Introduction

The Allied Group is focused on making decisions regarding two investment options: buying a packaging machine or a molding machine. Criteria for the capital-budgeting decision involve the calculation of the payback period, the net present value (NPV), and the internal rate of return (IRR) (Brigham & Houston, 2016). The purpose of this paper is to determine the payback period for each project, the NPV and IRR for these proposals, and recommend what project can be selected by the Allied Group for investment.

Each Project’s Payback Period

The payback period for an investment is calculated as the number of years that are required in order to recover the initial funding. For both projects, this number is computed with reference to the presented free cash flows determined for the next five years. The time value of money is not taken into consideration while calculating the payback period (Vallabhaneni, 2018). The focus should be on that project, for which the number of years to return the initial outlay is lower.

The initial investment for the packaging machine is $14,000, and cash flows for the next five subsequent years are $4,100, $3,300, $2,900, $2,200, and $1,200. Thus, in five years, the company will receive the sum of these cash flows in $13,700, which demonstrates that the payback period for this investment is more than 5 years. The initial funding for the molding machine is $12,000, and cash flows are $3,200, $2,800, $2,800, $2,200, and $2,200.

In four years, the company will receive $11,000, and in five years, the company will receive $13,200. While noting that during the fifth year, the company will receive $183.33 each month, the payback period for the second investment is four years and five and a half months. From this perspective, the lower payback period for the molding machine is more preferable for the company.

The Net Present Value for Each Project

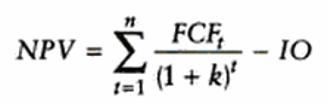

The NPV for each project should be calculated with the help of the following formula, where FCFt is the annual free cash flow for the required time period (cash flows for five years), k is a discount rate (15%), and IO is the initial investment.

For the first investment option, NPV is calculated with reference to cash flows for five years ($4,100, $3,300, $2,900, $2,200, and $1,200), k is 15%, and IO equals $14,000. For the packaging machine, NPV is -$4,178.24. For the second investment option, NPV is also computed with reference to cash flows for five years ($3,200, $2,800, $2,800, $2,200, and $2,200), k is 15%, and IO is $12,000. For the molding machine, NPV is -$2,907.50.

NPV is usually calculated for determining the net value of a proposal for investing. Therefore, if NPV is negative, an investment proposal should not be adopted (Brigham & Houston, 2016). In the case of these two projects, NPV for both proposals is negative, thus, these investments cannot generate the value for the company.

The Internal Rate of Return for Each Project

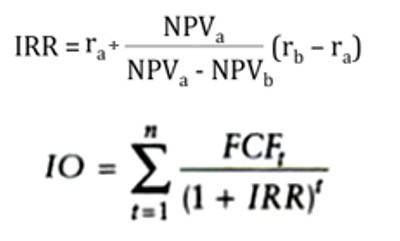

The IRR is usually calculated with the help of the following formulas, where attention is paid to NPV and different discount rates or to the annual free cash flow and the initial investment:

It is rather problematic to calculate IRR manually, and the financial calculator or Excel formulas can be used for computing IRR for the discussed two projects. Referring to the clash flows related to the first option, IRR is -0.861%. For the second option, IRR equals 3.502%. The IRR for the packaging machine and for the molding machine is lower than the cost of capital at 15%. As a result, it is inappropriate to accept any of these proposals.

Recommendations

While assessing both of these projects, it is important to note that they cannot be accepted by the Allied Group because these proposals cannot add value to the firm in terms of analyzing their NPV that is negative in two cases and IRR that is lower than the cost of capital in two cases. From this perspective, it is disadvantageous for the Allied Group to accept any of these projects even if the payback period for the second one seems to be appropriate (Brigham & Houston, 2016).

While accepting the idea that both proposals are mutually exclusive, it is possible to recommend the focus on the second project (the molding machine). The reason is that the payback period is lower than it is in the case of the first project. Furthermore, NPV is higher even being negative, demonstrating the potential of this project. In addition, IRR is also higher than it is in the first case even if IRR is lower than the cost of capital.

Conclusion

The capital-budgeting decision can often be viewed as a challenging task. In the case of the Allied Group, both investment options cannot be discussed as appropriate because they will not add value to the company in the future referring to the period of five years. Their NPV is negative and IRR is low, which indicates that these proposals cannot be accepted by the company. However, if there is a requirement to accept one of these projects, the focus on the molding machine can be offered.

References

Brigham, E. F., & Houston, J. F. (2016). Fundamentals of financial management (14th ed.). Boston, MA: Cengage Learning.

Vallabhaneni, S. R. (2018). Wiley CIAexcel exam review 2018, part 3: Internal audit knowledge elements. New York, NY: John Wiley & Sons.