Medical platform marketing is the sale of products targeting users who have different medical and nutrition problems. The firm used this approach to develop specialized nutrition products to cater to consumers with health weaknesses in the market.

The firm’s decision to expand its operations globally was driven by its marketing strategy of targeting new markets with high revenue potential. The firm’s research and development department developed baby and medical food products which were sold to a variety of consumer segments across the world.

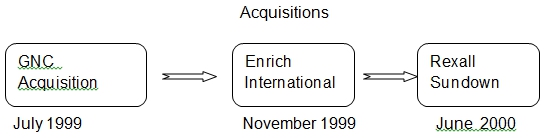

The firm acquired GNC to increase its share of the nutritional supplements’ market. GNC already had a large distribution network in place, and this merger would help the firm have a stronger retail presence in the market. The acquisition allowed the firm to develop new nutrition supplement products targeting unique consumer needs in the market.

The company had a long term strategy of increasing its profits. GNC’s extensive distribution network in the US enabled the firm to sell more products through retail channels without incurring extra expenses. This acquisition raised the firm’s profile in the market.

Van Rooij argued that the firm’s nutritional supplement products were dependent on various consumption trends in the market, which affected their performance. Supplements were dependent on different economic cycles, which had an impact on their sales in the market. Van Rooij emphasized that the firm’s competitors in the market were small firms with unpredictable strategies.

His assertion that these products were income elastic meant that the firm was likely to experience a reduction in demand for supplements when consumers’ incomes reduced. This is because consumers were likely to spend more on necessities whenever they experienced a reduction in their earnings.

Nutritional products produced by the firm were targeted towards vulnerable members of different societies. Therefore, this required the firm to observe high standards and safety procedures before releasing these products into the market to ensure they were suitable for human consumption.

There was also a foreign exchange risk the firm was likely to experience after shifting its operations to the U.S. This required the firm to conduct its operations in dollars, yet many of its investments had been done in euros. Economic fluctuations hurt nutritional supplement sales in the market. This required the firm to come up with effective market strategies to make a positive impact in different consumer segments.

The instability experienced in foreign exchange rates hurt the firm’s U.S. operations. The euro was weakening against the dollar, and this hurt the firm’s operations in the country. The firm’s products recorded poorly in the market, and this hurt its profits.

The board of directors should have recorded some of its assets in dollars to protect it from risks associated with instabilities in foreign currency markets. The company should have conducted a market study to find out its weaknesses to come up with better plans which would have improved its performance in the market.

The decision by the company to divest GNC and Rexall Sundown was in line with its long term business strategy. These two segments did not have high growth potential, which impacted negatively on the firm’s long term profitability. The firm’s decision to divest the two divisions allowed it to specialize in other product segments, which helped it avoid incurring unnecessary losses.