Introduction

The global sports retail industry has achieved a rapid growth over the last ten years. It is also expected to continue growing over the next five years, with an estimated growth rate of about 6% per annum to reach about $130 billion by 2020 (United Nations 2014). The rapid rate of growth in this industry is due to a number of factors.

However, the major factor contributing to the industrial growth and development at a faster rate is the dynamism in the demand for sports goods. For instance, studies have shown that there is an increase in the demand for sports goods or sport-style products in various parts of the world, especially Asia.

The purpose of this paper is to develop a comprehensive report based on the industrial analysis of the global sports retail business. It will examine the industry based on the conventional techniques of industry analysis, including forced field analysis, porters 5 forces, PEST and SWOT analysis.

This paper argues that the sports industry stands a better chance to develop rapidly over the next five years, giving corporate and other players a good chance to improve their economic development and financial health.

Force field analysis

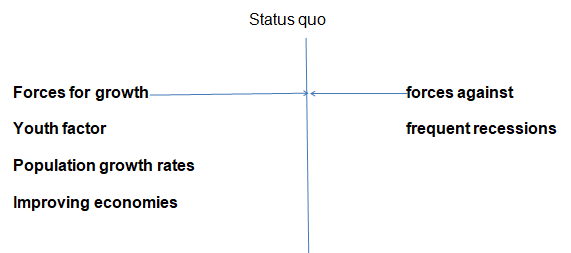

Force field analysis is an important tool in the process and technique of decision-making (Lewin 2000). It aims at analyzing the forces for and against industrial or corporate change in order to provide corporate leaders with information needed to make effective decisions.

In addition, the technique helps corporate leaders communicate the reasons behind their need for change in the corporate management area, which makes it easy to convince stakeholders that a change or project is needed. In particular, the force field analysis model yields information that has two effects (Cartwright 2009).

It can provide information that supports the idea of change, thus calling the corporations involved to go ahead with a project, a change of a program.

The forces favoring the growth of the sports retail industry

Population growth

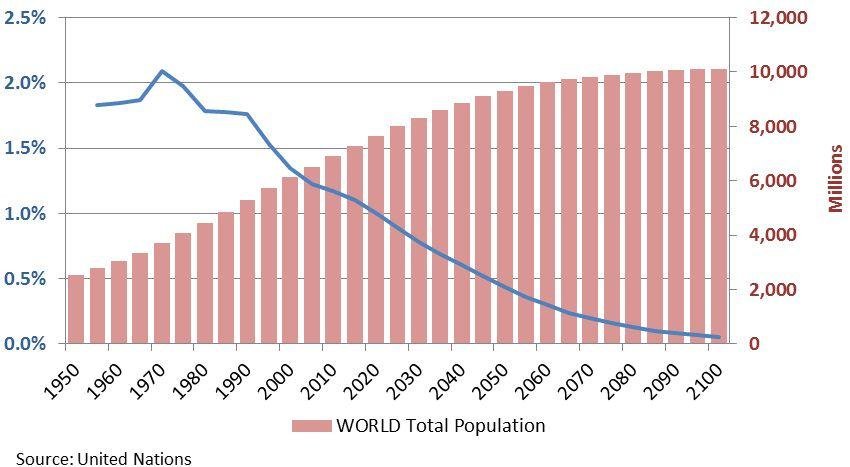

The increased rate of world population is an important factor supporting the rate of growth for sport retail industry. In particular, the growing demand for sports and sport-style products is high in areas with a high rate of population growth, especially in a number of Asian countries (Cai & Du 2013).

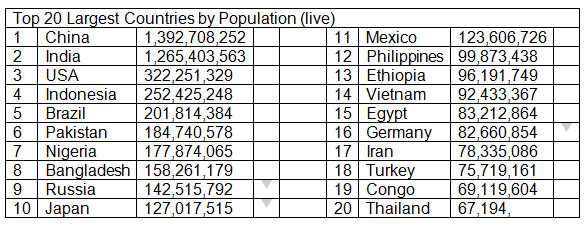

Statistics indicate that out of the estimated 7.14 billion people in the world, about 4 billion live in Asia, accounting for more than 55% of the total world population (World Bank 2013). Together, the populations of India and China make about 2.6 billion people, providing evidence of the increased rate of demand for sports products in these areas (Randers 2012).

For instance, the increase in the demand for sports-style products was more than 4% in China between 2005 and 2010 (Research markets 2012). Overall, the rate of demand for these products is more than 3% per annum (Mullin, Hardy & Sutton 2013). The high population is the largest player in the increased rates of demand.

Improved economies

Another major factor supporting the rate of growth in the sports retail industry is the trend of economies in various parts of the world. In North America, the economic situation has improved rapidly since the end of the global recession. Between 2010 and 2013, the economy of the US increased by 2.3% per annum (Coates & Humphreys 2003).

In addition, other regions have enjoyed improved economic growths since 2010. For instance, the economy of the south east Asian region has improved by more than 3%, while that of the near and middle east nations has achieved a growth rate of more than 4% per annum (World Bank 2013).

In addition, despite few cases such as Greece, Italy and Spain, the European Union has achieved an improved growth rate in its economy, which is expected to reach 2.1% per annum (Smith & Stewart 2012). South America has some of the most rapidly developing economies in the world. The number of people attaining the middle class level is increasing rapidly, while poverty rates are declining.

In nations such as Brazil and Argentina, the economic growth has developed rapidly over the last five years. This explains the rising demand for sport-like goods in these areas. In addition, African nations have the world’s largest rates of economic growth.

In the recent past, a number of African nations have achieved an economic growth rate of more than 5%, with some reaching a high of 8%, including Ghana, Angola and Senegal (Breisinger, Diao & Thurlow 2011). In addition, most countries in the region have a growth rate of more than 4%, with the most significant including Nigeria, Kenya, Tanzania, South Africa, Ethiopia and Ivory Coast (World Bank 2013).

The youth factor

In the modern world, the status of the young people has increased significantly. With an increase in the number of young people taking part in the economic building such as employment and business, most nations have experienced in increase in the demand for products and services that support youth affairs. Among the most important industry supported by this phenomenon is the sports retail industry.

In North American, South America, Asia and Europe, growth of the sports retail industry is favored by an increased rate of youth participation in various aspects of the economy. According to studies, young people have a tendency of being active in sports or wearing sport-like clothing and shoes.

In addition, the empowerment of the young people through financial support and improvement of employment opportunities in Asian nations, in particular, has supported the increase in the demand for sport goods and services, which supports the growth of the sports retail industry.

Restraining forces

Economic recession

Although the world economy has achieved a relatively good rate of recovery from the 2007-2010 economic recession, the effects of the phenomenon is still affecting most countries. For instance, the recession made the US economy lose by more than 4% per annum (Bjork 2012).

In particular, the employment rate declined significantly, with the rate of unemployment reaching about 8% per annum (World Bank 2013). The number of people that lost jobs during the time is significant, with a good number being young people.

This also took place in Europe and Asia, which affected the industrial growth rates. With a high number of people losing job opportunities due to the impact of the recession, the number of people purchasing luxury sport goods declined significantly in most nations in Europe, Asia and North America.

Porter’s Five Forces Analysis of the Global Sports Retail Industry

A five force analysis of the global sports retail industry is important in determining the effectiveness and micro environment forces that affect the industry’s ability to meet the demands of its customers, achieve profitability and the overall growth. The buyer power, new entrants, competition rivalry, supplier power and threats of substitutes provide evidence of the industry’s state at a given time.

Buyer Power in the Global sports retail industry

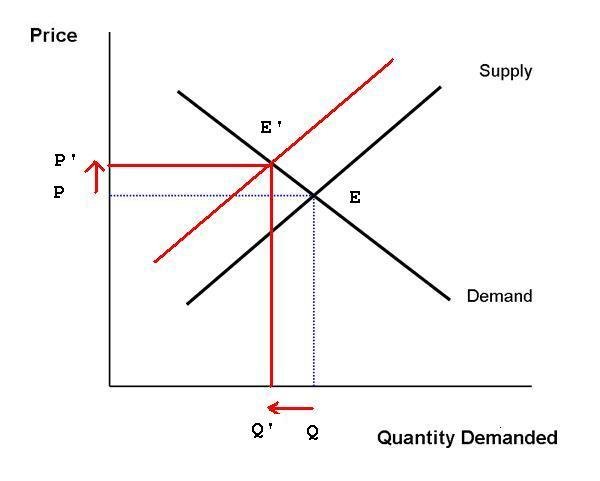

In sports retail industry, consumers have the largest role in driving the business of the industry. The power of the consumers is evident in pricing, especially when competitors tend to outdo each other based on pricing strategies. In the recent past, most competitors in the industry have been trying to attract more consumers through discounts and services to increase their market share.

Buyers reap the benefit of obtaining products at competitive prices. However, statistics have shown that the number of people aged 45 and above seeking to use sports product in managing their health has increased significantly, especially in the developed world (Quan 2010). This trend has allowed consumers to look for fashion that is mostly associated with sports.

The high rate of competition between retailers in the industry based on production of goods meant to meet the specific demands for various social groups has enhanced the power of buyers in the industry.

In addition, the amount of product differentiation in the market for sports goods has increased, with companies manufacturing products based on the specific needs such as jogging, cycling, skating for health purposes and those meant for real sporting activities (Andersen, Van Raalte & Brewer 2001). This has given consumers a wide range of choice, enhancing their power in the control of the industry.

However, there are only a small number of retailers in the oligopolistic sports retail market, which has restrained the buyer power because forward integration is difficult as the buyers are mainly the consumers, making their chance of taking over less significant. Nevertheless, the overall power of buyers in the industry is rated “moderate”.

The power of suppliers

In the global sports retail industry, the suppliers are the corporations involved in manufacturing, including Nike, Reebok, Adidas and Puma. These organizations are multinational and large corporates that control the industry. They are globally branded with reputation and value due to high quality products they offer to the market. This makes the bargaining power of the industry to be significantly low.

They have almost become the main decides of the prices for sports products. Forward integration seems to be relatively high because the retailers are threatened by the suppliers. For instance, a number of suppliers have been acquiring retailers, which makes the suppliers take over the control of the retail industry. A good example is the acquisition of Hargreaves Sports, a retail business in the industry, by Nike.

Nike used this opportunity to set up an exclusive fully branded outlet for sports good in Nike town, London, in 1999 (Deng 2009). On its part, Reebok opened a fitness center known as Reebok Sports Club in London, England, which provides consumers with a wide range of exclusively branded Reebok products for health fitness purposes (Yu 2011).

Moreover, the suppliers use marketing strategies such as advertising, promotion, corporate social responsibility and sponsorship for sports clubs and fitness welfares, achieving the overall control of the industry. Overall, the power of suppliers in the retail industry for sports good in the world is high.

Rivalry among competitors

There is a considerably good level of competition between main players in the retail business in the global sports industry. The concentration ratio as well as HHI is important measures of rivalry in the industry based on market share. These markets shares can be obtained in the Mintel’s report (2008) as shown in appendix 3.

In this case, it has been shown that the concentration ratio is the market share that the four major competitors in the global retail industry are JJB Sports, Sports World, DJ Sports and Supermarkets/retail chains in various parts of the world.

As shown in the appendix, the CR reveals that the four major competitors sell about 75% of the total output, which means that the degree of rivalry is high. In addition, the calculations in the appendix show that the HHI of the industry is about 1683, which lies between 1000 and 1800. This means that the market is moderately concentrated.

Threat of new entrants

As shown above, the CR and HHI degrees are relatively high, with the number of major players in the industry remaining relatively low. Each of the players has a large number of stores in various parts of the world. They compete among themselves to increase their market shares. In addition, they have dominated the market for a long time, providing quality products.

Therefore, for new entrants in the market to succeed, they must impress consumers that their products are quality. In addition, the entry of supplies in the market, especially through acquisitions and mergers or joint ventures with the existing retailers, has made it difficult for new entrants to tap market share in the industry (DePamphili 2013). Therefore, the overall threat of new entrants is low.

Threats of substitutes

In footwear, the price of sports shoes is likely to change when substitutes change in prices. In this case, substitutes include products from local companies, which is common in various parts of the world.

PEST analysis

Political

The global sports retail industry seeks to increase the volume of sales of sports goods and services to the global clients. The key players involved in this industry include Foot Locker, JD Sports, Sports Direct, Sports World, JJB Sports and supermarket chains. These companies face political challenges in their business. For instance, the politics of control of the industry is evident.

Suppliers seem to be fighting each other at the retail level. For example, Nike and Reebok have strategies to acquire or partner with selected retailers in order to lock out other suppliers (Slater & Lloyd 2004). This brings a tense political environment between the suppliers and the retailers.

In addition, retailers are flexing their muscles by moving beyond Europe and North American to venture new markets in Asia and South America, especially in China, India, Brazil and other nations in the Southeast Asian region. In all of these regions, the political environment is diverse.

For example, there are laws to protect local companies in some nations like South Korea and China. Taxation and legal politics are evident. In addition, the companies are considered western products, which affect the perceptions of the people in foreign nations.

Economical

Retailers of sports products seek to increase their market share and profitability. To do this, they tend to increase their outlets, which make it necessary to hire a large number of employees in Europe, North America as well as foreign markets. This contributes to the overall growth of the economies where the outlets are based. In addition, it is worth noting that labor affects these companies.

In Europe, the cost of labor is higher in France and Germany than in Britain. Similarly, the cost of labor is high in North American and Europe than in China and South Korea. Thus, most factories are located in Asia. It means that the retailers have to open new locations in Asia and sometimes obtain supplies from these areas.

Social

Sports products are associated with sports cultures at a given time and location. In Europe, North America and other westernized nations, sports are a major social factor, with few social restrictions attached to it.

Sportswear of different kinds and styles are allowed. However, in some nations such as those using strict Islamic laws, including Saudi Arabia, as well as those with strict cultural laws like North Korea, some sports and sportswear are not allowed, especially those though to expose certain parts of the bod. In addition, some cultural laws prohibit women from taking part in sports or wearing certain sports clothing.

Technological analysis

The internet technology has improved business processes. Sports retail business is one of the most affected industries. Currently, most consumers are increasingly moving to online shopping, where it is possible to select and order products. Thus, most retailers have implemented e-commerce as part of their business processes.

SWOT Analysis

Strengths

The sports retail industry is one of the fastest growing industries, thanks to an increase in the number of middle and aged people using sporting activities to enhance the quality of their lives.

According to statistics, the number of baby boomers population in North America and their similar population in Europe are concerned with their health. They have increasingly been using sporting activities as the most effective solution to improve their health and quality of life. Thus, the retail business is likely to remain strong over the next few decades.

Weaknesses

Sports products are mostly luxury goods and services. They do not have a high priority in most households. Therefore, frequent economic recessions and other financial problems are likely to affect the demand for these products (Mehta 2013). Thus, retailers face the risk of frequent decreases in demands.

Opportunities

As mentioned, the increase in global population, especially in Asia, South America and Africa, provides the sports retail business with chances for expansion and growth. In addition, the rising state of economics in various parts of the world means that the demands for these products are likely to rise. Moreover, the trend of using sporting activities to meet health demands is increasing throughout the world.

Threats

Although the number of retailers is relatively low, the current players face a threat of new entrants in the market. For instance, the increased tendency of suppliers to enter the retail market is a major threat. In addition, emerging nations like China, India and others have a quest for entering the market.

They are encouraging corporations to go global, which means that some of their retailers in this industry are likely to enter the market in the future (Development Research Center of the State Council 2009).

References

Andersen, MB, Van Raalte, JL & Brewer, BW, 2001, “Sport psychology service delivery: Staying ethical while keeping loose”, Professional Psychology: Research and Practice, vol. 32, no. 1, pp. 12-17.

Bjork, GJ, 2012, The Way It Worked and Why It Won’t: Structural Change and the Slowdown of U.S. Economic Growth, Praeger, Westport, CT.

Breisinger, C, X. Diao, X & Thurlow, D, 2009, “Modeling growth options and structural change to reach middle income country status: The case of Ghana”, Economic Modeling vol. 26, pp. 514–525.

Cai, F & Du, Y, 2013, The China Population and Labor Yearbook: The Approaching Lewis Turning Point and Its Policy Implications, Brill, New York.

Cartwright, D, 2009, Field Theory in Social Science and Selected Theoretical Papers, American Psychological Association, Washington, D. C.

Coates, D & Humphreys, BR, 2003, “The effect of professional sports on earnings and employment in the services and retail sectors in US cities”, Regional Science and Urban Economics, vol. 33, no. 2, pp. 175-198.

Deng, T, 2009, “Just Done It—Nike’s New Advertising Plan Facing Global Economic Crisis”, International Journal of Business and Management, vol. 4, no. 3, p. 102.

DePamphili, D, 2013, Mergers and Acquisitions Basics: All You Need To Know, Academic Press, New York.

Development Research Center of the State Council, 2009, “China: Seeking for new breakthrough in coping with crisis”, Manage World vol. 6, pp4–18.

Lewin, K, 2000, “Defining the Field at a Given Time”, Psychological Review vol. 50, pp. 292–310.

Mehta, M, 2013, “How Does the Global Economic Crisis Affect Textile, Apparel Sourcing?” Apparel Technology. Web.

Mullin, BJ, Hardy, S & Sutton, WA, 2013, Sport Marketing, Human Kinetics, New York.

Quan, K, 2010, “Use of global value chains by labor organizers”, Competition & Change, vol. 12, no. 1, pp. 89-104.

Randers, J, 2012, 2052: A Global Forecast for the Next Forty Years, Green Publishing, Vermont: Chelsea.

Research markets, 2012, “Global Retail Sports Apparel Market 2012-2017: Market Trends, Profit and Forecast Analysis”, Research and Markets. Web.

Slater, J & Lloyd, C, 2004, “It’s gotta be the shoes: exploring the effects of relationships of Nike and Reebok sponsorship on two college athletic programs”, Sports Marketing and the Psychology of Marketing Communication, vol. 191.

Smith, A & Stewart, B, 2012, Sports Management: A Guide to Professional Practice, Allien and Unwin, London.

United Nations, 2014, World Urbanization Prospects: The 2013 Revision, UN Publications, New York.

World Bank, 2013, Global Economic Growth Will Accelerate in 2014, WB publications, New York.

Yu, X, 2011, “Impacts of corporate code of conduct on labor standards: A case study of Reebok’s athletic footwear supplier factory in China”, Journal of Business Ethics, vol. 81, no. 3, pp. 513-529.

Appendix

Calculations for rivalry in the sports retail market

CR4 = Market Share (JJB Sports + JD sports + Sports World + Supermarkets).

CR4 = 33% + 16% + 13%+ 13%.

CR4 = 75%.

HHI = SQUARE [Market Share (JJB Sports + JD sports + Sports World + Supermarkets)].

HHI= 1089+256+169+169 = 1683.