Introduction

There are many low-cost airlines in the world. In Europe, major airline companies, such as Flybe, Wizz Air and Aer Lingus, dominate this space (Dobruszkes 2006). Jet2, Ryanair, and Easyjet are other dominant airline companies in this category.

Within this space, Ryanair and Easyjet are the two biggest low-cost airlines in the region (Elderman 2014; Dowling 2010). The two airlines are also the most popular low-cost airlines in Europe. Ryanair is an older airline company than Easyjet because its operations started in 1985, while Easyjet’s operations started in 1995 (Freire 2014).

Ryanair has evolved from a family owned business into one of the most successful regional brands in the market. The company brands itself as “Europe’s only ultra low-cost airliner” because it is the region’s largest low-cost airline company (Mayer 2008).

From 67 operational bases, Ryanair makes more than 1,600 flights daily. It also flies to more than 180 destinations in Europe (Mayer 2008). These destinations spread across 29 different countries in the region. Easyjet is Ryanair’s main rival.

Based at London’s Luton Airport, the company travels to more than 700 destinations and has a market presence in more than 30 countries (Mayer 2008).

Compared to other leading airlines in the short-haul market segment, the two airlines are among the top ten aviation companies with the highest passenger numbers in Europe. The following table shows this fact.

Figure One: Position of Easyjet and Ryanair in the global low-cost airline market (Source: Elderman 2014)

This paper analyses the corporate and competitive strategies of Ryanair and Easyjet. However, to get a correct understanding of this assessment, this paper demonstrates how both companies create value for their shareholders and reveals the strategic choices pursued by both organisations.

In later sections of the study, this paper shows the operational areas where the organisational strategies of both organisations converge and diverge.

Ryanair and easyJet Competitive Positions

Ryanair enjoys a dominant market share in the European low-cost airline market because it was among the first companies to adopt this strategy in the region (Malighetti et al. 2006).

However, because it could not protect this strategic approach from duplication by other airline companies, it lost a significant market share to other companies, such as Easyjet.

Relative to this development, Ryanair has also adopted a “red ocean” strategy where it “steals” customers from other market segments (predominantly the customers of major airlines) (Thomson & Baden-Fuller 2010). For example, it has “stolen” customers in the business class segment (Malighetti et al. 2006).

Since the company has succeeded by adopting this strategy, it has proved that a differentiated market strategy is still vulnerable to competition. Researchers such as Kim and Mauborgne (cited in Thomson & Baden-Fuller 2010) have always supported a differentiated strategy, but these developments have proved them wrong.

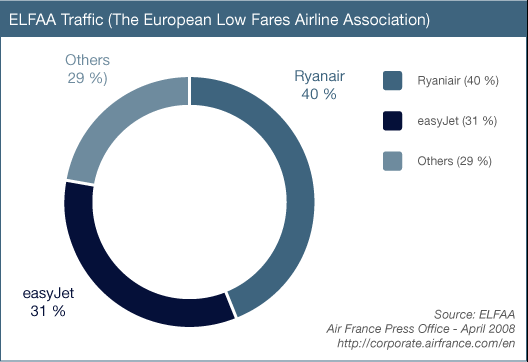

Therefore, a differentiated strategy is not exclusive. Nonetheless, Ryanair commands a stronger market share than Easyjet does. Concisely, Easyjet trails Ryanair air by commanding 31% of the market in the low-cost Airline sector (Air France 2011). Comparatively, Ryanair commands 40% of the market (Air France 2011).

This is the biggest market share in the European low-cost airline sector. The diagram below shows the current market shares of Ryanair and Easyjet in the European low-cost market.

Figure Two: Ryanair and Easyjet market share (Source: Air France 2011)

According to the diagram above, other low-cost airlines command only 29% of the market, while Ryanair and Easyjet dominate the rest of the market.

The dominant market share enjoyed by Ryanair also mirrors its high customer traffic because, compared to Easyjet, the company carries 4.5 million passengers, annually, while its rival carries 3,000,000 passengers annually (Dowling 2010).

Based on the strategies adopted by Ryanair and Easyjet, it is important to point out that competition determines the success or failure of the strategic approaches adopted by low-cost airlines.

Ryanair and easyJet Value for Shareholders

Mennen (2005) says it is important for low-cost airlines to adopt a low-cost structure if they want to create value for their shareholders.

This affirmation aligns with the goal of Ryanair, which is “to firmly set up itself as Europe’s leading low-fare scheduled passenger airline through continuous improvements and expanded offerings of its low-fares service” (Freire 2014, p. 4).

Easyjet also strives to become a market leader in the low-cost market segment. Both airlines create value for the shareholders in the following ways.

Reinvestment

Ryanair and Easyjet have always strived to support their market dominance by increasing passenger traffic through cost containment (Mayer 2008). The companies have also strived to support their leadership positions and create value for their shareholders by maintaining operation efficiencies.

Profit reinvestment is a common way that the airlines create value for their shareholders (Mennen 2005). For example, Easyjet has managed to do so by using the company’s profits to increase its fleet size and expand into new routes (Mennen 2005).

The company has also adopted the same strategy to improve passenger comfort and expand its operational network. Ryanair has also used the same strategy to meet the same goals (Mayer 2008). In this regard, both airlines have reported increased asset values and increased growth figures.

Managing Competition

According to Dobruszkes (2006), the relative success, or failure, of low-cost airlines lies in two factors – cost leadership and differentiation. Ryanair’s market strategy has focused on cost leadership because it strives to become the best company in the low-cost market segment (Mayer 2008; Thomson & Baden-Fuller 2010).

Even with these adjustments, the company has still increased its passenger numbers and remained profitable for a long time.

The success of this strategy has always depended on the control and management of the four facets of cost management in the aviation sector – “employee management, equipment and maintenance, customer service costs, and airport handling costs” (Thomson & Baden-Fuller 2010, p. 26).

By managing and controlling competition in the sector, both Ryanair and Easyjet have generated superior values for their investors. This view affirms the opinions of researchers who say price leadership is pivotal to creating market dominance, compared to cost leadership advantages (Mayer 2008).

Market Strength Alignment

Focusing on market strength is also another tenet of the airlines’ competitive strategies. For example, Easyjet has maximised its productivity by operating in airports where it enjoys market leadership (CAPA 2014). Half of its seating capacity is in such facilities.

Since it trails Ryanair in market strength, in some airports, the company has allocated 29% of its seats to such facilities (CAPA 2014). Ryanair has also focused on creating value for its shareholders by focusing its strengths on markets that it enjoys dominance.

For example, it has focused on improving its performance in many routes where Easyjet does not service (Easyjet operates in 702 routes, while Ryanair operates in 1,600 routes) (CAPA 2014). This way, shareholders in both airlines get value for their investments through structured competition and increased productivity.

Ryanair Strategy

The Low-Cost Strategy

Experts say Southwest Airlines was among the first aviation companies to exploit the opportunities that existed in the low-cost airline market segment (Dobruszkes 2006; Kew & Stredwick 2005).

Other airline companies, such as Ryanair, also discovered similar opportunities by leveraging their competitive advantage through the adoption of a low-cost strategy. Through its no-frills strategy, Ryanair discovered that it could be profitable by working 24 hours a day and keeping its aeroplanes in the air often (Dobruszkes 2006).

Researchers say when the airline adopted this strategy, it succeeded because it was a “blue ocean” strategy – no other airline had adopted this strategy before (Ryans 2009).

It created a huge demand for the airline’s services because it attracted price-conscious customers who would have chosen alternative modes of travel, or failed to travel at all, because of the high costs of air tickets.

Through this strategy, Ryanair became less concerned about existing competition because it was operating in a unique market segment that other airlines had not used before (Ryans 2009).

This way, it became profitable in an overcrowded industry. Today, the airline still reaps the benefit of being among the first airline companies, in Europe, to adopt the low-cost airline strategy. Partly, this is why the company commands the highest market share in the European low-cost airline market segment.

Since its low-cost strategy started increasing sales, Ryanair has always branded itself as a low-cost airline. Its strategy was to steal customers from dominant players in the airline industry by offering lower ticket prices compared to its rivals.

To expand its customer base, the company tried to please all their customers by trying to meet the customer needs of every type of market in the industry (Malighetti et al. 2006). However, the company changed this strategy after realising it needed a differentiation strategy that would set it apart from its competitors.

It also realised that its low-cost pricing strategy could not sustain its business because the margins made from such a strategy were low (Malighetti et al. 2006). Of importance, the company lacked a service advantage that would back up its cost advantage (Thompson 2005).

After realising these strategic weaknesses, the company decided to introduce an outside perspective on its business model by creating superior value for its customers. In line with this strategy, the company also introduced value-added services to its core strategy.

In this regard, it transformed its value chain for the better. This restructuring affirmed the views of Mennen (2005) who said a corporate strategy should have more value as a holistic entity as opposed to the sum of its parts.

Punctuality and Efficiency

Ryanair has always branded itself as an airline company that regards punctuality and efficiency as key segments of its service model (O’Connell & Williams 2012).

The company conveys these advantages to its customers by operating in secondary airports where long queues and complicated security rules rarely inconvenience customers (O’Connell & Williams 2012).

Furthermore, since the airline uses paperless booking, customers can easily buy their tickets and walk to the security gate without enduring any other sign-in rules. Comparatively, customers who fly with major airlines have to contend with these inconveniences, thereby making them less efficient and punctual compared to short-haul flight carriers.

Based on these competencies, Ryanair has always argued that its success does not only depend on its low-cost strategy because its innovative on-time record and its value-added services also support its growth (O’Connell & Williams 2012).

Observers have also said that its fleet of new aircrafts is another strategic competency that boosts the airline’s efficiency in the airline industry (Dobruszkes 2006; Kew & Stredwick 2005).

Flying to Secondary Airports

Ryanair prefers to fly to secondary cities and pursue an outsourcing strategy to undertake its core production services, such as catering and aircraft maintenance (Mayer 2008).

This strategy emerged after learning that many flag carriers use large airports, such as Heathrow, thereby limiting its competitiveness on this platform. Indeed, it would not be able to match the same level of customer service that most customers of long-haul carriers would enjoy if they used the larger airports.

Therefore, the company decided to use secondary airports, where their customers would get efficient services. To do so, the company uses a simplified airline network.

The low fare strategy intertwines with the low-cost strategy because through lower costs, the company is able to offer low fares to its customers. In line with this low-cost strategy is a simplified pricing structure.

easyJet Strategy

Similar to Ryanair, Easyjet’s strategic direction came from years of studying the success Southwest Airline (Sull 1999). Borrowing from the Southwest low-cost model, EasyJet operated using one type of aircraft and a point-to-point short-haul travel (Kew & Stredwick 2005).

Similar to other low-cost carriers, the airline also had no in-flight meals and a rapid turnaround. Another key aspect of its strategic competence was high aircraft use (Thompson 2005). These strategic factors made the airline more profitable than other flag carriers did. Other segments of its working model appear below

Direct Sales

Although Easyjet borrowed its strategic focus from Southwest Airline, its market strategy differed from Southwest because instead of relying on sales agents to make sales, the Airline relies on a direct sales strategy (Sull 1999). The logic behind this strategic approach is to eliminate commissions by not using travel agents.

This approach was a cost-saving strategy. Similarly, the company would have to pay commissions to reservation agents and pay associated operation costs to reservation computers if it used sales agents to make sales. It chose to lower its costs by eliminating these expenses.

Complementing its direct sales strategy is the paperless booking model.

Low-Cost Strategy

Easyjet relies on the low-cost strategy because it believes that it cannot successfully compete with large aircraft carriers because they would use their economies of scale to “crash” the competition.

In line with its low-cost strategy, the company also adopted a “no-frill” strategy, like Ryanair, by eliminating in-flight meals and reducing the number of aircraft attendants. The company chose this strategy because it did not believe that these services contributed to customer satisfaction (Kew & Stredwick 2005).

Flying to Primary Airports

For a long time, Easyjet has branded itself as a committed airline that strives to optimise customer experience, always. In this regard, it strives to offer convenience to its customers by operating in major airports around Europe.

By doing so, it believes that its customers can get around to where they are going in good time. Customers have appreciated this strategy by increasing ticket sales (Kew & Stredwick 2005).

Discussion

The low-cost airline sector has been a ruthless industry for aviation players. More than 20 airlines have collapsed after adopting the low-cost strategy (Air France 2011).

Of importance, experts say the European low-cost airline sector is more brutal for low-cost airline companies than the American market because both markets have different structures (CAPA 2014). The market differences are profound because profitable routes in Europe already have large airline companies that serve them.

The European airline industry is also distinct because charter planes play a greater role in the industry, compared to other markets (Air France 2011). Short distance routes are also limited to low-cost airlines because European Union (EU) policies favour train services as opposed to airline services (Air France 2011).

Lastly, in Europe, too much competition in the low-cost airline sector offers minimal profit margins for existing players in the industry. Therefore, the risk of overcapacity in the industry is real. This fact shows that this market has limitations that would ordinarily curtail the growth of companies that do not adopt an elaborate strategy.

Ryanair and Easyjet understand these limitations and adopted elaborate strategies to navigate the economic challenges of operating in the low-cost airline sector (Mayer 2008).

To cope with these challenges, both airlines have one dominant strategy that hinges on three factors – low costs of operations, low fares, and low frills. This understanding shows where the corporate strategies of both companies converge

Ryanair and easyJet Strategies Similarities

According to Malighetti et al. (2006), the relative success, or failure, of low-cost airlines lies in two factors – cost leadership and differentiation.

Ryanair and EasyJet have concentrated their corporate strategies on the cost leadership model because they both strive to become the best companies in the low-cost market segment. In this regard, both companies have gained the reputation of being the biggest low-cost airlines in Europe (Wallach 2015).

Their “no frills” strategy has been a core tenet of their low-cost strategy because both airlines do not accommodate passenger meals, pre-arranged sitting arrangements, or paper-based ticketing services (Malighetti et al. 2006). Therefore, both airlines strive to minimise their operating costs by cutting expenses such as salaries and fuel costs.

To do so, both airlines use the single fleet type of operation and optimize flight crew productivity (Air France 2011). Furthermore, the “no-frill” strategy works by eliminating in-flight services to lower operating costs.

However, the airlines employ the smallest number of people to meet the least regulatory requirement stipulated in the aviation sector (Malighetti et al. 2006). Therefore, a key part of their strategy is meeting the minimum contractual obligations required by airlines to their customers.

Ryanair and easyJet Strategies Differences

This paper has already demonstrated that Ryanair and Easyjet use the same business model – low-cost strategy. Both airlines also have similar performance indicators in the aviation sector. For example, in 2014, both organisations reported increased passenger numbers (Wallach 2015).

However, both companies have unique internal strategies that differentiate their services beyond the low-cost model. For example, both airlines fly to different types of airports. Ryanair mainly flies to secondary airports, while Easyjet flies to primary airports.

By flying to primary airports, the latter has had an edge above its competition because its customers can get to their destinations faster than Ryanair’s customers who have to board a taxi, or train, to get to major cities. Evidence of this fact emerges in Paris as a common destination for both airlines.

Easyjet flies to Charles de Gaulle Airport and Orly Airport (two main airports in the city) (Thompson 2005). Comparatively, Ryanair flies to Beauvais-Tillé Airport, which is almost one hour away from the city (Ryans 2009). The same example emerges in Rome as a popular destination for both airlines.

While Easyjet flies to Leonardo da Vinci–Fiumicino Airport, which is close to the city, Ryanair flies to Ciampino–G. B. Pastine International Airport, which is far away from the main business district.

Summary and Conclusion

Easyjet and Ryanair have similar strategies to the extent that they both share the low-cost business model. Furthermore, like Ryanair, Easyjet also bases its corporate strategy on Southwest’s business model. Both airlines have perfected this strategy by introducing new price reduction measures, such as paperless booking.

These operational strategies have created immense benefits for the two airlines, including optimizing airline use and increasing airline turnaround frequencies. Both airlines also have similar marketing strategies because besides marketing themselves as low-cost airlines, both companies do not use agents to reach their customers.

Stated differently, both airlines use the direct sales strategy to market their services. Comprehensively, the two organisations share almost similar strategies. Albeit these factors show areas of strategic convergence, both airlines are rivals in the low-cost airline market. Their performance will mainly depend on their ability to sustain their operational models.

References

Airfrance 2011, Low-cost carriers. Web.

CAPA 2014, EasyJet: more aircraft come in as more cash to shareholders goes out. Stelios’ baby is in good hands.

Dobruszkes, F. 2006, ‘An analysis of European low-cost airlines and their networks’, Journal of Transport Geography, vol. 14, no. 1, pp. 249–264.

Dowling, T. 2010, Ryanair v easyJet. Web.

Elderman, H. 2014, EasyJet Vs. Ryanair: The Curious Case Of 2 Budget Airlines. Web.

Freire, A. 2014, Ryanair: Strategy Report. Web.

Kew, J. & Stredwick, J. 2005, Business Environment: Managing in a Strategic Context Chartered Institute of Personnel and Development, CIPD Publishing, New York.

Malighetti, P., Paleari, S. & Redondi, R. 2006, ‘Pricing strategies of low-cost airlines: The Ryanair case study’, Journal of Transport Geography, vol. 14, no. 1, pp. 249–264.

Mayer, S. 2008, Ryanair and Its Low Cost Flights in Europe, Books on Demand, New York.

Mennen, M. 2005, An Analysis of Ryanair Corporate Strategy. Web.

O’Connell, J. & Williams, G. 2012, Air Transport in the 21st Century: Key Strategic Developments, Ashgate Publishing, Ltd., New York.

Ryans, A. 2009, Beating Low Cost Competition: How Premium Brands can respond to Cut-Price Rivals, John Wiley & Sons, London.

Sull, D. 1999, ‘Case Study: easyJet’s $500 Million Gamble’, European Management Journal, vol. 17, no. 1, pp. 20–38.

Thompson, J. 2005, Strategic Management: Awareness and Change, Cengage Learning EMEA, London.

Thomson, N. & Baden-Fuller, C. 2010, Basic Strategy in Context: European text and cases, John Wiley & Sons, London.

Wallach, B. 2015, A World Made for Money: Economy, Geography, and the Way We Live Today, U of Nebraska Press, Lincoln.