Introduction

Rolls-Royce deals in aircraft, military engines, propulsion systems used by navies, and gas turbine power. Its main competitors include GE Aviation, SAFRAN, and Pratt & Whitney Engine Services, Inc. (Rolls-Royce Holdings PLC Competition, n.d.). Salmon reports that Rolls-Royce relies on over 8,000 suppliers (2012).

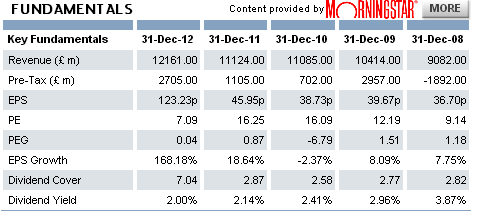

Cowan enlists stakeholders as the suppliers, creditors, customers, employees at all levels, and communities that are all concerned about the performance of a company (2005, p. 16). Competitors and business partners may also want to know the strength of an organization. Rolls-Royce financial statements have been extracted from the LSE website (RR. Rolls Royce Holdings PLC ORD SHS 20P, n.d.)

Financial ratios

Board of directors

The board can make decisions to invest in bonds or stocks to increase profitability. Davidson (2010, p. 65) claims that companies may consider issuing bonds instead of equity when interest rates are low.

Reliance on revenue source

Reliance on revenue source = revenue source total/ total revenue

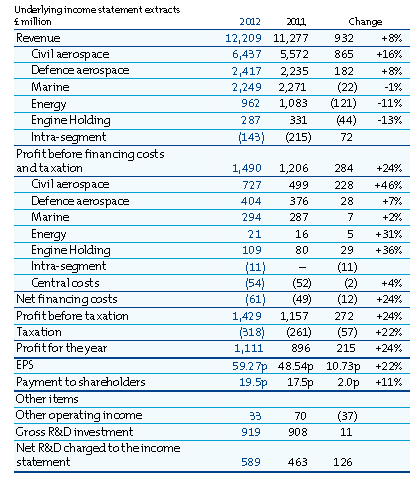

In 2012, it can be seen that civil aerospace had a revenue ratio of 0.5272, and engine holding had 0.0235. From these calculations, it can be seen that 52.72% of the revenue generated in 2012 came from the civil aerospace section. 2.35% was generated from the engine holding section (see appendix 6, no. 1).

The company mainly relies on civil aerospace section for its revenues. The ratio is used to determine areas where the firm is more reliant (Demonstrating value, n.d.). It can be used to influence diversification strategies, and reducing reliance on volatile sources. It can be used to find means of ensuring sustainability.

Operating expense ratio

The board may also be interested in the operating expense ratio. The operating expense ratio measures the efficiency of a company’s operation. It compares one period to another. A declining ratio indicates improvement in managing efficiency.

Operating expense ratio = operating expense/ total revenue

The calculations show that operating expense ratio has declined from 0.8981 in 2010 to 0.8871 in 2012. It indicates that the company operated more efficiently in 2012 than in 2011. 2011 was also better than 2010 (see appendix 6, no. 2).

Creditors

Current ratio

It is used to analyze the liquidity and stability of an organization in the short-term period. It shows that a firm can finance its operations within the short-term period. Current assets consist of cash and holdings that can easily be exchanged for cash. Pendlebury & Groves explain that the ratio should be higher than 1 because of the time needed to convert some of the assets into cash (2004, p. 148).

Creditors are interested in the current ratio because it indicates ability to honor debts in the current period. Creditors may want to avoid companies that may default. A high current ratio may indicate that resources are not applied to full capacity. Pendlebury & Groves explain that different companies need to keep different levels of current ratio depending on a company’s needs (2004, p. 148).

Current ratio = current assets/ current liabilities

The company has maintained a current ratio valued between 1.4 and 1.2 in the 5-year period (see appendix 6, no. 3). The current ratio indicates that the company is able to cover its short-term liabilities in the current period.

Quick ratio

Quick ratio is used in industries where the stock is considered less liquid such as manufacturing industry where Rolls-Royce is found (Pendlebury & Groves 2004, p. 149). It reduces the current assets by deducting the value of stocks.

Quick ratio = (current assets – stocks) / current liabilities

Values should be closer to 1 or more than 1. The amount of assets that the company has been maintaining to meet its current needs has declined in the 5-year period (see appendix 6, no. 4). In 2012, it has a quick ratio of 0.95. It shows that the company is unlikely to default.

Shareholders/ investors

Shareholders look at the proportion of a company’s capital that is financed by debts. Pendlebury & Groves discuss that shareholders are concerned about the capital structure of a company (2004, p. 155). Gearing refers to raising capital from debts. Debt repayment and interest on debts are prioritized before paying dividends. A high proportion of debts may reduce the amount received as dividends.

Debt to equity ratio

Debt to equity ratio = (short-term debt + long-term debt) / total equity

Low levels of debt may indicate a firm that is operating below its full potential. High debt levels indicate that shareholder earnings may decrease. It can also indicate a higher risk. In the case for debt to equity ratio, shareholders may feel comfortable because the company has been reducing reliance on debts over the 5-year period. In 2008, the debt to equity ratio was 5.9 compared to 1.97 in 2012 (see appendix 6, no. 5). The company is becoming less risky for shareholders.

Return on equity

Shareholders also consider return on equity. It compares the value they have obtained by investing in the company rather than in other assets. It shows whether the amount earned is worth the risk they have taken.

Return on equity = net profit/ average shareholder equity

Average shareholders’ equity is obtained by calculating the average of shareholders’ equity at the start and at the end of the period (Fridson & Alvarez 2011, p. 284). Returns on equity calculations indicate that there has been an improvement in the amount generated from shareholders’ funds apart from 2008 and 2009 fiscal years (see appendix 6, no. 6).

In 2008, it had a negative value (-0.6) which may indicate servicing big debts or the company took more investment opportunities. Investors are interested in the company’s growth prospects. Long-term investors would like to see the value of their investment multiply.

Competitors

Return on assets

A lower return on assets ratio than competitors may mean the company should look for more efficient methods of doing business (Demonstrating value n.d.). Competitors may want to know the return on assets to compare Rolls-Royce’s efficiency to theirs.

Return on assets = net profit/ average total assets

The average total asset is obtained by dividing the sum of asset values at the beginning and the one recorded at the end of the period. It should be used by comparing an industry’s return rate. Rolls-Royce return on assets shows a trend that is similar to returns on equity.

Returns on assets are 0.13, 0.05, and 0.03 in 2012, 2011, and 2010 respectively. The company is on an improvement path except in 2009 when it recorded a higher value (see appendix 6, no. 7). Competitors can use these values to compare it with their efficiency in utilizing capacity.

Sales growth

The competitors may look at the sales growth. It is calculated by subtracting previous period sales from current period sales, and then dividing the difference by previous period sales.

Sales growth = (current period sales – previous period sales) / previous period sales

Competitors can use it to analyze whether their market share is likely to increase or decline. It can be used to measure the performance of marketing and sales strategies. It can also be used to examine if sales growth matches inflation. It can justify changes in price to account for inflation (Demonstrating value, n.d.). As a result of changing price, the company can avoid a slow growth rate.

Rolls-Royce’s sales growth indicates periodic fluctuations. It was high in 2009 at 14%. It was low in 2010 (6%), and lower in 2011 (0.3%). There were signs of recovery in 2012 at 9% (see appendix 6, no. 8). Competitors can compare these trends with theirs to find out if the conditions are caused by external factors such as the global economic condition or if there is a consumer preference for another brand.

Conclusion

Company results affect the price movement in the stock listing. Davidson (2010, p. 51) explains that “a company may cut expenditure to increase profits now, at the expense of the long term”. Another company may invest for future growth which reduces current profits such as Rolls Royce in 2008 shown by a net gearing of -50.68% (see appendix 3).

Investors need to examine the cause of a company’s good or poor performance reports. A company’s growth depends on how much it borrows for investment purposes. There is a need to balance debt and equity depending on which lowers the cost of raising capital. Some ratios may be converted into percentages for easy interpretation.

Reference List

Cowan, N. 2005, Risk analysis and evaluation, 2nd edn, Institute of Financial Services, Canterbury.

Davidson, A. 2010, How the city really works: the definitive guide to money and investing in London’s square mile, 3rd edn, Kogan Page, London. Demonstrating value. Web.

Fridson, M., & Alvarez, F. 2011, Financial statement analysis: a practitioner’s guide, 4th edn, John Wiley & Sons, Hoboken.

Pendlebury, M., & Groves, R. 2004, Company accounts: analysis, interpretation and understanding, 6th edn, Thomson Learning, London.

Rolls-Royce Holdings plc Competition. Web.

RR. Rolls Royce Holdings PLC ORD SHS 20P. Web.

Salmon, J. 2012, Rolls-Royce reveals it has been forced to lend to its own suppliers to keep them afloat, media release. Web.

Appendices

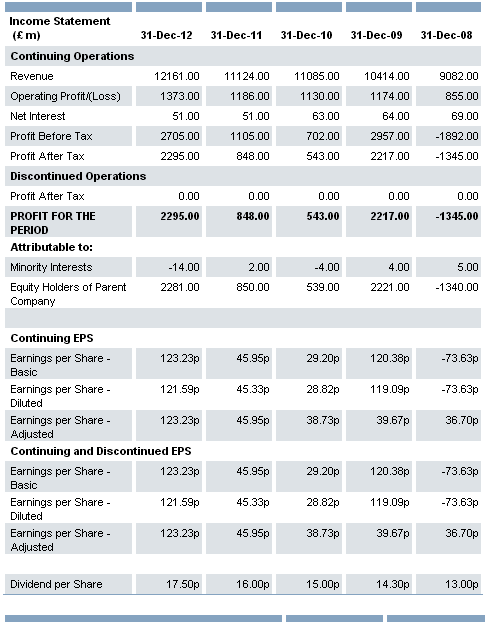

Appendix 1

Appendix 2

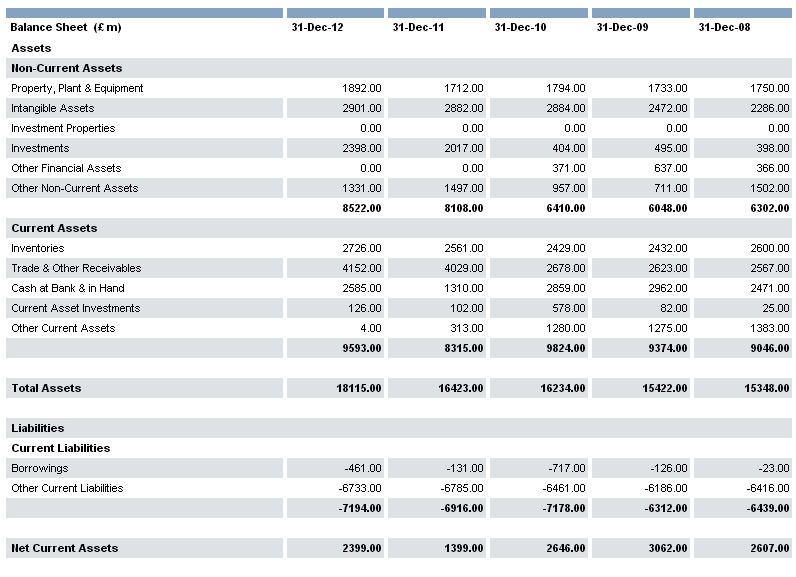

Balance sheet

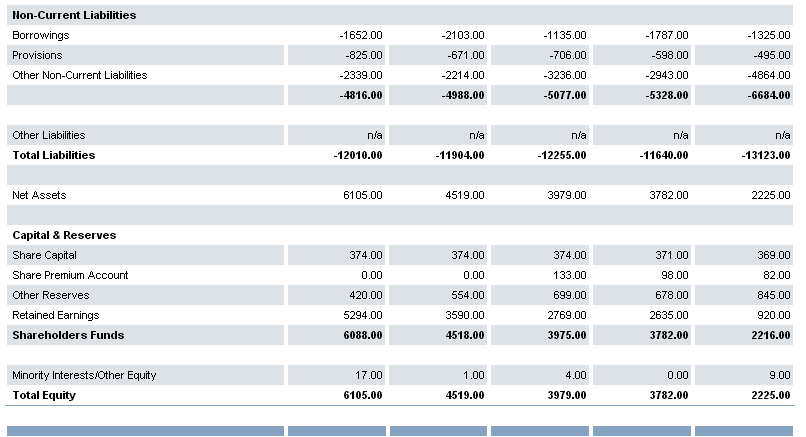

Appendix 3

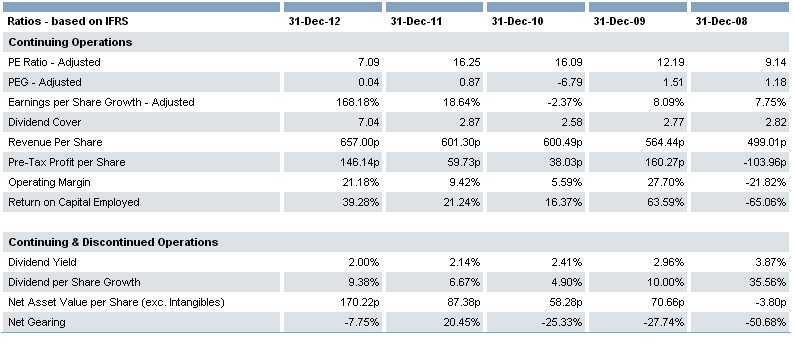

Appendix 4

Appendix 5

Appendix 6

Calculations

Reliance on revenue source = revenue source total/ total revenue

Reliance on civil aerospace = 6,437m/ 12,209m = 0.5272

Reliance on engine holding = 287m/ 12,209m = 0.0235

Operating expense ratio = operating expense/ total revenue

2012 Operating expense = revenues – operating profit = 12,161 – 1,373 = 10,788

2011 Operating expense = revenues – operating profit = 11,124 – 1,186 = 9,938

2010 Operating expense = revenues – operating profit = 11,085 – 1,130 = 9,955

2012 operating expense ratio = 10,788/12,161 = 0.8871

2011 operating expense ratio = 9,938/11,124 = 0.8934

2010 operating expense ratio = 9,955/ 11,085 = 0.8981

Current ratio = current assets/ current liabilities

2012 current ratio = 9,593m/ 7,194m = 1.333

2011 current ratio = 8,315m/ 6,916m = 1.202

2010 current ratio = 9,824m/ 7,178m = 1.369

2009 current ratio = 9,374m/ 6,312m = 1.485

2008 current ratio = 9,046m/ 6,439m = 1.405

Quick ratio = (current assets – stocks)/ current liabilities

Stocks value is obtained from the inventories entry.

2012 quick ratio = (9593 – 2726)/ 7194 = 0.9545

2011 quick ratio = (8315 – 2561)/ 6916 = 0.8319

2010 quick ratio = (9824 – 2429)/ 7178 = 1.0302

2009 quick ratio = (9374 – 2432)/ 6312 = 1.0998

2008 quick ratio = (9046 – 2600)/ 6439 = 1.0011

Debt to equity ratio = (short-term debt + long-term debt)/ total equity

Values are in millions of pounds

2012 debt to equity ratio = 12010/ 6105 = 1.9672

2011 debt to equity ratio = 11904/ 4519 = 2.6342

2010 debt to equity ratio = 12255/ 3979 = 3.0799

2009 debt to equity ratio = 11640/ 3782 = 3.0777

2008 debt to equity ratio = 13123/ 2225 = 5.8979

Returns on equity = net profit/ average shareholder equity

For average shareholder equity, the average shareholders’ funds have been used

Values are in millions of pounds

2012 returns on equity = 2295/ ((6088+4518)/2) = 2295/ 5303 = 0.4328

2011 returns on equity = 848/ ((3975+4518)/2) = 848/ 4246.5 = 0.1997

2010 returns on equity = 543/ ((3782+3975)/2) = 543/3878.5 = 0.1400

2009 returns on equity = 2217/ ((2216+3782)/2) = 2217/ 2999 = 0.7392

2008 returns on equity = -1345/ 2216 = -0.6069

Return on assets = net profit/ average total assets

2012 return on assets = 2295/ ((18115+16423)/2) = 2295/ 17269 = 0.1329

2011 return on assets = 848/ ((16423+16423)/2) = 848/ 16423 = 0.0516

2010 return on assets = 543/ ((16423+15422)/2) = 543/ 15922.5 = 0.0341

2009 return on assets = 2217/ ((15422+15348)/2) = 2217/ 15385 = 0.1441

2008 return on assets = -1345 (15348) = -0.0876

Sales growth = (current period sales – previous period sales)/ previous period sales

2012 sales growth = (12161 – 11124)/ 11124 = 0.0932

2011 sales growth = (11124 – 11085)/ 11085 = 0.0035

2010 sales growth = (11085 – 10414)/ 10414 = 0.0644

2009 sales growth = (10414 – 9082)/ 9082 = 0.1467