The recent decision by the Federal Reserve to inject a massive $600 billion into the economy through the purchase of treasuries has attracted a great deal of debate. Both proponents and antagonists of this policy are yet to come to a consensus on the effectiveness of this measure. From an economic point of view, increasing government spending is a vital macroeconomic policy that rejuvenates a sluggish economy.

Such government injections aim at lowering interest rates, increasing borrowing and eventually enhancing investments. In other words, government injections stimulate the Aggregate Demand (AD), which in return ensures a vibrant production and overall economic growth. This essay focuses on the impacts of Quantitative Easing (QE2) on Inflation, employment, interest rates and general economic growth both in short run and in the medium term.

The Federal Reserve decision to the purchase the Treasuries injects money into the economy. This open market operation is one of the most successful macroeconomic policies commonly used to revive an economy. According to Arnold (2008, p.270), a successful open market operation stimulates Aggregate Demand which in turn boosts national production and government revenue.

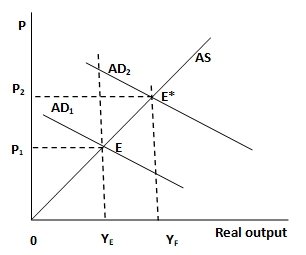

It is in the same vein that the Federal Reserve opted to participate in open market operation. The effects of this macroeconomic feature are graphically illustrated below.

Real output

Graph adapted from (Arnold, 2008, p.338)

From the graph, AD represents Aggregate Demand, P represents prices, Y represents the national income and AS represent Aggregate Supply. Before government injection, the aggregate demand was at AD1 while the equilibrium level of output is at point YE and prices are at P1.

The QE2 will stimulate Aggregate Demand forcing it to shift to the right to AD2 while national income will expands towards full employment at YF. A shift in aggregate demand pushes price up from P1 to P2. The resulting price increases stimulates firms and households to increases production in order to obtain higher revenues. Sustained high production rates shifts equilibrium from point E to point E*, which reflects a higher level of output and higher price.

Arnold (2008, p.277) classifies government expenditure into three: Consumption expenditure, human capital expenditure and capital expenditure. He argues that capital expenditure and expenditure on human capital development have a greater future impact on the economy unlike consumption expenditure, which has high immediate impact and minimal future economic influence. With this in mind, Federal Reserve injections will have a positive impact to the US economy both in the short term and in the middle term.

As the AD increases, the firms will up their productions and the entire economic output will eventually increase. In addition, an increase in production will cause expansion of firms resulting to new employment opportunities. With increased employment, the public welfare improves resulting into a vibrant economy characterized by high demand and production capacities.

On the same note, high aggregate demand ensures stable government revenues in terms of taxes from the firms and the household levies. Thus, the Federal Reserve injections are well placed and are likely to rejuvenate the US economy.

Nonetheless, Arnold (2008, p.270) discourages excessive government expenditure since it may lead to crowding out of the private sector. It is worth noting that the private sector forms an integral part for any economy, and therefore government injections should not hamper with this sector. Critics of the Federal Reserve injections deem the government’s action as unnecessary and ineffective. Majority of them argue that Quantitative Easing (EQ2) will lead to price increases, which will eventually cause inflation.

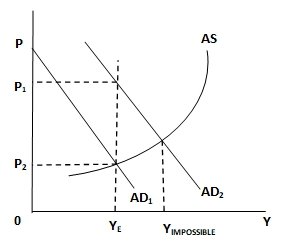

Graph adapted from (Arnold, 2008, p.343)

From the graph above, equilibrium income is at YE while equilibrium price is at P2 before government injections. Assuming that that the economy currently operating at full employment, Federal Reserve injections will cause aggregated demand to shift from AD1 to AD2, and national income is supposed to shift from YE to where AD2 equal to AS.

However, this is not possible because the economy is producing at its maximum. Income Y1mpossible will be unattainable and instead prices will skyrocket to P1 causing inflation. Isadore (2010) points out that the US economy has reached inflationary trap where low interest rates have zero effects on borrowings. Hence, further easing will have no effects on stimulating AD but will increase inflation.

Isadore (2010) holds that even though QE2 will lead to low interest rates, little investments will be established because investors’ confidence is low, and therefore few investors will be motivated to secure bank loans. In addition, Isadore (2010) asserts that that the move will weaken the value of dollar, which will lead to new assets bubbles, leading to high inflation rates.

Al-Erian (2010) perceives Federal Reserve policy unnecessary and likely to backfire. According to him, the problem of the American economy can only be solved by incorporating multidimensional actions rather than a mere monetary approach. Consequently, Al-Erian (2010) recommends that some institutional reforms have to be done to allow other stakeholders to be actively in charting the way forward.

In conclusion, actions by Federal Reserve have instigated heated debate on whether QE2 will offer any solution for the poor US economy. Sharp divisions on the viability of EQ2 have not only torn apart the US economists but also the Federal Reserve policy makers. As the stalemate continues only time will tell whether quantitative easing will revive the US economy.

References

Al-Erian, M. 2010, Blunt QE2 Instrument Likely To Backfire, Pimco Ltd. Web.

Arnold, A. R. 2008, Economics, Cengage Learning Press: Florence.

Isadore, C. 2010, Eyes on the Fed: Why the Fed’s Bold Move Won’t Work, CNN Money. Web.