Introduction

The success of international-businesses seats heavily on the shoulders of micro businesses in the least local settings which in a long run constitute a chain that culminates into an international business community and make international business stand tall. In recent years, for example, the use of software as application-tools for designing network systems for marketing has necessitated the need for massive design of software. Most times, designing and applying the designs requires a number of innovative and creative individual. It then becomes obvious that the force behind effective international business remains the innovators in a global chain. The paper under consideration accesses Charles-Robel and De-Wall, who were recently absorbed as Board-members into start-up-jive software as discussed by Hickins MicheaL in Wall St. Journal of1st April, 2011. The article can be found at Web.

The issue in the paper

The paper identifies with recent increment of business operatives’ link with the acquisition of social-networking in the promotion of business. Recently, businesses operatives have realized the need to adopt the use of social media in reaching out to customers. The tool is so far turning in impressive results – and the need for attractive branding of software is made pronounced. Jive is directly engaged in the process of designing sophisticated but user-friendly software that targets at attracting customers on mediums like Facebook/Twitter.

Prior to successful transaction of an international business, there must be the existence of well structured and acceptable laws/principles. These are necessary in order to influence issues that may ordinarily hamper smooth transactions. In developing economies, the need for appropriately structuring rules in favor of international practices has been domesticated by professional institutions whereby they endeavor to localize monitory laws. The idea of international-best-principles can then be seen as a present-day global agreement amongst different legislative bodies.

Venture Capital Business

It is rare for an International business to survive in this twenty-first century without assistance of independent-investors- who cut across different countries and firms. In most cases, the support comes through the venture-capital-market. Venture-capital businesses make available finances to host nations in area like technological-designs, financial projects and legal matters which bring about ample chances to save the rights of financiers and help government agencies to be strengthened (Barry 23). Businesses achieve more international recognition and expertise which can easily conquer any setbacks that may be experienced. Venture-capital in an international business has to do with investment-organizations coming together financially to protect the interest of a company (Barry 29).

The practice is been carried out by financially expert-organizations with the sole responsibility of collecting funds from various sources and looking out for different firms worldwide who are in dare need of capital to advance their newly established business. After their financial commitment in all these companies, venture-capitalist in returns get an equitable share from such firms and enjoy more dividends if the firms do better in the business environment. Every business has its own gray-sides, same happens to venture-capital business which sometimes provides data that may not be satisfactory especially on fresh establishment (Alan 18). Studies have reviewed that Venture-capital is the best place to access fund for establishing firms (Alan 28).

Venture-Capital-Business in Today’s World as Considered in Financial Times

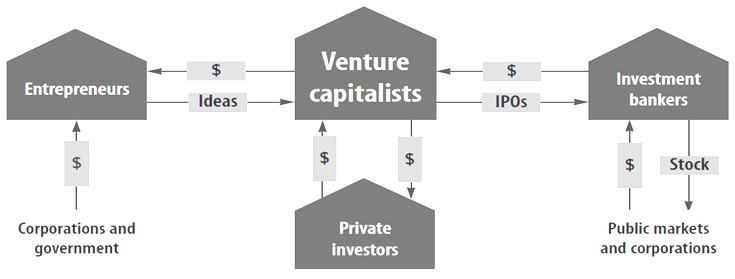

Gulfer (373) argues that based on the high rise in internationalization of business, a lot of the freshly established firms which lack the know-how that investor really want may enjoy the open hands of venture-capital firms Which’s assistance provides unquantifiable benefit to all investors worldwide. Figure 1 is an Illustration of the interconnectivity between venture-capitalist and interacting bodies.

Banks are sometimes not that readily positioned to assist fresh establishments; not because the funds are not available but for information lop-sidedness and overhead cost. Venture-capitalist is stronger in this type of business by engaging effective monitoring and personal contracting. This and more have made the VC to get more patronage.

The venture capital business has four main players: entrepreneurs who need funding; investors Who want high returns; investment bankers who need companies to sell; and the venture capitalists Who make money for themselves by making a market for the other three (Alan 34).

In the United State, venture-capital is appreciated as an economic hub which embraces difference industries. Venture finance is not a long period transaction but only cherished investment in an organization with a good balance-sheet and well-positioned infrastructural capabilities are the bases for future acquisition to any public institution. Venture-capitalists acquire parts of any entrepreneur capital and build it within a specific period to grow and later dispose it with the assistance of an investment-banker. Usury laws which allow reduction in what banks charge on interest base on the money borrowed funds and any danger that may be witness come into play.

Even though personal equity and VC funds are fairly small worldwide, several nations still record high-growth-level in this business. Some years back personal equity fund move up to forty-five percent in India, while China republic was three hundred and twenty-eight percent. Facts behind this advancement in VC activities in China can be trace to result-oriented-formation and good host nation policies to defend funds. Any country with political stability will definitely win the heart of venture-capital-organization and couple with others factors mentions earlier which allow firmness in policy, there is a good location for investor without any iota of doubt.

It should be known that investment from another country creates ample of opportunities to the investors of such funds; these privileges can be in the form of a free-tax-holiday, fast approval of business documents, easy recognition and patronage by policy makers to all the foreign investors. Again the host nation gains a lot in this kind of international investment environment which drive growth economically by creating jobs, improving on expertise, raising proper standard of living for the citizenry. Now it is known that every party that involves in international business especially the host nation benefits immensely from such an opportunity. Host nations to this kind of direct investment need to develop articulate policies that can drive more investment which can boost national economy in a positive direction. For some nations, caution needs to be taken in tax collections. This is a sensitive field that a professional needs to be consulted and possibly propose a total reduction in investment-tax which can really encourage the influx of foreign investor to the nation.

Conclusion

Today’s awareness of technology-based economy encourages banks to look out for substantial assets in getting loans which only few have such assets to give as a standing order. Most of this banks and Equity-Company are guided by a law to safeguard public investment and again such a law allows an organization to get an access to public-market. Venture-capital firms are headways in some nations especially in United State by funding difference area of innovation by adding their quotas to the economy to large VC firms in other parts of the world.

Works cited

Alan, Day. Political Handbook of the World 1997. Binghamton, NY: CSA, 1997. Print.

Barry, Tunner. Statesman Yearbook 1998-99. New York: St. Martin’s Press, 1998. Print.

Gulfer, Harris. Ethics in International Business. LA: Weldom House Press, 2010. Print.