Industry Profile

Softchoice Corporation is an information communication technology (ICT) firm. The firm particularly deals with programming tools, database products, and obscure software, and has been authorized to deal with corporate, government, as well as educational licensing programs (Government of Canada, 2013). Canada’s ICT industry mainly comprises of small companies, numbering about 33,300 in total.

A bigger percentage of this number, 86.9 percent (Government of Canada, 2013), deal in computer services and software. On the other hand, a paltry number of 6.2 percent is within the wholesaling industries (Government of Canada, 2013). Larger companies operating in the industry are comparatively few, with close to 75 companies only employing a workforce of over 500 employees in 2011.

In comparison, more than 28,300 companies employed not more than 10 employees, translating to 85 percent of all companies in the industry (Government of Canada, 2013).

The ICT industry comprises of four main sub-sectors, including software and computer services, ICT wholesaling, ICT manufacturing, and communications services. Softchoice falls under software and computer services sub-sector, which is also the largest among the sub-sectors with an 86.8 percent volume cover of the entire industry.

Industry structure and financial performance

According to the “Branham top 250” (2012), the software and computer services sub-sector had combined revenue of over $ 4.997 billion in 2011. This was a marked improvement from the previous year’s revenue amount of $ 4.274 billion, representing a percentage growth rate of 16.92.

The top performers in the industry, who also comprise of Softchoice’s biggest competitors, include BCE, Rogers Communications, TELUS, CGI Group, and Open Text (“Branham top 250”, 2012).

In 2011, both CGE and Rogers Communications recorded modest gains in their business operations, where each of the companies increased their sales by approximately 2 percentage points (“Branham top 250”, 2012). TELUS, on its part, registered approximately 9 percent growth in Internet and wireless sales, posting $7.98 billion.

These companies, also referred to as the big three, have tight business competition amongst them. This increases the possibility of other smaller companies in the sub-sector to consolidate together (“Branham top 250”, 2012).

During the same year of 2011, CGI Group worked towards building its new acquisition, Stanely, which was worth $923.15 million (“Branham top 250”, 2012). The company closed the year with its total sales figure amounting to $4.32 billion, representing a percentage growth rate of 15.84 percent from the previous year (“Branham top 250”, 2012).

In a bid to enhance its performance even further, CGI Group has established new independent business units, focusing on health and government areas. The health business area generated about $350 million in global sales in 2011, which represent 8 percent of its entire sales revenue (“Branham top 250”, 2012).

Open Text recorded a landmark performance in 2011 when the company’s annual sales exceeded the $1 billion sales mark in the company’s history. The company’s revenues grew by 13.30 percentage points from the previous year (“Branham top 250”, 2012).

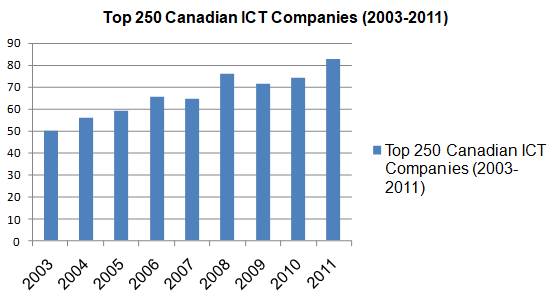

Open Text’s main strategy of business involved acquisition deals that were completed in 2011, which saw the company obtain Metastorm, StreamServe, and weComm. The graph below highlights the cumulative performance posted by Canada’s leading 250 ICT firms (“Branham top 250”, 2012).

Source: “Branham top 250” (2012)

From the graph above, it is observable that the ICT industry’s cumulative revenue performance has been increasing over the years. For instance, between 2003 and 2006, the annual revenue figures for each year exceeded the previous year’s sales results.

The average growth indicates that the industry is set to continue with its annual growth in the future, where the companies are set to make additional sales. Although there are secluded years, specifically 2007 and 2009, where the total annual sales made were less than the previous year’s, these are isolated cases and are not expected to affect the growth pattern going forward.

Competitive Strategies within the Industry

Buyer power

The buyers have a modest bargaining power in the industry. The software and computer services sub-sector comprises of 86 percent of the total 33,000 companies in the ICT industry in Canada (“Branham top 250”, 2012). This implies that the buyers have many choices from where they can seek to acquire their software products.

It is evident that the firms compete with each other as they seek to win over the market because of relatively large number of companies in the sub-sector.

This competition, in turn, provides the buyers with the necessary bargaining power advantage because the firms use such aspects as price to base their competition. However, the firms also enhance their business positions because firms such as Softchoice specialize in obscure software products. This lowers the buyers’ overall power to bargain, making it generally modest.

Supplier power

The suppliers’ bargaining power is equally modest in this industry. With the high number of industry players exceeding 33,000, it means this huge number of ICT firms is depending heavily on the suppliers to enable them achieve their business objectives (“Branham top 250”, 2012). The suppliers deal with a large clientele base, thus making them to enjoy high frequency business.

However, it is also important to note some of the players in the industry, such as BCE, TELUS, and Rogers Communication are well established and have the potential of integrating backwards (“Branham top 250”, 2012). With Softchoice’s specialization in obscure software, the company enjoys more bargaining power over suppliers. Only a few suppliers can serve the company’s needs fully, giving it the necessary bargaining power.

New market entrants

The industry has fewer barriers to entry. Although the five leading industry players have consolidated the market, many other smaller players still exist and do their business. There are numerous sub-areas within the software and computer services sector, where firms can specialize in and still establish themselves (“Canada information technology”, 2012).

Although the established firms in the industry benefit from the economies of scale advantage, they focus their attention on a larger area of the ICT industry. This, in turn, gives the smaller industry players room to penetrate into the industry as they only focus on smaller areas of the industry. The smaller industry players most likely provide high quality products and services, which attracts a significant portion of the market.

Threat of substitution

The threat of substitution is low. Although the wider ICT industry has many players concentrating on the same market, each of these companies has focused on specialization in different areas. Thus, customers with particular ICT need may find it difficult to locate an alternative ICT firm that deals in the exact area.

Although many software and computer services firms exist in the industry, Softchoice specifically deals in obscure software. The major companies in the industry may be dealing with a wide range of service and product areas, but they also specialize in specific business areas to improve the quality of their performance (“Canada information technology”, 2012).

Competitive rivalry

Competitive rivalry is high in the industry. There are many companies in the industry that have a great potential and power to compete in the market. The large established companies have resorted to acquisitions to increase their competitive edge over other industry rivals (“Canada information technology”, 2012). With the industry trends indicating growing cumulative revenue each year, the players are working hard towards ensuring that they capture a significant portion of the total market revenue. Companies are also differentiating their services to limit competition by focusing on particular areas as a way of enhancing their quality performance.

Industry Trends and Emerging Opportunities

Increasing Expenditure on R&D

ICT industry players have been setting apart an increased volume of their revenue for funding research and development activities. In 2010, for instance, the ICT firms increased their R&D expenditure to 15.44 percent compared to 14.78 percent in the previous year (Anderson, 2013).

This trend highlights the fact that the industry players recognize the importance of investing in their core expertise, as well as the products and services that they deal with to increase their competitive edge within the global playing field (Anderson, 2013).

With ICT relying heavily on research and development activities because of its continuous growth and advancement, there is a higher likelihood that the ICT industry players will continue experiencing a growing need to spend more revenues on the R&D activities.

Increased spending on research and development increases the opportunity of the ICT firm to grow even further. It increases the probability of enhancing quality and general performance, which will in turn attract more buyers.

With an increase in the number of the buyers, the firms are likely to make more sales and improve their revenues. Increased R&D activity is also likely to expand the Canadian ICT market to include the international buyers.

Increasing Value of the Canadian Dollar over the US Dollar

The Canadian dollar gained value over the US dollar towards the end of 2010 (Anderson, 2013). This was the second time that such a trend had been noticed over a period of 30 years.

Over 40 percent of the Top 250 companies generated more than 50 percent of the total sales from the international market during the same year (Anderson, 2013). In particular, over 30 percent of the listed firms produced in excess of 50 percent of their total revenues within the US. This played a critical role in increasing the Canadian dollar’s value with respect to the US dollar (Anderson, 2013).

A continuation of this trend will subject the Canadian ICT firms concentrating on the international market into increased competition. This is due to the high product cost influenced by the increasing value of the local currency over that of the US dollar (Anderson, 2013).

In essence, the Canadian firms seeking to position themselves as efficient near-shore alternatives compared to the traditional outsourcing destinations must rely on other significant strengths.

This may include looking more into innovation and leadership aspects, instead of concentrating on overall savings on labor cost (Anderson, 2013). In other words, the increase in value of the Canadian dollar over the US dollar is a threat to business for the ICT firms because it diminishes the overall profitability of the firms.

Mergers and Acquisitions

The ICT industry in Canada is experiencing an increase in mergers and acquisitions. Several of the established firms in the industry have acquired other companies, including both emerging startups and established firms to complement their existing technologies and entrance into new markets (Anderson, 2013).

Foreign players have also acquired several other small and medium sized Canadian ICT firms to earn leverage into the market. In 2010, for instance, ICT players BreconRidge, Coretec, Protus, Brainhunter, as well as Fusepoint Managed Systems and Clarity System were all acquired by other firms (Anderson, 2013).

This trend is likely to continue going forward as uncertainty in the industry pushes firms towards seeking to strengthen their presence in the market. This creates additional market opportunity for the established firms pursuing the acquisitions and mergers because it helps them to expand their potential market.

It also increases their areas of specialization as the acquired firms could be specialists in different ICT areas. However, this trend is a threat to the smaller firms that seek to remain independent. It consolidates the market and gives the established firms more power to manipulate the industry to their advantage, leaving the smaller firms with little capability to challenge them.

Importance of Information Technology to the Industry

Technology is a critical aspect of the ICT industry. ICT as an industry will be non-existent without technology. Presently, the world is considered as a global village, where information flows very fast from one region or part to another. The entire globe is interconnected, where networks play a critical role in generating large amounts of data flow that accumulate on a daily basis (van Weert & Tatnall, 2005).

Technology has had its immense share in supporting and enabling this to be a reality. Improved computing devices with high performance power, including laptops, desktop computers, and Smartphones all have the ability to browse the Internet at fast speeds and enhance the ICT interconnectivity (van Weert & Tatnall, 2005).

As advancements in technology continue to be witnessed, the ICT capacity is also growing. There is an emergence of a new technological trend, Internet of Things (IOT), which has made it virtually possible to connect anything via such methods as Machine-to-Machine communication (M2M) (Giusto et al., 2010).

The new network is sustained by new technological developments where information sensors are embedded in home appliances, houses, machines, cars, as well as extended to such social infrastructures as transportation and energy systems. Technology is also enabling unprecedented progress where meaningful patterns are found from undertaking an analysis of the diverse and vast data flow from the Internet (Giusto et al., 2010).

ICT has been settled upon as the appropriate means of enhancing back office productivity within public organizations. Many organizations are increasing their efficiency. Consequently, they are able to deal with real time information and details that they require for their operations.

Technology is playing a critical role in exploiting new business areas, which have made ICT to be a virtual boundary-less area. ICT is expanding in both quality performance and reliability as more technological innovations come into play (van Weert & Tatnall, 2005).

By extension, the quality of life is also improving as individuals are able to learn fast, products can be produced more efficiently, firms can avert losses at the opportune time, and the health sector is capable of enhancing its performance.

References

Anderson, D. (2013). Canada’s ICT industry: a work in progress. Web.

Branham top 250 Canadian ICT Companies 2012. (2012). Backbone Magazine. Web.

Canada information technology report Q1 2012. (2012). Research and Markets. Web.

Giusto, D., Iera, A., Morabito, G., & Atzori, L. (2010). The Internet of things: 20th Tyrrhenian workshop on digital communications (1st ed.). New York, NY: Springer.

Government of Canada. (2013). Information and communications technologies (ICT). Web.

van Weert, T. J., & Tatnall, A. (2005). Information and communication technologies and real-life learning: New education for the knowledge society. New York, NY: Springer.