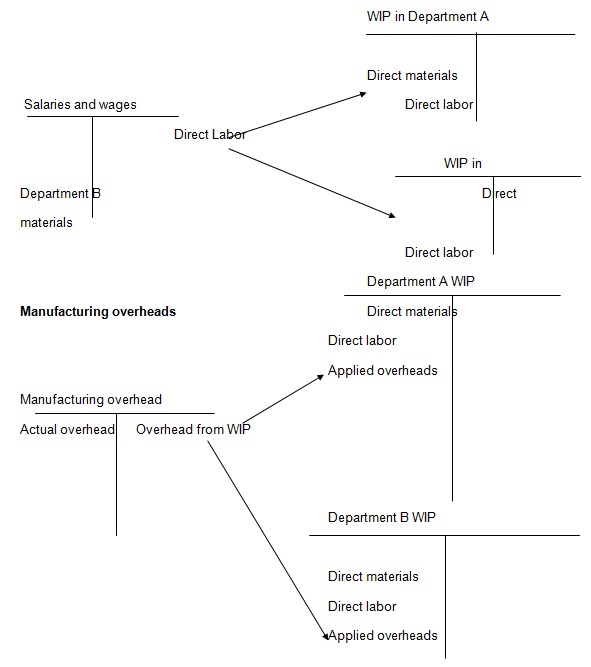

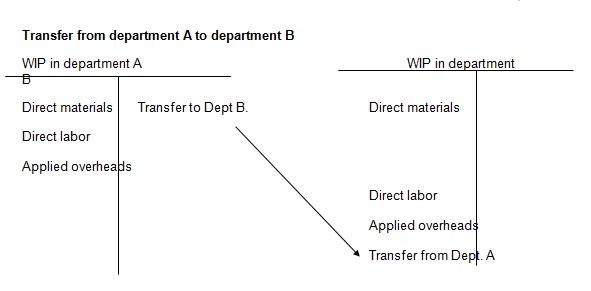

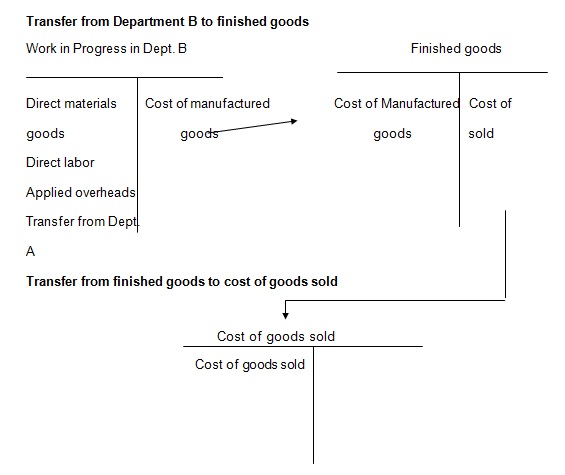

Assuming a company has two departments A and B.

Salaries and Wages form part of the overheads

Reference

Warren, C., Reeve, J. & Duchac, J. (2011). Managerial Accounting. Ohio: Cengage Learning.