SHUAA Capital

The research topic

How Quality and Management tools and Techniques are being implemented in SHUAA Capital.

Introduction

This research prepared is an individual project that is one of the necessities in a Course of Quality Management Tools and Techniques. The research will be handed over to the Course Instructor.

The purpose of the research

The research’s purpose is to identify the Quality and Management Tools and Techniques that the organization is implementing successfully. The research will also identify any other Quality Management tools and Techniques that are not successful. It also aims at identifying where improvement is required.

Brief about SHUAA Capital

SHUAA Capital PLC is a company that was founded in 1979. It is controlled by the UAE Central Bank and listed on the Dubai Financial Market. The company deals with the management of assets, investment banking, brokerages, private equity and finance. It was the first company in the United Arab Emirates to adopt the IAS reporting standards.

It was also the first company to give out quarterly financial statements, which is currently a requirement for all companies listed on the Dubai Financial Market. The company has spread its services across the GCC’s vibrant and competitive regional economies (Ahire and Golhar 30).

The company has been a pioneer in the investment management within the Middle East. In addition, the company remains at the forefront on the MENA fund and wealth management today. It has headquarters in Dubai with branches in Riyadh, Abu Dhabi and Jeddah.

The company has spread its services across the GCC’s vibrant and competitive regional economies. The company has received many awards from EUROMONEY in many categories (Kuratko, Goodale and Hornsby 295). The Best Equity House award is the one that the company has received for many times.

Following the strictest standards, the transparency has been one of the pillars of the company’s success. Giving advice on corporate finance along with information on debt capital markets and ways to configure Investments are some of the duties of the company’s investment Banking wing.

The SHUAA Capital Asset Management is the best in the GCC region. This comes from the provision of all-inclusive market insights following best research techniques and timely relevant products. Its Securities branch gives the highest quality brokerage and advisory services. A team of experienced investment professionals runs the SHUAA Capital Private Equity business.

Members of this team fully understand the dynamics of the GCC economic zone. The company has most experienced individuals in the financial services industry in the region. Its employees come from more than 25 different countries most of which are bi-lingual in English and Arabic. The SHUAA Capital has worked to clarify and define a framework for the organization matching them with the Dubai government’s plan and this framework summarized in the organization’s vision, mission, values and objectives.

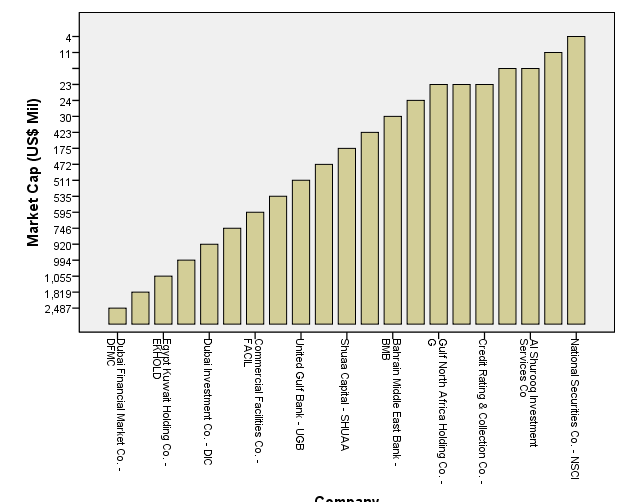

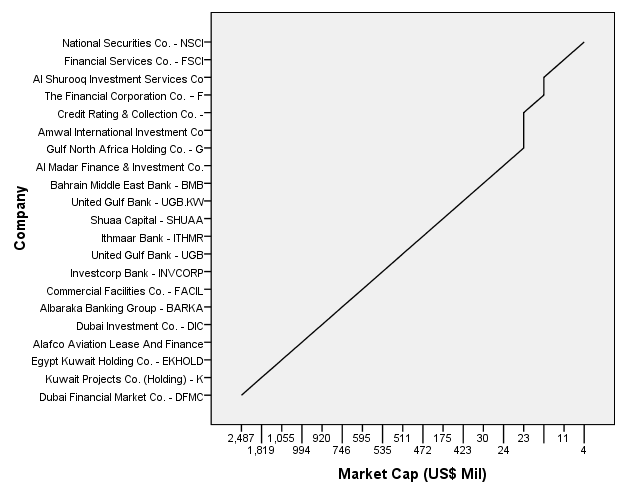

Performance of SHUAA and some other companies in GCC

Source: Gulf Base (2013).

Source: Author

Source: Author

Vision: become a dominant force in the investment, banking, and other financial service industries across the GCC and the rest of the world.

Mission: provide financial empowerment of clients within the zones in which it operates.

Values:

Customers and partners: Their ambassadors to represent their business.

Employees: Their real investment.

Support and backing: A creative work environment.

Future thinking: Creativity for improvement and development.

Objectives:

- To successfully manage assets in the region to make it a model to be emulated

- Serve customers to their satisfaction

- Serve humankind with humanity using the best technology

- To successfully implement Quality management Tools and Techniques

Findings:

- SHUAA Capital uses various quality management tools in its improvement processes. These tools are used in the analysis of the information, organizing and keeping it for future reference. The tools are also useful when the company is looking for information sources (Roger 54).

- Among the tools, it has Process Maps. They come at the beginning of the improvement process. They describe the whole process including the duration, frequency, and complexity.

- The control chart is primarily used during statistical analysis. During this process, performance is plotted over time. This considers the upper and lower limits of control. This tool observes the causes of variations and their process, and it makes sure the entire process is under control (NHS Institute for Innovation and Improvement 34).

- Redesigning and distribution of signboards inside and outside the center to help the customers to go to the right employee quickly, in addition to providing landline telephone, fax machines and Internet for customers to ensure their communication with their company or if they wish to obtain information or papers were incomplete.

- Using their table numbers, they analyze various relations between data over a given period.

- The company analyzes the defects using the Pareto chart. It puts them in an order from the most to the least. It helps the company in redirecting its focus to the most significant areas that need improvement.

- Fishbone also referred to as the Cause and Effect Diagrams visually represent the causes associated with problems of improvement. The name originates from its shape. It analyzes the ultimate sources of problems covering among others the start of the analysis of root causes.

Inefficiency of employees

SHUAA Capital has realized that some employees do not have the skills to handle customers well. If a customer is not handled properly, the chances of losing him or her is very high. This pushed the company to give a broader definition of customers and suppliers, especially that its businesses are service oriented.

The company should understand that quality, beginning with the customer. Taking benchmarking steps is also important. SHUAA Capital being a market leader is likely to be complacent. However, it should compare its factional performance to other companies marking their differences. This helps in analyzing the best methods to be used to get the desired performance.

Poor systems of accountability and guidance to the staff

The SHUAA Capital realized that there was a poor relationship between the top management, the middle level and the low level. This pushed the company to transform the tools of accountability into the working activity and the related systems. Preparation of performance appraisals falls into this phase (Vorley and Tickle 34). The company formed quality teams in the respective countries within the GCC economic zones.

These teams were then integrated from the top to the bottom including clients and other stakeholders. This made sure that the top management had a commitment to the quality process so that it could give support to the rest of the staff. Finally, to have effective implementation the company gives quality training to the staff along with rewarding and recognizing quality improvement.

Recommendations

Referring to the above areas earmarked for improvement, the company must think beyond the GCC region. It is very possible that its products would do better in market zones the company has not ventured yet.

- Appraisal mechanisms must be developed to evaluate the input of the employees towards the realization of company goals. The customers have to be handled in a way that will make SHUAA Capital a household name among all the existing and potential customers.

- It will also be prudent if the company acquired technology that would allow single customer viewing. This is because most clients do invest in various products offered by the company. Adopting the single customer viewing technology such as the flexi cube system would enhance customer satisfaction. The company would hold on to customers since it would be easy for employees to serve customers on their various investments at one stop. This idea though will require thorough training of employees to make sure they grasp the details of the system.

- The company will also be expected to do more by taking care of the welfare of its staff. This would cover improved better terms along with emotional and psychological stability.

Conclusion

SHUAA Capital has moved forward in an attempt to make a mark in carving its niche in the financial industry. Some of its flagship projects are unrivaled in the GCC economy. This serves to underscore their effort. The accolade the company has received over the last decade only further illustrates the potential the company has.

However, the above-identified areas of improvements need to be considered. This is important because the company is involved in an industry that is very competitive. The rivals keep developing new products in a customer friendly way. The idea of designing products that suit the market dynamics remains one of the best ways of market retention.

Works Cited

Ahire, Sanjay L., and Damodar Y. Golhar. “Quality Management in large vs. small firms.” Journal of Small Business Management, 32.2 (1996): 25-46. Print.

Gulf Base. Financial Services in GCC, 2013. Web.

Kuratko, Donald F., John C. Goodale, and Jeffrey S. Hornsby. “Quality Practices for a competitive advantage”. Journal of Small Business Management 39.4 (2001): 293–311. Print.

NHS Institute for Innovation and Improvement. The Handbook of Quality, and Service Improvement Tools. London: NHS Quality Institute, 2010. Print.

Roger, Swanson. The Quality Improvement Handbook: Team Guide to Tools and Techniques . New York: St. Lucie Press, 1995. Print.

Vorley, Geoff and Fred Tickle. Quality Management Tools and Techniques. New York: ASQ, 2002. Print.