Ratio Analysis

Financial statements include a profit and loss A/C (income statement) that tells us about the performance of a company throughout the financial year. It also includes a balance sheet that shows the financial position or status of a company and lastly a cash flow statement, which shows changes in the cash position of the entity.

We analyze financial statements by the use of accounting ratios. Such as liquidity, leverage/gearing ratios, activity ratios, profitability and equity/investor ratios. For the case of Qassim Cement, I am going to look at the last five years that is, from 2006 to 2010.

Liquidity Ratios

This measures the firm’s ability to meet its short-term maturity obligations.

Gearing ratios determine the degree at which non-owner has funded the company. An activity ratio measures the efficiency with which the firm is using various assets to generate sales, revenue, or how active the firm is. Profitability ratios measure the efficiency with which the firm uses various funds to generate profits or returns. They also measure the management’s ability to control the various expenses in the firm. Equity ratios/ investor ratios measure the relative value of the firm and returns expected by the owners of the firm. They also try to look at the overall performance of the firm and growing concern of the firm.

Gearing Ratios

This measures the financial risk of a firm that is, the probability that a firm would not be able to pay up its debts. The more debts a business has that is, non owner supplied funds, the higher the financial risk. This ratio measures the proportion of total assets financed by non-owner supplied funds. The higher the ratio, the higher the financial risk

Debt Equity Ratio = Total Liabilities/Net worth (shareholders’ funds)

The case in hand, Qassim Cement, has a debt to equity ratio of 1.1%, 2.3%, 0%, 0.01% and 0% in 2006, 2007, 2008, 2009 and 2010 respectively. This shows that Qasim Cement is lowly geared or levered. This means that shareholders of this company stand to benefit a lot from the returns of this company. This ratio measures how much has been financed by the non-owner supplied funds in relation to the amount financed by the owners that is, for every dollar invested in the business by the owners how much has been financed by the non-owner supplied funds.

Therefore, Qassim Cement is healthy in terms of financing itself. We see all the Leverage ratios reducing to zero in 2010, which means that the company is able to meet its obligations and has already done so. The Quick and current ratios keep on improving, which indicates that the company is in a position to meet its short-term obligation with ease. The ratio is more than 100%, which is a good indicator.

Activity Ratio

Stock Turnover = Cost of Sales/Average Stocks

Where;

Average Stocks = Opening Stock + Closing Stock

This is the number of times that stock has been converted to sales in a financial year. The higher the ratio the more active the firm is. From the year 2008, Qassim Cement has shown an increasing stock activity from 1.42 in 2008, 2.16 in 2009 and 2.21 times in 2010. This shows that stock replenishment is increasing. The same trend is observed in Receivable turn over and assets turnover. Payables turnover is decreasing, which is a good trend for the company. This means that the company has and is still negotiating for better credit terms from the suppliers.

Average Collection Period = 360.

Debtors Turnover

This measures the number of days it takes for debtors to pay up. The lesser the period, the better for the firm, as it improves the liquidity position. Qassim Cement has had an increase in collection period from 2006 to 2008; a drop to17.02, with an increase of 19.12 in 2010. It is however not clear whether this will continue, though it is estimated to fall to 18.07 for the next four years.

Creditors Turnover = Credit Purchases.

Average Creditors

The ratio tries to measure how many times we have creditors during a financial period. The lesser the ratio the better it is for the company. The figures have been 9.30, 14.16, 258.93, 115.72 and 73.13 for 2006, 2007, 2008, 2009 and 2010 respectively for Qassim Cement. These days are expected to drop to 40 in the next four years. This shows that the company did so well in 2006 and was worse in 2008. There was an improvement in 2010.

Non Current Assets Turnover (Fixed Assets Turnover) = Sales.

Average Fixed Assets

The ratio measures the efficiency with which the firm is using its fixed/ Non Current Assets to generate sales. The higher the ratio, the more active is the firm. Qassim Cement has its asset turn over increasing from 0.74 to 0.79 from 2007 to 2010 and expects it to increase further to 0.89 times in future.

Total Assets

The total assets turnover has moved up from 0.41 in 2007 to 0.48 in 2010 and is expected to grow further.

Profitability Ratios

Profitability in relation to sales shows the profit made by the company from sales and is calculated as follows

Gross Profit Margin= Gross Profit/Sales

The higher the margin, the more profitable the firm is. Qassim has enjoyed increased profitability from 61.6 in 2006 to 64.1 in 2008 but dropped in 2009 and remained constant in 2010 at 57.50%.

Net Profit Margin = Net Profit after tax/Sales

The higher the margin, the more profitable the firm is. Margin is normally affected by operating expenses for the period. Qassim has had its margins drop from 2007 all the way to 2010 at 51.7% down from 63.8% in 2007.

Profitability in Relation to investment

Return on Investment = Net Profit after tax/Total Assets

This ratio shows how efficient the firm has been in using the total assets to generate returns in the business.

Return On Capital Employed.

Return on Equity = Earnings after tax/Net worth

The higher the ratio the more efficient the firm is. This keeps fluctuating from one year to the next. It is not easy to tell whether it would improve in the future as per the estimates.

Equity Ratios

Earnings per Share (Eps)

EPS = Earnings attributable to ordinary shareholders/No. of ordinary shares outstanding

This is the return expected by an investor for every share held in the firm. The higher the EPS, the better it is for the investor. In this case, the basic EPS increases between 2006 and 2008 but decline in 2009 and 2010 at 5.6 per share.

Dividend per Share = Total Dividend (ordinary shareholders)/Ordinary shares outstanding

This is the amount expected by an investor for every share held in the firm. The higher the amounts the better the situation for the firm is. The DPS of Qassim declines from eight in 2008 to 5 in 2010. This is not a good indicator.

The importance of Ratio analysis

Evaluation of performance

By use of ratio analysis, a company is able to compare its current performance with its past performance that is, vertical analysis, or even compare its performance with other companies falling in the same industry that is, horizontal analysis.

Acts as control

Ratios are at times is used as a controls by companies. The employees of a company are given goals, which they need to attain. At the end of the accounting period, their performance is reviewed with an aim of finding what the problem might have been.

Parties interested in the following Ratios

Current Ratio

The current ratio measures the liquidity position of a business. The creditors would be interested in it in order to know the probability of their debt being paid.

Net Profit Margin

This measures the profitability of a company. Almost all parties are interested in this ratio that is, from the company itself to the government, employers, creditors, the general public, potential investors, among others. It helps to know whether to invest in the company.

Stock Turnover

This represents how fast the company is able to turn stocks into sales. The company management and even potential investors are interested in this. Furthermore, the suppliers would like to know this in order to be familiar with how frequent they ought to supply goods.

Regression

This is a concept, which refers to the changes that occur in the dependent variable because of changes occurring on the independent variable. Knowledge of regression is particularly very useful in business statistics whereby it is necessary to consider the corresponding changes on dependant variables whenever independent variables change. It should be noted that most business activities utilize a dependent variable and either one or more independent variable. Therefore, knowledge of regression will enable a business statistician to predict or estimate the expenditure value of a dependant variable when given an independent variable. The general equation used in simple regression analysis is as follows.

y = a + bx

Where y = Dependent variable

- a= Interception y axis (constant)

- b = Slope on the y axis

- x = Independent variable

The determination of the regression equation is normally done by using a technique known as the method of least squares.

Regression equation of y on x is calculated as follows

y = a + bx

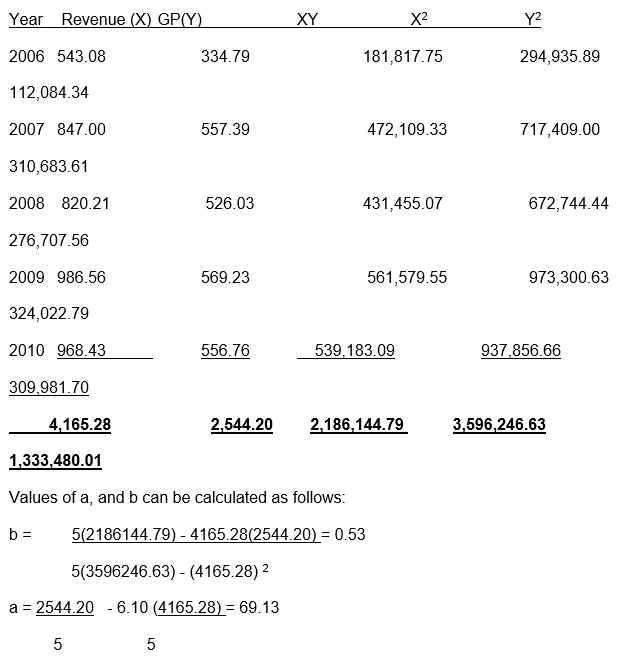

For example, let us take the Gross profit margin and revenue between 2006 and 2010. The GP depends on revenue such that when Revenue increases, the margins also go up. In this case, revenue is the independent variable while GP is the dependent variable.

Therefore, the predicting function is Ŷ = 69.13 + 0.53X