Introduction

This report covers different aspects of procurement by companies. It focuses on the role of the finance function, quality management, supplier development and its challenges, risks associated with different types of contracts, avoidance of litigation, purchasing performance, and acceptance of a discounted price. Furthermore, this report includes calculations of ordering costs and forecasting methods.

The Role of Finance Function (Q1)

The purchase function and finance function work together to furnish purchase orders and fulfill the requirements of the business. The finance department determines the available sources of funds and informs the purchasing department about the possibility of completing their purchases. The purchasing department is related to the operations of a business, which regularly monitors the requirements of the production process to ensure that it does not halt at any time due to the shortage of supplies. It is not concerned with the availability of finance; instead, it is responsible for the continuation of the production process.

Therefore, it places purchase orders to suppliers or sends them to the finance department for approval. This department decides to assess whether the purchase order can be completed or not. The cost of maintaining a certain level of inventory and reordering of supplies also need to be monitored and decided by the finance function. The finance management draws limits to the purchasing that the company can make. It knows the level of funds available and plays a leading role in negotiating the terms of payment with the seller. It is in a better position to negotiate a price discount or a more extended payment period, for example, if the company has cash shortage, then the finance management can negotiate credit terms with suppliers and make payments when the firm’s cash position improves.

In the same way, the finance department is responsible for large accounts receivable and related losses (Lasher, 2017). Therefore, it can be stated that the finance department plays a crucial role in sustaining the financial viability of the business. The purchasing and sale departments cannot operate efficiently without effective management of the finance function.

Quality Management (Q2)

It is crucial for manufacturing companies to ensure that they have an uninterrupted supply of materials for production. It is argued that quality is an important factor throughout the firm’s supply chain. Moreover, it is essential for the purchasing department to make sure that the desired level of quality is maintained throughout the production cycle, starting from the acquisition of supplies to the development of the final product. The purchasing department works with suppliers so that they comply with its quality requirements. This has a direct impact on the production process and the costs associated with it. If the quality of supplies is unsatisfactory, then the company will incur high costs due to production losses. It implies that the purchasing department needs to perform quality checks at all stages of the supply chain (Musau, 2015). It performs inspections during the manufacturing process and receives quality reports from the production function.

The production department provides its requirements for supplies to the purchasing department, which then works with suppliers to fulfill its requirements, including physical description, dimensional requirements, chemical composition, industry standards, and performance specifications. It ensures that the production process continues without problems and the final product to be delivered to customers meets their demands or specifications. If the process is examined backward, then it could be stated that the purchasing department is responsible for attaining the desired level of quality that the company wants to offer to its customers. It is the responsibility of the purchasing department to find suitable suppliers who can meet the increasing demand for production and, at the same time, do not compromise the quality of supplies (Monczka, Handfield, & Giunipero, 2016).

Supplier Development (Q3)

Supplier development refers to the process through which companies establish and maintain close working relationships with certain suppliers to achieve a high-level of organizational efficiency. In this arrangement, firms work with specific suppliers on a one-to-one basis to assist them and improve their capabilities, performance, and quality that would ensure timely delivery of products and services. Therefore, it is essential for companies to create a network of suppliers who can confirm that their products will meet business requirements (Monczka et al., 2016). Moreover, it helps in lowering the cost of inputs by effectively managing relationships with suppliers. However, it is argued that this is not an easy task, and the outcomes of the firm-supplier relationship are not always fruitful. It often leads to a significant loss to both entities in terms of time and higher costs.

I agree with the statement of Chrysler’s executive as it is not possible to maintain 100% successful relationships between companies and suppliers. It also means that companies must develop relationships with multiple suppliers to avoid any disruption. There are various reasons for the failure of supplier development efforts. The primary reason is the differences in the organizational framework, approach, culture, values, and financial objectives between firms and suppliers. The problems between firms and suppliers intensify in the absence of effective leadership or ownership as most of the vendors are reluctant to commit their resources to innovation or improvement. Although such relationships initiate with common goals, they become difficult to manage as the deal or project expands in scope, and the lack of trust between entities worsens (Genovese, Koh, Kumar, & Tripathi, 2014).

Moreover, expectations on both sides may change, and supplier relationship managers need to address them beyond contractual terms. It is also common that companies and suppliers operate in different markets, which makes it challenging to monitor suppliers’ activities. Furthermore, interventions by the government or regulatory bodies can make it challenging to continue a business arrangement, for example, a Chinese firm is recently banned in the US, which is likely to affect the telecom industry that depends on its products and services. Thus, it could be stated that many uncontrollable factors affect supplier development.

Risks Associated with Contracts (Q4)

Various risks associated with the three types of contracts, including fixed-price, incentive, and cost-based contracts are discussed in the following.

Fixed-price Contracts

These contracts have a fixed-price term, which means that the price of goods or services cannot be altered based on the contractors’ cost experience. Buyers face the risk of incurring a high cost of procurement (Eckerd & Girth, 2017). It means that the buyer has to pay a higher price despite a reduction in the cost of goods or services. However, fixed-price contracts have the least risk for the buyer. In this case, the Sharpe ratio is 0/100, which implies that the entire burden is on the contractor to make sure that goods or services are rendered within the set time at a price decided in the contract (Nyambuu & Tapiero, 2018).

Incentive Contracts

These contracts combine fixed price and incentive terms, which implies that the buyer pays additional compensation to the contractor if it fulfills all requirements of the contract. In this case, there is a higher risk to buyers in the case of inappropriate incentive measures for assessing the performance of the contractor (Eckerd & Girth, 2017).

Cost-based Contracts

There are three variations of cost-based contracts, namely Cost-Plus-Fee (CPF), Cost-Plus-Fixed-FEE (CPFF), and Cost-Plus-Incentive (CPIF). In all of these contracts, the buyer bears a high risk of paying the cost plus additional compensation (Eckerd & Girth, 2017). If the contractor overruns the procurement cost, the buyer is still responsible for paying this amount.

Avoidance of Litigation and Purchasing Performance (Q5)

Litigation is one of the seven different methods of dispute resolution in which the case is submitted to the court and facts are presented to the independent jury that decides the dispute which has to be accepted by all involved parties. However, this method is avoided by many firms in settling contractual disputes due to the high cost of litigation. Moreover, companies prefer alternative methods of resolution that are less time intensive and helpful to avoid a procedure from which it may be difficult for them to recover. It is also noted that there are emotional effects of litigation on the management and employees of companies, which distracts them from their responsibilities. Litigation can also affect the firm’s relationships with other businesses, investors, employees, and customers as the negative outcome of the case can adversely affect its reputation and standing (Malm, Adhikari, Krolikowski, & Sah, 2017).

Effectiveness measures refer to the course of action that the management could follow to achieve the corporate objectives. When assessing purchasing effectiveness, the price paid for supplies is not an appropriate measure. For this purpose, inventory turnover, which determines that the number of times that the company converts its inventory into sales is a more useful measure. The company should focus on purchasing effectiveness measure when there is greater stability in the market or fluctuations in economic conditions are as expected. On the other hand, efficiency measures refer to the difference between planned and actual sacrifices that the management has to make to achieve the corporate objectives. Purchasing efficiency measure is not related to the number of units procured. It relates to the performance of the department responsible for this process. If the department manages its purchases within the budget, then it is considered efficient. The company should focus on purchasing efficiency measure when assessing the internal performance of the firm. Measuring purchasing performance is crucial as it is a crucial part of the firm’s supply chain. In this regard, effectiveness and efficiency measures are useful as they both assist in determining the overall purchasing performance.

Forecasting Sales (Q6)

The three-month moving average and exponential smoothing forecast are given in Table 1.

Table 1. Forecasting.

MAD and MSE are calculated for each forecast in Table 2.

Table 2. MAD and MSE.

3 MA:

Exponential Smoothing:

Based on the results given in Table 2, it is noted that 3-month moving average provides a better forecast as its MAD and MSE is lower. Moreover, error (%) of this method is lower than the exponential forecasting method.

Case of Ben Gibson (Q7)

It could be argued that Ben Gibson legally acted as he has the right to seek new suppliers of corrugated boxes, who can sell them at a lower price. The company has the legal right to rebid the corrugated contract and find latest offers. However, it can be stated that Gibson did not act ethically. His decision to initiate the bidding process to put pressure on the present supplier to lower its price of corrugated boxes can be regarded as sharp practices. Such practices fall short of actual fraud as Gibson was involved in misrepresentation of the issue faced by his company. It can be stated that he was willfully creating a competition between suppliers to take advantage of the situation by deceiving its current vendor.

My decision as the marketing manager for Southeastern Corrugated would be not to submit a bid by lowering the price of corrugated boxes. It may be possible to discuss the situation with Coastal Products and negotiate an acceptable price of corrugated boxes. However, if the discussion is unsuccessful, then it is logical for Coastal Products to seek a new supplier.

Calculation of Economic Order Quantity (Q8)

The assumptions of Economic Order Quantity (EOQ) are given below:

- There is a uniform demand rate throughout the period.

- There is a fixed item cost.

- The ordering and holding cost does not change over the period.

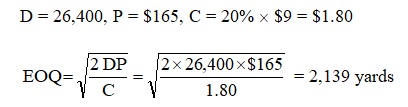

The economic order quantity is calculated in the following.

The number of orders per year is calculated as follows.

26,400 / 2,139 = 12 orders

The order level is determined by determining demand for denim cloth per working day and per week is calculated as follows.

26,400 / 250 = 105.6 yards per day

105.6 x 5 = 528 yards per week

Purchasing lead time = 2 weeks

Order level = 1,056 yards.

The total annual cost for the item is calculated as follows.

Total cost per yard ($9 + $1.80) = $10.80

Total annual cost = $10.80 x 26,400 = $285,120

Acceptance of Discounted Price (Q9)

Vendors often offer a price discount to encourage buyers to buy large quantities. However, the decision to avail this offer depends on the assessment of the business requirements by the purchasing manager. There are various factors which can affect the choice to buy a large quantity of a product at a discounted price. First, the purchasing manager needs to estimate production requirements. Since the company uses this product regularly, it may be feasible for the company to buy it and store it for the full year’s production. However, the storage life of the product and the company’s warehousing capacity should also be evaluated to make sure that it does not incur an inventory loss (Li, 2014). Second, the purchasing manager must consult with the finance department and determine if the benefit of a low price exceeds inventory management and reordering costs to be incurred by the company.

In case if the financial benefit of buying a large quantity of the product is greater than its related costs and expenses, then the purchasing manager should go ahead with it. Third, the finance department will assist by determining the availability of finance as the decision to purchase a large quantity of the product will incur a significant expenditure. Therefore, the purchasing manager should seek approval from the finance department, which will evaluate the use of funds between different alternate investments that the company may be considering. If there are no issues of liquidity, then it will be an appropriate decision to buy the product. Fourth, the purchasing manager should ensure that there are no quality issues with the product. In some cases, vendors try to get rid of their huge stocks by offering a large-quantity discount. Therefore, the manager must conduct an in-depth evaluation of the available product’s quality before accepting this offer.

Calculation of Relevant Cost (Q10)

The calculation of the relevant cost is given in Table 3.

Table 3. Relevant Cost.

Table 3 shows that the total annual relevant cost when choosing Sontek is $183,380, and that of Denton is $185,254. John should buy from Sontek as there is an annual difference in favor of this supplier.

Calculation of Safety Stock (Q11)

The calculation of the safety stock is given in Table 4.

The most likely demand is 600 units for two weeks as it has the highest probability, as shown in Table 4. Since the carrying cost is not identified, it is assumed to be $5. Stockouts can occur if demand is 700 and 800. If the demand is less than 600, there will be no stockout costs, but it will have carrying costs.

References

Eckerd, A., & Girth, A. M. (2017). Designing the buyer–supplier contract for risk management: Assessing complexity and mission criticality. Journal of Supply Chain Management, 53(3), 60-75.

Genovese, A., Koh, S. L., Kumar, N., & Tripathi, P. K. (2014). Exploring the challenges in implementing supplier environmental performance measurement models: A case study. Journal Production Planning & Control – The Management of Operations, 25(13-14), 1198-1211.

Lasher, W. R. (2017). Practical financial management. Boston, MA: Cengage Learning.

Li, X. (2014). Operations management of logistics and supply chain: Issues and directions.Discrete Dynamics in Nature and Society, 2014, Web.

Malm, J., Adhikari, H. P., Krolikowski, M., & Sah, N. (2017). Litigation risk and investment policy. Journal of Economics and Finance, 41(4), 829–840.

Monczka, R. M., Handfield, R. B., & Giunipero, L. C. (2016). Purchasing and supply chain management (6th ed.). Boston, MA: Cengage Learning.

Musau, E. G. (2015). Determinants of procurement function and its role in organizational effectiveness. IOSR Journal of Business and Management, 17(2), 12-25.

Nyambuu, U., & Tapiero, C. S. (2018). Globalization, gating, and risk finance. Hoboken, NJ: John Wiley & Sons.