Nature of the Problem

The United States’ residential housing market has remained robust over the recent past as individuals struggle to purchase their own homes. The real estate industry was significantly affected by the 2008 global economic recessions, as Schwartz (2014) observes, but it has since recovered and is currently registering impressive growth. A study by Hunt-Ahmed (2013) shows that although the demand for housing units has remained high over the past decade, competition is growing as new construction firms continue to penetrate the local market. Buyers are keen on getting the best value for their money. When making their buying decisions, the principal factors they always consider is the price of the house, its location, and the quality of the unit. It means that the developers who fail to understand these factors may find it difficult to achieve success in this market.

Putting up a residential house in the United States is a costly process. If a developer is unable to sell the product at the desired time, the company’s operations may be halted. The longer it takes for a company to sell its housing units, the lesser the profit margin will be. That is why it is important to have a comprehensive understanding of the market in terms of customers’ tastes and preferences, the best locations, and the best pricing strategies. The construction companies with the largest market share have learned how to cut their unit cost of operations as a way of gaining a competitive advantage over their rivals in the market. On the other hand, homeowners must understand when and where to buy their homes. Andritzky (2014) advises that it is not prudent to purchase a housing unit before understanding the location. Such a mistake may force a person to vacate the home because of various undesirable factors within the surrounding environment that one failed to detect because of a lack of due diligence when purchasing the unit. Timing is also critical in ensuring that one gets a housing unit at the best price possible. In this paper, the researcher will conduct a comprehensive analysis of the United States residential market.

Research Questions

Homeownership is one of the most desired things in the United States. However, not everyone can own a decent house because of varying reasons. The residential housing market has been growing consistently over the years despite the natural, economic, and socio-political challenges. In this study, the goal is to analyze the market in a way that outlines the challenges and opportunities that the players in the industry have. The study should provide comprehensive information that can be instrumental in the decision-king processes of both developers and buyers. The following are the guiding questions used in this research:

- What are the fundamental challenges in the residential housing market?

- What are the opportunities in this industry that can benefit both buyers and sellers?

- What are the strategies that firms in this industry can use to overcome the challenges?

- What are the trends in homeownership in the United States over the last two decades?

Answering these questions will enable the developers to understand issues that may affect their rate of success when operating in the real estate industry. Collecting data from the relevant databases will make it possible to understand the current problems and how they can be addressed.

Mission Statement

The mission of this research is to come up with a comprehensive document that analyzes the residential housing market in the United States. The document should be useful both to the aspiring homeowners and real estate developers. The United States has one of the most robust residential housing markets in the world. Those who plan to purchase a housing unit should have as much information as they can get. They need to know the right time when they can get the best deals in the market. They need to know areas that offer the best value in terms of the available infrastructure, connectivity to the rest of the country, ability to withstand destructive natural forces such as major floods and earthquakes, and any other factor that may be personal to the buyer. The real estate developers are always keen on ensuring that houses they build are released to the market within the shortest time possible. This report aims to provide a pattern in the real estate market over the last 20 years that can help the developers to make correct predictions in the market. By studying the past changes in this industry based on the prevailing socio-economic and political forces, these companies will be able to foresee events that may have significant implications for their business, as Taylor (2018) observes. The comprehensive statistical analysis of the market will be particularly important in predicting the change in demand and price of the housing units in different cities across the United States.

Summary of Existing Problems

According to Schwartz (2014), although the residential housing market in the United States is one of the most attractive in the world, it is often faced by numerous challenges that may affect how firms and customers behave. Understanding these problems is critical in enabling the players to understand the best approach to take when dealing with them. In this section of the paper, the researcher will look at the challenges that affect both the developers and their customers.

Problems Faced by Real Estate Developers

The real estate developers in the United States often face varying problems in the residential housing market. Some of these challenges have serious implications that may cost a lot to manage. Other challenges are common to all the players in the industry and may require a united approach to find an appropriate solution. The following are the fundamental problems that players in the residential housing market often face:

The high cost of construction

According to Schwartz (2014), the cost of construction has been going up consistently over the recent past, and the situation is expected to get worse in the coming days. The construction companies heavily rely on immigrants who are willing to take physically demanding jobs in this industry. Most of the American-born citizens often shy away from demanding jobs in the construction industry. However, Lin (2013) explains that the problem has always been solved by the high number of immigrants, especially from Africa, parts of Asia, and Mexico, who are willing and able to work in this industry. The current regime has expressed its desire to reduce the number of immigrants coming to the country and deport those who have overstayed their visit. It means that the construction companies will be forced to attract American-born citizens as the labor force is expected to shrink even further in the coming days. These companies will be forced to pay more to attract the locals into this industry. The increased cost of labor is expected to inflate the overall cost of construction. The emerging needs and preferences also mean that the developers have to build modern houses using high standards. These new demands mean that the unit cost of construction will go up. The additional cost must be transferred to the customers, which in turn increases the price in the market. The high price negatively affects the demand for these products.

Financing

The United States’ housing bubble and the credit crisis that followed (2007-2009) have left a lasting impact on the financing of the real estate market (Rogers, Powell, & Carter, 2013). Many financial institutions faced serious challenges, and some were on the brink of collapse because of their heavy involvement in financing the real estate industry. Lehman Brothers Holdings Inc was not lucky as it was forced out of the market because of the bubble burst in the housing industry. The collapse of such a giant financial company because of the unforeseen forces in this volatile market has made many financial institutions reluctant when it comes to extending loans to developers. Unlike in the past when it was easy for the construction companies to have access to loans, banks are currently very demanding. Before issuing a loan, they ensure that it is adequately insured to protect them from any volatility in the market. Ensuring these loans means that the borrowers have to pay more to cover the insurance cost. The problem has significantly affected small and medium-sized developers who rely on financial support from banks to put up housing units for sale. The problem has forced some of them out of the industry.

Fluctuating prices

When putting up a residential housing unit, profitability is always based on the current market. One of the dangerous assumptions that are often made is that the price of the houses can only change upwards. However, there are cases where the change in price is negative. Recession can affect the economy at any time, and it is almost impossible to predict how it will affect the housing market. If the price of housing units drops, the profitability of the companies will be affected. In some cases, the price may drop below the cost that was used to construct the unit. Some companies may prefer to hold on to their product until such a time that the market forces will adjust the price to the desirable levels. However, Schwartz (2014) warns against such a strategy because sometimes the price may fall further, contrary to the expectations of the affected firms. Moreover, when a developer holds on to a product for a long time, the net benefit from that unit drops. As such, sometimes these companies are forced to sell the housing units at a loss and find ways of making their recovery.

Natural disasters

The real estate sector is not immune to some of the worst natural disasters that the country has been experiencing. The country has been affected by major cyclones that have destroyed homes, some of which were under construction. Hurricane Katrina is one of the most catastrophic natural disasters in the United States’ history. It claimed several lives and led to the loss of over $ 100 billion in destroyed properties. Hurricane Harvey is a more recent natural disaster that led to the destruction of properties to the tune of $ 108 billion (Fujita, 2016). Hurricane Sandy, Hurricane Andrew, and Los Angeles Earthquake are the other major natural disasters of recent times. According to Fujita (2016), these natural disasters mostly affect buildings. Even if it is predicted and other properties moved to safer locations, it is not possible to move buildings. Some of these natural disasters such as major earthquakes and hurricanes often destroy buildings irrespective of measures that may be taken to counter them. Developers often lose millions of dollars in such disasters.

Household formation

The changing housing formation in the United States is another worrying trend that affects the demand for residential houses. More adult Americans now stay in their parents’ homes for long before considering acquiring their housing units. The number of adults (25-34 years of age) who are still staying with their parents has increased significantly over the last 15 years. In 2000, the number was one in every ten individuals falling under the above category (Gjerstad & Smith, 2014). However, that has increased significantly to one in every seven individuals in 2017. The more time adults spend in their parents’ home before considering getting their apartments, the lesser the demand will be in the market.

Problems Faced by Home Buyers/Owners

Buyers of residential housing units are also facing numerous challenges in their quest to purchase their desired housing units in preferred locations. These challenges faced by the buyers directly affect the market. Some of these problems include the following:

Financing

Homeownership is different from renting a housing facility. Hunt-Ahmed (2013) defines homeownership as the percentage of homes owned by their occupants, which currently stands at 67.4% in the United States. To purchase a residential house, one must be able to pay the lump sum amount demanded by the seller. In many cases, the buyers may not have the full amount and may resort to borrowing from financial institutions. However, many banks are currently shying away from the real estate market following the collapse of the giant financial institution, the Lehman Brothers, because of its heavy involvement in the real estate industry. The problem has reduced the buying power of the customers.

Mortgage distress

Inflation and other turbulent economic forces tend to reduce the value of housing units in the country. The ‘underwater effect’, which refers to a situation where the value of a home is less than the amount the owner owes to the bank (the mortgage) affects over 50 million residential units in the country (Schwartz, 2014). A few may continue servicing their mortgages even after realizing that their value is less than the amount of money they have to pay. It is stressful to realize that the value of the home has dropped to the levels below what one has to pay. The phenomenon has made many Americans prefer renting for a very long time before considering the option of buying their own homes.

High prices

High prices that developers demand is one of the main challenges that buyers cite. According to Wiedemer, Wiedemer, and Spitzer (2014), the cost of an average house in the United States is $ 187,000. The cost may vary depending on the state, city, and the population in a given area. When it is impossible to get the amount from financial institutions, some of the low and mid-income families are unable to purchase the residential housing units.

Assumption Based on Economics, Finance, and Management Theory

The real estate industry is often driven by various assumptions based on past trends and events. One of the main economic assumptions common in this industry is that when all other factors are held constant, the price of housing units will increase with a change of time. Factors such as inflation, economic progress, and an increase in the population are some of the major factors believed to influence the price of housing units. Segoviano (2013) argues that this assumption remains true unless there are unforeseen events that may create a different pattern in the market. Another major financial assumption that is common in this industry is that every American family (a couple with children) is likely to make an effort to purchase a home as a means of enhancing its stability.

The assumption, as Koo (2014) observes, is also true among American citizens and residents who plan to stay in the country even in their old age. However, those who plan to relocate to other parts of the world after a given period rarely consider owning a home in the country. The management theory that is often applied by financial institutions when giving a mortgage to their customers in this industry is that the value of the property will remain higher than the amount that the customer owes the bank after the initial basic payments have been made (Fujita, 2016). It means that in case of a default, the bank can still recover its money by repossessing the property. Lin (2013) observes that although they are painful experiences, foreclosures cannot be avoided in case customers are unable to pay.

Arguments for and Against Based on the Managerial Economics

Some of the assumptions and theories used by players in the real estate market are unavoidable, and when used properly can be beneficial to the companies. For instance, the assumption that housing unit prices will consistently increase can help in avoiding negative speculations that tend to affect housing prices negatively. When there is a drop in the market price because of an event in the market, firms will avoid the rush to dump their products, a move that can worsen the situation. The assumption that many American families would consider buying homes as a sign of stability is another important factor that should guide the developers when marketing their products. It identifies the most attractive segment of the market. Although the assumption that the value of the house will always be higher than the amount owed to the bank by the homeowners is always right, some changes in the market may affect its validity. It is common to find cases where the value drops below what the customers owe.

Analysis of the Existing Situation

The statistical and mathematical analysis of the residential housing market is critical in understanding the current forces in the industry and how the players can deal with them effectively. It is important to start by conducting an analysis of the housing units in the United States over the recent past. As Koo (2014) explains, it is important to understand the difference between the residential housing units and rental units in major urban centers. This study primarily focuses on the residential housing market. Figure 1 below shows the increase in the housing units in the United States over the past 40 years.

The statistical analysis shows that in 1975, there were 78.82 million housing units in the United States. The number has increased significantly since then because of the increasing population. In 1985, the number increased to 97.33 million housing units. In 1995, the number of housing units increased to 112.66 million. In 2005, it was estimated that the country had 123.6 million housing units. The current estimates show that the number of housing units in the United States is over 136.57 million. It is an indication that since 1975, the number of residential houses is almost doubled, a sign that the demand is increasing. Those who are not living in their houses are renting housing units (Piketty & Goldhammer, 2017). They are not part of the above statistics. It is also important to note that a small number of Americans are homeless and live in their cars or structures that cannot be classified as housing units. The price for the housing units has been fluctuating over the years. Figure 2 below shows the fluctuation.

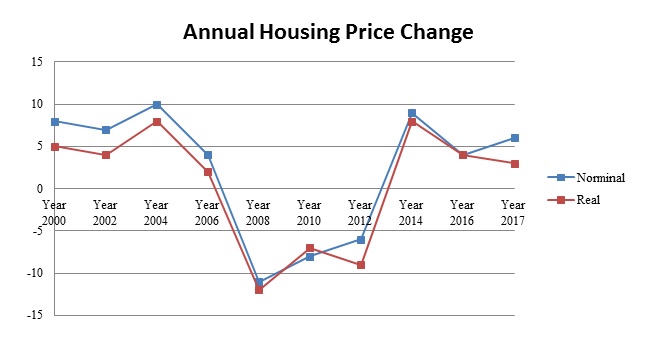

The chart above shows a pattern of change in the price of residential houses that are based on various external environmental factors. From 2000 to 2002, there was a drop in the price of a house in the country. The trend was attributed to the change of regime from Bill Clinton and George Bush. Buyers were not sure of the economic impact of the change of government and, therefore, adopted the ‘wait-and-see’ attitude when it came to purchasing the housing units. However, the price went up after the change of regime. In the elections of 2008, the price that had been on the rise consistently started dropping. It is an indication that political events in the country also affect the price of houses. The price of residential houses was at its lowest in the year 2008. It was the year that the recession started affecting many sectors of the economy. It was also another year of a general election. The unfavorable economic and political events affected the price. From 2012 to 2014, the price was once again on the increase. When the country was nearing the general election in 2016, the same pattern of a drop in the price of housing units was witnessed. Using these statistical data, it is easy for the developers to know when the price of their products will increase or decrease. Figure 3 below shows the cities that have registered the highest price hike in the United States.

Seattle had the highest increase in the price of its residential housing units in the past year at 12.71%. It is followed by Las Vegas at 10.60%, San Francisco at 9.04%, San Diego at 7.45%, and Los Angeles at 7.02%. Other cities that have registered a significant increase in the residential housing price include Tampa, Dallas, Detroit, and Denver. The common factor in these cities associated with the price increase is the consistent increase in population. Most of them have registered more than an 8% increase in population over the past 2 years. The increase in the purchasing power of the residents is another factor that is attributed to the above change. The above analysis makes it necessary to look at the homeownership in the country over the past decade. Figure 4 below shows the varying homeownership in the United States based on the different status of those interviewed.

A married couple is the most likely individual to own homes in the United States at 84.2%. The trend is attributed to the fact that the couple has a combined financial effort that makes it easy for them to purchase the units. The desire for married individuals with children to have a stable home for the family is an extra push for such individuals to purchase homes. Real estate developers should understand that this category is the most attractive when marketing their products in the real estate market. The second-highest category has single females at 59.6%. A significant number of them are divorced and because of the need to take care of their children in their home, were given full ownership of such homes. Men who have never been married come third at 59.1%. Women who have never been married are the least likely group of people to own homes in this country. Table 1 below shows homeownership by race over the recent past.

Table 1: Homeownership by Race. Source (Piketty & Goldhammer, 2017).

Constructive Criticism

The real estate industry has been registering impressive growth over the past five decades because of the economic progress that has been witnessed in the country within that same period. The real estate developers have done a lot to ensure that they meet the housing needs in the country. However, Fujita (2016) admits that some of them have failed to meet the expectations of the industry. One of the main criticisms leveled against this industry is its overreliance on the banking industry. The real estate developers can rarely survive without the direct support of the banking industry. The trend needs to change. The returns made from the investments should be enough to support future developments. Loans from financial institutions should only form a small percentage of their capital. The change of trend will help this industry to avoid cases where negative events in the financial industry have a crippling effect on its operations. Segoviano (2013) identifies another major criticism of the industry as its inability to deal with speculative forces. Some developers make extraordinary profits on such speculations. What they forget is that such speculations may hurt their customers, earning them a negative image in the market.

The Probable Solutions and Suggestions to Get Appropriate Credits

The real estate market needs to find a way of overcoming the issues identified above to boost its growth and to increase its resilience against external environmental forces. When it comes to the issue of financing their operations, the developers should form a trend where they reinvest their profits to avoid cases where they have to depend heavily on financial institutions. The stakeholders should also be capable and willing to deal with speculative forces in the market irrespective of the possible beneficiaries. These firms should regularly inform the market about how the current socio-political and economic forces may have a real impact on the industry. Such regular public awareness campaigns help in fighting speculations. Andritzky (2014) also advises that these firms should broaden their product portfolio. Other than the attractive middle class, there should also be products that target low-income earners in the country. The strategy will not only improve revenues for these companies but also increase homeownership in the country.

The Main Focus Based on the Mission Statement and the Problem

The main focus of this study was to conduct a critical analysis of the residential housing market both quantitatively and qualitatively to explain forces that affect it and how they can be dealt with in the country. The study has identified the trends in homeownership, changes in price, and factors that hinder Americans from owning homes. The study also provides constructive criticism as a way of identifying the weaknesses of real estate developers and what they can do to address the identified issues. This study provides insightful information that can be used by the developers to understand and predict changes in this market.

Conclusion

The real estate market is one of the most robust and highly profitable industries in the United States. However, the industry has only been attracting large companies with the financial capacity to finance expensive projects. The study shows that homeownership in the United States has been on the rise over the past decade. The learning experience has provided the researcher with critical information about the major factors that affect the industry. The information, when applied correctly by the players in this industry, can enable developers to avoid massive losses that are sometimes common in the industry. The information equips them with the power to predict possible changes in this industry.

References

Andritzky, J. (2014). Resolving residential mortgage distress. Washington, DC: International Monetary Fund.

Fujita, K. (2016). Residential segregation in comparative perspective: Making sense of contextual diversity. New York, NY: Routledge.

Gjerstad, S., & Smith, V. (2014). Rethinking housing bubbles: The role of household and bank balance sheets in modeling economic cycles. Cambridge, UK: Cambridge University Press.

Hunt-Ahmed, K. (2013). Contemporary Islamic Finance: Innovations, applications, and best practices. Hoboken, NJ: John Wiley & Sons.

Koo, R. (2014). The escape from balance sheet recession and the QE trap: A hazardous road for the world economy. Hoboken, NJ: Wiley.

Lin, J. Y. (2013). Against the consensus: Reflections on the great recession. Cambridge, UK: Cambridge University Press.

Piketty, T., & Goldhammer, A. (2017). Capital in the twenty-first century. Cambridge, MA: The Belknap Press of Harvard University Press.

Rogers, C., Powell, J., & Carter, V. (2013). Where credit is due: Bringing equity to credit and housing after the market meltdown. Lanham, MD: University Press of America.

Schwartz, A. (2014). Housing policy in the United States. New York, NY: Francis & Taylor Group.

Segoviano, B. (2013). Securitization: Lessons learned and the road ahead. Washington, DC: International Monetary Fund.

Taylor, M. (2018). Application of the political economy to rural health disparities. Cham, Switzerland: Springer

Wiedemer, D., Wiedemer, A., & Spitzer, C. (2014). Aftershock: Protect yourself and profit in the next global financial meltdown. Hoboken, NJ: John Wiley & Sons.