Executive Summary

The offered paper analyzes the COVID-19 impact on the Asian region. The Chinese retail industry was selected for the analysis. The choice is explained by several important reasons that should be mentioned. First, the state has one of the biggest and fastest growing economies with a substantial impact on global trade and economy. Second, the Chinese retail industry is the biggest in the world, with stable and high revenue. Finally, the Chinese government introduced one of the severest quarantine and regulatory measures to address the problem. The lockdown measures became a severe challenge for the retail industry. The paper outlines how the local culture, relations, and government’s peculiarities impacted the situation and retail changes. At the same time, the solutions to the problem are analyzed. These include the shift to online trade, digitalization of the retail sector, governmental support, and the effective use of new channels. Using the acquired data, it is possible to predict that the sector will be able to recover from the COVID-19 aftermath and continue its evolution in the future.

Introduction

The COVID-19 pandemic has become a severe challenge for the whole world. The high threat coming from the disease, its contagious nature, and harm done to individuals’ well-being required specific measures. For this reason, governments had to introduce restrictive measures implying quarantine, minimization of personal contacts, social distancing, and strict monitoring. These decisions impacted the economic life of states globally. The restrictive measures introduced critical changes in the functioning of the big, medium, and small businesses and industries. As a result, many nations experienced serious economic aftermath affecting their further opportunities for development and recovery after the pandemic.

The Asian region was also impacted by COVID-19, and measures introduced to stop the further spread of the virus. China was one of the first states to take steps to minimize the threat and regulate social contacts. It helped to cope successfully with the challenge; however, it also had numerous adverse effects on business. For instance, the retail industry, as the spere dependent on cooperation with clients, experienced the worst decline in two years (Ma et al., 2021). It indicated the need for specific strategies to recover and realign the stable work of the sector. The following paper is devoted to analyzing the Chinese retail industry regarding the pandemic and unique factors peculiar to the Asian region.

Problem

Thus, the problem under discussion is the effect of the COVID-19 pandemic on the retail industry in China and the strategies that were used to cope with the challenge. Before the pandemic, the state was one of the leading economic powers in the world (Smith & Fallon, 2020). The state was also the biggest retail market globally. It was linked to the growing population, income, and the fast-evolving industrial sector. In 2021, it preserved its leading position with a retail sales revenue estimating around $6.5 trillion (Liu & Hu, 2020). There are about 269,345 retail chains across the country, generating a stable income (Song et al., 2021). The biggest companies are Suning Commerce Group, Come Electrical Appliances Holding, Red Star Macalline Holding, and Beijing Easyhome New Retail Development (Liu & Hu, 2020). Chinese retail market is highly digitalized and is characterized by extremely high levels of diversity (Burnham et al., 2020). There are numerous low, medium, and big-sized enterprises offering services to clients.

However, the COVID-19 pandemic became a severe challenge for the industry. Lockdowns impacted the company’s ability to interact with clients and offer products to them. Moreover, there was a disruption in supply chains caused by the restrictive measures and the necessity to avoid further virus spread. As a result, 34% of firms were closed, while sales declined by 65% compared to pre-pandemic numbers (Brucal et al., 2021). The pandemic became a severe challenge for retailers as they had to survive in terms of strict regulatory measures and the new laws regulating interactions.

In such a way, the central problem discussed in the paper is the effect of covid 19 pandemic on the retail industry in China and its potential recovery. The recent reports prove the scope of the challenge, as the first signs of revitalization were noticed only in 2022, while in the previous years, the situation remained complex (Habibi et al., 2020). The selected topic should be discussed regarding the macro characteristic peculiar to the region, its politics, culture, and regulations affecting the work of companies in China. Numerous researchers agree that the impact of COVID-19 is much higher for Asian firms compared to others (Akinola & Tella, 2022). It is explained by the peculiarities of local laws, regulations, people’s mentalities, and responses to the pandemic. Because of the virus outbreak, the local governments had to use extreme measures to protect citizens, which resulted in the limitation of movement, contact, and interactions. As a result, as part of the Asian region, China suffered a dramatic decrease in revenue peculiar to the retail industry, which constituted up to 30% (The World Bank, 2022). It became a critical problem for the state and required specific measures.

Major Challenges

The paper also focuses on investigating the major challenges that impacted the retail industry and its functioning during the COVID-19 outbreak. The first major issue is the necessity to realign the work of the sector regarding the new regulations and requirements. The Chinese response to the pandemic included restrictions on movement, contacts, and work of various types of businesses to ensure reduced chances of its transmission. Moreover, media campaigns were launched to increase awareness and ensure individuals remained at home (Jia & Lu, 2021). As a result, the firms and retail companies started suffering from the lack of consumers (Liu & Hu, 2020). Retail sales responded to this change and slowed down by 6% in the first stages (The World Bank, 2022). It became a critical challenge for the whole industry and impacted the economy’s growth (Liu & Hu, 2020). Another challenge is the necessity to realign the work of the sphere by using measures that might be legal regarding the existing laws and regulations. To overcome this challenge, the government uses specific economic tools and investments to ensure that small, medium, and big businesses can survive. At the same time, the digitalization of retail became one of the possible responses to the described barriers.

Discussed Solutions

The scope of the problem and the outlined issues require potent and robust strategies to respond and avoid further decline. Before the pandemic, the Chinese retail sector was characterized by high levels of technology integration. The new restrictions created the basis for their deeper integration and wide use. In such a way, the extensive use of innovations and shift to e-commerce became one of the solutions to the issue that should be discussed (Reeves et al., 2020). Moreover, the Chinese government offered specific measures to support the sector, such as tax liabilities, access to subsidies, and support for operating costs (Liu & Hu, 2020). Finally, the use of specific devices and safety measures to minimize contact helped firms to start working regarding new terms and conditions (Reeves et al., 2020). As a result, these solutions became a full measure to address the problems emerging after the COVID-19 pandemic. The effectiveness of these measures contributed to the revitalization of the economy and China’s ability to continue its development, relying on the solid and functional retail sector. These solutions became critical for the Chinese economy.

Thus, the retail sector’s future in China is considered an essential topic for discussion. At the moment, the industry is starting to recover and demonstrating stable growth because of the effective measures mentioned above. However, there is still a risk of new COVID-19 waves and the deterioration of the situation. Moreover, some restrictive measures in China remain relevant and require increased attention. For this reason, the future of the retail sphere in the country remains unclear, and much depends on the current situation and the effectiveness of regulatory measures. However, the leading country’s retailers managed to cope with challenges and adapted to new conditions by using the diversified client base, technologies, omnichannel, and following strict government regulations (Li et al., 2022). According to current forecasts, China can remain one of the retail leaders with an excellent opportunity for the further rise and transformation of its retail industry into a highly innovative sphere with stable income and flexibility to overcome new crises. It can be viewed as a result of transformation during the pandemic time.

COVID-19 Impact on the Economy

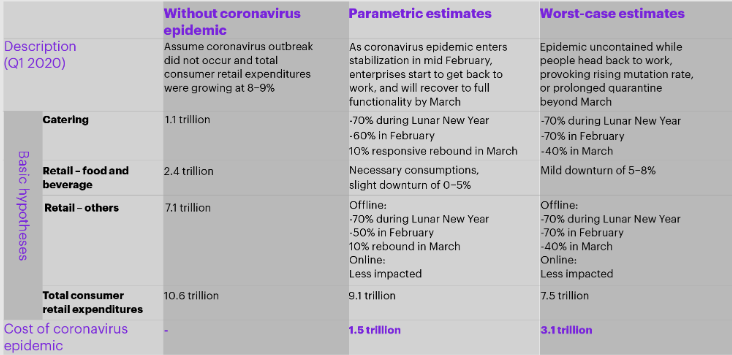

Speaking about the Chinese retail industry, it is critical to admit the overall impact of COVID-19 on the country and its economy. The extremely fast speed of the country’s evolution transformed it into one of the leaders globally (Naughton, 2018). However, the pandemic impacted the pace of development by 2,6% and slowed it down (Liu & Hu, 2020). Moreover, it is projected that in 2022, China’s economic growth will slow to 4,3% and continue up to 5,2%, which is viewed as the pandemic’s impact (Liu & Hu, 2020). The retail sector was one of the industries hit by the virus most of all. Retailers lost up to $426 billion in the first quarter of 2020. The effects of coronavirus can be seen in Figure 1. The parametric and worst-case estimates that China might lose 1.5 trillion and 3.1trillion correspondingly (Kearney, 2020). The losses come from reduced sales during major events, such as Lunar New Year, and daily restrictions (Li et al., 2022). The numbers evidence the severity of the crisis caused by the pandemic and the scope of the problem. The retail industry became one of the sectors dependent on regulatory measures and restrictions introduced by the government.

The severity of measures introduced by the Chinese government to stop the spread of the virus is one of the major causes of the reduction in revenue in the retail sector. First, the government introduced the zero tolerance COVID-19 strategies nationwide (Hu & Sidel, 2020). It implied stay-home measures, entry and exit controls, business closures, and transport suspensions in big cities with the highest risk of the COVID outbreak (Hu & Sidel, 2020). Moreover, the negative tests were the only permission to use public transport and enter the subway and local shops (Hu & Sidel, 2020). Some regions limited the transportation of individuals, especially from areas where the virus was detected recently (Liu & Hu, 2020). International travel restrictions were also introduced to minimize the risk of arriving persons who might have COVID-19 (Lin & Wei, 2022). These severe lockdown measures became a serious challenge to the whole industry and impacted its development and evolution. For retailers using physical shops and spaces, it created a critical problem because of the absence of clients and the necessity to pay rent (Liu & Hu, 2020). As a result, the inability to interact with the target audience became the main factor impacting the retail industry in China.

Cultural Peculiarities

The scope of the problem also comes from the cultural peculiarities of the region. Generally, Asian people are viewed as law-obedient individuals with high respect for authorities and existing laws. China has a specific form of government characterized by solid authoritarian power concentrated in the hands of the ruling communist party (Hu & Sidel, 2020). As a result, it has the necessary tools to impact the social and economic life in the state (Hu & Sidel, 2020). For this reason, the severe measures introduced by the government were followed by the majority of citizens living in different areas (Hu & Sidel, 2020). On the one hand, it helped to slow down the spread of the disease and protect the nation’s health (Wang & Wu, 2021). However, the measures became a severe challenge for the retail sector, and the cultural peculiarities of the region became a factor making it worse (Wang & Wu, 2021). At the same time, the hardworking nature of Chinese people and their resilience and coping skills helped to avoid panic and introduce effective measures to revitalize the economy and ensure the sector could recover and continue its growth.

Policy and Governmental Regulations

The right policy used to manage the pandemic should be viewed as one of the factors helping to avoid the worst-case scenario. China’s successful management of the crisis was mainly shaped by institutional settings, existing governing structures, and actor strategies (Jing, 2021). The combination of the specific regime, unitary government, legitimacy, and trust among citizens guaranteed strong political commitment and helped to align the effective coordination (Jing, 2021). The local authorities were supported by the national ones, while the incentives for introducing the restrictive measures and controlling their observation were financed using the national budget (Jing, 2021). It promoted a better response to the virus and helped to reduce the lockdown period (Jing, 2021). As a result, although the retail sphere experienced severe stress, it preserved the capability to recover and restore its functionality. In such a way, the cooperation between civil society and political powers helped to create a substantial response to the pandemic. It ensured the economy remained functional and could support the further development of the state, which was vital for that period.

At the same time, governmental regulations and specific forms of governance were critical for the Chinese economy during the pandemic. For instance, citizens of many European states protested against severe limits used to control their movements and traffic to stop the further spread of the virus (Yan et al., 2020). It resulted in the growing tension in relations between governments and people and required additional investment to manage the problem (Zhao & Wu, 2020). Moreover, the attention shifted from the real problems caused by the pandemic to civil protests, which reduced the effectiveness of policies used to control the situation. In China, the rise of new forms of co-governance was observed (Yan et al., 2020). In Urban China, the resident committees organized the functioning of neighborhoods in terms of the new legal field and contributed to the increased political legitimacy of all offered solutions (Liu et al., 2022). These measures positively impacted the retail sphere as local shops and markets benefited from the organized collaboration with locals and managed to survive by selling products to groups requiring them (Liu et al., 2022). In such a way, the emergence of the new forms of governance within communities helped to avoid severer aftermath.

Major Issues among Retailers

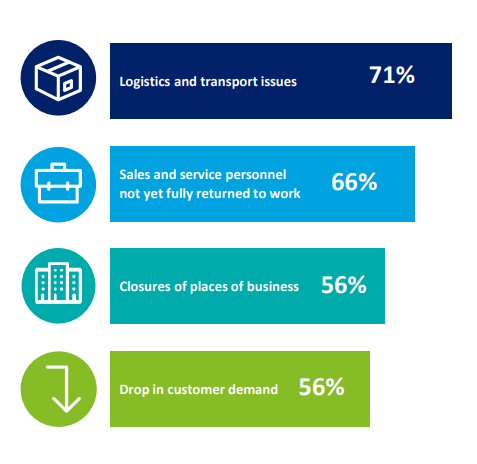

Unfortunately, despite strong and effective measures used to support the economy during the crisis, the retail sector still suffered from a decline. The investigation of the major retailers’ work outlines several main factors for revenue declines (see Figure 2). 85% of supermarkets and convenience stores in China report that logistics and transport issues have the strongest negative impact on their sales (Deloitte, 2020). The insufficient stock of required products because of the problems with transportation became critical for the retail sector. Moreover, the lack of sales and service personnel because of COVID was mentioned by 66% of retailers as a serious negative factor (Deloitte, 2020). The closures of the places for business due to the lockdown are another factor that affected the sphere and its revenue (Deloitte, 2020). Finally, more than half of agents working in the retail industry admitted the drop in customer demand caused by the pandemic (Deloitte, 2020). Many families started to save money because of the crisis and uncertainty (Guo et al., 2022). These issues became the major barriers threatening the sector’s future recovery and its ability to return to the pre-pandemic numbers.

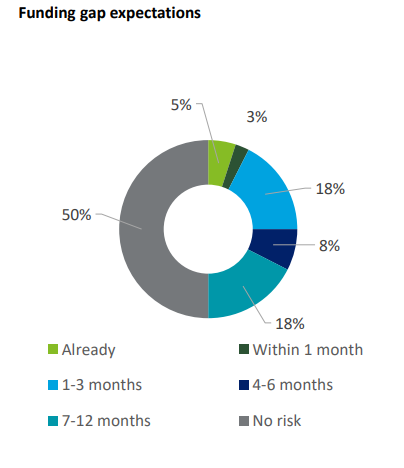

Furthermore, the pandemic and lockdown introduced the problem of cash flow pressure. More than half of companies working in the retail sphere report the risk of insufficient cash, meaning they might fail the outgoings (see Figure 3) (Deloitte, 2020). In the term of 1 to 6 months, a significant number of firms might require additional investment to pay for their debts and ensure the existing operations are performed (Deloitte, 2020). It can be viewed as the result of the pandemic as the companies lacked a major source of their income and could not cooperate with clients (Deloitte, 2020). However, at the start of 2022, most retailers had more optimistic forecasts, admitting the tendency toward the improvement of the situation because of a set of measures introduced by the government (Wang et al., 2022). It means that the risk of the retail industry collapse is lower; however, there is a need for practical regulatory measures and new ways of doing business to avoid critical outcomes.

Shift to New Business Models

The pandemic also promoted the shift to new business models and broader use of technologies. For instance, Lin Qingxuan, a cosmetics retailer based in China, was critically impacted by the pandemic as its sales reduced by 90% in 2020 (“Chinese beauty retailer moves in store advisors online during COVID-19,” 2020). The high risk of collapse impacted the reconsideration of the approach to working with clients and the shift toward e-commerce solutions and cloud-based services (Sun, 2021). As a result, a B2C e-commerce platform was created using Alibaba’s e-Commerce solution (“Chinese beauty retailer moves in store advisors online during COVID 19,” 2020). The cooperation with the giant corporation working online helped Lin Qingxuan to avoid closure and continue interacting with clients online (“Chinese beauty retailer moves in store advisors online during COVID 19,” 2020). Moreover, employees who worked in physical spaces were trained to consult customers online (“Chinese beauty retailer moves in store advisors online during COVID 19,” 2020). As a result, the company managed to save its workers and increase sales up to 60%, which was critical during the pandemic (Sun, 2021). The example shows the digitalization of the main activities and shift of priorities towards using the Internet and various forms of e-commerce to respond to the new challenges.

E-Commerce and Online Sales

The biggest product retailers in China also shifted towards using online sales and delivery services. For instance, Suning, one of the biggest companies working in the sphere, managed to preserve its competitive advantage by ensuring customers could buy products when needed (Bernot & Siqueira Cassiano, 2022). It helped to achieve two goals: first, the company saved its loyal clients and met their basic needs, and, simultaneously, it managed to survive the lockdown (Johnston, 2021). The example was followed by other retailing companies offering various products to clients. For this reason, it is possible to speak about the emergence of new business models and the popularization of online trade and e-commerce. This trend became an essential aspect of the retail industry during the pandemic and is viewed as one of the central factors helping it to recover (Johnston, 2021). At the same time, the fast shift to the new models was possible due to the favorable conditions peculiar to the region. These include the high level of the retail sphere digitalization and the existence of giant e-commerce corporations, such as Ali Baba.

The number of online shoppers before the pandemic in China was traditionally high. In 2020, it reached the number of 798.8 million, with about 42% using their mobile devices for payment (Forer, 2019). It means that e-commerce’s popularity and importance were growing during the pre-pandemic years. At the same time, the mass use of online retailers helped to create the basis for the fast transformation during the COVID-19 outbreak. The digitalization of the retail industry, employment of online payment systems, and the population’s readiness to use innovative forms became critical during the pandemic. As a result, most retailers could use online platforms that were popular in the state to rent a marketplace and continue providing their services to clients (Forer, 2019). The developed infrastructure and delivery services supported this shift and contributed to the faster transformation and emergence of new ways of interacting with the target audience. As a result, B2C models and online retail have become extremely popular during the pandemic and remain attractive for clients in China (Johnston, 2021). They also helped firms of various sizes to survive during the pandemic and avoid critical losses.

Alibaba Group’s Role

The work of Alibaba group, one of the e-commerce leaders, can evidence the importance of online business models for retailers during the covid. The corporation introduced a specific strategy to fight against the coronavirus (Sun, 2021). It implied sheltering smaller businesses to help them survive and preserve a stable level of sales (Sun, 2021). Moreover, the Alibaba group created a business customer support incentive and offered a financial support platform (Sun, 2021). It promoted better cooperation between clients and businesses and helped numerous firms to survive. Additionally, new retail services, such as connecting various retail grocery partners, were established (Sun, 2021). In general, the work of the Alibaba group and its effective and timely response to the new threat can be considered one of the factors that helped the Chinese retail industry survive during the pandemic and avoid catastrophic losses (Sun, 2021). The positive effects of the decision to shift to online business models are evidenced by the fact that numerous retailers continue using cloud services and e-commerce forms, combining them with physical shops and the marketplace (Johnston, 2021). It means that the pandemic promoted the further digitalization of the Chinese retail industry.

Finally, the increased importance of e-commerce and online forms of interaction increased the popularity of omnichannel retail. It implies combining the benefits of in-store shopping and online methods to provide an outstanding customer experience (Salvietti et al., 2022). It means that clients can use showrooms and websites to select a product and acquire it using physical spaces (Salvietti et al., 2022). The COVID pandemic accelerated e-commerce in China and increased the importance of the omnichannel model (Johnston, 2021). The ultra-fast delivery became vital for Chinese local and small markets (Qi et al., 2021). For instance, egrocery retail became one of the dominant forms during the pandemic because of its ability to meet clients’ demands (Li et al., 2020). In such a way, independent stores acquire the opportunity to interact with their clients directly and use both physical and online methods.

Role of Government

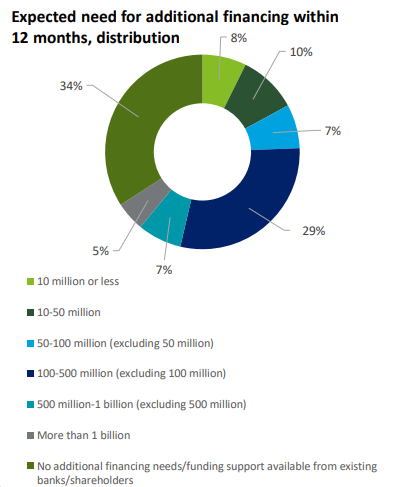

Analyzing the Chinese retail industry during the pandemic and its following recovery, it is critical to admit the significant role of government and new governance models. Following the theory of good governance, it is vital that social, economic, and political priorities rest on the consensus in the society (Naughton, 2018). At the same time, the interests of local firms and individuals should be considered to avoid conflict of interests and growing dissatisfaction (Naughton, B. (2018). Thus, realizing the pressure from the severe restrictive measures, the government also provided significant financial support to companies working in the retail sphere. The report shows that more than 60% of businesses required additional financing after the pandemic (see Figure 4). The numbers might differ; however, successful recovery requires additional investing (Deloitte, 2020). For this reason, the government introduced measures such as loans, additional financing, and a tax deduction to stabilize the situation and guarantee that the industry could recover (National Bureau of Statistics of China, 2022). Solid regulatory measures contributed to the revitalization of the economy in the short term.

The government’s contingency plan implies preserving specific restrictive measures to ensure the situation is controlled. However, less stringent and more targeted measures are employed to avoid negative results triggered by the lockdown measures. For instance, during the Omicron outbreaks, the severity of quarantine measures was much lower, and the retail sphere could continue working (National Bureau of Statistics of China, 2022). The revitalization of the economy and various types of business was also promoted by supporting the practices that emerged during the virus outbreak and financing the firms in complex states (Zhang et al., 2020). Zero tolerance policy remains topical for the region; however, the Chinese government controls the situation and relaxation of the rules when necessary (Zhang et al., 2020). In such a way, the situation remains complex; however, the retail industry shows the first signs of revitalization and the ability to recover.

Future

In general, the research shows that the pandemic became a severe challenge to the Chinese retail industry. The lockdown measures and restrictions used by the government caused numerous adverse effects on the sphere. However, the timely and successful measures helped to avoid critical losses and created the basis for new achievements. The Chinese retail sphere acquired several important post covid trends that might shape its future. First, the direct to consumers strategies have become more prevalent in the sector (Bernot & Siqueira Cassiano, 2022). Second, social commerce acquired a potent stimulus for its development and evolution. B2C interaction by using micro-stores and applications influences future interactions (Bernot & Siqueira Cassiano, 2022). In the future, it might create the basis for more effective international collaboration and interaction.

The emergence of these trends can be a key to resolving the outlined problems and stabilizing the work of the retail sphere. The increased importance of e-commerce and its spread are supported by beneficial regulations and legislation. Moreover, the government encourages the development of giants, such as Alibaba, which also shelter smaller companies and businesses. In 2022, for the first time after the pandemic, the Chinese retail industry started to grow (National Bureau of Statistics of China, 2022). It is forecasted that it will be able to recover completely because of the effective measures used by retailers and governmental support (Wu et al., 2021). Moreover, the peculiarities of the local culture, citizens’ behaviors, and their relations with the government can be viewed as positive factors helping to avoid the worst-case scenario.

Conclusion and Recommendations

Altogether, the data shows that the Chinese retail sector experienced a critical strike because of the pandemic and restrictive measures introduced by the Chinese government. The lockdown measures deprived retailers of the chance to interact with clients and generate revenues. However, the sector managed to cope with the stress because of the peculiarities of effective governance models, the specific culture of the local population, and the shift to new business models. These factors helped the sector to survive and move forward. However, the threat coming from coronavirus remains high, and it can be recommended to keep using some strategies. It is vital to cultivate e-commerce and online forms of interacting with clients as they are safe, convenient and might ensure high levels of sales in terms of the pandemic. Furthermore, the current strategy used by the government is highly effective, and it should continue using it.

References

Akinola, A. O., & Tella, O. (2022). COVID-19 and South Africa-China asymmetric relations. World Affairs, 185(3), 587–614. Web.

Bernot, A., & Siqueira Cassiano, M. (2022). China’s COVID-19 pandemic response: A first anniversary assessment. Journal of Contingencies and Crisis Management, 30, 10–21. Web.

Brucal, A., Grover, A., & Reyes, S. (2021). Damaged by the disaster: The impact of COVID-19 on firms in South Asia. The World Bank. Web.

Burnham, T. A., Frels, J. K., & Mahajan, V. (2020). The outlook for China’s innovation-driven development beyond COVID-19. Journal of the Academy of Marketing Science, 3(4), 109–126. Web.

Chinese beauty retailer moves in store advisors online during COVID 19. (2020). Springwise. Web.

Deloitte. (2020). Impact of COVID-19 on the finance and operations of China’s retailing and the industry outlook. Web.

Forer, G. (2019) China’s online retail market in an era of technological innovations. Beijing Law Review, 10, 698-729. Web.

Guo, H., Zhang, Y., Peng, Y., Luo, T., & Wang, H. (2022). Does COVID-19 affect household financial behaviors? Fresh evidence from China. SAGE Open, 12(3). Web.

Habibi, Z., Habibi, H., & Mohammadi. M. (2022). The potential impact of COVID-19 on the Chinese GDP, trade, and economy. Economies, 10(4), 73. Web.

Hu, M., & Sidel, M. (2020). Civil society and COVID in China: Responses in an authoritarian society. Nonprofit and Voluntary Sector Quarterly, 49(6), 1173–1181. Web.

Jia, W., & Lu, F. (2021). US media’s coverage of China’s handling of COVID-19: Playing the role of the fourth branch of government or the fourth estate?Global Media and China, 6(1), 8–23. Web.

Jing, Y. (2021). Seeking opportunities from crisis? China’s governance responses to the COVID-19 pandemic. International Review of Administrative Sciences, 87(3), 631–650. Web.

Johnston, L. A. (2021). World trade, e-commerce, and COVID-19: Role of and implications for China’s electronic world trade platform (eWTP). China Review, 21(2), 65–86. Web.

Kearney. (2020). The coronavirus is stirring Chinese retail. Web.

Li, J., Hallsworth, A. G., & Coca-Stefaniak, J. A. (2020). Changing grocery shopping behaviours among Chinese consumers at the outset of the COVID-19 outbreak. Journal of Economic and Social Geography, 111(3), 574–583. Web.

Liu, Z., & Hu, B. (2020) China’s economy under COVID-19: Short-term shocks and long-term changes. Modern Economy, 11, 908-919. Web.

Li, S., Liu, Y., Su, J., and Yang, X. (2022). Can e-commerce platforms build the resilience of brick-and-mortar businesses to the COVID-19 shock? An empirical analysis in the Chinese retail industry. Electronic Commerce Research. Web.

Lin, L. W., & Wei, S. Y. (2022). The impact of the internationalization of China’s new retail industry on corporate performance-A moderating effect based on proprietary assets. PloS one, 17(5), e0267825. Web.

Liu, Z., Lin, S., Lu, T., Shen, Y., & Liang, S. (2022). Towards a constructed order of co-governance: Understanding the state–society dynamics of neighbourhood collaborative responses to COVID-19 in urban China. Urban Studies. Web.

Ma, Z., Liu, Y., & Gao, Y. (2021) Research on the impact of COVID-19 on Chinese small and medium-sized enterprises: Evidence from Beijing. PLoS ONE 16(12): e0257036. Web.

National Bureau of Statistics of China. (2022). National economy sustained the momentum of recovery in July. Web.

Naughton, B. (2018). The Chinese economy (2nd ed.). The MIT Press.

Reeves, M., Faeste, L., Chen, C., Clarsson-Szlezak, P., & Whitaker, K. (2020). How Chinese companies have responded to coronavirus. Harvard Business Review. Web.

Salvietti, G., Ziliani, C., Teller, C., Ieva, M. & Ranfagni, S. (2022). Omnichannel retailing and post-pandemic recovery: Building a research agenda. International Journal of Retail & Distribution Management, 50(8/9), 1156-1181. Web.

Smith, N. R., & Fallon, T. (2020). An epochal moment? The COVID-19 pandemic and China’s international order building. World Affairs, 183(3), 235–255. Web.

Song, Y., Hao, X., Hu, Y., & Lu, Z. (2021) The impact of the COVID-19 pandemic on China’s manufacturing sector: A global value chain perspective. Frontiers in Public Health, 9, 683821. Web.

Sun, Y. (2021). How the Alibaba Group implements its mission in fighting against the epidemic. E3S Web of Conferences, 253, 01017. Web.

Qi, X., Tian, X., & Ploeger, A. (2021). Exploring Chinese consumers’ online purchase intentions toward certified food products during the COVID-19 Pandemic. Foods (Basel, Switzerland), 10(11), 2729. Web.

Wang, L., Tian, B., Filimonau, V., Ning, Z., & Yang, X. (2022). The impact of the COVID-19 pandemic on revenues of visitor attractions: An exploratory and preliminary study in China. Tourism Economics, 28(1), 153–174. Web.

The World Bank. (2022). Real estate vulnerabilities and financial stability in China. Web.

Wang, F., & Wu, M. (2021). The impacts of COVID-19 on China’s economy and energy in the context of trade protectionism. International Journal of Environmental Research and Public Health, 18(23), 12768. Web.

Wu, S., Wang, C., & Zhang, L. (2021). State capacity in response to COVID-19: A case study of China. Chinese Public Administration Review, 12(2), 152–159. Web.

Yan, B., Zhang, X., Wu, L., Zhu, H., & Chen, B. (2020). Why do countries respond differently to COVID-19? A comparative study of Sweden, China, France, and Japan. The American Review of Public Administration, 50(6–7), 762–769. Web.

Zhang, Z., Shen, Y., & Yu, J. (2020). Combating COVID-19 together: China’s collaborative response and the role of business associations. Nonprofit and Voluntary Sector Quarterly, 49(6), 1161–1172. Web.

Zhao, T., & Wu, Z. (2020). Citizen–sate collaboration in combating COVID-19 in China: Experiences and lessons from the perspective of co-production. The American Review of Public Administration, 50(6–7), 777–783. Web.