Executive summary

This paper is a study of strategy and strategic choices. The company that has been selected is the aerospace division of the UK-based Rolls Royce Company. The company operates in a niche market that can be characterized as an oligopoly. It has been found after an analysis using Porter’s five forces model that the company has a very strong strategy in place. The company has a wide product portfolio, diverse workplace, multiple manufacturing locations, customer focus, etc. The only recommendation that was provided is that Rolls Royce should look at forming more joint ventures. This is because the aero-engine industry is a high-risk, high investment, and competitive market. This is even though it is an oligopoly.

Introduction

The concept of strategy is a natural process in the life of a human being. Hence, strategy can be applied in any area where human activity is involved. Strategy can be personal or it can be applied to business, politics, diplomacy, or military. Due to this reason, the definition of strategy also varies in nature. The only common factor that appears in all definitions is a plan of action that needs to be taken in a particular situation or environment. This paper deals specifically with strategies in business and will be done regarding a well-known and well-established company. The company is the UK-based Rolls Royce and the study will be divided into four parts. The first part will analyze the industry in which Rolls Royce operates. In this case, the focus will be on the aerospace industry with a small reference to the automotive sector. The second part will be an analysis of the strategic capability of the company. The third part will critically discuss the strategic choices that are pertinent to the strategic positioning of the company. The fourth and final part will be a justification of the strategies that the company is perusing. If it is felt that other strategies can be perused, those will be mentioned and justified

Background of Rolls Royce

Even though the company is known for its high-quality luxury automobiles, the real strength of the company lies elsewhere. “Rolls-Royce plc is a global power systems company providing power for land, sea, and air, with leading positions in civil aerospace, defense, marine and energy markets.” (Rolls and Royce 2004). The company bears the name of its founders Henry Royce and Charles Royce. The company was originally known as C S Rolls & Co until it was named Rolls Royce Ltd in 1906. It should be mentioned here at this stage that its car division is now owned by BMW. The focus of the strategy will be on its aerospace division

The aerospace industry analysis

Market is an oligopoly

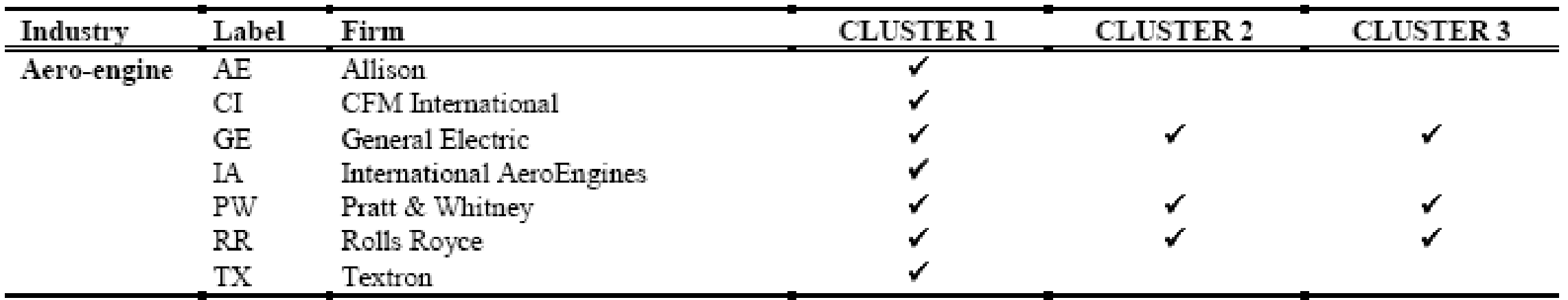

The aerospace engine industry is, unique in the world of business in the sense that it is very oligopolistic. It means that there will be only a limited number of producers or manufacturers (or buyers) in the market. They can easily control the movement of goods in the market. In effect, it can be called a differentiated oligopoly. “In a differentiated oligopoly, the rival businesses can provide product features that differentiate their offerings in terms of quality, features, styling, performance, and service. This might be said to be the present-day business environment for aero-engine systems and services.” (Olofsson and Farr 2002, p.25). Only three major players exist in the aerospace engine industry that manufactures large airplanes and military planes. This means that the engines will have to be big and powerful. The two companies other than Rolls Royce are Pratt & Whitney and General Electric Corporation. All three companies have a presence in the market for medium-sized and small-sized aircraft also. They also manufacture other types of engines (apart from jet engines) like turboprop. The chart will show the relative market that exists in this industry.

The clusters shown in the chart are explained below. “Cluster 1 represents the smaller segment of the market, including the first turbojets introduced at the birth of the industry, the turbofans introduced at the beginning of the 1960s in substitution of the turbojets, the second generation of turbofans and the small regional jets of the 1990s. Cluster 2 includes larger size engines while cluster 3 includes the largest engines of the three big players, which power very large aircraft.” (Bonaccorsi and Giuri 2001, p.12).

Vertical relationships

Another feature of this industry is that almost no major manufacturer of aircraft has developed their engines. In other words, the aircraft is built by one company and the engines are supplied by another company. This trend is seen as universal especially in the case of larger capacity engines where the three major players operate. The reason is that the engine itself is a higher technology, high investment venture. Combining the manufacture of aircraft plus the engines will be too high a financial risk and burden. In effect, there is a vertical relationship between the buyer (aircraft manufacturer) and the seller (Rolls Royce). In other words, there is a vertical relationship between the buyer and the seller (as mentioned above). One is that the task of making the aircraft and the engine is done by two different organizations. The next feature of vertical relations is that buyers often pass detailed information on the type of product that they need and the seller will try to make it into a working product that contains all requirements

Market segmentation

The aero-engine industry has two distinct sections namely manufacture and service/maintenance. Both are money-making options for a company as has been mentioned in the next section. Apart from the manufacturer there also exists outside companies engaged in the maintenance of engines also. In some instances, the airline company (operator) may have its own maintenance division. There is also another classification for the market according to Rolls Royce. This market can be classified into primary and secondary markets. The primary market is the actual sale of new engines. Engines are designed for long life and will be used for a period of ten or twenty years. Hence, a market for spares also exists which is called the secondary market.

Changing customer requirements

Another feature for the market is the changing customer requirements that have occurred over some time. The early days were defined by cost, quality, and the fuel economy of the engines. But demands have changed and now customers want more comprehensive after-sales service. This also includes shipping parts on time, availability of spares, etc. In other words, customers now want comprehensive care for the product they buy.

Long term customer relationship

Engine manufacturers need to have an excellent relationship with their end customers. The end customer in this case is primarily the airline operators and not the aircraft manufacturer. Customer relations are important in any business. But there are two reasons for this with special regard to the aerospace industry. One is that engines have a long life and the customer relationship should also be such. In this industry, it is the airline operator (end customer) and not the aircraft manufacturer that decides which engine to use. The choice is left to the airline operators by the manufacturers. Hence if the relationship is not proper the airline operator will opt for either Pratt & Whitney or General Electric engines.

Analysis of strategic capabilities of Rolls Royce

It would be pertinent to define what a strategy is in general terms and also in terms of a business point of view. One of the (several) definitions given by Merriam-Webster that can be shown as a generic concerning strategy is that it is “an adaptation or complex of adaptations (as of behavior, metabolism, or structure) that serves or appears to serve an important function in achieving evolutionary success.” (Strategy: Business Strategy. 2008). The main point that the definition stresses is that strategy is to try and achieve success in any endeavor. In the context of this paper “A business strategy is a set of guiding principles that, when communicated and adopted in the organization, generates a desired pattern of decision making. A strategy is therefore about how people throughout the organization should make decisions and allocate resources in order accomplish key objectives.” (Watkins 2007). The key objective even though not specified in the survival and success of the organization. A new term that will now come up is strategic management. This implies the strategic decisions taken by the management of a company for achieving its key objectives. “Strategic management is the process of identifying, choosing and implementing activities that will enhance the long-term performance of an organization.” (Methodologies 7: Change Management. 2008).

The Rolls Royce Company and strategy

A business strategy can be based on two approaches namely Outside-in or Inside –out. Companies can also adopt a combination of these two approaches. The outside-in strategy focuses on the external environment and then decides what strategy to adopt. “Outside-in perspectives provide insights into the nature of the external environment, its threats and opportunities.” (Chenhall and Chapman 2005, p.13). Many management experts feel that this approach is more relevant in today’s globalized environment and hence many methods like Porter’s Five Forces Model and PESTLE analysis are available as a basis for study. An inside-out strategy on the other hand is strengthening the company from the inside. It involves strengthening the company resources, improving its core competencies, adapting to the external environment, etc. A review of the strategy of Rolls Royce shows that the company has adopted both of these approaches. It is seen that Rolls Royce has set out some clear-cut strategies which have resulted in its current status as a global leader in its field.

Diversified workforce

To effectively cater to its global markets, the company has employed a diverse range of personnel from as many as fifty countries (who are a part of the workforce). This will enable the company to effectively utilize the talent and knowledge of many countries and cultures which is essential for a multi-national corporation.

Investment in technology

The Company invests heavily in the development of its technology, capability, and infrastructure. (Annual Report and Accounts 2004: Invest in Technology, Capability, and Infrastructure 2005). In a five-yearfive years period starting from 1994, the company had spent around 3 billion pounds for these areas alone. Another strategy of the company is to develop, maintain, and manage a wide product portfolio. The company produces machinery to power aircraft (both civilian and military), boats, ships, turbines (gas-based), compressors, etc. The company got orders worth around 9 billion dollars from the Farnborough Airshow alone. “These orders reflect the company’s ability to create market opportunities by continuing to develop its broad portfolio of power systems and services, the most extensive in the aerospace industry.” (Farnborough Airshow Underlines the Success of the Rolls-Royce Product. 2008). Its latest high technology offering is the Trent engine that is now being used by the world’s largest passenger aircraft, the Airbus A380. The Trent technology has also been modified to drive gas turbines and industrial-level compressors.

Market expansion

Market expansion is another strategy that is being aggressively followed. China is now one of the new customers especially for the Trent engine and also uses Rolls Royce products for many of the country’s expansion projects. Getting the Airbus Industries to fit their A380s with the new Trent engine is another example. “Engine maker Rolls-Royce has said that the first commercial Airbus A380 flight between Australia and the US West Coast on Monday (20 October) marked the debut of the Rolls-Royce Trent 900 engine in North America.” (Rolls Royce Trent 900 Debuts in North America with Qantas A380 Flight to Lax. 2008).

Value addition

Value addition for its existing customers is also a very fruitful operation for the company. The company has a very active services division and its roles include helping existing customers to have a 24-hour engine monitoring system along with repairs and maintenance. This strategy seems to have hit off very well because according to the company, more than half of total revenue comes from this division. It has also seen a growth rate of 12% for the last few years. (Annual Report and Accounts 2004: Invest in Technology, Capability, and Infrastructure 2005). The company also has a strategy to have manufacturing bases in as many as twenty countries. This facilitates Rolls Royce to leverage costs, time, and other resources available in each of the manufacturing bases.

Strategic choices

Rolls Royce is a prominent firm in the commercial aero-engine manufacturing industry. For overcoming the extreme competition in the industry, the company plans to take a strategic decision of transplantation of business orientation towards the provision of improved customer service. To identify the suitability of such a strategy, the year five existing environment in the industry has to be analyzed thoroughly. For analyzing the external environment of the industry, the Porters’ Five Forces analysis tool is reliable and effective. For analyzing the business environment of the aero-engine industry, the five force analysis is used.

Analysis of external business environment through Porter’s Five Force Model

In Porter’s five force model, the general business environment is classified into five fields such as competitive rivalry, power of buyers, power of suppliers, the threat of substitutes, potential entrants, and the threat of entrants.

Analysis of Commercial aero-engine industry

Competitive rivalry

In the oligopoly market of aero-engine products, competition is at its extreme level. There is the only limited number of buyers in the market and the suppliers are equally powerful with approximately similar products. Due to the maturity stage of the product differentiation cannot be possible. For improving the features and quality of the product in order to attain customer satisfaction, advanced technology has to be developed and this requires huge investment in research and development. Thus cost-effectiveness of such a huge investment in R&D is influencing the profitability and growth of firms in the industry. Due to the limited technological differentiation in the industry manufacturers are concentrating on customer service differentiation and this creates strong competition in the customer service field also.

Power of Buyers

The number of buyers in the industry is only limited. Purchasing decisions of buyers are long-term in nature. Due to the limited number of buyers, they occupy potential power in the pricing decisions of products. It has been seen in the market that the price for new engines is largely fixed by the customers. Long-term customer satisfaction is necessary for business growth in the industry. Customers are seeking reduced repair costs and a lifetime cost of ownership guarantees for their product.

Power of suppliers

In the aero-engine manufacturing industry, suppliers have limited power. Due to the limited number of buyers in the market, they have to compete with other firms for attaining customers. For this additional cost-benefit and efficiency has to be provided. The pricing decisions are always based on decisions of rivalry firms due to the similarly featured products. No independent pricing decision is possible for different firm’s products. Customers have a high influence onthe fixation of prices.

Threat of entry

In the aero-engine industry, threat of entry of new firms does not exist. It is extremely difficult for new firms to enter the industry due to its peculiar features. The initial cost requirement of business in the industry is very huge. Related research and development processes also require huge investment. Together with cost constraints, customer acceptance of new firms can not be assured because the reputation of firms influences buying decisions.

Threat of substitutes

The threat of substitutes does not exist in the industry. There is no substitute aero-engine products available in the market. (Competing Within a Changing World 2000).

Critical discussion of generic choices

Rolls Royce is engaged in the business of new engine products sales and engine parts sales. These two sectors are interrelated. For achieving acceptance in the secondary market, primary market share is essential.. For achieving success in the industry, product improvement with adequate technology is essential. Along with product improvement, improved customer servicing also has to be assured in the business. Customer services can be improved with better information management and inventory management. The Aero-engine industry is an oligopoly market where the number of buyers and sellers is limited. Due to the limited number of buyers’ competition for buyers are strong in the market. Purchasing decisions of buyers are based on their present and future needs. Thus suppliers are required to satisfy both the present and future needs of customers concerning the product. Customers in the industry now prefer a complete service from the suppliers along with efficiency and economy. To ensure complete service to the buyers, a better customer relationship is necessary. Thus the Rolls Royce’s strategy of strengthening the customer relationship through appropriate manner seems to be accurate and effective in the current market environment of aero-engine products.

Justification of a strategy

The strategy that has been followed by Rolls Royce has been discussed here. The major strategies are market expansion, diverse product portfolio, diversity in the workforce, multiple international manufacturing centers, and focus on after-market operations. It can also be seen that Rolls Royce has been quite successful with these strategies and has been able to hold its place in the market very well. The one area that was not covered in the market strategy of the company is the formation of joint ventures or acquisitions. The company has already entered into some joint ventures in the past. But it has not taken this up as a strategy yet. A review of the material available has shown that the company has two prominent joint venture agreements with two companies. “Rolls-Royce said on August 14 that it planned to form a joint venture with Goodrich to develop and supply engine controls for Rolls-Royce aerospace engines. The companies would create a 50:50 joint venture.” (Rolls Royce, Goodrich in Joint Venture 2008). The second one is with a company called GKN Aerospace concerning the development and use of composite materials on their engines (blades). It should be noted that this is the aero-engine industry is a high technology, high investment area. Even though there are two major competitors, all of them are popular as suppliers of aero-engines. Apart from being cost-effective and having the capacity to provide good customer service, development in new technology is also a prerequisite for success in the industry. Research and development are costly and time-consuming, especially in this industry. It is also highly risky if the technology is not accepted in the market. A joint venture strategy can help the company to achieve technical superiority without too much investment. “A joint venture involves two or more businesses pooling their resources and expertise to achieve a particular goal.” (Practical Advice for Business, Joint Ventures, and Partnering: Introduction). A joint venture has the following advantages.

Advantages

A joint venture can bring in additional resources from the joint venture partner. This will help the company to free up its resources and use them in some other critical areas. On the other hand, if the company does not reduce its research budget, the combined resources can be used for better research. In both cases, it is beneficial for the company. Another advantage is the facility to share technology and research data. The joint venture partner may be an expert in one area and this expertise can be leveraged by Rolls Royce to the advantage of both parties. According to a GKN executive “We have long been a pioneer and driving force in the application of lightweight, high-performance composites to the airframe and it is one of our strategic goals to bring the benefits of composite materials to propulsion systems.” (GKN Aerospace and Rolls Royce Form Joint Venture 2008). This strategy can be followed in other areas also. There are many complicated parts in an engine where research and development are further possible. This can be speeded up the company starts more such joint ventures mentioned above. This will help the company remain competitive and remain in the top position in the aerospace engineering industry. It may also help to develop its current product portfolio.

Conclusions

A study of the strategy of Rolls Royce Company has been done here about its aerospace engine division. A study of the aerospace and aero-engine industry was done and the distinct characteristics like oligopoly, vertical relationship between customer and buyer, etc have been listed. Next, the specific strategy followed by the company and an analysis of the same was done. The next section was a critical discussion of the strategic choices of the company. This was done using Porter’s five forces model. Next, a strategy not yet seriously adopted by the company was recommended and justification for its adoption was also provided. It can be seen that the company has well thought out and formulated strategies. It is operating in an oligopolistic (but competitive) market. The company has the capability and expertise to stay and grow in this market.

Recommendations

The recommendations have already been given in the section on the justification of a strategy. It is recommended there that the company need to follow its existing policies. But a serious look at joint ventures will be very advisable since the market is characterized as having high risk, high investment, and competitive.

Bibliography

- Annual Report and Accounts 2004: Invest in Technology, Capability, and Infrastructure, 2005, Rolls Royce.

- Bonaccorsi, Andrea and Giuri, Paola 2001, Learning, Technological Competition and Network Structure in the Aero Engine Industry, LEM: Working Paper Series, p.12.

- Bonaccorsi, Andrea and Giuri, Paola 2001, Learning, Technological Competition and Network Structure in the Aero Engine Industry, LEM: Working Paper Series, p.25.

- Chenhall, Robert, S 2005,Content and Process Approaches: Outside-in Perspective, ed. Chapman, Christopher, S, Controlling Strategy, p.13, Web.

- Competing Within a Changing World 2000, Rolls Royce.

- Farnborough Airshow Underlines the Success of the Rolls-Royce Product 2008, PRdomain Business Register.

- GKN Aerospace and Rolls Royce Form Joint Venture2008, Azo Materials: The A-Z Materials. Web.

- Methodologies 7: Change Management 2008, Reframing the Future.

- Olofsson, Lotta and Farr, Richard 2006, Business Models Tools and Definition: Uniqueness and the Business Model, Vivace, p.25.

- Practical Advice for Business, Joint Ventures and Partnering: Introduction, Business Link.

- Rolls, Charles and Royce, Henry 2004, Overview, Rolls Royce.

- Rolls Royce, Goodrich in Joint Venture 2008, IW India.

- Rolls Royce Trent 900 Debuts in North America with Qantas A380 Flight to Lax 2008, BNET: The Go To Place for Management.

- Strategy: Business Strategy 2008, Merriam Webster, Web.

- Watkins, Michael 2007, Demystifying Strategy: The What, Who, How, and Why.