Introduction

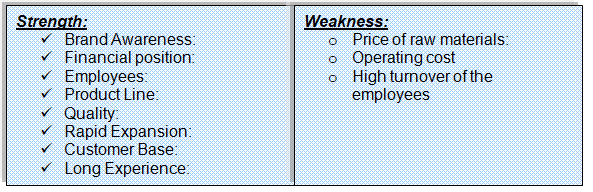

The main objective of this research paper is to present the strategic analysis with internal strengths and weaknesses, the external threats and opportunities of Saudia Dairy & Foodstuff Company (SADAFCO). However, the internal strengths of the company are brand image, financial position, efficiency of the employees, product line, technological adoption, quality of the products, and market share in global market, customer base, and internal management system.

On the other hand, the external threats are unstable price of raw materials, large operating costs, veterinary, global financial crisis, global worming, presence of strong competitors both in national and international market, and so on.

Company Overview

SADAFCO established in 1970 as a milk producer of Saudi Arabia and it became one of the major players in the GCC zone in dairy and food processing industry within 1987 by joint venturing with several businesspersons and expanding business operation vertically as well as horizontally (Global Research 27). On the other hand, the company was criticised for merging with two similar firms Gulf Danish Dairy and Medina Danish Dairy and the critics argued that SADAFCO lost its uniqueness and originality due to such strategic decision.

However, according to the report of Global Research, this company has five plants in order to produce more than hundred products those are vertically diversified products while only 50% products related with milk segments.

This company also produces highly diversified products for the customers such as it offers several kinds of juice, Tomato Ketchup, ice cream, cheese and so on. However, the following figure demonstrates the food categories the diversified products of milk, dairy products, Ice cream, beverages, juice and water –

On the other hand, the following figure describes the name of subsidiaries with business location, and share of Saudia Dairy & Foodstuff Company –

Current financial position of SADAFCO

According to the report of Global research (3) on SADAFCO, the net profit of the company is ups and down each year, such as, its net profit was SR 57 million in 2008, but subsequent years it was only SR 28 million, and SR 203 million.

This data demonstrates that the net profit increased SR 175 million in 2008 and decreased SR 67 million in 2010; therefore, it is difficult to predict the sequential profitability level. On the other hand, total assets and growth profit level of SADAFCO have increased gradually each year except the fiscal year 2008, for instance, gross profit of SADAFCO were SR 365 million and SR 372 million in 2009 and 2010 accordingly.

Table 1: – Key features of financial statements of SADAFCO. Source: self generated from Global Research (3).

Current strategy

- Marketing strategy: The strategic decision of SADAFCO has designed realizing the present market condition and this company will spend large fund to research team to analyze the business environment in such global economic condition (Global research 1). In addition, SADAFCO company to enlarge the target customers from family use for other purposes, which will assist to strengthen the brand image in international market;

- Cost Leadership: SADAFCO maintains cost leadership strategy of Porter through using the maximum capacity of the production those contracting with suppliers who have the capacity to provide the high quality materials with competitive price to offer lower price of its products.

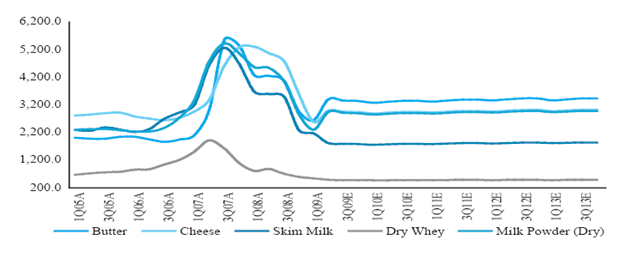

Figure 3: Average Prices of Dairy Products (US$ / ton). Source: Global Research (10).

- Promotional strategy: this company is intended to advertising on famous electronic medias in order to promote Saudia Dairy & Foodstuff Company to attain maximum customers’ attention and increase sales as a consequence;

- Investment Strategy: In order to achieve long-term strategic competitive advantages and develop the position of SADAFCO, the management team decided to undertake a major investment program concerning a total capital expenditure more than SR 1.10 billion in five fiscal years 1993 -1997. However, this investment fund was used to establish new small plants with ten thousands cattle, and these plants would be incorporated within next ten years as part of its brand expansion program (Global research 15);

- Research project: the marketer of this company also concentrated on the importance of research and development team and increased budget for this department they identify the industry trend, and keep undisrupted supply of its products, which has influence on the gross profit margins as the subsequent figure shows that fluctuated gross profit margins for 2005 to 2013;

- Markets: As a part of the development projects of supply chain management, SADAFCO has increased number of stores in local and international market by opening new super and hypermarkets.

Internal strengths and weaknesses of SADAFCO

Strengths:

- Brand Awareness: The brand has great popularity in the market where customers treat the brand image as a significance of trusted source of pure milk and diary product with other diversified products;

- Employees: The company has a team of competent human resource with team sprit to face any challenge in the completive market;

- Product Line: This Company also produces tomato paste, juice, Triangle Cheese, ice cream, Cream Jar Cheese, Tomato Ketchup, bottled water, chips, Cream, Basateen, foodstuff and so on. However, Saudia Tomato Paste is the market leader in KSA as it is 100% natural and preservative free product;

- Financial position: The financial strength of the company demonstrates its success while the recessionary economy has no greater impact on the company. As a result, the share price of the company has increased within short period though it was severely fall in 2008; however, the subsequent figure shows the stock performance of SADAFCO –

- Technology: This is one of the most significant factors for SADAFCO as the foodstuff and milk products need to preserve properly. In addition, integration of new technologies helps the company to raise the productivity and maintain the temperatures and humidity of the production place while the weather of the Saudi Arabia is not suitable for dairy food products, therefore, SADAFCO invests large amount for technological advancement to provide quality dairy food products;

- Quality: SADAFCO has considered as an icon for its quality and high grade of product mix and the customers are highly satisfied with the quality, such as, Favourite brand Saudia UHT milk successfully captured 70% local market share because of its outstanding quality in terms of solidity and nutrients,

- Rapid Expansion: Due to it quality, price and marketing policy, the company is rapidly growing both in home and abroad,

- Corporate Governance: SADAFCO maintain its governance with high degree of compliance with general norms of corporate practice and pay care to the local legislation,

- Corporate Social Responsibility: The company has a significant level of budgetary involvement for its CSR (Corporate Social Responsibility) policy and practice,

- Customer Base: The strong base of loyal customers has turned as competitive force for the company and the existing customer base is gradually increasing;

- Long Experience: This Company continues its journey with remarkable footprint in the market with its long experiences starting from 1976.

Weaknesses:

- Price of raw materials: The customers are dissatisfied due to high price of milk powder and tomato paste is increasing in global market but the company is not responsible for price increase since unstable price of raw material influence the company to increase price of these products;

- Operating costs: One of the weak point of the company is high operating costs as the global economic pressure increase the importance of low operating expenses of the company;

- Supply of milk: The management team of SADAFCO addressed that the supply of milk could be one of the main weaknesses for this Company because it has no cattle stock or has no home based raw milk production;

- Other: Increase rate of fuel and interest rate.

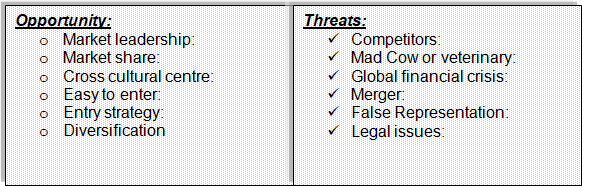

External threats and opportunities of SADAFCO

Opportunities:

- Market leadership: it has enough financial capabilities to expand its market outside of GCC market with more products and be the market leader within the target period;

- Market share: at the same time, it can capture a significant part of global market share by changing its present strategies and utilizing capital more efficiently;

- Cross cultural centre: Though it is Saudi Arabian company, it has opportunity to increase its brand image in global market by giving special facilities to the expatriates;

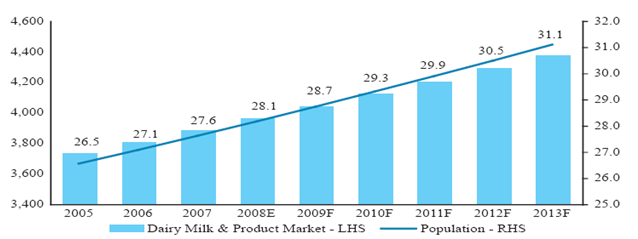

- Demand: Food & Agriculture Organization (FAO) reported that the milk supply is increasing because of intense demand, for instance, 3.1% to 696.6mn tons milk supply increased by 2004-08, and 2.4% to reach 40.4mn tons butter, cheese, whole milk powder, and skim milk powder supply increased within this period. In addition, FAO estimated that the demand would raise 1.7% by 2013 as the growth rate of world population has broadened the gap of supply and demand, which demonstrates that the target market is also expanding besides companies regular growth;

- Easy to enter: Most of the countries of the world are now member of WTO, which gives the opportunity to enter new market easily by applying any entry mode strategies;

- Joint Venture: As the company has a brand awareness in GCC countries for its products, it can expand the market in European, America, and South Asian countries by applying joint venture strategies;

- Diversification: According to the report of Global research, SADAFCO is highly diversified company and it diversified its products vertically, therefore, it has opportunity to develop the financial position by focusing few business segments.

Threats:

- Competitors: The presence of strong competitors in national and international market are one of the main threats for the company while the competitors offers lower price of similar products and uses more effective strategies. However, Al Rabie Food Company (Alrabie), Nestle Al Othman Dairy, National Agricultural Development Company, Al Safi Danone Company, and SAVOLA have already positioned them as the key market players in the global dairy food industry;

- Mad Cow disease or veterinary: the production system of the company may hamper due to the risk of animal diseases like mad cow. Nowadays, the customers become health conscious and they stop to purchase milk products if they know about these diseases, and the affects on sale is wide spreading while sales reduce all GCC countries but the problem occur in Saudi Arabia;

- Global financial crisis: According to the report of central bank of Saudi Arabia, global financial crisis is not hit the Saudi economy more seriously while the world economy has faced adverse impact of this downturn. Therefore, the customers of SADAFCO in the Saudi market was loyal but customers of non GCC countries has shown little interest on high consumption of dairy products as the sales revenue has decreased due to recessionary impact on this zone.

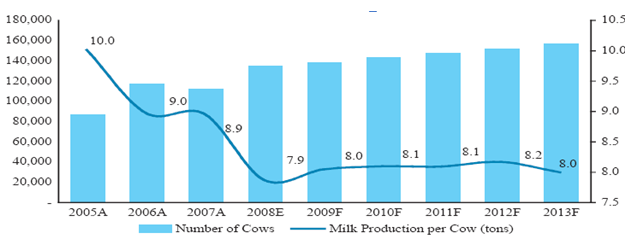

- Production per Cow: production per cow is decreasing due to increasing number of old cows, which may create hindrance of production system near future in Saudi Arabia and following figure shows this issue with more data –

- Merger: merger with foreign companies may destroy the originality of the product line of SADAFCO; as a result, it may loss market share because of decreasing sales. For instance, merger with Danish companies was the main cause of market fall of this company;

- False Representation: Some publishers misrepresent SADAFCO is not producing products considering Saudi culture and it has close connection with Danish companies. Such publications adversely affected on the profitability level and raised question about the corporate social responsibility of SADAFCO;

- Legal issues: frequent change of regulation may increase the cost for legal claims and increase costs in this sector as well.

Key Recommendations:

- The marketer of SADAFCO should concentrate more on the promotional activities in order to increase sales in GCC countries and develop the brand image in the global market;

- The financial report of this company forecasted that the annual sales revenues have not been satisfactory level in 2009 and 2010 considering financial performance of previous years. As a result, the company should restructure its pricing strategy to increase sales revenue in the unstable market;

- At the same time, the performance of SADAFCO in the stock market was substandard level. Therefore, it should consider financial ratio and debt analysis to change the future strategy;

- The prime importance of the company should attract the investors by changing internal policies;

- The above discussion demonstrates that the performance of SADAFCO in GCC countries is outstanding but it is not successful in global market like the competitors. As a result, it should more concentrates on the global expansion by following suitable entry strategies;

- Most of multinational competitors have e-commerce site and online purchasing facilities for the customers and online payment system, but the website of SADAFCO is not offering such facilities. As a result, it should focus on e- commerce system to meet the demand of modern era;

- In addition, SADAFCO should upgrade its technology time-to-time as the integration of IT and other latest technology can change the scenario of business;

- SADAFCO should take the opportunity to diversify its product range,

- This company is concern about corporate social responsibility, so, it should not use any artificial harmful things (such as artificial colour or flavour) to increase taste of foodstuff;

- SADAFCO should increase the budget for market research as it is a effective way to assess market risks, the demand in the market, customer choice, and so on;

- Finally, SADAFCO is the consumer-focused company, so, it should offer products considering customers’ preference, as they are the heart of the business.

Conclusion

From the above discussion, it can be said that SADAFCO has long experience to operate business in Saudi Arabia and GCC countries as one of the leading market player. However, this report highlighted that the global presence of this company is not satisfactory enough though SADAFCO has strong financial position to establish it as major player of global dairy food industry.

This paper recommended that integration of information technology, diversification of products, think customer first, cost effectiveness, and expand business operation in new market with existing products are effective strategies for the company.

Works Cited

Global Research. Saudia Dairy & Foodstuff Company (SADAFCO). 2009. Web.

Global Research. Saudia Dairy & Foodstuff Company (SADAFCO). 2011. Web.