Segmentation Analysis

Market segmentation refers to a marketing strategy that divides a broad target market into subsections of customers who have similar wants and interests, and then develops a method of getting them (Majaro 2013). The segmentation analysis involves evaluating factors, such as geographical, demographic, psychographic and behavioural (Majaro 2013).

These factors are significant in understanding how the imported chocolate would be marketed, including the positioning of the product (Alexander, Yach & Mensah 2011). Regarding behavioralistic factors, it has been argued that population features have impacts on new products.

For example, if Turkish people are nationalistic and patriotic, it would be difficult for them to buy the new products from outside the country (Wilson & Mukhina 2011; Peri, Stipevi, & Guszak 2009). Wilson and Mukhina (2011, p. 57) argue that the evaluation and selection of products would be affected by psychographic factors.

Notably, citizens’ personalities, values, beliefs, motivations, lifestyles and attitudes would affect the purchasing power of imported chocolate, especially if it interferes with their culture (Wilson & Mukhina 2011). Demographic factors are vital because they are utilised to determine prices, needs and wants.

The age is a key demographic factor because the young concentrate on images, while adults would focus on prices (Peri et al. 2009). Chocolate’s most target markets would the young, implying that the appearance must be attractive.

Geographically, the country is strategically located. This indicates that it would be easier for companies from outside to enter into the country (Peri et al. 2009). The positioning of the chocolate market will depend on the population settlement.

Porter’s Five Forces Analysis of the Turkey Chocolate Industry

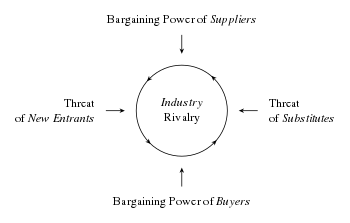

Porter’s five forces analysis entails analysing the level of competition in the industry and designing a business strategy. The forces are comprised of factors that are close to a firm and affect its ability to offer services to consumers and make profits (Porter 2008).

The forces are the threat of substitute goods, the peril of established rivals, the danger of new contestants, the bargaining power of distributors and that of consumers (Porter 2008). With regard to Turkey’s chocolate industry, Porter’s five forces analysis is vital.

The first factor that Porter considers is the consumers’ abilities to bargain. According to him, in situations where products are cheap, consumers are not price-sensitive (Porter 2008; Ozilgen 2012). The bargaining power will be critical in determining how frequently the customers will be buying chocolate (Atalaysun 2013).

In Turkey, most purchasers are consumers and brokers. Brokers have the most impact for chocolate and other confectioneries. The existence of large retailers would contribute to the struggle for space and the threat of backward incorporation (Ozilgen 2012). The second force is the bargaining power of distributors.

Notably, this category of people has impacts on manufactured products in relation to the quality and price of goods. Having a conflict with a supplier might cause issues, which could result in changes. For example, high bargaining capabilities may force a producer to give in to customers’ demands (Atalaysun 2013; Knezevic, Renko & Bach 2011).

Struggle among existing competitors is the third force. Lindt Special, Ulker Godiva, Patchi, Vakko, Beymen, Pelit Boutigue and Marie Antoinette are the main competitors in the market (Knezevic et al. 2011). The growth rate of the industry is high with a 5 % growth rate in developed nations and 10 % in the upcoming market, making it very attractive (Knezevic et al. 2011).

Due to high competition, there is a likelihood of an increase in prices, making companies operate on lower margins. Notably, chocolate faces competition from biscuits that are produced in the country (Dogan, Toker & Goksel 2011). Thus, it would be important for the company that would be importing it to develop attractive brands.

The fourth force is danger of substitute products. This is the case because of the effects chocolate has on the health of people. It is attributed to obesity, and according to studies, 400 million adults were obese worldwide in 2005 (Dogan et al 2011).

As a result, many customers have focused on substitutions, such as cereal bars, fruit bars and biscuits (Atalaysun 2013). These would be major threats not only to the imported chocolate, but also to the chocolate sector in Turkey (Dogan et al. 2009).

To counter the threats, importers should concentrate on adding value, such as vitamins and/or removing fat and sugar to their products (Grundy 2006).

The last force is the threat of a new entry. It is certain that chocolate sector is controlled by companies that have attractive brands that draw global attention (Grundy 2006).

Arguably, it is difficult for a new organisation to creep in with a new product of chocolate from outside the country, unless it develops new goods that are health-friendly. This is for the reason that many customers are loyal to Ulker Godiva, the leading producer in the nation (Atalaysun 2013).

Another challenge that the entrant product will face is the existence of traditional deserts. Turkish people are ethnocentric, implying that they like the products from their country, and it might be hard to buy a new product (Atalaysun 2013; Guldas, Dagdelen & Biricik 2008).

Therefore, the importing of chocolate would be affected by many factors as aforementioned. The existing traditional deserts and biscuits would be major threats. The introduction of the new product will face stiff opposition from the suppliers who are loyal to Ulker, the leading company in Turkey.

References

Atalaysun, M, 2013, Sugar and Confectionery Sector. Web.

Alexander, E, Yach, D, & Mensah, GA, 2011, ‘Major multinational food and beverage companies and informal sector contributions to global food consumption: implications for nutrition policy’, Globalization and health, vol. 7, no. 1, pp. 26-37.

Dogan, M, Toker, OS, & Goksel, M, 2011, ‘Rheological behaviour of instant hot chocolate beverage: Part 1. Optimization of the effect of different starches and gums’, Food Biophysics, vol. 6, no. 4, pp. 512-518.

Guldas, M, Dagdelen, AF & Biricik, GF, 2008, ‘Determination and comparison of some trace elements in different chocolate types produced in Turkey’, Journal of food, agriculture & environment, vol. 21, no. 3, pp. 334-367.

Grundy, T 2006, ‘Rethinking and reinventing Michael Porter’s five forces model’, Strategic Change, vol. 15, no. 5, pp. 213-229.

Knezevic, B, Renko, B, & Bach, MP, 2011, ‘Web as a customer communication channel in the confectionery industry in South Eastern European countries’, British Food Journal, vol. 113, no.1, pp. 17-36.

Majaro, S, 2013, International Marketing (RLE International Business): A Strategic Approach to World Markets, Routledge, London, United Kingdom.

Ozilgen, S, 2012, ‘Failure Mode and Effect Analysis for confectionery manufacturing in developing countries: Turkish delight production as a case study’, Food Science and Technology (Campinas), vol. 32, no. 3, pp. 505-514.

Peri, N, Stipevi, VB, & Guszak, I, 2009, ‘Perception of chocolate brands in the Czech market: the case of Dorina’, International Journal of Management Cases, vol. 11, no. 2, pp. 80-91.

Porter, ME, 2008, ‘The five competitive forces that shape strategy’, Harvard Business Review, vol.86, no.1, pp. 25-40.

Wilson, I, & Mukhina, M, 2010, ‘Market segmentation in Russian subsidiaries of FMCG MNEs: Practitioner and academic perspectives’, Marketing Intelligence & Planning, vol. 30, no.1, pp. 53-68.