Five Forces Analysis

It is necessary to note that Stratasys captured the value due to the innovative nature of the product and services provided as well due to the company’s approach. Remarkably, innovation is the core value of the organization as it was launched after Scott Crump’s (the founder of Stratasys) attempt to make a toy for his child in his kitchen (Stratasys is shaping our world, 2015).

In 2014, the company’s revenue was almost $750 million and the full year earnings per share was around $2 (McGrath, 2015). It is possible to implement the five forces analysis to understand the way the company captured the value.

Supplier Power

One of the powers that can affect the company’s performance is the supplier power. Notably, companies try to create a chain of vendors who have the necessary capacity as well certification to provide high-quality components (Gibson, Rosen & Stucker, 2014). As has been mentioned above, the company was launched after its founder patented the principal element in the process of 3D printing. FDM is the process utilized to produce 3D elements from 3D CAD files, which is easy and efficient.

Notably, the company can obtain materials for the development of its products from a broad range of suppliers. Therefore, Stratasys can easily change suppliers, which happened in the 2000s (Nelson, 2004). Vertical integration played a significant role in the creation of the favorable position of the organization that is not dependent on particular suppliers. Several mergers and acquisitions that have been implemented throughout the history of the company contributed to its vertical integration (Stratasys is shaping our world, 2015).

Buyer Power

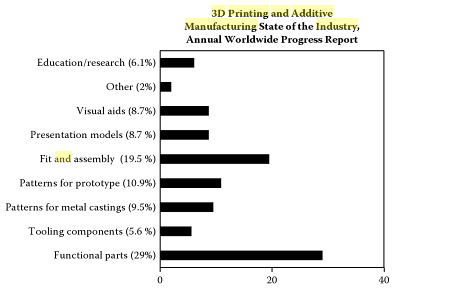

Buyer power is a significant factor that has an impact on the development of the company. Stratasys focuses on the provision of its products and services to large enterprises in such sphere as industry and medical as well as scientific research (see fig. 1). It is noteworthy that the business provides its products and services in such spheres as aerospace, automotive, architecture, dental, commercial and consumer products prototyping, education, entertainment, defense, medical device prototyping (Stratasys is shaping our world, 2015).

Therefore, the buyer has quite limited power over Stratasys as there are still many customers, and the company’s position is favorable in this respect as well. However, those are big companies that can afford to buy such expensive technologies. Making their products more affordable for smaller businesses and even households will enable the company to gain a leading position in the market.

Competitive Rivalry

It is necessary to note that the market for 3D printing and additive technology is rapidly evolving. Thus, according to the recent report, the industry will grow up to $20 billion by 2020 (Srivatsan et al., 2015). It is also quite a competitive market as there are more than 60 companies worldwide providing “more than 66,000 professional-grade additive manufacturing systems for eight industrial sectors” (Srivatsan et al., 2015, p. 28).

Nonetheless, Stratasys has been one of the leaders in the field, and it holds its position due to its efficient policy. The company has implemented a number of mergers and acquisitions. For instance, it merged with one of its competitors, Objet, and purchased another rival, MakerBot in the late 2000s (Sharma, 2013). This horizontal integration leads to the disappearance of serious competitors. It also strengthens the company’s position in the market.

Threat of Substitution

The industry is quite new and, hence, the chances 3D technology can be substituted in the near future are quite slim. Importantly, although 3D printing is unlikely to replace 2D printing in the short- and even long-term perspective, the former will acquire more popularity in such spheres as architecture, entertainment, medical and scientific research and automotive industry.

At the same time, there are new industries developing at a high pace. For instance, injection molding, CNC or laser cutting can be a serious threat to 3D printing (Lipson & Kurman, 2013). Thus, CNC is associated with high accuracy and the use of the software employed in many companies (CAD and CAM). Laser cutting can also be more helpful than 3D printing in the development of many components.

Development of components is automated and, therefore, highly efficient. Injection molding is a technology similar to 3D printing, and it has a significant potential. These innovations enable people to optimize many processes (Handerson, 2004). The technologies are developing quite rapidly, and new applications are found. Therefore, Stratasys should take into account the threat associated with the innovations mentioned above. Otherwise, the organization can lose its leading position in the market.

Threat of New Entry

Clearly, like any developing market, the market of additive manufacture and 3D printing is characterized by the entrance of new players. There are high chances that new companies will enter the market and evolve into serious competitors (Srivatsan et al., 2015). Many smaller companies are unable to remain competitive due to the lack of the capital.

Therefore, they are often merged. However, in some cases, rivals of the company collaborate, which leads to enhancement of their positions in the market (Eisenhardt & Galunic, 2000). It is also important to note that availability of skilled labor force enables companies to operate more efficiently.

More so, the technological development provides a variety of opportunities, and new players can enter the market (Eisenhardt & Brown, 1999). The industry is expanding as researchers identify various applications of 3D printing (Bassoli, 2007). However, if the company continues its efficient policy of vertical and horizontal integration, it will be able to keep its leading position.

Capturing the Value

The brief analysis provided shows that the major elements of the company’s capturing the value have been innovation, acquisitions, and mergers. The company develops new products and services. It also aims at the development of technologies available to wider audiences. Acquiring smaller (but successful) enterprises as well as merging with serious competitors, Stratasys has managed to remain one of the leaders in the field.

The company has improved its operations through vertical as well as horizontal integration. Stratasys is trying to acquire the necessary facilities to achieve maximum vertical integration. For instance, the organization acquired the company producing thermoplastic materials, Interfacial Solutions (Stratasys strengthens materials development capabilities, 2014). It is noteworthy that Interfacial Solutions had been the company’s partner for several years.

Thus, Stratasys acknowledged the efficiency of the facility and the acquisition of assets of this company contributed to the vertical integration of the leader in the market. There are various other small companies that can enable Stratasys to complete its vertical integration (Tranchard & Rojas, 2015).

As far as mergers are concerned, there are a few options at the moment. However, the company can enter various collaborations with such giants as HP, Microsoft, Google. Such collaboration helps companies to use innovative technology and strategy and benefit from the use of new approaches (Tushman & Smith, 2002).

It also gained the reputation of the reliable and responsible organization, which leads to the development of proper relationships with the company’s partners. It is important to add that the vast majority of enterprises in the industry also focus on innovation, which is the key to success in 3D printing and additive manufacture (ASTM additive manufacturing standards, 2015).

Thus, IBM and HP, some of the primary competitors of Stratasys, have developed similar technologies and they also make steps in horizontal integration. It is possible to assume that the winner of the race will be the company that is the most successful in these two areas. Development of new products and services, as well as the search for new implications, will enable companies to gain (or keep) the leading position in the market.

Uniqueness and Complementary Assets

Apparently, uniqueness has played the central role in the development of the company as well as the entire industry. As far as the industry is concerned, it is possible to note that people got used to the printing technology, and 3D printing turned out to be revolutionary. Importantly, it had various implications. Such industries as automotive, architecture and commercial goods development benefited from the development of additive manufacture most.

The primary buyers of the technology are companies involved in the aerospace industry and medical (especially dental) research (Srivatsan et al., 2015). The prototypes could be detailed, and the production was automatized. Now, 3D technology is used for manufacturing purposes as well.

When it comes to the company, its uniqueness also had an enormous impact on its development. Thus, the creation of FDM ensured a significant competitive advantage. Stratasys could provide high-quality products and services that were gaining immense popularity. The use of 3D technology in medicine and innovative approach of Stratasys contributed to the uniqueness of the company (Rengier, 2010).

Importantly, speed is another essential element that contributed to the development of the industry. Additive manufacture provides such advantages as the reduction of waste and energy consumption, decreased marketing time, just-in-time production and so on. There is no need to spend months developing prototypes as people are now able to create a prototype within hours.

Apparently, this makes their products’ cost-effectiveness significantly higher. Moreover, in many cases, companies do not need to look for producers of certain elements of their products as they are capable of developing these components utilizing 3D printers.

The company can also be characterized by a number of complementary assets that ensured its growth. First, Stratasys earned the reputation of an innovative and reliable company during its early years. This status encouraged many companies to buy from this firm rather than from its competitors who were less famous or reliable (Nelson, 2004).

Apart from that, the company has developed efficient distributional channels, which can be seen as another important complementary asset (Gibson et al., 2014). The Minnesota-based company provides its products and services worldwide, which makes it one of the leaders in the market. Furthermore, the complementary asset of the company is the provision of co-producing power to the consumer (Gibson et al., 2014).

The technology provides a broad range of possibilities to users of 3D printers as they can create new shapes quite easily. It is also important to add that the company has online stores that enable customers to purchase products easily. Another important complementary asset is the compatibility of the technology with such software as Windows, Linux and so on.

Conclusion

In conclusion, it is possible to note that Stratasys has been a leader in the field of additive manufacture and 3D technology due to its focus on innovation and vertical as well as horizontal integration. Clearly, the company has to take into account various threats such as new entrants and empowerment of competitors. The organization provides high-quality products that are gaining more and more popularity. Stratasys also plans to develop more affordable 3D printers that will expand the market significantly.

Reference List

ASTM additive manufacturing standards: What you need to know. (2015). Web.

Bassoli, E. (2007). 3D printing technique applied to rapid casting. Rapid Prototyping Journal, 13(3), 148-155.

Eisenhardt, K., & Brown, S. (1999). Patching: Restitching business portfolios in dynamic markets. Harvard Business Review, 1(1), 1-19.

Eisenhardt, K., & Galunic, C. (2000). Coevolving: At last, a way to make synergies work. Harvard Business Review, 78(1), 21-35.

Gibson, I., Rosen, D., & Stucker, B. Additive manufacturing technologies: 3D printing, rapid prototyping, and direct digital manufacturing. Atlanta, GA: Springer, 2014. Print.

Handerson, R. (2004). Going for growth: Managing discontinuous innovation. New York, NY: Springer.

Lipson, H., & Kurman, M. (2013). Fabricated: The new world of 3D printing. New York, NY: John Wiley & Sons.

McGrath, M. (2015). Stratasys tanking more than 30% on slashed guidance. Forbes. Web.

Nelson, B. (2004). Almost out of the Woods. Forbes. Web.

Rengier, F. (2010). 3D printing based on imaging data: review of medical applications. International Journal of Computer Assisted Radiology and Surgery, 5(4), 335-341.

Sharma, R. (2013). The real reason Stratasys bought MakerBot. Forbes. Web.

Srivatsan, T. S., Maningandan, K., & Sudarshan, T. S. (2015). Additive manufacturing of materials: Viable techniques, metals, advances, advantages, and applications. In T. S. Srivatsan & T.S. Sudarshan (Eds.), Additive manufacturing: Innovations, advances, and applications (pp. 1-49). Natick, MA: CRC Press.

Stratasys is shaping our world. (2015). Web.

Stratasys strengthens materials development capabilities with the asset acquisition of Interfacial Solutions. (2014). Web.

Tranchard, S., & Rojas, V. (2015). Manufacturing our 3D future. Web.

Tushman, M., & Smith, W. (2002). Organizational technology: Technological change, ambidextrous organizations and organizational evolution. London, UK: Oxford University Press.