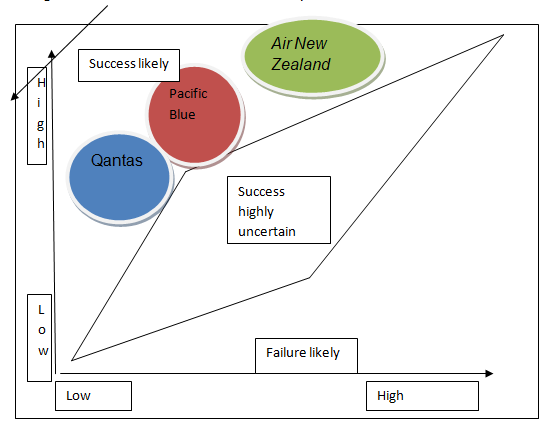

Table 1: strategic characteristics of the industry players

New Zealand market is very competitive with most of the industry players competing on the limited passengers. Some of the airlines which are not competitive enough are likely to be trounced out in future, with one of the most helpless being Air New Zealand, given that its strongest competitors can absorb losses for quite some time due to their financial superiority.

These eventualities herald enormous menace to the company’s profits or its survival at the worst (Kaynak, 1993).

Air New Zealand is a monopoly supplier of many equipments and ground handling equipments, which requires new entrants to enter into agreements with them, especially due to New Zealand’s geographical isolation. Furthermore, Air New Zealand has established a strong hold on the industry such that it becomes easy to negotiate better airport charges (Evans and William, 1999).

Air New Zealand has established strong customer royalty as many New Zealanders support foreign owned firm’s particularly the ones from Australia (Shiques, 2007).

Additionally, Air line New Zealand has extensive net works that extends both in the domestic and the international market of airline routes. To further pursue its low cost strategy, Air New Zealand reduced its fare by 26 percent which increased its domestic passenger growth by 23 percent, which counterbalances the reduction in profits.

This shows that its strategy has been a great success, despite strong competition from Qantas and Pacific Blue Airlines, resulting from better pricing and similar level of frequency compared to airline New Zealand (Bemowsky, 1992).

The company intends to increase its competitiveness against Air New Zealand by increasing its frequency and capacity. Qantas’ strong financial base and its size is significantly competitive. It offers superior quality and level of services, and its network coverage is extensive and covering many parts of the world (De Wit and Meyer, 2004).

Pacific blue runs a low cost strategy coupled with high quality services which includes friendly and professional crew. In addition, in-flight meals which can be purchased on board are offered to further strengthen its image.

The company intends to introduce more planes to help achieve its growth strategy. Pacific blue’s low cost strategy is likely to face Air New Zealand very competitively because “its cost base is much lower due to a greater capacity to outsource ground handling, engineering, crew support and infrastructure such as hangars” (Lindblom, 1959, p. 212).

Fig 1.Perceived differentiation vs. competitive brands

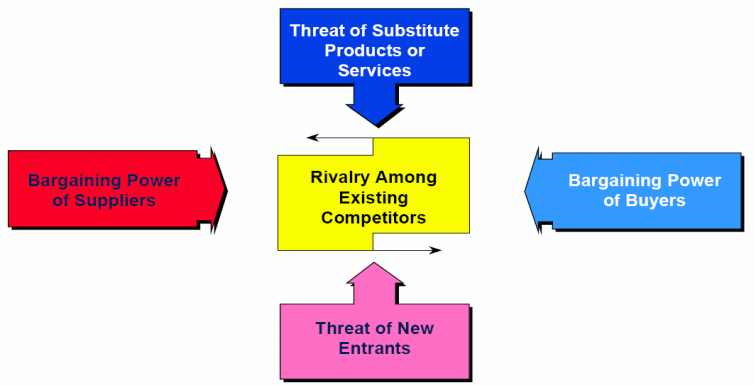

Competitive condition of Glasses Direct in regard to Porter five forces

Some of New Zealand major competitors seem to be Qantas and pacific blue Airlines. On the other hand, New Zealand’s extensive frequency and strong position enables it to win sizeable customer royalty from all corners of the world. In this regard, porter five forces model can be used to discuss these issues (Berdell, 2002).

Competitive rivalry: high

Air New Zealand is a monopoly supplier of many equipments and ground handling equipments, which requires new entrants to enter into agreements with them, especially due to New Zealand’s geographical isolation. Furthermore, Air New Zealand has established a strong hold on the industry such that it becomes easy to negotiate better airport charges (Evans and William, 1999).

Nonetheless, Air New Zealand risks losing substantial share of its market to its closer competitors if they continue using their strong position to offer even lesser prices to their customers while retaining high quality in their services. This is especially possible because the economic recession makes many customers desire to optimize the value for their money (Needham, 1999).

The threat in substitution: high

The threat in substitution may affect market prices since the customer can prefer a different substitute to the company’s goods or services. This threat may affect the company’s marketing power. The threat of substitution may affect market prices since the customers can switch to substitute services in case of a price increase. This may weaken the company’s bargaining power considerably (Johnson and Scholes, 1999).

Supplier bargaining power: moderate

In assessing supplier power, the company needs to identify the ease in which suppliers drive up prices. There is also a need to analyze the product’s difference and their uniqueness (Walton, 1986). It is important to know the number of suppliers per input and the advantage they will have over others because of the differences in material requirements.

Due to limited number of suppliers who can supply some specific inputs, Air New Zealand may not be able to select the suppliers hence increasing their power. However, the company has been able to maintain close relationship with the most trusted suppliers, hence avoiding unnecessary exploitation (Hill and Jones, 2007).

Threat of new entry: moderate

Air New Zealand operates a low cost strategy with frequent flights and quality services. Start-up airline companies find it hard to enter the industry since “new entrants must gain access to terminal facilities which are largely monopolized by air new Zealand” (Godfrey et al., 1997, p.56).

While it is possible to concur that it is not possible for fresh new entrants to invade its territory due to its competitive strength, it would not be possible to ignore an entry threat by stronger players such as Pacific Blue and Qantas who have substantial capital (Godfrey et al., 1997).

Buyer Power: moderate

Air New Zealand uses good customer service and low price strategy to woo its customers; however that does not preempt possibility of brand switching by some customers. If product the quality of its services is not adequate enough, some customers may switch to other company’s services which are offered at lesser prices (Armstrong and Kotler, 2008).

Fig 2. Michael Porter’s Five-Forces Model & Sovereign States

Attractiveness of investing in Glasses Direct

The nature of the New Zealand market has revealed that the number of passengers is limited and hence the competition is rife. Some of the airlines which are not competitive enough are likely to be edged out in future, with one of the most vulnerable being Air New Zealand, since its strongest competitors can absorb losses for quite some time due to their financial supremacy(Spangengerg, 1992).

These eventualities portend great threat to the company’s profits or its existence at the worst (Kaynak, 1993).Nonetheless, Air New Zealand strong position and greater frequency can be used competitively to minimize the impact of Qantas and pacific Blue, which will again send the two companies struggling, and making the company worth investing in (Babette, Bensoussan, and Fleisher, 2008).

References

Armstrong, G. and Kotler, P., 2008. Principles of Marketing. University of California: Pearson/Perentice Hall.

Babette, E., Bensoussan,C., and Fleisher, K., 2008. Analysis without paralysis: 10 tools to make better strategic decisions. New Jersey. FT Press.

Bemowsky, K., 1992.The quality glossary. Quality Progress, 25(2), pp. 18-29.

Berdell, J., 2002. International trade and economic growth in open economies: the classical dynamics of Hume, Smith, Ricardo and Malthus. Cheltenham: Edward Elgar Publishing.

De Wit, B. and Meyer, R., 2004. Strategy Process, Content and Context. International Perspective. London: Thomson.

Evans, J. R. and William, M. L., 1999. The Management and Control of Quality. 4th ed. Cincinnati: South-Western.

Godfrey, G., Dale, B., Marchington, M. and Wilkinson, A., 1997. Control: a contested concept in TQM research. International Journal of Operations & Production Management, 17(6), pp. 558-573.

Hill, L.W.C. and Jones, R. G., 2007. Strategic Management an integrated approach. New York: Cengage learning.

Johnson, P. and Scholes, K., 1999. Exploring Corporate Strategy: Test and Cases. London: Prentice Hall.

Kaynak, E., 1993. The Global Business: four key marketing strategies. London: Routledge.

Lindblom, C., 1959. The science of muddling through, Business Strateg. Penguin Books: Middlesex.

Needham, D., 1999. Business for Higher Awards. Oxford: Heinemann.

Shiques, P., 2007. Marketing Strategies & Solutions. Web.

Spangengerg, O., 1992. A systems approach to performance appraisal in organizations, the 25th International Congress of Psychology. London: International Thomson Business Press.

Walton, M., 1986. The Deming Management Method. New York, NY: Perigee Books.