Introduction

The current economic status of UAE economy

The global crisis that hit the world adversely affected the economies of developing countries. This is because these countries lacked the ability to withstand the external forces that resulted from the collapse of the major world’s economies from which they depended forcing them to restructure their operating business models.

As the crisis took hold, the Gulf Corporation council countries’ were adversely affected by the depression which hit the region through the trade and financial channels (Khamis, n d).

Among the most hit GCC countries was the United Arab Emirates whose economy has transformed itself from a classical base of fishing and pearling into oil based high income economy with a high concentration of expatriate labor as the main drivers in the key sectors of the economy (IMF, 2003).

The UAE had achieved impressive economic growth over the past years due to its rapid development in the non oil economy making it one of the most diversified economies among the Gulf cooperation Council Counterparts (IMF, 2003).

However, the region’s persistent dependency on oil as the key driver in the economy and its widely segmented labor market where nationals still continue to have a strong preference for public sector employment over the private sector rendered the region highly vulnerable to the negative implication of the global economic downturn.

Real estate and construction sector in UAE

The study covers the actual effects of the crisis to the construction and real estate sector in the region which is among the key sectors in the economy contributing an approximate 16% GDP in UAE (IMF, 2003). The sector which had earlier on achieved remarkable growth rapidly declined with the occurrence of the global financial crisis resulting in depreciating values of property as well as departure of foreign investors from the region.

The emirate of Dubai provides a clear evidence of the decline in the real estate industry following the crisis.

Consequently, the country provides us with the appropriate case study through which we will analyze the trend in the construction and real estate sector in the period between 2002 and 2006 where the industry achieved remarkable growth, the period between 2008 and 2009 when the global financial crisis hit the economy and the forecasted growth up to 2012.

This analysis will be essential in our formulation of an informed conclusion.

Financial crisis facing the region

It is worth noting that the rental market had been soaring in Dubai due to the increased demand for residential houses and office space. Lease prices as well as the real estate prices have doubled since 2005 with prices varying between $ 1700 and $ 3500 per square meter according to location (Noack, 2007).

Due to drastic rent increases, the government of Dubai implemented a rental cap forcing land lords to keep the rent increases to a maximum of 15% per year in 2006 which was further reduced to 7% in 2007 (Noack, 2007).

There appeared to be the stepping stone towards stabilization on the rental and real estate markets which could be attributed to the implementation of the rental cap and the establishment of new housing units in the market (Noack, 2007).

During the boom period, the countries in the GCC particularly Qatar and the UAE experienced remarkable increases in banking system credit to the private sector and this led to real average credit growth which increased bank leverage and doubled the ratio of private sector credit to non oil GDP to 122% by the end of 2008 (Khamis, 2010).

Excess credit coupled with low interest rates and a vibrant economy facilitated higher demand for real estates and equities consequently increasing prices (Khamis, 2010). In the UAE, speculative investments significantly contributed to marked increases in real estate prices.

Further, following the stock market decline in 2006, GCC markets posted 22-60% gains in 2007 but this dramatically reduced in 2008 by 29-73% with the intensification of the global crisis (Khamis, 2010).

With the global recession occurrence, the real GDP growth in the gulf region was expected to sharply decline from 5.8% in 2008 to 1.1 % in 2009 due to correction in oil prices, reduced overall production as well as tight credit conditions (UN, 2009).

Among the GCC economies, the UAE was the most affected by the crises with its real GDP falling from 7.4 % to 0.5% between 2008 and 2009 (UN, 2009). This resulted from severe contraction in domestic demand for real estate prices.

Literature review

UAE attained a per capita income in terms of GDP amounting to $16700 in 1998 which was relatively higher than the GDP of most developing countries (Al Abed and Helyller, 2001). The three emirates of Abu Dhabi, Dubai and Sharjah account for the highest percentage of UAE gross domestic product as well as the population.

The income differences between the emirates are generated by the variations in natural resource endowment prevalent in the region (Al Abed and Helyller, 2001). The key resource in the region is oil and gas and in 1998, crude oil contributed for 22% of the total UAE gross domestic product. The UAE economy is highly dependent on external sector as reflected by the import export disparities prevalent in the region’s economy.

Both exports and imports are relatively high and consequently the external sector plays a major role in performance and evolution of the UAE economy (Al Abed and Helyller, 2001).

The 2003-2008 oil price booms spurred economic activity in the GCC consequently strengthening all the sectors in the economy with overall growth in the economy averaging to 6.6% per year which was considerably higher than the pre oil price boom period.

Role of construction and real estate sector in UAE economy

The construction and real estate sector is one of the key driving forces in the UAE economy. Increasing volumes of local and tourist population in the region as well as the liberalization of the real estate market had significantly contributed to the rapid growth in the sector due to the rapidly increasing demand for property in the region (Noack, 2007).

The United Arab Emirates is by far the biggest property market in the Gulf region which facilitated its domination in the construction sector. Abu Dhabi heavily invested in tourism and residential sector with its numerous projects including beach and island development, town houses, and facilities for residents (Noack, 2007).

Dubai’s real estate sector was mushrooming with projects worth billions of dollars and projects including infrastructure development were under construction. Continuous population growth and immigration in the region has led to increased demand for residential houses especially in Dubai. Other emirates are also increasingly investing on the construction sector but on a relatively smaller scale.

Effects of the Crisis in the Region

The GCC countries have been hit hard by the decline in oil prices and production as well as by liquidity shortages in global financial markets (Khamis, 2010). The impact of the crisis in the GCC manifested itself in plunging stock and real estate markets with the region’s market capitalization falling dramatically by 41% (Khamis, 2010).

As the effects of the global market became more apparent, the average correlation of the GCC markets with the global markets became evident in the period between 2007 and 2008 (Khamis, 2010).

The region was further affected by decline in the international asset prices with losses estimated by market analysts at between 20-30% in 2008 (Khamis, 2010). Consequently, real estate prices dramatically declined which corrected prices in Dubai which had initially risen more sharply.

A couple of scholars had predicted the impact of global economic downturn across the Gulf Corporation Council. The economic down turn as well as the dramatic plunge in oil prices led to a major blow on the development efforts in the region and shattered dreams of thousands of investors seeking maximum returns in a region that was once a land of opportunity (BM, 2010).

The construction and real estate sector was rendered vulnerable to the adverse effects of the crises due to the fact that credit growth in the region substantially contributed to lending in the real estate sector. This lending was funded substantially by bank’s foreign liabilities which rendered the region’s banking system susceptible to credit losses during economic downturn (Khamis, 2010).

The international monetary fund predicted that economic growth across the region would slow down in 3.5 % in 2009 from 6.8% in 2008.

The United Arab Emirates which accounts for approximately 46% of the GCC construction boom is likely to be adversely affected according to research findings by EFG Hermes (BM, 2010). The findings further revealed that the region is experiencing a ‘real estate crash ‘and the effects of this have not yet been fully addressed.

Objectives, Scope and coverage

The Extent of the Crisis in UAE and the gulf region

The property and the construction sectors have been worst hit in the emirate following the global economic downturn. Although various sectors continue to register considerable growth in the recent past, the construction and real estate sectors evidently achieved negative growth in 2010 (Property Wire, 2010).

This failure can be attributed to the sector’s dependence on demand and supply consequently elongated the recovery period. The world debt crisis has also intensified the negative implications on the real estate sector which plummeted with the diminishing international funding Property sales in the region increased by more than half their value since 2008 (Property Wire 2010).

A report compiled by the royal institution of Chartered surveyors revealed that there was a substantial increase in the number of distressed assets coming into the UAE market in the third quarter of 2010 and this was further expected to rise in the last quarter of the year (Property Wire 2010).

Tom Bunker, an investment sale consultant confirmed this increment in distressed selling citing that this property hit the market below their purchase price and in some cases below the price level at which they were initially sold by the developer.

The global economy has started showing signs of revival from its previous down turn (Property digest, 2009).

The United Arab Emirate real estate sector has subsequently registered gradual change and according to the Gowealthy Research Team, whereby the demand for off plan properties in the UAE ended with the departure of speculators changing the trend towards preference of ready to move in property that are at least half way complete.

Dwindling market demand and oversupply of units coupled with distress sales by owners who aim at raising the mortgage requirements have affected the prices of property adversely (Property Digest, 2009). Research by Colliers revealed that home prices in Dubai declined by 40-42% since the fourth quarter of 2008 with sales transactions in Dubai and Abu Dhabi being driven by professional investors rather than speculators. T

his helps us to understand the long term impacts of foreign debt as a means of financing local projects. In this region increased foreign debt coupled with global depression has resulted in devaluation of property in Dubai which has consequently affected the region’s economy.

The UAE has an ideal location for long term property investment. At present, quality accommodation and work space can be acquired at moderate states with scales heavily tipped in favor of serious investors who negotiate for appreciable bargains (Property Digest, 2009). This creates room for optimism in the UAE real estate market orientation towards long term investment.

However, the most important question remains whether the UAE young realty sector is strong and resilient enough to withstand the adverse effects of the forces within the external economies as well as its ability to meet long term investor demands and expectations.

To an attempt to achieve this end, the government of Dubai has recently amended Article No. 13 that aims at protecting the stakeholders in the realty sector. The article provides reviewed provisions for cancellation of contracts and also offers property auction licenses to private firms in order to facilitate the auction process.

Research question and methodology

Our study will focus on a case study of Dubai’s real estate sector and the impact that the global financial crisis has had on the same. This will enable us to evaluate the extent to which the crisis has affected the UAE region since Dubai is one of the major determinants of overall performance of UAE economy.

Effects of the financial crises on the real estate sector in Dubai

The crisis has adversely affected the emirate of Dubai which has heavily invested in construction projects as well as establishment of a financial sector.

Dr, Eckart Woertz, program manager of economics at the Gulf Research Center observed that Dubai, which was the pioneer in economic development in the UAE has been adversely affected by the crisis due to its over reliance on real estate sector as well as its foreign debt financed growth (BM, 2010).

The impact that the economic downturn has had on the Dubai’s construction sector is an obvious indicator of the extent to which the UAE has been affected by the crisis hence our focus on the emirate. Construction projects worth billions of dollars have been rendered worthless with numerous projects being prematurely terminated due to lack of cash inflow (BM, 2010).

A report by Proleads research firm uncovered that an approximate 53% of the projects in Dubai had been suspended while only projects worth $698 were still in operation in a sector estimated to be worth US $1.3 trillion (BM, 2010).

In addition, job cuts have been widespread in the real estate sector with numerous companies announcing a lot of redundancies while considerable number of expatriates continues to leave the country (BM, 2010).

A report by Emirates Business 24/7 claimed that Indian carriers were preparing to accommodate bulk bookings for constructions workers and expatriates leaving the UAE in search of greener pastures.

Further, figure released by Dubai’s ministry of interior naturalization and residency highlighted that 54684 residency visas were cancelled in the beginning of 2009 compared to 29418 in January 2008 with the majority being expatriates and private sector workers who had been frustrated by the poor performance in the construction and real estate industry in Dubai (BM, 2010).

The impact of the global financial crisis further sent shock waves through out other related industries in the region that relied on the construction sector consequently affecting them negatively. For instance, the media companies which depended heavily on the real estate sector for advertising lost significant revenue due to reduction in advertising efforts by the sector (BM, 2010).

The architecture and engineering firms as well as facilities management providers were also adversely affected. According to the Property wire (2010), “The construction and real estate sectors in Dubai have seen a decrease of almost 5% in 2010 and the recovery is some way off according to officials” (p1).

Data Analysis: The Case of Dubai

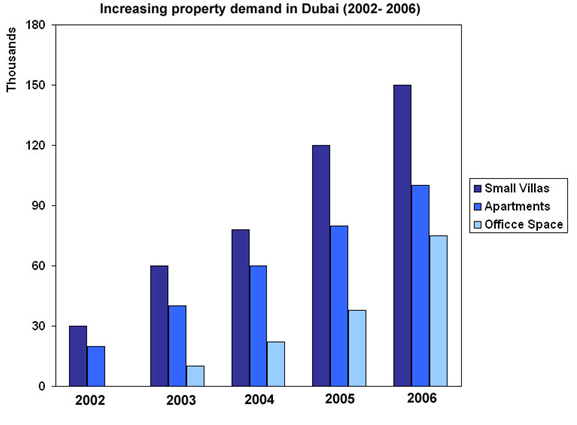

The property industry in Dubai registered remarkable growth in years prior the global financial crisis (Anonymous, 2007). The trend of the industry in the period between 2002and 2006 is a clear indicator of the robust growth that the sector had enjoyed in previous years. The graph below displays the percentage growth sustained by Dubai’s real estate sector during the period.

Source: Zahrat Dubai real estate.

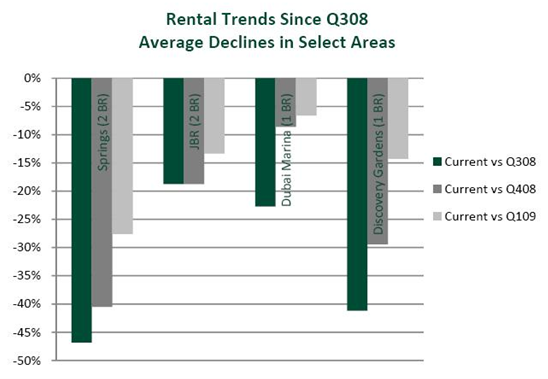

However, the upward trend rapidly declined with the occurrence of the global financial crisis that affected all the economies in the world. Reports indicated that the residential property prices in Dubai were bound to decline in the subsequent years from the peak levels seen in the third quarter of 2008. The graph below displays the falling real estate prices in specific locations in Dubai during the period of the financial crisis.

Source: Dubai Forums 2009.

Despite the numerous challenges facing the real sector as a result of global financial depression, the region is optimistic that the sector will survive the financial crisis. Substantial market corrections have taken place which has led to the restructuring of the business models in operation.

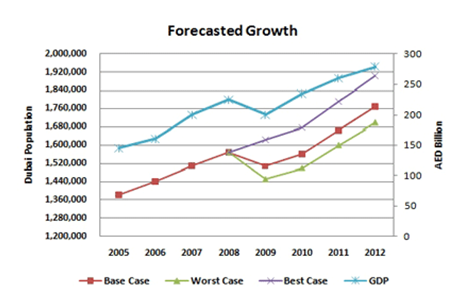

In order to achieve the best case scenario industry conditions as shown in the graph, the government of Dubai should seek to support the country’s economy by increasing infrastructural spending, reducing oil and foreign income dependence in the economy and bail out guarantees to financial institutions in order to improve performance of the industry and regain investors’ confidence.

Conclusion

The financial crisis that hit the global economy adversely affected numerous countries’ economies without exception of the countries in the GCC. The UAE was the most affected among the GCC member countries with its construction and real estate sector rapidly declining as a result.

The construction and real estate sector which contributes significantly to overall GDP in the UAE has had severe consequences on the overall economic growth of the region.

Evident from the study, the decline in the sector has significantly reduced returns to investment which has led to mass exodus of foreign investors from the region’s free zones and disrupted performance in other related industries. The region should therefore seek to rectify the situation by minimizing their dependence on oil and foreign funding in order to reduce the risks of industry collapse in future.

Reference List

Al Abed, I., & Helyller, P. (2001). United Arab Emirates- A New Perspective. London: Trident Press Ltd.

Anonymous (2007). Statistical Report on Dubai Real Estate Trends. Web.

Business management (2010). How The Bubble Burst. Web.

Dubai Forums (2009). Dubai Prices to Fall ‘70% from the Peak. Web.

IMF (2003). United Arab Emirates: Selected Issues and Statistical Appendix. Washington, D.C: International Monetary Fund.

Khamis, M. (2010). Impact of the Global Financial Crisis on the Gulf Corporation Council Countries and the Challenges Ahead. Web.

Noack, S., & Betriebswirt, D. (2007). Doing Business in Dubai and the United Arab Emirates. Berlin: GRIN Verlag.

Property Digest (2009). UAE Real Estate Sector on the Road to Recovery. Web.

Property Wire (2010). Real Estate Sector Is The Worst Hit In Economic Terms, Officials Admit. Web.

United Nations (2009). The Global Economic and Financial Crisis: Regional Impacts, Responses and Solutions. New York: United Nations publications.