Abstract

The housing bubble in London had created undesirable social consequence. The middle-class was driven out of the city due to unaffordable prices of property. High foreign investment in the property market also resulted in inflated price of houses. This paper studies the determinants and effects of the housing bubble in London and provides recommendations.

Introduction

The housing market in London has been in a bubble for past few years. However, the bubble burst in 2017. The housing sales in London fell by 18 percent and prices fell by 55 percent in 2016 (Collinson 2017, pp. para 3-4). In 2016, the housing prices in London were beyond the reach of average income household (Coppola 2017, p. para 7). This should have reduced the price instead the prices increased. The aim of the paper is to understand the reasons behind the bubble in the property market in London.

Economic Functioning of the Housing Market in London

Sources And Determinants Of Demand And Supply

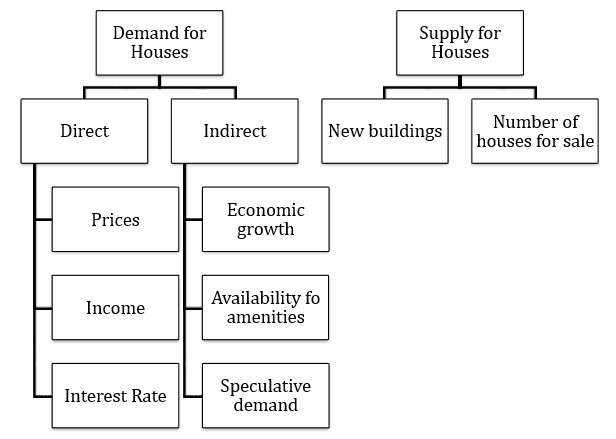

Theoretically, prices should be determined by the interaction of market demand and supply. The determinants for demand for housing are demographic development, income level, interest rates, and the intent to purchase. The indirect determinants are those that influence the demand indirectly such as availability of transportation, amenities, schools, etc. So, the houses located in areas with abundance of amenities, such as London, fetched higher prices. The following diagram shows the main determinants of housing prices in London (see figure 1).

Incentives

The incentives that may have resulted in the rise in house prices in London are rise in land prices, regulations, and promotions. As the land prices in London increased, the general tendency was to invest in land. Thus, the relatively better short and long-term performance of London housing market may have induced for higher investment.

Price Mechanism

Demand for houses has an inverse relationship with prices. When prices are higher, demand for houses will fall and vice versa. However, the inverse may also be true as the housing market is speculative. Higher prices may mean higher investment opportunity as buyers expect greater return on the property. When property market is highly speculative, it results in higher demand. Further, if higher price induces the buyers to believe that it will fetch them higher rent then they may be convinced to purchase the property at higher price.

Therefore, when the price mechanism is considered purely from the conjecture of price and demand, with other external factors assumed fixed, price has a negative relationship with demand but when the external factors determine demand, price and demand has a positive relationship. This is what has been observed in London house market.

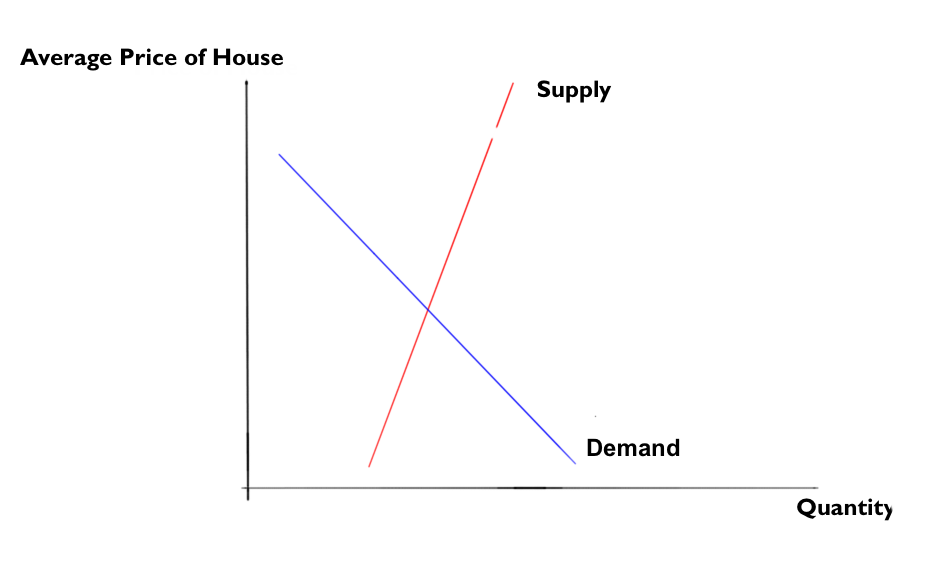

Over time the demand for houses has risen continually, while the supply for houses has remained almost stable as land availability is fixed. Given that all other determinants are constant, the demand curve is downward sloping and the supply curve is an upward-sloping (see figure 2).

Causes For And Effects Of Shifts In Demand And Supply

Demand

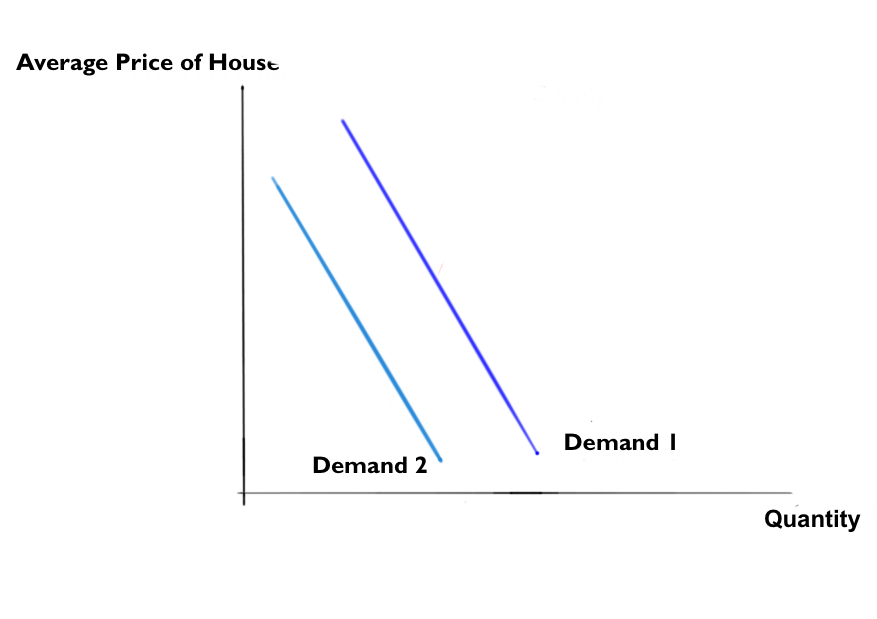

Some other factors that cause a shift in the demand curve are change in interest rates, mortgage availability and interest rates, population, social trend, availability of finance for purchase, income of households, etc. For instance, the demand curve for houses will shift when there is an increase in interest rates for housing loans. When interest rate increases, it increases the cost of the house considerably for the buyer, who will then try to demand less and so the demand curve will shift leftward (see figure 3). However, when interest rates are low, there will be higher demand.

Supply

The factors that cause a shift in the supply curve are non-price factors such as government legislation, availability of factors such as land and labor, and cost of building new houses. Let us consider the example of land as a factor for building houses. As land is a fixed commodity, increase in population reduces availability of land. This increases the cost of building houses. As cost increases, the market determined price of the house is no longer profitable for the seller, who tends to decrease the supply of houses in order to maintain higher prices. This will therefore, shift the supply curve to the left.

Elasticity of Demand for Housing

Own Price Elasticity

Levin and Price (2009, p. 714) point out that demand for houses are not price sensitive as there are many other factors that affect the decision to purchase a house. Price elasticity of housing demand has historically been inelastic as it is mostly affected by other determinants. For instance, if there is a rise in price of a house in London, given its status as a highly developed urban area with many amenities, the fall in demand will be low, as buyers will still be attracted to buy property in the city because of its social status.

According to the study conducted by Ermisch, Findlay and Gibbc (1996, p. 72) the demand for house will increase by only 3 to 4 percent due to a 10 percent decrease in price. However, this elasticity will vary for different demographic groups. For instance, price elasticity of demand for houses becomes more inelastic when the average age of the population is higher. Thus, when the demography consists of middle-aged to older individuals there is a greater demand for houses even at higher prices. Essafi and Simon (2015 , p. 119) found the same results while studying data from French housing sector.

Income Elasticity of Demand

Carliner (1973, p. 531) points out that the income elasticity differs based on the demographics of the population. For instance, people with higher income levels tend to have an inelastic income elasticity to demand while people with lower income have a moderate-income elastic demand. Further, age too has a strong influence on the decision to purchase. Younger age cohorts from 25 to 40 years will not be influenced to buy more houses with an increase in income. However, people above 40 and below 65 years will be more inclined to purchase a house with increase in income.

Cross-price Elasticity

Cross elasticity of housing demand is high as it shows the change in demand of houses with respect to changes in prices of land, interest rate, etc. For instance, if the land price increases, this will increase the cost of production, which in turn will drive up demand prices. When price increases, there is a fall in demand. Thus, the cross elasticity of prices of houses are relatively elastic.

Price Elasticity of Supply for Housing

According to the findings of Hilber & Vermeulen (2016, p. 359) the main factors that affect the price elasticity of housing supply are regulatory constraint, scarcity of land, economic condition. For instance, when there is economic growth, the price elasticity of supply is elastic, but when the economy is in recession, the price elasticity is inelastic. Further, stringent regulatory control in the London area has increased the difficulty of constructing new houses in the city, thus reducing supply (Hilber & Vermeulen 2016, p. 383). Further, local income levels also affect housing supply. When the economy is in slump, there is higher unemployment, thus, reducing demand for houses. So, the suppliers make fewer houses as construction cost vis-à-vis housing prices are higher.

Determine the Nature of the Equilibrium in the Housing Market

The housing price in London for an average income household is considerably high. The average price of individual property is as high as 6 times that of the average income of a household in mid-2007 in the UK (Kuenzel & Bjørnbak 2008, p. 7). The buyer’s ability to pay for a house was much lower than that of the housing prices. Thus the demand and supply curve adjust to reach a price at which the housing market is willing to buy houses.

House Price Bubble in London

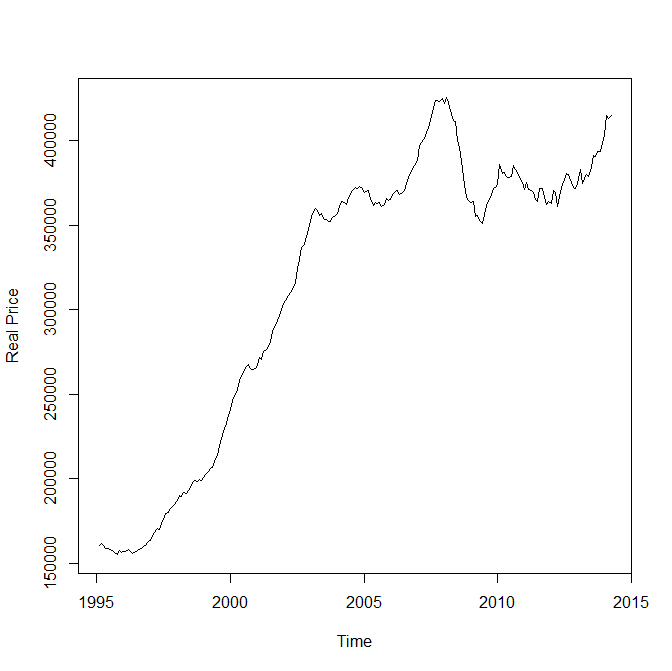

The existence of housing price bubble in London till 2016 is undeniable. The housing prices in the city reached eight times to that of first-time buyer’s salary.

The rise in the property prices in London is due to the influx of large amount of foreign capital. Foreigners have started to invest in the London property market and have increased the demand and price for the properties. It is believed that this high influx of foreign capital in the London housing market is purely speculative in nature and the rise in property prices in the city is a speculative bubble (Garino & Sarno 2004, p. 789). Further, the expansionary monetary policy of the government also instigated the housing bubble in the UK.

Social and Economic Consequences of the Increase in House Prices in London

The London housing bubble has far-reaching social and economic consequence. The bubble has worst affected the middle classes who are unable to afford houses in London. The high prices have consequently resulted in higher income households to flock to the city, where the middle class cannot live. Though, in terms of trade in London, the influx of high-income groups has boosted economic growth in London but has far reaching social consequences. Such disparity in the market is bound to cause market failure.

Policy Intervention To Correct Such Market Failures

The main problem in London is fixed land supply. The policy intervention that the government has tried to do is to build more houses in more innovative way in order to reduce the price. These houses are cheaper to build and therefore can be sold at lower prices.

This policy intervention can help the London market in two ways. First, it can reduce the socio-economic homogeneity of the residents as there are more higher income households residing in the city. This will help more middle-income group households to buy houses.

Recommendations

Since the economic slowdown in 2008, the UK government has followed a monetary policy that aimed at inflating real estate prices. This policy must be changed in order to reduce prices.

Development of sub-urban areas with similar amenities as the city is the only way to dissipate population pressure on urban areas. This will help reduce housing prices in London.

Reference List

Carliner, G 1973, ‘Income Elasticity of Housing Demand’, The Review of Economics and Statistics, vol. 55, no. 4, pp. 528-532.

Collinson, P 2017, House sales have fallen by nearly a third in some parts of UK, says Lloyds. Web.

Coppola, F 2017, The London housing bubble has finally burst. Web.

Ermisch, J, Findlay, J & Gibbc, K 1996, ‘The Price Elasticity of Housing Demand in Britain: Issues of Sample Selection’, Journal of Housing Economics, vol. 5, no. 1, pp. 64-86.

Essafi, Y & Simon, A 2015 , ‘Housing market and demography, evidence from French panel data ‘, European Real Estate Society, pp. 107-133.

Fry, J 2014, Is there a bubble in London property prices?. Web.

Garino, G & Sarno, L 2004, ‘Speculative Bubbles in U.K. House Prices: Some New Evidence’, Southern Economic Journal, vol. 70, no. 4, pp. 777-795.

Hilber, CAL & Vermeulen, W 2016, ‘The impact of supply constraints on house prices in England’, Economic Journal, vol. 126, no. 591, pp. 358-405.

Kuenzel, R & Bjørnbak, B 2008, ‘The UK Housing Market: Anatomy of a house price boom’, ECFIN Country Focus, vol. 5, no. 11, pp. 2-10.

Lavin, EJ & Pryce, GBJ 2009, ‘What are the price elasticity of house supply? Real interest rate effects and cyclical asymmeries’, Housing Studies, vol. 24, no. 6, pp. 713-736.